Living Trust Form Blank For Indiana

Description

How to fill out Florida Notice Of Assignment To Living Trust?

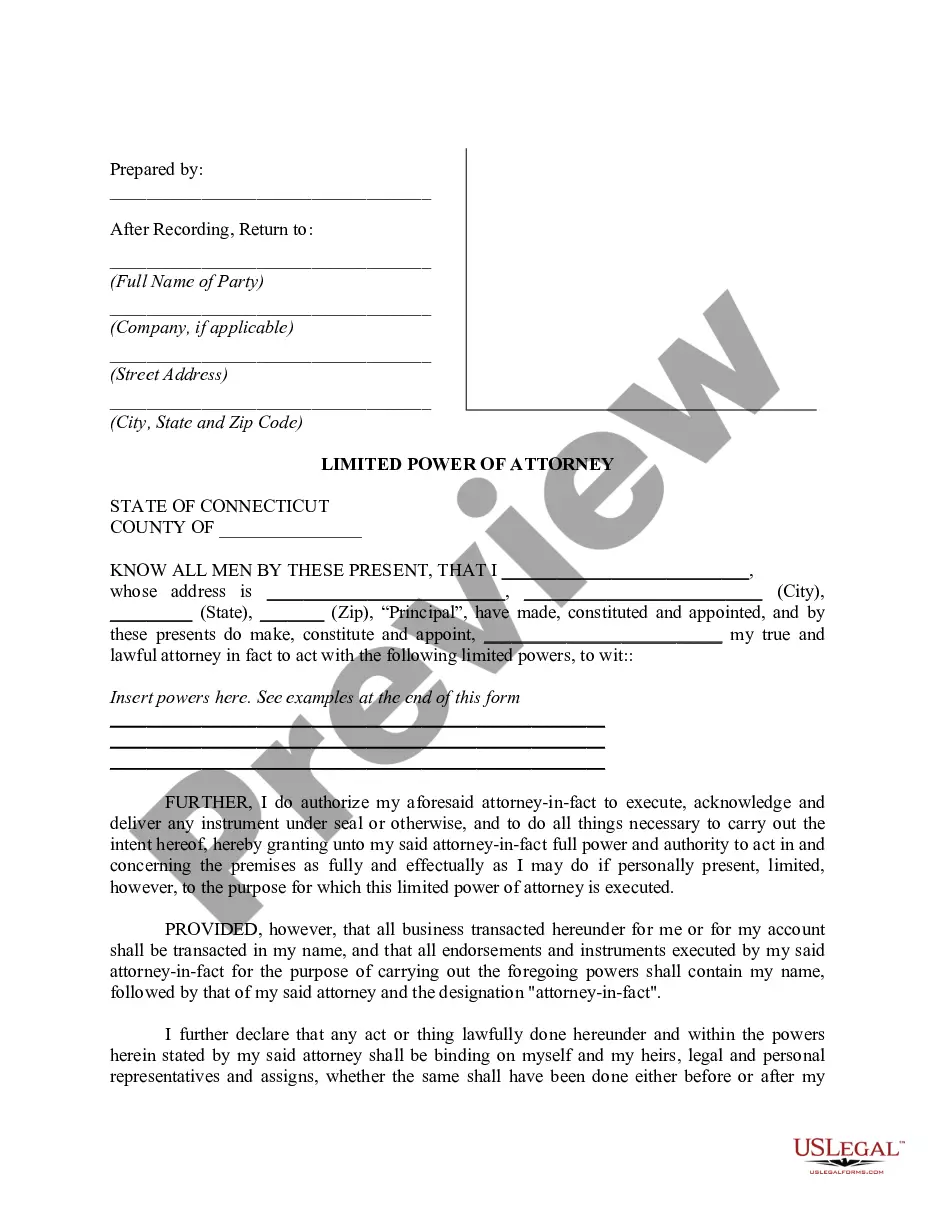

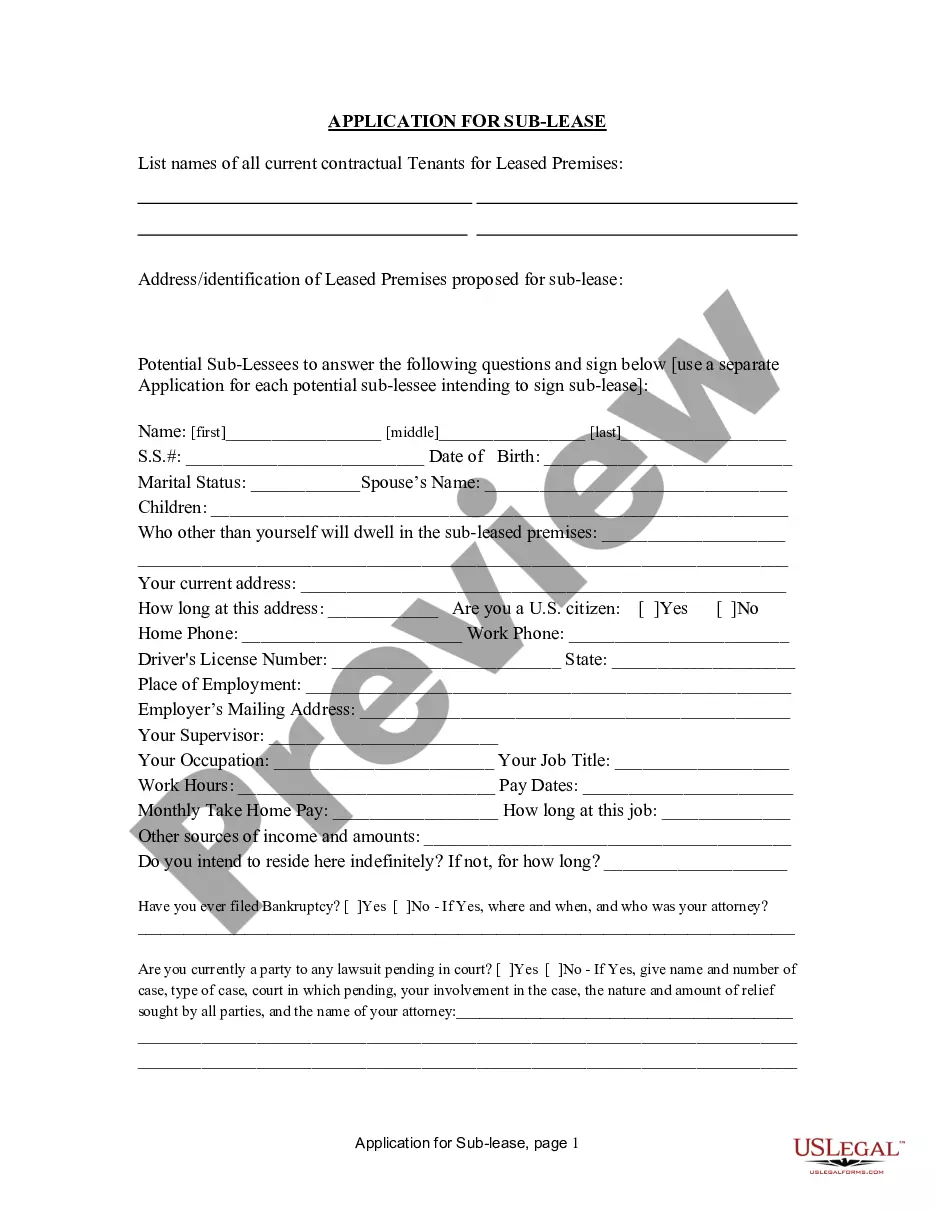

- Log in to your US Legal Forms account if you're a returning user. Make sure your subscription is active and click the Download button to save the form on your device.

- For first-time users, start by browsing the Preview mode to review the form description. Ensure the living trust form you choose meets your requirements and complies with Indiana regulations.

- If necessary, utilize the Search tab to find any needed forms that fit your specific circumstances. Confirm they are suitable before advancing.

- Select your form by clicking the Buy Now button and pick a subscription plan that works best for you, which requires creating an account for access.

- Process your payment using your credit card or PayPal account to finalize your subscription.

- Download your living trust form. Save the file on your device and access it anytime in the My Forms section of your profile.

In conclusion, US Legal Forms offers a robust and user-friendly solution for those seeking legal documentation. With a vast library of over 85,000 forms, you can ensure your documents are accurate and tailored to your needs.

Don’t wait—visit US Legal Forms today to get started on your estate planning!

Form popularity

FAQ

Setting up a trust template using a living trust form blank for Indiana is straightforward. First, gather necessary information about your assets and beneficiaries. Then, choose a reliable source, like US Legal Forms, that offers compliant templates specific to Indiana law. Finally, fill out the form accurately, making sure to review it thoroughly before signing.

Filling out a living trust form blank for Indiana involves a few simple steps. First, gather all pertinent information regarding your assets and beneficiaries. Next, clearly outline your wishes for asset distribution and designate a trustee to manage the trust. Finally, ensure that you follow state-specific requirements, which may involve notarizing the document or having witnesses present.

When creating a living trust form blank for Indiana, certain assets should not be included. For example, retirement accounts, such as 401(k)s and IRAs, should typically remain outside the trust because of tax implications. Additionally, assets with beneficiary designations, like life insurance policies, should also be excluded. It's important to consult with a legal expert to ensure your living trust is set up correctly.

