Mortgage Deed Sample With Bank

Description

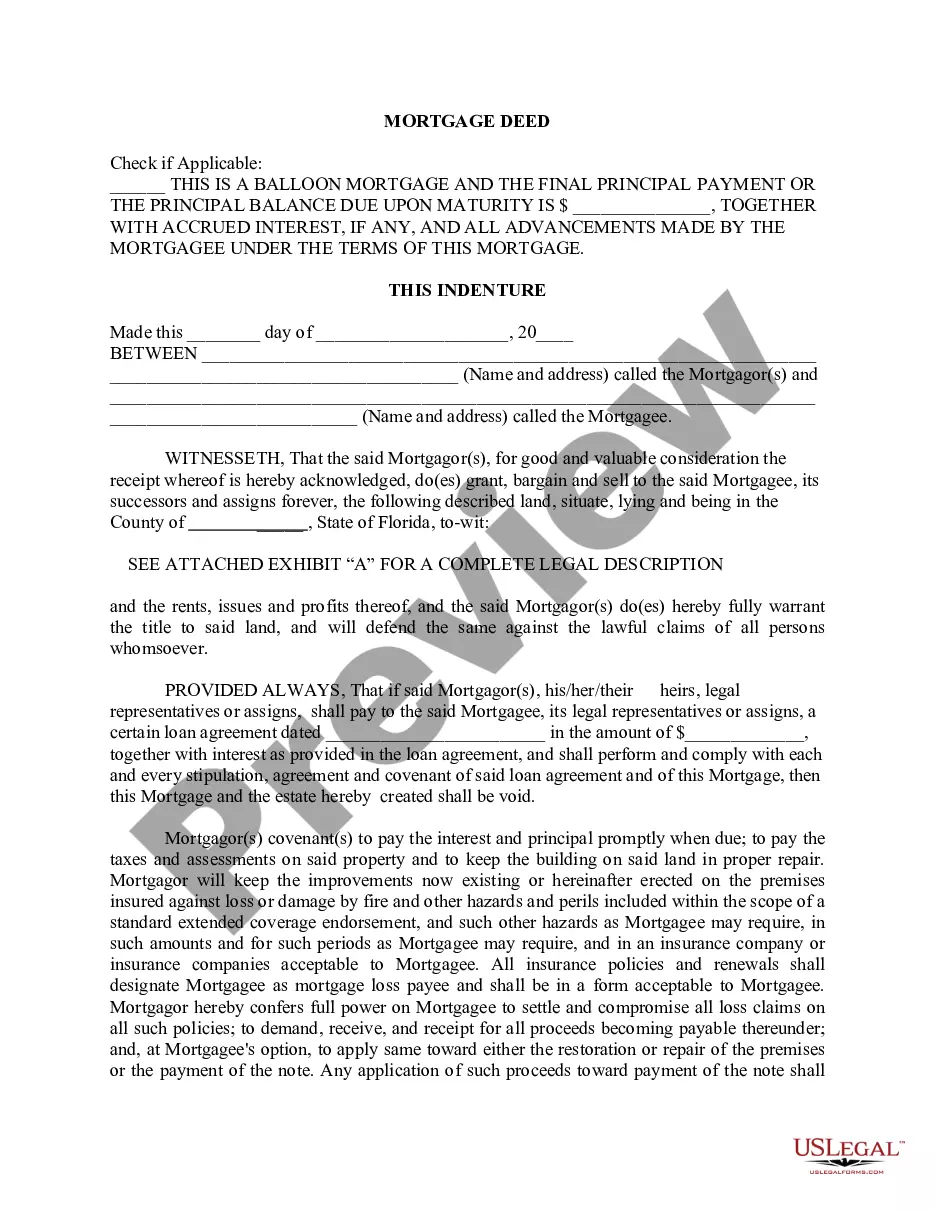

How to fill out Florida Mortgage Deed From Individual?

Handling legal paperwork and procedures might be a time-consuming addition to your day. Mortgage Deed Sample With Bank and forms like it often need you to search for them and understand how you can complete them properly. As a result, whether you are taking care of economic, legal, or individual matters, using a comprehensive and convenient web catalogue of forms at your fingertips will greatly assist.

US Legal Forms is the top web platform of legal templates, boasting over 85,000 state-specific forms and a number of tools to assist you complete your paperwork effortlessly. Discover the catalogue of pertinent documents available to you with just one click.

US Legal Forms provides you with state- and county-specific forms available at any moment for downloading. Protect your document management processes using a high quality support that allows you to put together any form in minutes without having additional or hidden charges. Simply log in to the account, locate Mortgage Deed Sample With Bank and download it right away from the My Forms tab. You may also gain access to formerly saved forms.

