Partial Rent Payment Agreement With Irs

Description

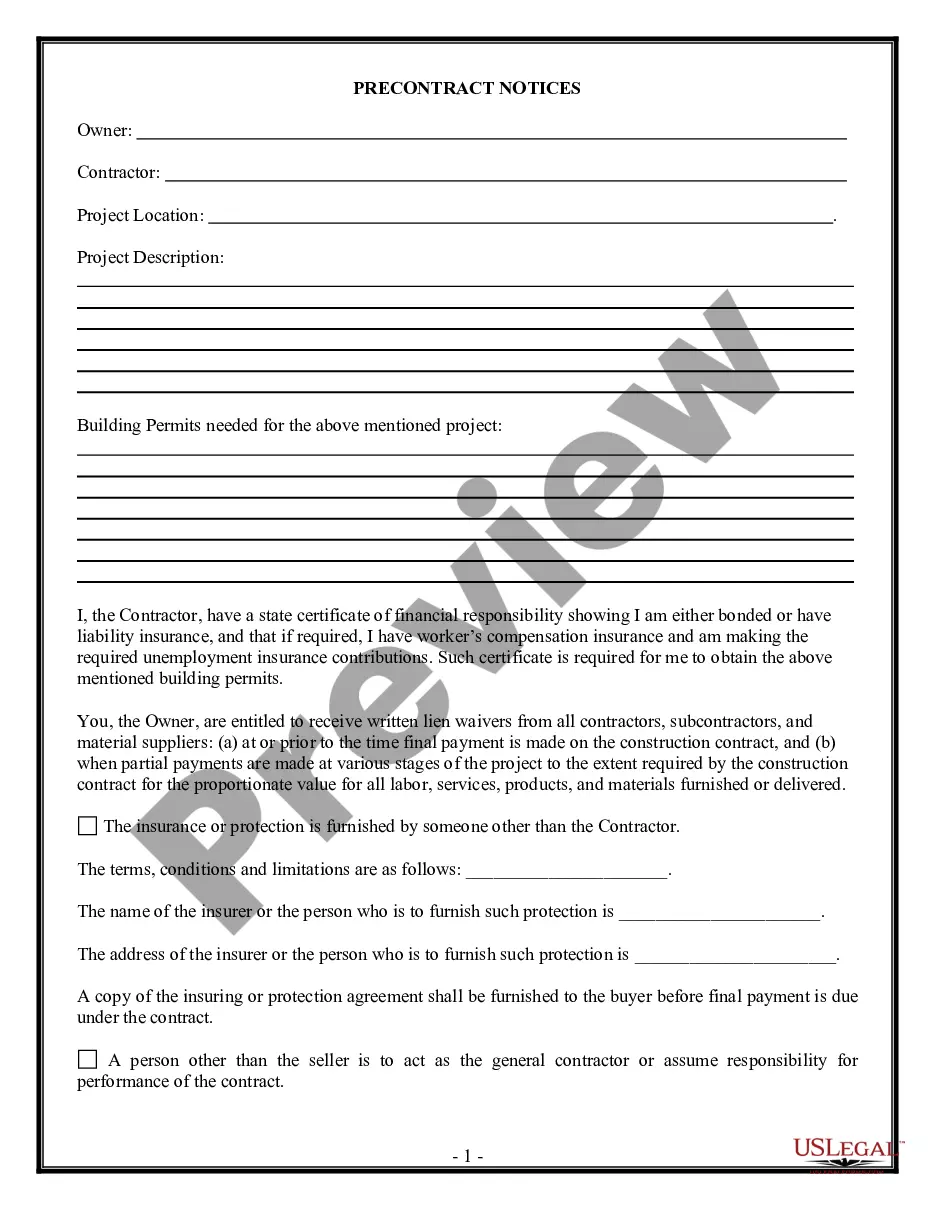

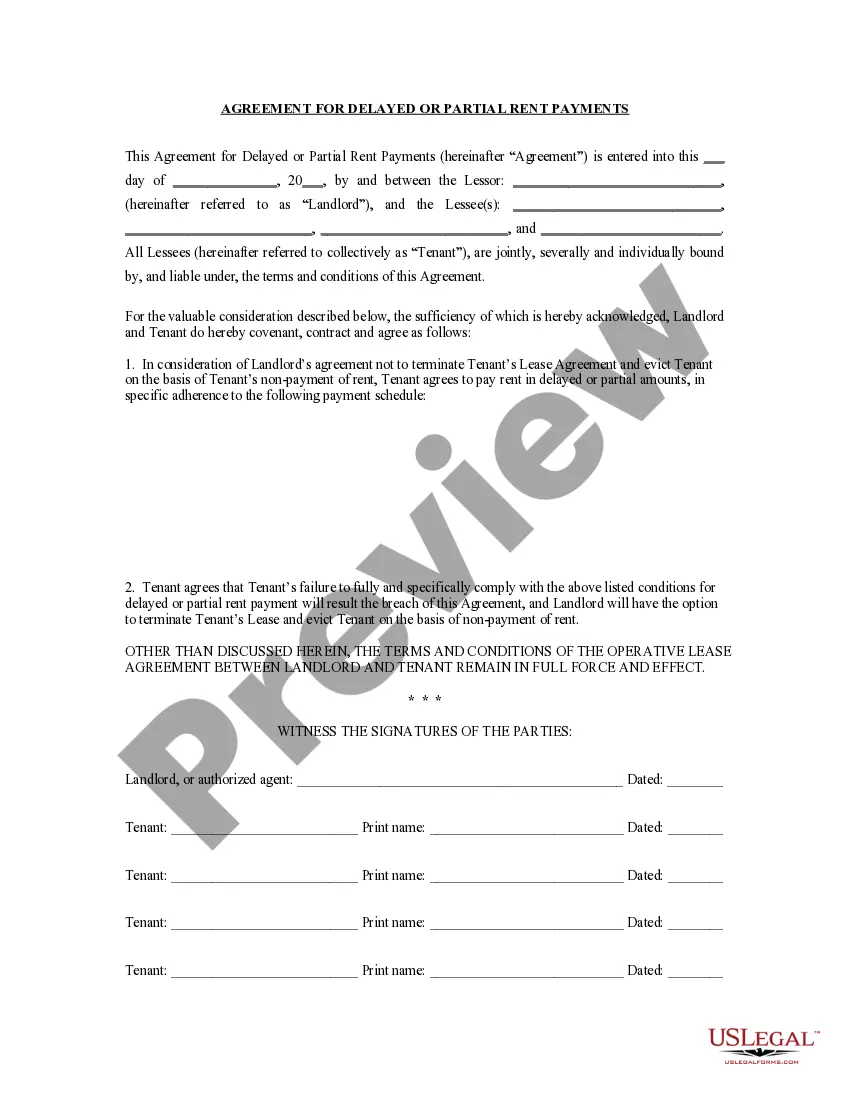

How to fill out Georgia Agreement For Delayed Or Partial Rent Payments?

Managing legal documentation and processes can be a lengthy addition to your schedule.

Partial Rent Payment Agreement With Irs and similar forms frequently necessitate that you search for them and navigate the most effective method to complete them accurately.

As a result, regardless of whether you are attending to financial, legal, or personal issues, having a comprehensive and straightforward online collection of forms available when needed will be extremely helpful.

US Legal Forms is the top online resource for legal templates, providing over 85,000 state-specific documents and a variety of tools to assist you in completing your paperwork efficiently.

Simply Log In to your account, find Partial Rent Payment Agreement With Irs, and obtain it instantly in the My documents section. You can also access forms you have saved previously. Is it your first time using US Legal Forms? Register and create your account in a few minutes, and you'll gain entry to the forms library and Partial Rent Payment Agreement With Irs. Then, follow the steps outlined below to complete your document: Ensure you have identified the appropriate form by utilizing the Review feature and examining the form description. Select Buy Now when you are prepared, and choose the monthly subscription plan that fits your needs. Click Download, then fill out, eSign, and print the document. US Legal Forms has 25 years of experience aiding users in managing their legal documents. Locate the form you require today and enhance any task without breaking a sweat.

- Explore the compilation of relevant documents accessible to you with just a single click.

- US Legal Forms provides state- and county-specific documents that can be downloaded at any time.

- Protect your document management operations with superior support that enables you to generate any form in minutes without incurring additional or hidden charges.

Form popularity

FAQ

The approval time for an IRS installment agreement can vary, typically taking around 30 days. Factors such as the complexity of your case and the accuracy of your submitted documents can influence this timeline. If you pursue a partial rent payment agreement with the IRS, using services like USLegalForms can help you prepare the necessary paperwork efficiently, potentially speeding up the process.

Yes, the IRS accepts partial payments through specific agreements like the partial payment installment agreement. This option is particularly useful for taxpayers who cannot fulfill their total tax liabilities immediately. If you are exploring a partial rent payment agreement with the IRS, using resources from USLegalForms can simplify the documentation process.

