Living Trust Form Sample For Texas

Description

How to fill out Florida Assignment To Living Trust?

- Visit the US Legal Forms website and log into your existing account. Make sure your subscription is active before proceeding. If you need to renew, follow your payment plan guidelines.

- Search for the desired living trust form sample using the Preview mode and description. Confirm it meets your requirements from both a personal and legal standpoint.

- If necessary, use the Search tab to explore more templates. When you find one that fits your needs, continue to the next step.

- Select the Buy Now button for the form you wish to purchase. Choose the subscription plan that best suits your needs and create an account if you haven’t done so already.

- Complete your purchase by entering your payment information, either through credit card or PayPal.

- Download the living trust form to your device. You can also access it later via the My Forms section of your profile.

In conclusion, US Legal Forms provides a robust solution for anyone looking to create legal documents like a living trust. With a vast library and expert assistance, you can ensure that your forms are accurate and meet legal standards.

Take the next step in securing your future and access your living trust form today!

Form popularity

FAQ

While having a trust offers numerous benefits, it also comes with some potential downfalls. One major concern is that a trust must be properly funded to be effective. If your parents do not transfer their assets into the trust, it may not serve its intended purpose. Moreover, using a living trust form sample for Texas can help ensure proper funding and alignment with their estate planning goals.

A family trust can provide many advantages, but it also has some disadvantages worth noting. For instance, managing a family trust may require ongoing administrative work, and failure to follow the proper guidelines can lead to complications. It's crucial to have a living trust form sample for Texas that outlines clear terms and conditions. However, many people find these challenges manageable with the right support and resources.

While putting assets in a trust has many benefits, there are some drawbacks to consider. Firstly, creating a living trust form sample for Texas involves legal fees and administrative tasks that can be time-consuming. Secondly, depending on the type of trust established, your parents may lose certain tax benefits associated with direct asset ownership. It's important to weigh these factors carefully before deciding on the best option.

Establishing a trust can be a wise decision for your parents, as it offers control over how their assets are managed and distributed. Using a living trust form sample for Texas can simplify this process, ensuring that their wishes are clearly outlined. Additionally, a trust can help avoid the probate process, making it easier for their beneficiaries to access the assets. Overall, a trust may provide peace of mind for your parents and financial security for their loved ones.

You can set up a trust fund by yourself, but it requires careful planning and documentation. A living trust form sample for Texas can provide you with the necessary framework to get started. While managing it independently is possible, consult with a professional if questions arise as you navigate the process.

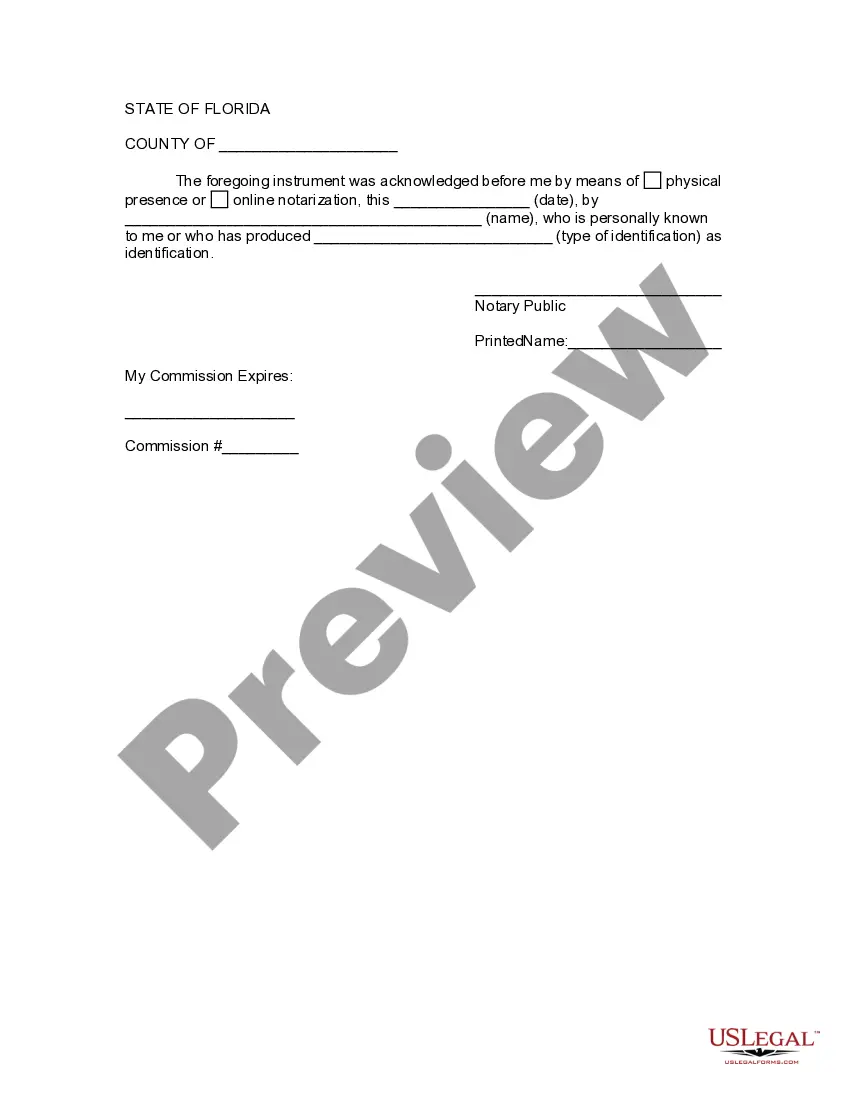

Yes, a living trust typically needs to be notarized in Texas to be considered valid. This step ensures that the signatures are authentic and protects the trust's enforceability. Using a living trust form sample for Texas can help you identify the notarization requirements effectively.

To create a living trust by yourself, start by gathering your assets and determining how you want them distributed after your death. A living trust form sample for Texas will guide you through drafting the necessary documents. After drafting, you must sign and fund your trust properly to activate it.

You can write your own living trust in Texas, provided you meet legal requirements. Utilizing a living trust form sample for Texas can give you a strong foundation and ensure you include all necessary elements. However, it's wise to have a legal professional review your document to confirm it's valid and suits your intentions.

The biggest mistake parents often make when setting up a trust fund is failing to properly fund it. A trust without assets does not provide its intended benefits. To avoid this common pitfall, consider using a living trust form sample for Texas to ensure you understand the funding process and include all necessary assets.

Yes, you can write your own trust in Texas. It's important to ensure that your trust meets all legal requirements to be valid. Utilizing a living trust form sample for Texas can guide you through the necessary steps and language, making it easier to create an effective trust that serves your needs.