Living Trust Taxes

Description

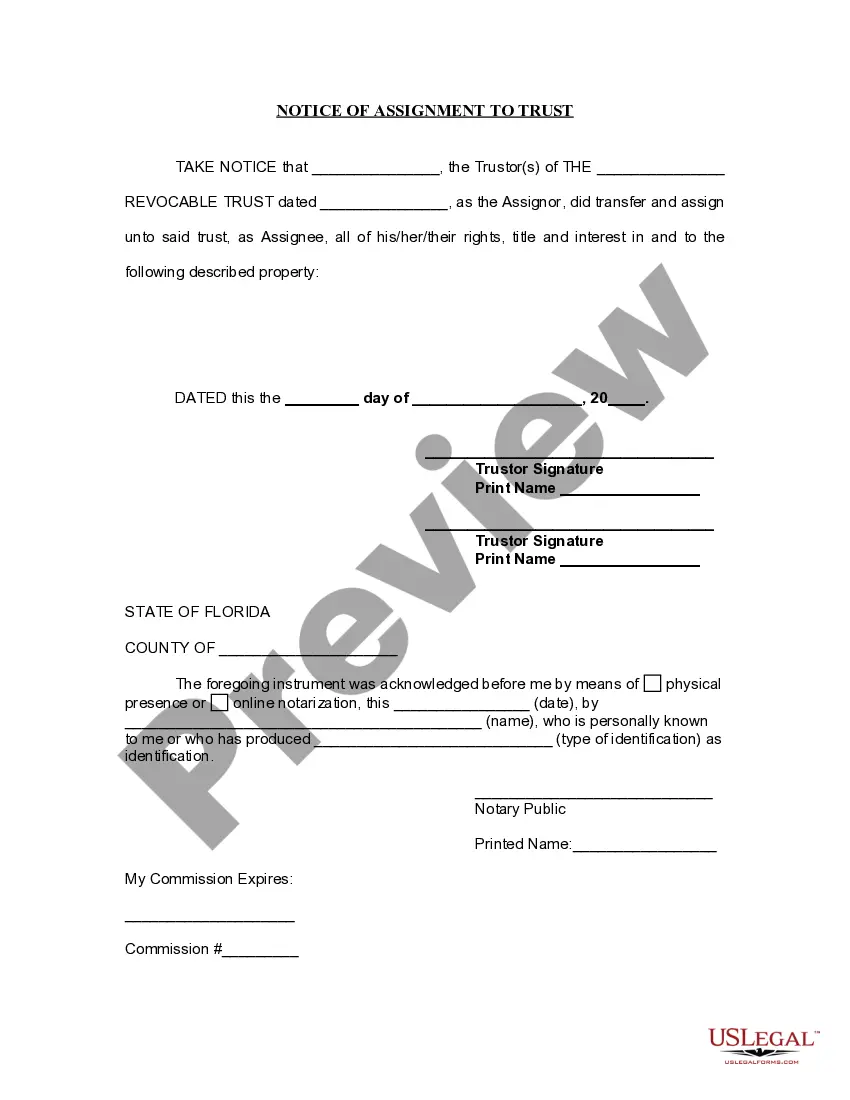

How to fill out Florida Notice Of Assignment To Living Trust?

- If you're a returning user, log into your account and locate the template you need. Click the Download button to save it to your device. Ensure your subscription remains active to avoid interruptions.

- For first-time users, start by reviewing the form preview and description. Confirm that it meets your requirements and complies with your local regulations.

- If the chosen template doesn't suit your needs, utilize the search feature to find the correct one. Once you find a match, proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting the subscription plan that works best for you. You'll need to create an account to access the full library.

- Complete your transaction by entering your credit card or PayPal details. After the purchase, you’ll have immediate access.

- Download your completed form. You can save it and find it anytime in the My Forms section of your profile.

In conclusion, US Legal Forms simplifies the process of obtaining living trust tax documents. With a robust collection of over 85,000 forms and access to premium experts for guidance, you can ensure your legal documents are accurate and up-to-date.

Start your journey today by visiting US Legal Forms and take advantage of their extensive resources!

Form popularity

FAQ

To avoid inheritance tax with a trust, consider establishing an irrevocable trust, as these types of trusts remove assets from your estate. By transferring assets to this trust, you can potentially protect them from being taxed upon death. Additionally, it's wise to stay informed on state laws and exemptions that affect living trust taxes. Platforms like uslegalforms can assist you in setting up the best trust to minimize tax burdens.

No, a living trust itself does not count as income during the grantor's lifetime. Instead, the assets within a living trust are treated as part of the grantor’s estate and taxed accordingly. Income generated by the trust's assets may be considered taxable income when distributed to beneficiaries. Understanding how these distributions work can help you manage living trust taxes more effectively.

A living trust itself typically does not file a tax return during the grantor's lifetime. Instead, the income is reported on the grantor’s personal tax return, which simplifies the tax process. However, when the grantor passes away, the trust may need to file a separate tax return for income generated after their death. It's advisable to rely on platforms like uslegalforms to ensure compliance with the right procedures for living trust taxes.

Beneficiaries of a trust may face taxes based on the income distributed to them. Generally, income distributions from a trust are taxable to the beneficiaries at their individual tax rates. It's crucial to remember that distributions of principal are not taxable but may have different implications under living trust taxes. Using reliable resources can help beneficiaries navigate these tax obligations effectively.

Trusts can avoid income taxes through specific provisions that allocate income to beneficiaries. In many cases, the income generated from the trust's assets is taxed at the beneficiaries' tax rates. Additionally, a properly structured living trust can help defer some tax liabilities, allowing better financial management for those receiving distributions from the trust. Utilizing our platform can guide you through establishing a trust with favorable tax implications.

Living trust taxes can be a concern for individuals considering this estate planning tool. One disadvantage is that a revocable living trust does not provide tax benefits during the grantor's lifetime. Also, assets held in a living trust may still be subject to estate taxes, depending on the total value of the estate. It’s essential to consult a tax professional for personalized advice.

Trust beneficiaries may face taxes on distributions they receive from the trust. When a trust generates income, that income is typically taxed to the trust unless it is distributed to the beneficiaries. In such cases, living trust taxes apply to the beneficiaries, who will report the income on their individual tax returns. It is essential to understand how distributions work to manage your tax obligations effectively.

Having a living trust generally does not affect your taxes significantly. When you create a living trust, your assets remain part of your estate, and you still report income generated from those assets on your personal tax returns. Living trust taxes are similar to how you would handle taxes on assets held outside of the trust. Therefore, while the trust may help with estate planning and avoiding probate, it does not provide tax benefits during your lifetime.

Certain assets may not be suitable for an irrevocable trust, including personal residences, retirement accounts, and certain types of insurance policies. Placing these assets in a trust may trigger unwanted living trust taxes or complications in management. Evaluating assets with a financial professional can help ensure optimal asset placement and management for tax purposes. Consulting platforms like US Legal Forms offers structured guidance to ease the process.

To avoid capital gains tax in an irrevocable trust, consider utilizing strategies like holding assets until they appreciate in value or employing tax-loss harvesting techniques. Additionally, becoming familiar with living trust taxes helps in understanding how gains are taxed during trust administration. Working with financial advisors can provide tailored advice and strategies for your specific situation.