Attorney Powers Power With Dementia

Description

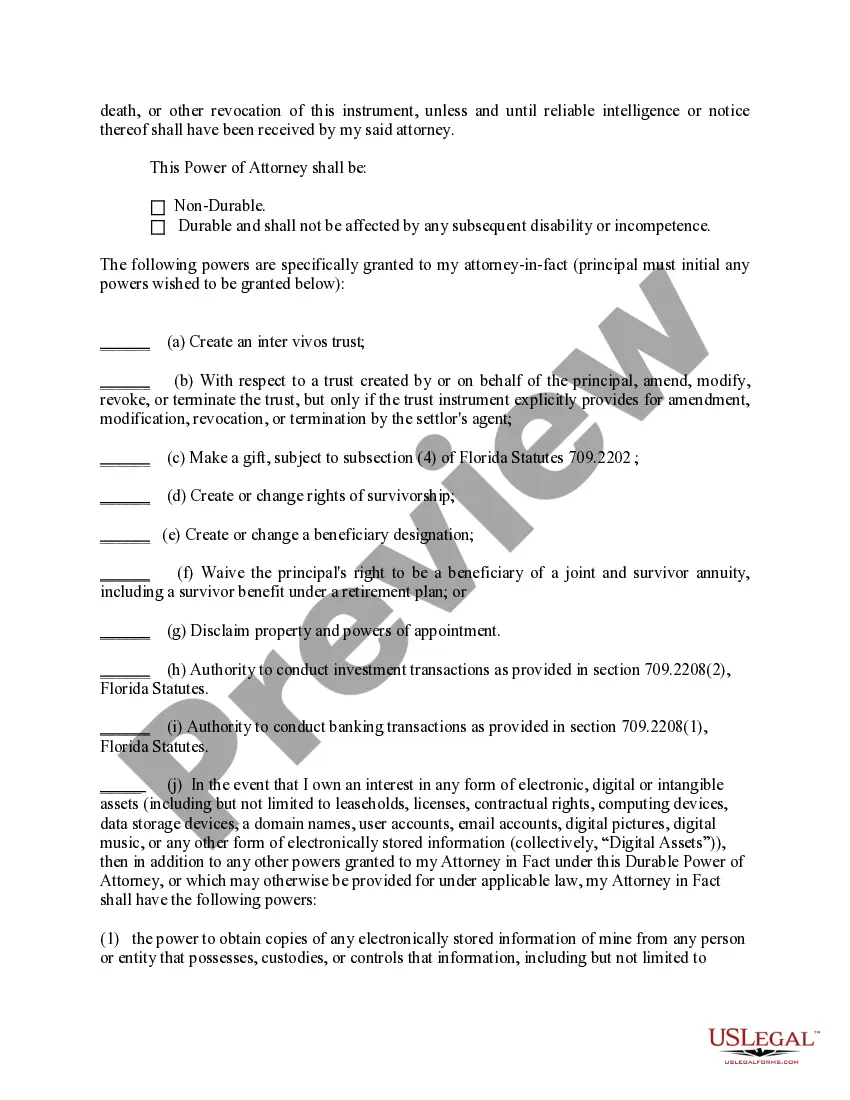

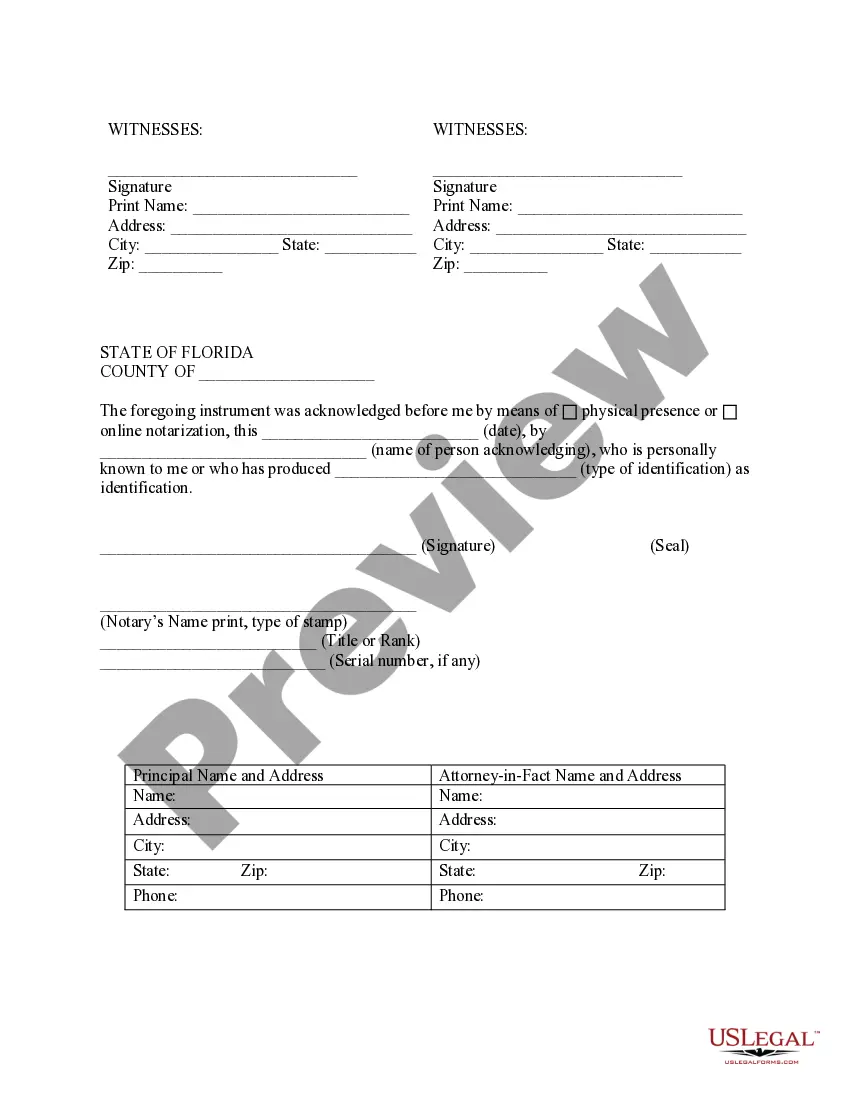

How to fill out Florida Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

It's clear that you cannot transform into a legal authority instantaneously, nor can you quickly learn how to proficiently prepare Attorney Powers Power With Dementia without a dedicated background.

Drafting legal documents is a lengthy undertaking that necessitates specific education and expertise. So why not entrust the crafting of the Attorney Powers Power With Dementia to the professionals.

With US Legal Forms, one of the most comprehensive libraries of legal documents, you can discover everything from courtroom documents to templates for corporate internal communications.

If you need another template, start your search anew.

Register for a complimentary account and select a subscription plan to purchase the form. Click Buy now. Once the payment is completed, you are able to download the Attorney Powers Power With Dementia, fill it out, print it, and send it or mail it to the relevant individuals or organizations.

- We understand how crucial compliance and adherence to both federal and local laws and regulations are.

- That’s why, on our site, all templates are localized and current.

- To begin using our platform and obtain the document you need in just a few minutes.

- Find the necessary form using the search bar located at the top of the page.

- Preview it (if this option is available) and review the accompanying description to determine if Attorney Powers Power With Dementia is what you seek.

Form popularity

FAQ

Never argue with your loved one. This can increase stress and confusion for both parties. Instead, redirect the conversation to a comforting topic to help them feel at ease. Additionally, avoid asking too many questions; this can overwhelm them. Instead, provide simple, clear choices. Lastly, do not rush their responses. Allow them the time they need to process information. Remember, understanding attorney powers power with dementia can help you establish clear and compassionate communication.

Legally, a family member or guardian is often responsible for a person with dementia, particularly if they cannot make decisions for themselves. If no one in the family is suitable, a court may appoint a guardian. Consulting with an attorney can clarify who holds these responsibilities when necessary. Understanding the attorney powers with dementia is crucial for ensuring that the rights and needs of the individual are met appropriately.

The average age of death for someone with dementia varies depending on several factors, including the type and progression of the disease. Most individuals may live between four to eight years after diagnosis, but some can live longer. It's essential to discuss medical and end-of-life decisions with an attorney familiar with dementia issues. Utilizing attorney powers with dementia can guide families through these sensitive matters.

