Living Trust Form Sample For Canada

Description

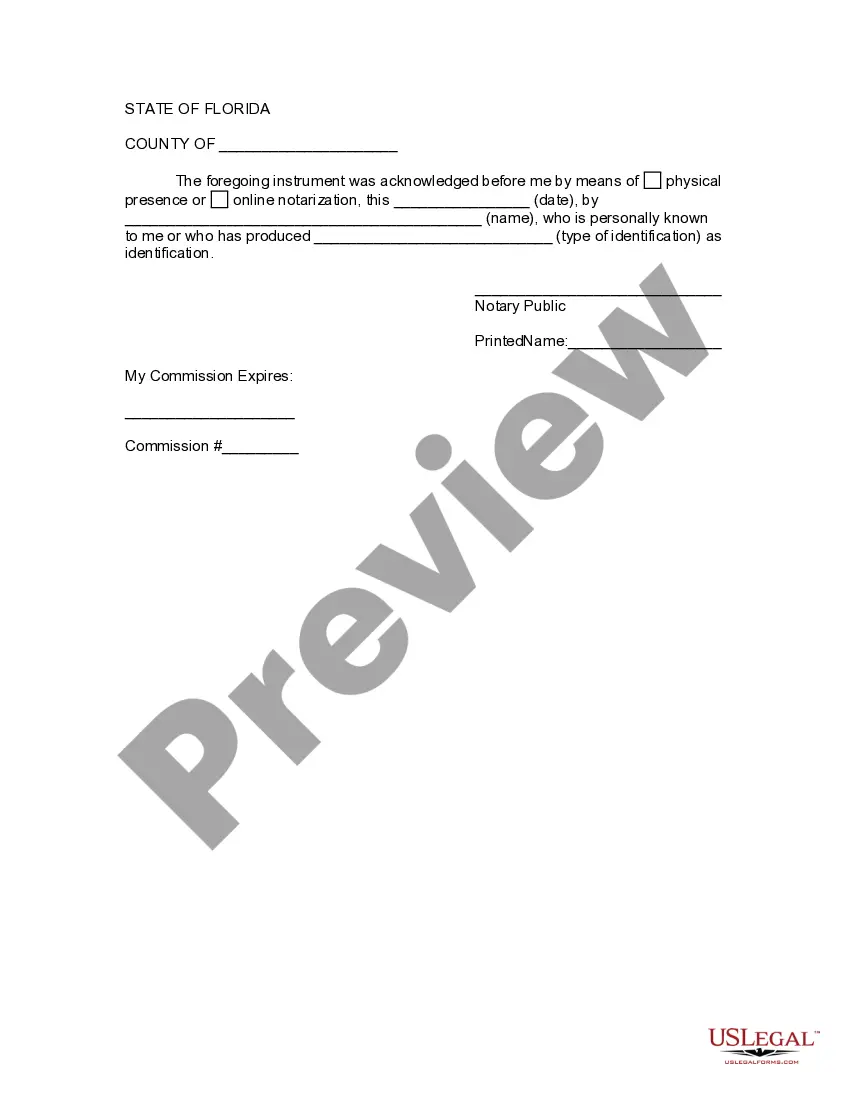

How to fill out Florida Assignment To Living Trust?

- If you are a returning user, log in to your account to access your downloaded templates. Ensure your subscription is current; if it has expired, renew according to your selected plan.

- For new users, start by checking the preview and description of the living trust form. Confirm that it meets your requirements and complies with local laws.

- If the form doesn’t fit your needs, utilize the search feature to find an alternative template that better suits your situation.

- Once you’ve selected a suitable form, click on the Buy Now button and choose your preferred subscription plan, creating an account to access the vast library.

- Complete your purchase by entering your payment details for your subscription plan.

- Finally, download the living trust form and save it to your device. You can also access it anytime through the My Forms section of your account.

US Legal Forms not only provides a robust collection of legal documents but also offers access to over 85,000 fillable and editable templates. Users benefit from premium expert support for document completion to ensure accuracy and legality.

Ready to simplify your estate planning? Visit US Legal Forms today to explore their extensive library and obtain your living trust form sample for Canada with ease.

Form popularity

FAQ

Creating a living trust on your own is an achievable task if you follow a structured approach. Begin by researching and obtaining a reliable living trust form sample for Canada, which provides guidance on how to fill it out. After completing the form, ensure you transfer ownership of your assets to the trust, and remember to update any beneficiary designations as necessary. Using a platform like US Legal Forms can simplify this process, offering templates and expert instructions tailored to your needs.

To set up a trust template, start by gathering essential information about the assets you wish to include and the beneficiaries you want to designate. You can use a living trust form sample for Canada to ensure compliance with local laws. After completing the template, review it carefully, and consider consulting with a legal professional to confirm it meets your needs. Finally, sign and notarize the document to make it valid.

Creating a living trust in Canada involves a few key steps. First, you need to decide on the assets you want to include in the trust and designate a trustee to manage it. Utilizing a living trust form sample for Canada can simplify the drafting process, and platforms like USLegalForms provide valuable resources to guide you through the creation of your trust.

In general, US trusts may not be directly recognized as valid in Canada due to differing laws. However, many trust principles are similar, and under certain circumstances, a US trust can function within Canada. When examining a living trust form sample for Canada, it's advisable to seek guidance from an attorney, ensuring compliance with Canadian regulations.

Yes, a living trust can be applicable in Canada, but it is essential to understand the local regulations. A living trust allows individuals to manage their assets during their lifetime and can facilitate estate planning. If you are considering a living trust form sample for Canada, it's crucial to consult with a legal professional familiar with Canadian laws.

To put your house in a living trust in Canada, you need to draft a trust agreement and transfer the title of the property to the trust. This process often involves legal assistance to ensure everything is done correctly. A living trust form sample for Canada can provide clear examples and help ease the transition.

If your parents want to protect their assets and avoid probate, a trust may be an effective solution. However, it is crucial to evaluate their specific needs and financial situation first. A living trust form sample for Canada can empower you with the necessary information to discuss this option with them.

One notable downfall of having a trust is the potential for complicated management, especially if the trust is not adequately funded or monitored. Additionally, some may face emotional challenges when designating beneficiaries. A living trust form sample for Canada can simplify understanding and implementing your wishes.

Filling out a living trust involves providing detailed information about your assets and beneficiaries. You must specify how your assets will be managed and distributed after your passing. To assist you, a living trust form sample for Canada provides a clear structure you can follow.

A family trust can limit your control over assets, restricting your ability to make quick financial decisions. Moreover, it may require ongoing management and legal compliance that can add costs. Utilizing a living trust form sample for Canada can guide you in navigating these challenges effectively.