Third Party Bank Guarantee Format

Description

How to fill out Georgia Guaranty Attachment To Lease For Guarantor Or Cosigner?

Drafting legal documents from scratch can sometimes be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re searching for an easier and more affordable way of creating Third Party Bank Guarantee Format or any other documents without jumping through hoops, US Legal Forms is always at your fingertips.

Our online catalog of more than 85,000 up-to-date legal forms covers almost every aspect of your financial, legal, and personal affairs. With just a few clicks, you can quickly get state- and county-specific templates carefully prepared for you by our legal specialists.

Use our platform whenever you need a trustworthy and reliable services through which you can easily locate and download the Third Party Bank Guarantee Format. If you’re not new to our website and have previously set up an account with us, simply log in to your account, locate the form and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No worries. It takes little to no time to register it and explore the library. But before jumping directly to downloading Third Party Bank Guarantee Format, follow these tips:

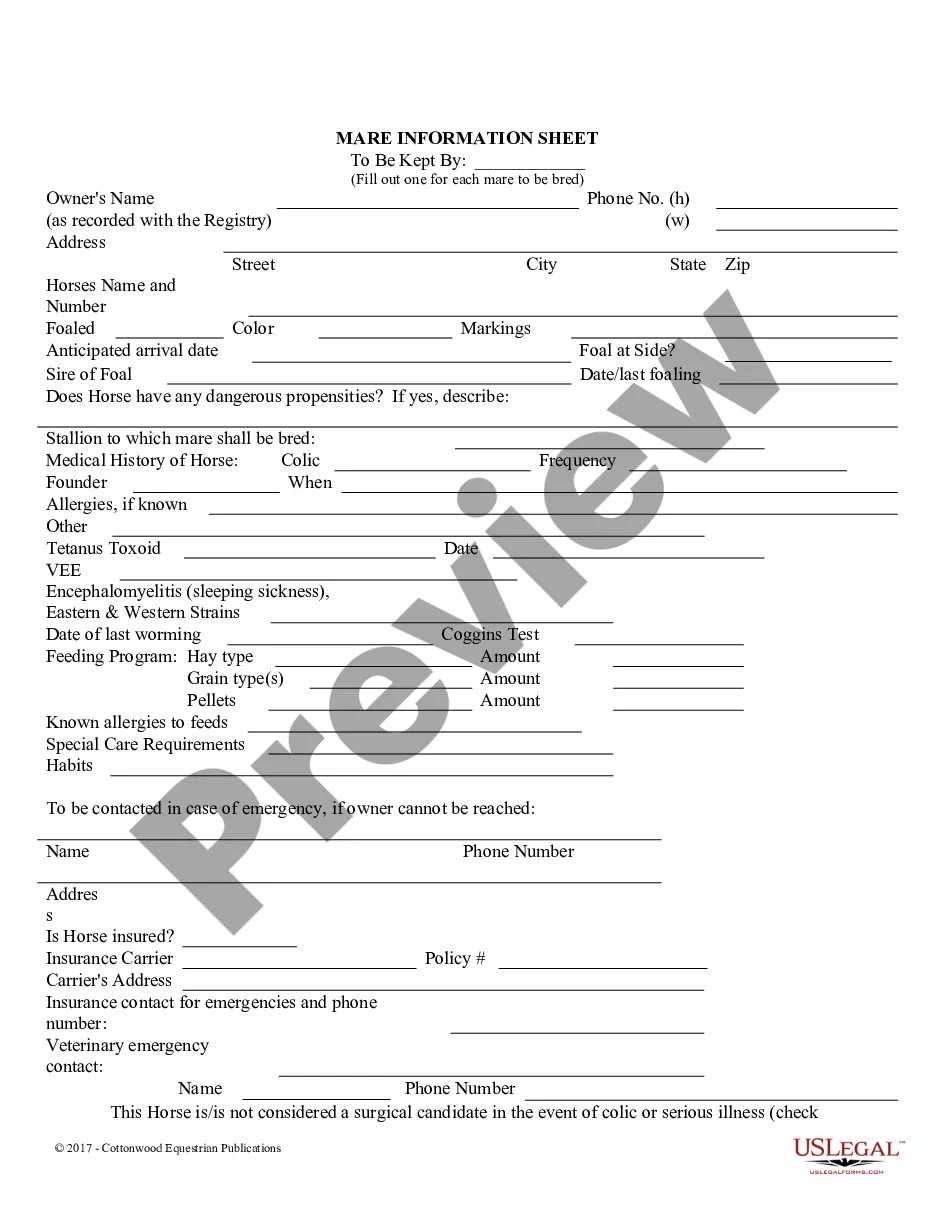

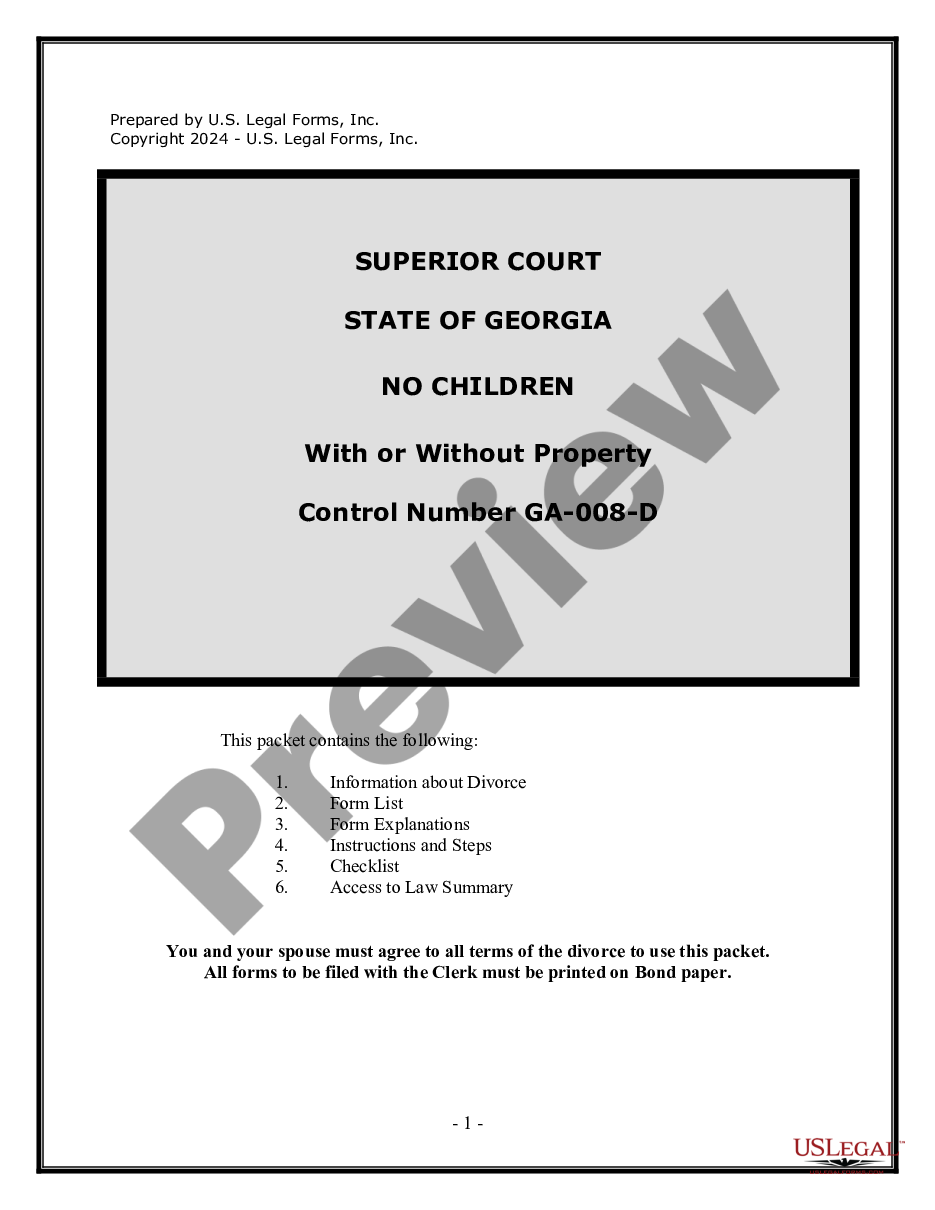

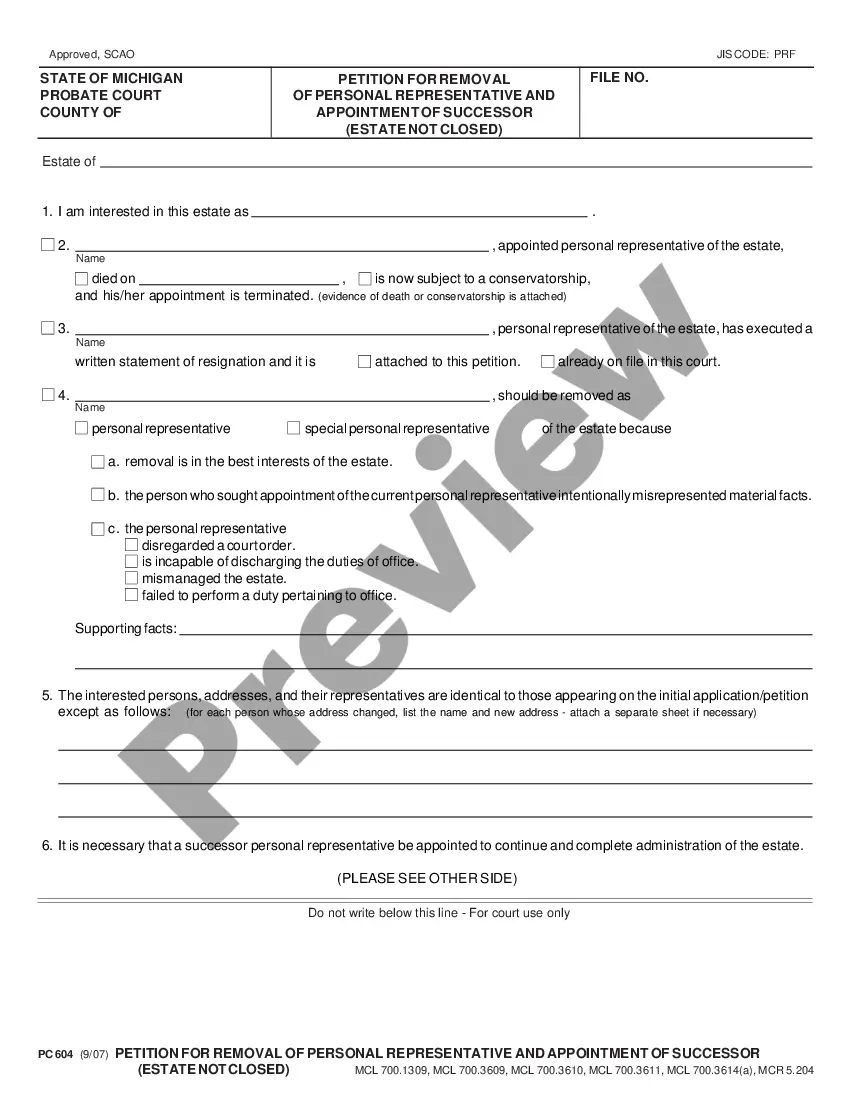

- Check the form preview and descriptions to make sure you are on the the document you are looking for.

- Make sure the form you choose complies with the requirements of your state and county.

- Pick the best-suited subscription option to buy the Third Party Bank Guarantee Format.

- Download the file. Then complete, sign, and print it out.

US Legal Forms boasts a good reputation and over 25 years of expertise. Join us now and transform document execution into something easy and streamlined!

Form popularity

FAQ

To request a guarantee, the account holder contacts the bank and fills out an application that identifies the amount of and reasons for the guarantee. Typical applications stipulate a specific period of time for which the guarantee should be valid, any special conditions for payment and details about the beneficiary.

I) Our liability under this Bank Guarantee shall not exceed Rs?????.. ii) This Bank Guarantee shall be valid up to and including????????.. iii) We are liable to pay the guaranteed amount or any part thereof under this Bank Guarantee only and only if Purchaser serve upon Bank a written claim or demand on or before?..

As another instance, if a debtor owes a creditor a sum of money and has not been making the scheduled payments, the creditor is probably to hire a third party, a collection agency, to ensure that the debtor honours his agreement.

Dear Sir/Madam: This letter will serve as your notification that (Bank Name) will irrevocably honor and guarantee payment of any check(s) written by our customer (Customer's Name) up to the amount of (Amount Guaranteed) and drawn on account number (Customer's Account Number). No stop payments will be issued.

Third-party guarantees are a form of securing loans, where the guarantor is liable for the outstanding debt including interest in case the borrower defaults. By granting a guarantee one can help family and friends to gain access to credit.