Guarantor On Lease Requirements

Description

How to fill out Georgia Guaranty Attachment To Lease For Guarantor Or Cosigner?

Establishing a reliable source for obtaining the latest and most suitable legal templates is a significant part of navigating bureaucracy.

Selecting the appropriate legal documents necessitates accuracy and careful consideration, which is why sourcing Guarantor On Lease Requirements exclusively from trustworthy providers, such as US Legal Forms, is crucial. An incorrect template can squander your time and delay your situation. With US Legal Forms, there is minimal need for concern. You can access and review all the details regarding the document’s usage and relevance for your particular circumstances and in your jurisdiction.

Eliminate the stress associated with your legal documentation. Explore the comprehensive US Legal Forms library where you can discover legal templates, assess their relevance to your situation, and download them instantly.

- Use the catalog navigation or search bar to locate your template.

- Review the form’s description to ensure it aligns with the requirements of your state and area.

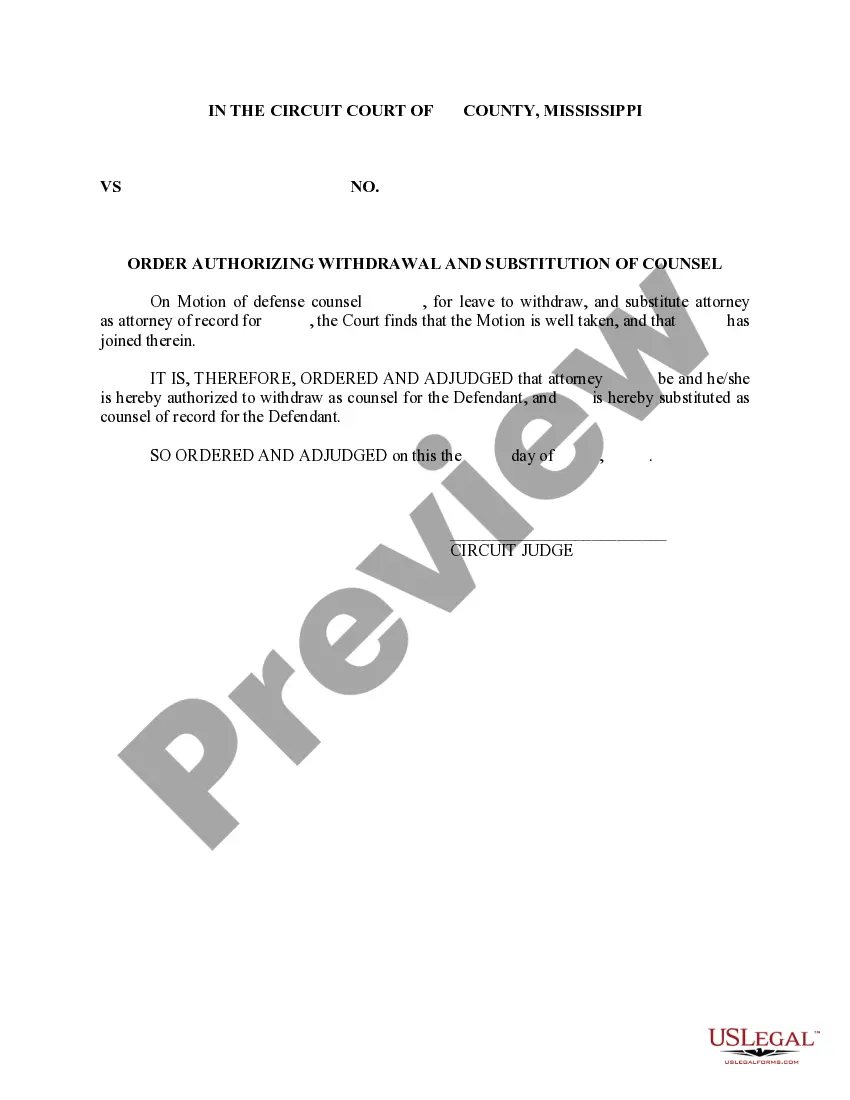

- View the form preview, if available, to confirm that the template is the one you are looking for.

- Return to the search to find the appropriate template if the Guarantor On Lease Requirements does not meet your needs.

- Once you are confident about the form’s relevance, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you do not yet have an account, click Buy now to acquire the template.

- Select the pricing plan that suits your requirements.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Guarantor On Lease Requirements.

- Once you have the form on your device, you can modify it using the editor or print it out and fill it in manually.

Form popularity

FAQ

The primary difference between a co-signer and a guarantor is how soon each individual becomes responsible for the borrower's debt. A co-signer is responsible for every payment that a borrower misses. However, a guarantor only assumes responsibility if the borrower falls into total default.

Guarantors are responsible for all those named on the tenancy. I would reject the application. Please note, even if a guarantor passes referencing, you have to ask yourself can the guarantor meet their rent or mortgage payment and still have enough to cover your tenants' rent payment should the need arise.

Can you be a guarantor for two or more renters? Technically speaking you can. In fact, you can be a guarantor for as many renters as you want. A guarantor usually needs to earn around three times the rent of a tenancy they are covering.

A guarantor letter must include the names of both the guarantor and the person they are guaranteeing, a statement of the guarantor's willingness to guarantee the person's obligations, the duration of the guarantee, and the amount of money or other resources the guarantor is providing.

They will want evidence that the guarantor would be able to afford to pay any rent that's not paid by the renter, for the full term of the rental agreement on top of their usual outgoings. For many people this is a friend or family member who: Is between 18 and 75 years old (often 21 or older)