The IRS does not have a strict minimum payment requirement, but your payment should be reasonable based on your tax debt and financial situation. Typically, payments can be as low as $25 per month, depending on your total amount owed. If you're looking for a partial rent payment agreement with the IRS, it’s wise to assess your budget to propose a payment that works for you.

You can have multiple payment arrangements with the IRS, but it's essential to manage them effectively. Each arrangement can be tailored to your specific financial situation, allowing you to address your tax obligations over time. If you find yourself needing a partial rent payment agreement with the IRS, consider using platforms like USLegalForms to streamline the process.

To file an installment agreement with the IRS, you need to complete Form 9465, which is the Installment Agreement Request. This form allows you to propose a monthly payment plan based on your financial situation. You can submit the form online through the IRS website, by mail, or during a phone call with a representative. Remember, a partial rent payment agreement with the IRS can help alleviate some financial pressure if you owe back taxes.

Yes, you can make minimum payments to the IRS if you enter into an installment agreement. Establishing a Partial Rent Payment Agreement with the IRS can provide clarity on the minimum amount required. This can be a helpful solution if you're managing multiple financial obligations.

Sending a partial payment directly to the IRS without an agreement is not advisable. It’s best to set up a formal Partial Rent Payment Agreement with the IRS to ensure that your payments are recognized. This approach helps you stay organized and compliant with tax laws.

You can file an installment agreement with the IRS online through their website or by submitting Form 9465 by mail. The process is straightforward, and having a Partial Rent Payment Agreement with the IRS can simplify your payment plan. Consider using platforms like uslegalforms to guide you through the necessary steps.

Yes, you typically need to report rent payments to the IRS if you receive rental income. This is crucial for compliance and affects your overall tax obligations. Utilizing a Partial Rent Payment Agreement with the IRS can help you manage any tax implications related to your rental income.

Yes, the IRS does accept partial payments. However, it's important to establish a formal agreement, such as a Partial Rent Payment Agreement with the IRS. This can help clarify the terms and ensure that your payments are applied correctly to your tax balance.