Automobile Promissory Note With Personal Guarantee

Description

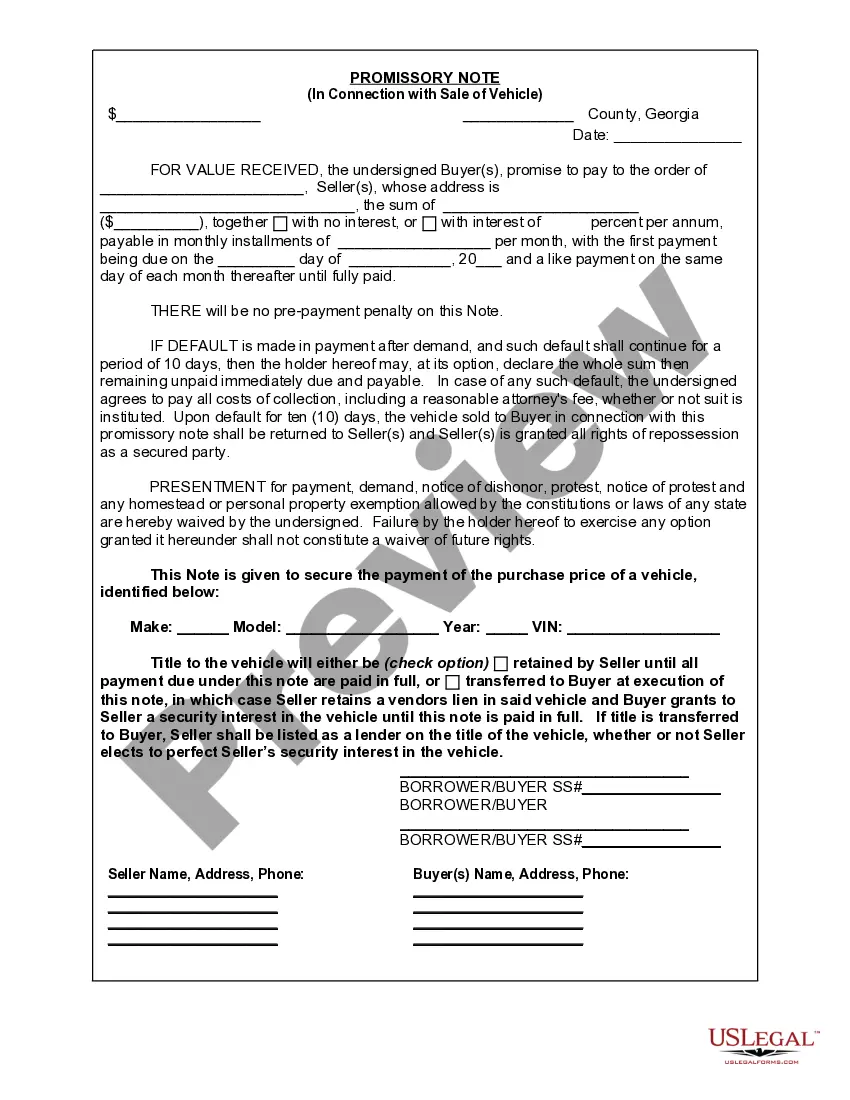

How to fill out Georgia Promissory Note In Connection With Sale Of Vehicle Or Automobile?

No matter if you handle documents routinely or need to file a legal report from time to time, it is essential to have a resource where all the samples are pertinent and current.

The first step you should take when using an Automobile Promissory Note With Personal Guarantee is to ensure it is the latest version, since this determines whether it can be submitted.

If you want to make your search for the most recent document examples easier, look for them on US Legal Forms.

Forget about the confusion of handling legal documents. All your templates will be structured and validated with an account at US Legal Forms.

- US Legal Forms is a repository of legal forms that includes almost any document sample you may seek.

- Look for the templates you need, check their relevance immediately, and learn more about how to utilize them.

- With US Legal Forms, you have access to over 85,000 document templates across various fields.

- Obtain the Automobile Promissory Note With Personal Guarantee samples in just a few clicks and store them conveniently in your profile.

- Having a US Legal Forms profile enables you to access all the samples you need more easily and with less hassle.

- You simply need to click Log In at the top of the website and navigate to the My documents section where all the forms you require will be available, saving you the time of searching for the best template or verifying its validity.

- To obtain a form without an account, follow these instructions.

Form popularity

FAQ

A promissory note is a legal document signed by a debtor who promises to pay a debt in a form and manner as described in the document. A personal guaranty, as defined at businessdictionary.com, is an agreement that makes one liable for one's own or a third party's debts or obligations.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance. Personal guarantees provide an extra level of protection to credit issuers who want to make sure they will be repaid.

When you write the promissory note, make sure to contain the following information:Name and address of the borrower and lender.Model, year, make, and VIN of the vehicle.Loan amount, interest rate, length of the loan, and maturity date.Late fees and penalties.Collateral information.Odometer reading.More items...

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.