No Lien Affidavit Format

Description

How to fill out Florida Owner's Or Seller's Affidavit Of No Liens?

Creating legal documents from the ground up can frequently be daunting.

Certain situations may require extensive research and significant financial investment.

If you’re seeking a simpler and more economical method of preparing No Lien Affidavit Format or any other paperwork without unnecessary hurdles, US Legal Forms is always here to assist you.

Our online repository of over 85,000 current legal documents encompasses nearly every facet of your financial, legal, and personal matters.

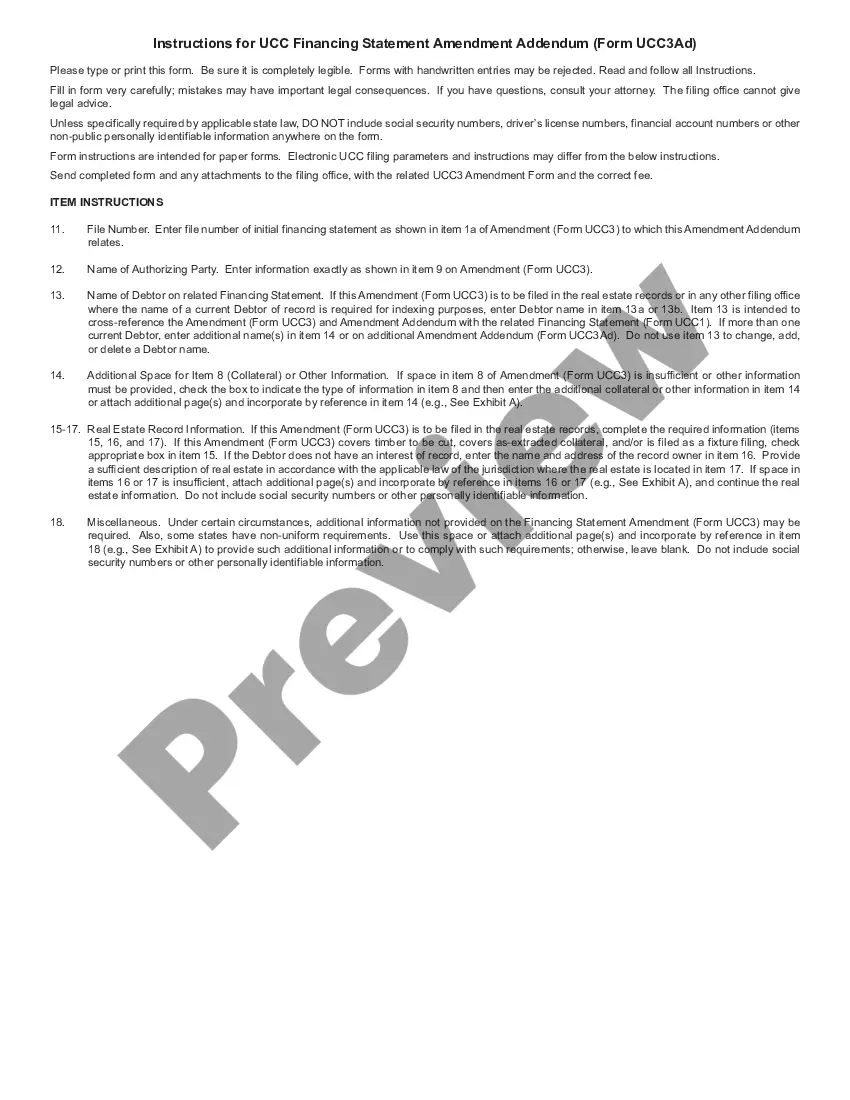

However, before proceeding directly to download the No Lien Affidavit Format, follow these suggestions: Review the document preview and descriptions to confirm that you are on the correct document you are seeking. Ensure that the template you select complies with the statutes and regulations of your state and county. Choose the most appropriate subscription option to acquire the No Lien Affidavit Format. Download the form. Then fill it out, certify it, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of expertise. Join us today and transform the form filling process into something straightforward and efficient!

- With just a few clicks, you can quickly obtain state- and county-compliant forms meticulously crafted for you by our legal experts.

- Utilize our website whenever you require trustworthy and dependable services through which you can conveniently find and download the No Lien Affidavit Format.

- If you’re already familiar with our services and have created an account with us in the past, simply Log In to your account, find the form, and download it or re-download it anytime later in the My documents section.

- Not signed up yet? No problem. It requires minimal time to register and browse the catalog.

Form popularity

FAQ

The State of Arizona allows a credit for accounting and reporting expenses which results in a reduction of the amount of state tax owed. The accounting credit is applicable only to the state's transaction privilege tax and/or severance tax. The credit does not apply to city, county or other taxes.

Changes can be made online (No Fee) from the Designated Broker personal page. Log into .azre.gov, under Quick links, select Business Address Change and follow the prompts. (If Sole Proprietor, in signing this form, I declare I am the ONLY person who owns, has exclusive title or legal right to the business.)

In order to earn CPA licensure in Arizona, you must provide proof of a passing score (90% or better) on an examination in professional ethics within two years immediately preceding submission of the application for certification. The AICPA offers the ethics exam.

An Arizona LLC MUST have a Business Address, but it may be: A physical street address in Arizona OR not in Arizona. A post-office box in Arizona OR not in Arizona.

You can easily change your Arizona LLC name. The first step is to file a form called the Articles of Amendment with the Arizona Corporation Commission and wait for it to be approved. This is how you officially change your LLC name in Arizona.

You cannot change your business name on-line. You must notify the Department of Revenue in writing by completing the Business Account Update (form 10193) and submitting it with payment for applicable fees. The update form is available in the Forms section for Transaction Privilege Tax (TPT) on .azdor.gov.

??Arizona Corporation Commission? - Corporations or LLCs ??Corporations and LLCs may file a change of mailing address with the AZ Corporation Commission through eCorp, by email, or by phone. See their webiste for more information about forms and filing fees.

IRS. Go to the IRS.gov website to search and find Form 8822-B. You'll use this form to change your registered business mailing address, business location, or the identity of your responsible party. The form is fairly straightforward and takes care of updating your Employer Identification Number (EIN) information.