This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed to Secure Debt with Power of Sale, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. GA-8206

Secure Debt Application With Irs

Description

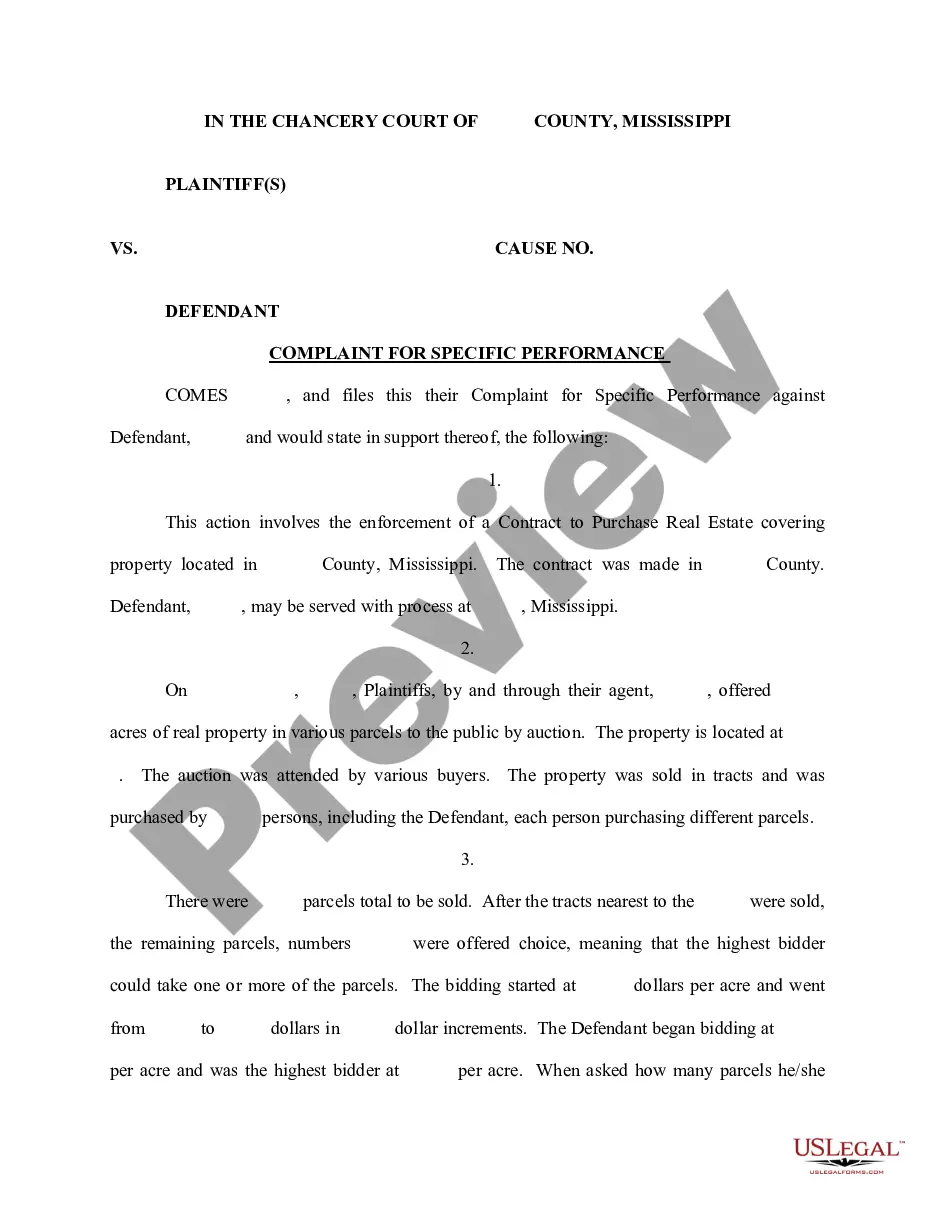

How to fill out Georgia Deed To Secure Debt With Power Of Sale?

- If you are a returning user, log in to your account. Ensure your subscription is active before proceeding to download the template you need.

- In case this is your first time, begin by previewing the form and reviewing its description to confirm it meets your requirements and complies with your local jurisdiction.

- If you don't find the appropriate form, utilize the Search tab at the top to look for other templates that may suit your needs.

- Once you've found the right form, click on the Buy Now button to select your preferred subscription plan and create an account for access to our extensive library.

- Complete your purchase by entering your credit card details or utilizing your PayPal account for payment.

- Finally, download the form to your device and access it anytime through the My Forms section of your profile.

US Legal Forms is dedicated to empowering individuals and attorneys by providing a comprehensive library of over 85,000 fillable legal forms. This extensive collection is unmatched in the industry and allows users to generate precise and legally sound documents quickly.

Start your journey towards a secure debt application today with the support of US Legal Forms. Streamline your legal processes and ensure compliance with expert assistance. Explore our library now!

Form popularity

FAQ

To file for financial hardship with the IRS, you will need to provide comprehensive documentation of your income, expenses, and debts. This usually includes filling out specific forms, which can be complex. By using the secure debt application with the IRS, you can navigate this process more easily and effectively present your case for hardship.

The acceptance rate for an Offer in Compromise can fluctuate, but the IRS generally accepts offers that meet their criteria for financial ability. This includes a thorough review of your assets and income. A secure debt application with the IRS can significantly enhance your chances of acceptance by demonstrating your financial reality effectively.

The amount the IRS accepts for an Offer in Compromise can vary widely based on your financial capabilities and outstanding tax liabilities. The IRS may accept less than what you owe if they believe it's in the best interest of both you and the government. Submit a secure debt application with the IRS to illustrate your financial situation clearly.

Yes, there are specific IRS forms designed to assist with debt cancellation, including the Offer in Compromise form. Completing these forms accurately is crucial for your application process. Consider using the secure debt application with the IRS to streamline this process and ensure all necessary information is included.

The IRS does not have a set standard for settlements because each case varies individually. Factors like your total tax debt, payment ability, and financial situation greatly influence the settlement amount. By utilizing a secure debt application with the IRS, you can present your unique circumstances effectively.

When considering an Offer in Compromise, it is important to evaluate your financial situation thoroughly. Typically, you want to offer an amount that reflects what the IRS may collect from you within a reasonable time frame. Submitting a secure debt application with the IRS requires you to provide detailed financial information, so ensure your offer is realistic and well-documented.

To make an Offer in Compromise with the IRS, first, determine your eligibility based on your income, expenses, and asset value. Then, complete the necessary forms and submit your secure debt application with the IRS along with an upfront payment. This process can help you negotiate a manageable settlement on your tax debt. If you need assistance, consider using platforms like US Legal Forms to simplify the application process and increase your chances of approval.

The IRS does not directly offer debt forgiveness, but it provides several programs to help reduce your tax debt, such as the Offer in Compromise. This program allows you to settle your tax liability for less than the full amount owed, making it easier for you to manage your finances. By submitting a secure debt application with the IRS, you may qualify for relief, depending on your financial situation. It's essential to explore your options and understand how these programs can benefit you.

The best company to assist with IRS debt usually has a solid track record of success and positive customer feedback. Look for a firm that specializes in tax relief, offers tailored solutions, and simplifies the process of submitting a secure debt application with the IRS. Researching customer reviews and professional ratings can guide you toward a reliable option.

Many individuals fall into IRS debt due to unexpected life events such as job loss, medical emergencies, or poor financial planning. Additionally, underreporting income or neglecting to file taxes can lead to significant tax liabilities. Understanding these factors can help prevent debt, and if you're already in this situation, US Legal Forms can assist you in preparing a secure debt application with the IRS.