Florida Trust Amendment Form For Taxes

Description

How to fill out Florida Amendment To Living Trust?

It’s clear that you cannot transform into a legal expert instantly, nor can you swiftly learn how to prepare the Florida Trust Amendment Form For Taxes without a specialized background.

Drafting legal documents is a lengthy endeavor that demands specific education and expertise.

So why not entrust the drafting of the Florida Trust Amendment Form For Taxes to the experts.

Preview it (if this feature is available) and review the supporting information to confirm whether the Florida Trust Amendment Form For Taxes is what you are looking for.

If you need another form, restart your search.

- With US Legal Forms, one of the most comprehensive legal template libraries, you can discover a variety of documents ranging from court filings to templates for internal corporate communications.

- We recognize the significance of compliance and adherence to federal and state regulations.

- That’s why all forms on our site are locale-specific and current.

- To begin, visit our website and obtain the document you need in just a few minutes.

- Utilize the search bar at the top of the page to find the document you require.

Form popularity

FAQ

Irrevocable trust: If a trust is not a grantor trust, it is considered a separate taxpayer. Taxable income retained by the trust is taxed to the trust. Distributed income is taxed to the beneficiary who receives it.

It's important to know what you want to change and where in your trust document this information lives (such as the article number you're amending). Fill out the amendment form. Complete the entire form. It's important to be clear and detailed in describing your changes.

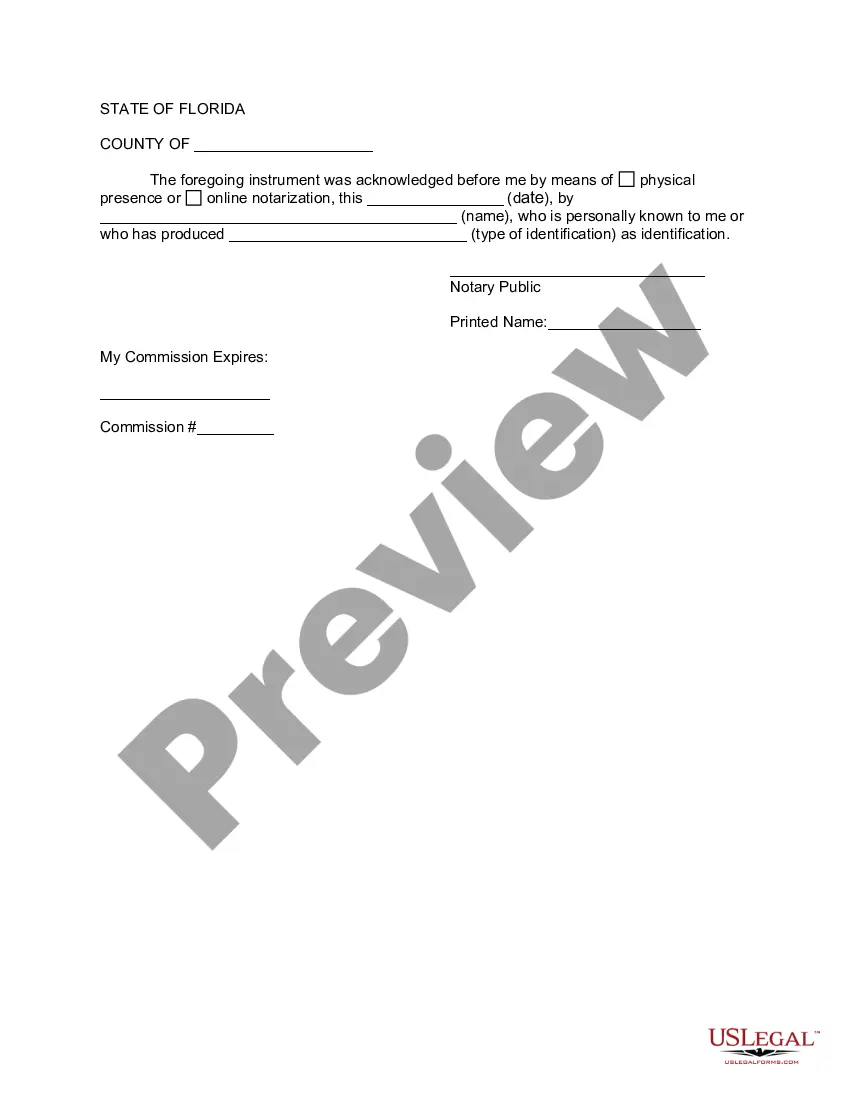

In Florida, anytime a trust amendment is created, it must be notarized in order to become enforceable.

In Florida, the amendment must conform to the procedures laid out in the trust's declaration. If no procedures are specified, Florida law allows the grantor to amend the trust by executing a document that clearly states their intentions.

Florida law requires that a trust document and any amendments to it be executed by the Grantor(s) in the presence of two witnesses who must also execute the document.