Would it be the first time making use of US Legal Forms? Sign up and set up your account in a few minutes and you will get access to the form catalogue and Mortgage Deed Sample With Bank. Then, adhere to the steps listed below to complete your form:

- Make sure you have discovered the proper form by using the Review option and reading the form information.

- Choose Buy Now as soon as all set, and select the subscription plan that meets your needs.

- Choose Download then complete, sign, and print out the form.

US Legal Forms has twenty five years of experience supporting users deal with their legal paperwork. Discover the form you want today and streamline any process without breaking a sweat.

Form popularity

FAQ

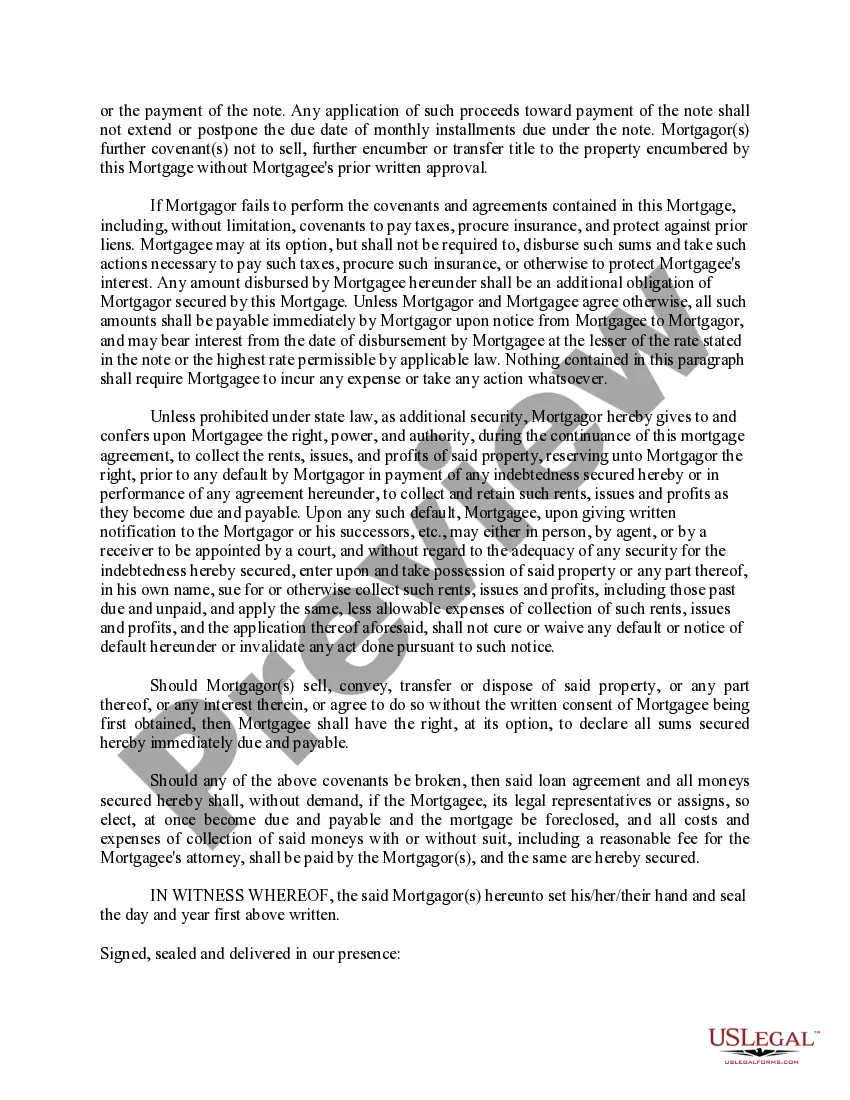

The Mortgage or Deed of Trust is a legal document in which the borrower transfers the title to a third party (trustee) to hold as security for the lender. When the loan is paid in full the trustee transfers the title back to the borrower.

Again, the loan transaction consists of two main documents: the mortgage (or deed of trust) and a promissory note. The mortgage or deed of trust is the document that pledges the property as security for the debt and permits a lender to foreclosure if you fail to make the monthly payments.

FAQ Fill in the date of the mortgage deed. Enter the names of the lender (Natwest) and borrower. Enter the address of the property being mortgaged. Specify the amount of the loan and interest rate. Provide a description of the property being mortgaged. Enter the term of the mortgage.

To put simply, the deed is the legal document that proves who holds title to a property, while a mortgage is an agreement between a financial lender and borrower to repay the amount borrowed to purchase a home.

A mortgage involves only two parties: the borrower and the lender. A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.