Power Attorney Form Florida With Irs Verification

Description

How to fill out Florida General Power Of Attorney For Care And Custody Of Child Or Children?

There’s no longer a necessity to waste time searching for legal documents to meet your local state stipulations. US Legal Forms has compiled all of them in one location and streamlined their availability.

Our platform offers over 85k templates for various business and personal legal situations organized by state and area of application. All forms are expertly crafted and verified for accuracy, allowing you to confidently obtain an up-to-date Power Attorney Form Florida With IRS Verification.

If you are familiar with our platform and already possess an account, make sure your subscription is active before acquiring any templates. Log In to your account, choose the document, and click Download. You can also return to all saved documents whenever required by accessing the My documents section in your profile.

You can print your form to complete it manually or upload the sample if you prefer using an online editor. Creating official documents under federal and state regulations is quick and straightforward with our platform. Experiment with US Legal Forms today to maintain your documentation in order!

- If this is your first time using our platform, the process will require a few more steps to finish.

- Here’s how new users can find the Power Attorney Form Florida With IRS Verification in our catalog.

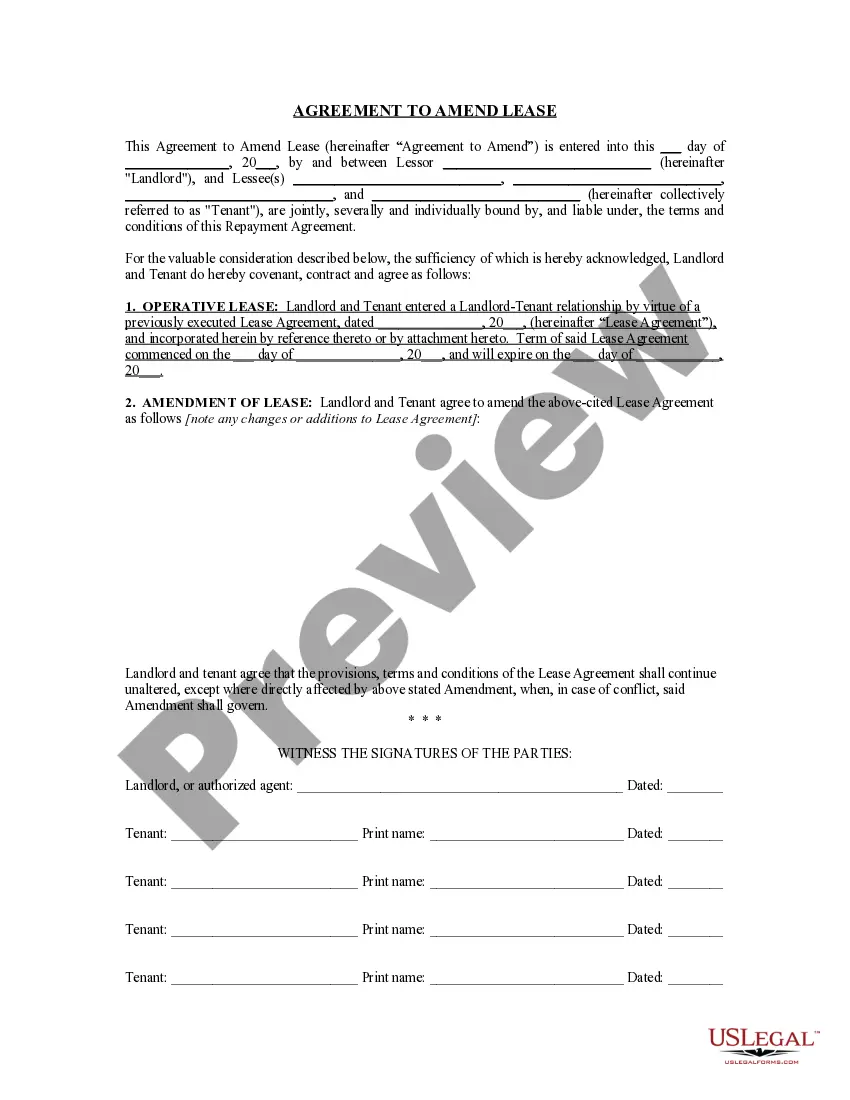

- Carefully examine the page content to ensure it contains the sample you need.

- Utilize the form description and preview options if available to assist you.

- Use the Search field above to look for another sample if the current one doesn’t meet your needs.

- When you find the appropriate one, click Buy Now next to the template title.

- Select the most suitable pricing plan and create an account or Log In.

- Complete your payment using a credit card or PayPal to proceed.

- Choose the file format for your Power Attorney Form Florida With IRS Verification and download it to your device.

Form popularity

FAQ

Use Form 2848 to authorize an individual to represent you before the IRS. See Substitute Form 2848, later, for information about using a power of attorney other than a Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be eligible to practice before the IRS.

To verify their identity with ID.me, taxpayers need to provide a photo of an identity document such as a driver's license, state ID or passport. They'll also need to take a selfie with a smartphone or a computer with a webcam. Once their identity has been verified, they can securely access IRS online services.

If you can't verify your identity online, you can call the telephone number on the letter you received from the IRS telling you that you may be eligible to receive advance Child Tax Credit payments (Letter 6416 PDF).

The IRS offers only two ways to verify your identity: Online at the IRS Identity Verification Service website. By phone at the toll-free number listed on your 5071C Letter.

As long as you can create a Secure Access account and follow authentication procedures, you may submit a Form 2848 or 8821 with an image of an electronic signature.