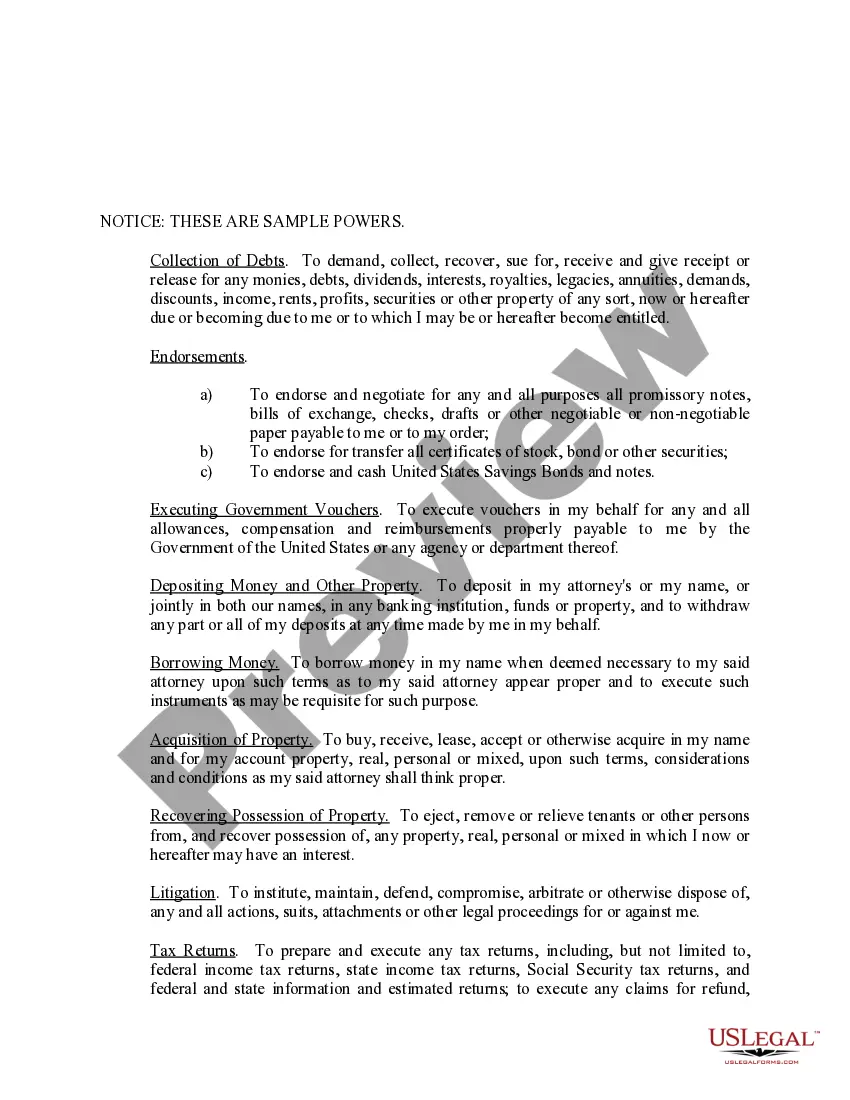

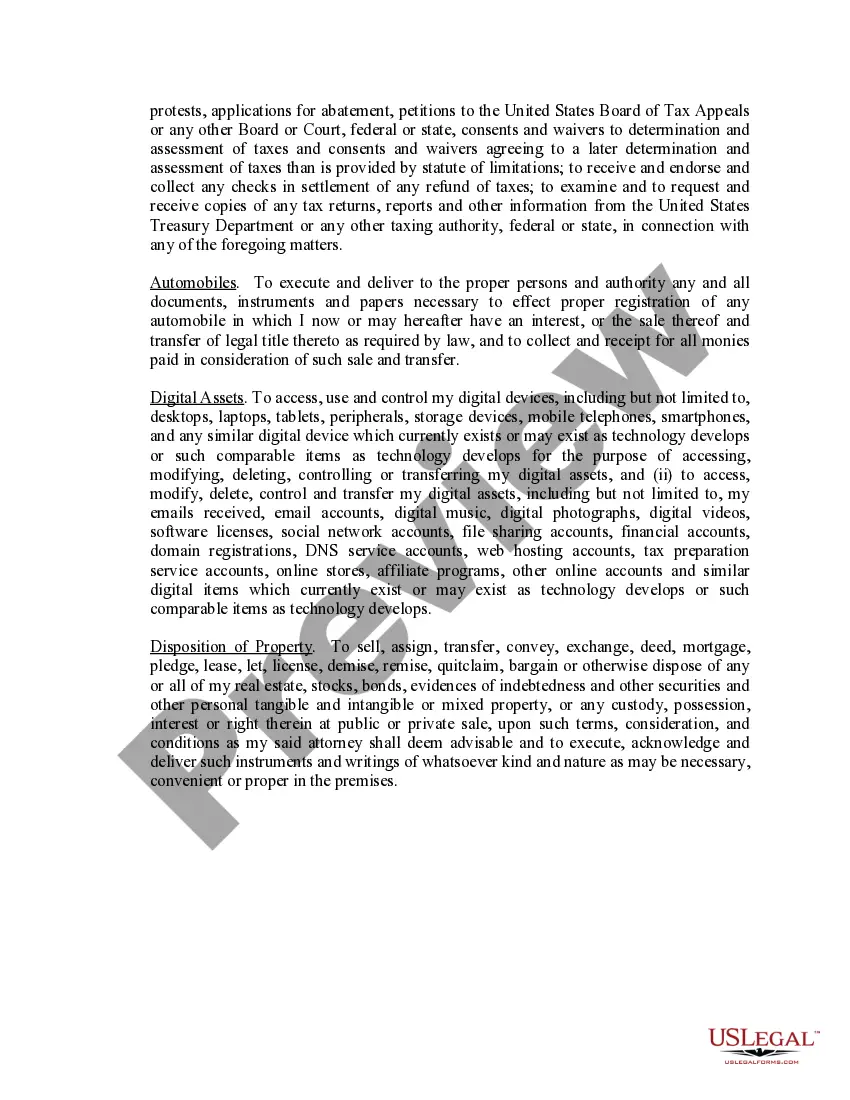

To obtain a Power of Attorney for someone with dementia, you must first ensure they are still capable of understanding the process. Engaging an attorney early on can streamline this process and provide necessary legal guidance. The attorney will help draft the POA document and ensure it complies with state laws. Utilizing attorney powers with dementia simplifies complexities in the future and supports good decision-making.

Typically, the financially responsible party for a person with dementia is usually a family member or court-appointed guardian. This responsibility includes managing bills, healthcare costs, and daily expenses. Engaging an attorney can clarify the specific legal obligations and rights in these situations. Understanding the attorney powers with dementia helps ensure that financial matters are handled responsibly and ethically.