Yes, you can set up a trust fund by yourself using a living trust form blank for Indiana. Many individuals successfully establish trust funds independently by filling out the necessary paperwork. However, it's crucial to understand the specifics of Indiana law to ensure the trust is valid. If you feel uncertain, consider consulting an expert or utilizing a trusted online platform for guidance.

Yes, you can write your own trust in Indiana, and using a living trust form blank for Indiana can simplify the process. It is important to ensure that your document adheres to state laws to be legally binding. If you have uncertainties, seeking guidance from a legal professional can provide peace of mind and help clarify the process.

While notarization is not a legal requirement for a trust in Indiana, it is advisable. Notarizing your living trust form blank for Indiana can help validate the document, making it more acceptable to banks and other institutions. Having a notary witness your signing can also reduce the risk of future disputes.

To create a living trust by yourself, start by gathering your assets and deciding how you want to distribute them. Use the living trust form blank for Indiana as a starting point, and fill in the necessary details. It's essential to review your completed document thoroughly and consider having it notarized for added security.

Creating a living trust template can be straightforward. Begin by determining your assets and beneficiaries, then utilize the living trust form blank for Indiana as your foundation. You can customize this form to suit your specific needs, ensuring all legal requirements are met along the way.

One significant mistake parents make is failing to fund the trust properly. After creating the living trust form blank for Indiana, it is crucial to transfer assets into the trust to effectively utilize its benefits. Not addressing this step can leave the trust underfunded, negating its advantages for future generations.

In Indiana, trust documents do not have to be notarized. However, having your living trust form blank for Indiana notarized can offer greater protection. It is wise to consult with an attorney to ensure compliance with all relevant laws and to enhance the trust's validity in the eyes of any financial institutions.