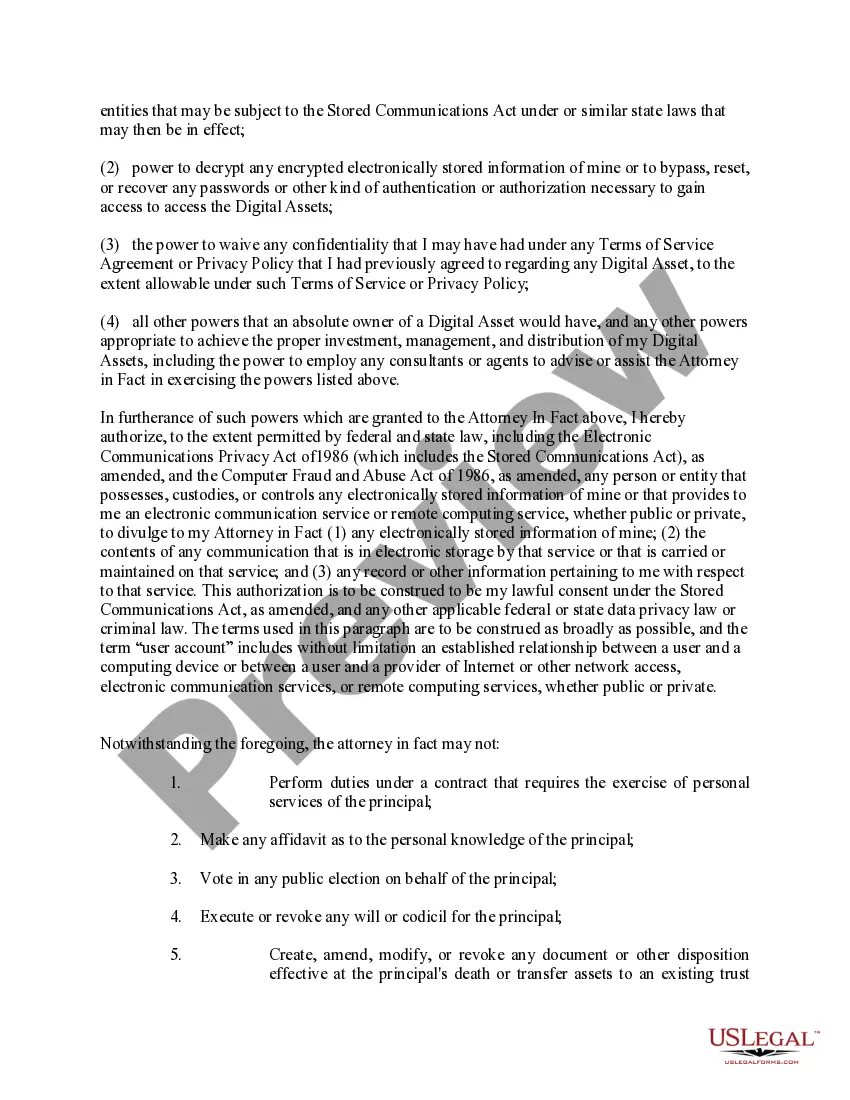

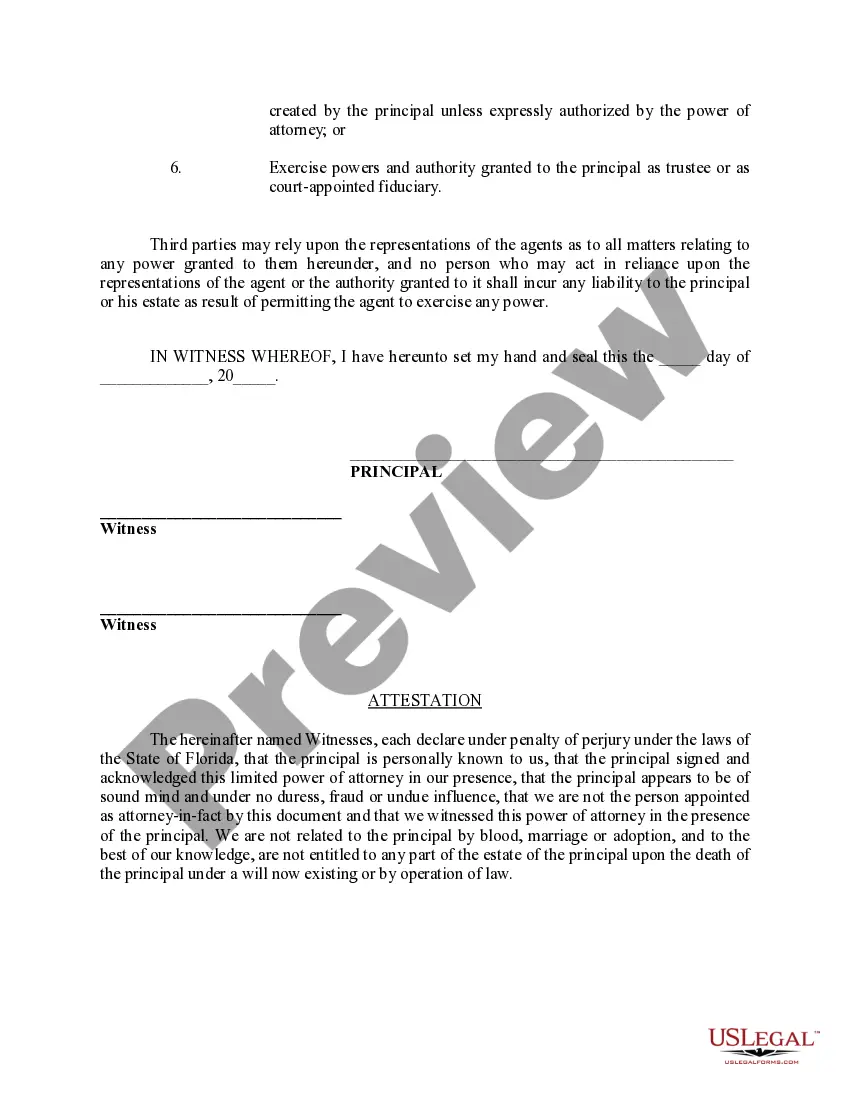

A Power of Attorney (POA) for someone with dementia is a legal document that allows a designated person to make decisions on behalf of the individual. This can cover areas like financial matters, medical care, and property management. When choosing a POA, it is vital to understand the specific attorney powers with dementia involved. This ensures that the chosen representative can act in the best interest of the person with dementia.

The life expectancy of someone with dementia at 84 can vary significantly based on factors like overall health, type of dementia, and available care. While the average life expectancy may be around four to eight years after diagnosis, some individuals may live longer. Accessing legal support, such as an attorney's powers with dementia, can help families navigate these complexities compassionately. This enables them to plan better for both health care and legal needs.

It can become unsafe for a person with dementia to live alone when they begin to forget essential daily tasks, such as cooking or taking medication. If they wander or get lost, or if their safety is compromised, this indicates a need for assistance. Engaging an attorney can help families assess the situation legally. Therefore, understanding attorney powers with dementia is essential for making informed decisions.

Deciding when to move a person with dementia into a care home depends on their safety and care needs. Factors to consider include their ability to perform daily tasks and the support available at home. If their condition worsens, and the caregiver struggles to provide adequate care, it may be time to consider a care home. Engaging with legal advisors through uslegalforms can help outline attorney powers related to making such significant decisions.

Yes, a person with dementia can choose a power of attorney if they understand the decision at the time. It's important to assess their cognitive ability as this varies with the progression of dementia. This legal designation allows an appointed individual to manage financial and healthcare decisions when necessary. Utilizing services like uslegalforms can simplify the creation of these documents, ensuring the right choices are made.