Rent Default Meaning For Insurance

Description

How to fill out Florida Notice Of Default On Residential Lease?

No matter if for corporate reasons or personal issues, everyone encounters legal circumstances at some point in their life.

Filling out legal documents demands meticulous care, starting with choosing the right form template.

Complete the account creation form, choose your payment option: either a credit card or PayPal account, select the desired file format, and download the Rent Default Definition For Insurance. After saving it, you can fill out the form using editing software or print it and complete it manually.

- For example, selecting the incorrect version of a Rent Default Definition For Insurance will lead to its rejection upon submission.

- Consequently, it is vital to have a trustworthy source of legal documents like US Legal Forms.

- If you are looking to obtain a Rent Default Definition For Insurance template, follow these simple steps.

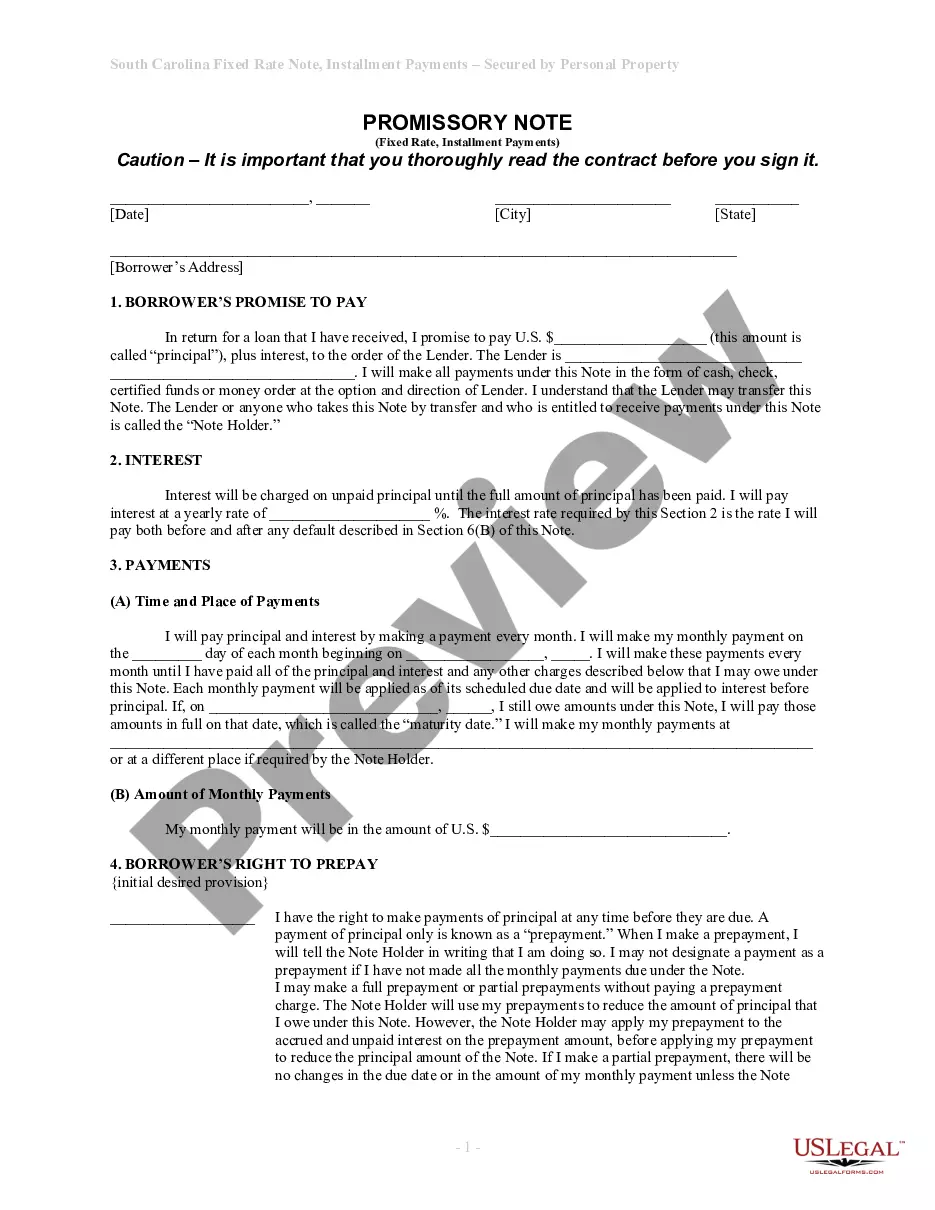

- Access the template you require via the search feature or through catalog browsing.

- Review the description of the form to ensure it corresponds with your situation, state, and area.

- Click on the preview of the form to inspect it.

- If this is not the correct document, return to the search option to locate the Rent Default Definition For Insurance example you need.

- Download the file when it fulfills your criteria.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the suitable pricing choice.

Form popularity

FAQ

Defaulting on rent refers to a tenant's failure to meet their rental payment obligations as specified in the lease agreement. This situation can lead to various consequences, including eviction proceedings and potential damage to the tenant's credit history. Understanding the rent default meaning for insurance can help landlords take preventive measures to protect their investments. Resources like US Legal Forms can provide valuable insights into navigating these issues effectively.

In the context of rental agreements, 'default' refers to a situation where a tenant fails to meet the terms outlined in their lease. This could involve not paying rent on time or not adhering to specific regulations agreed upon in the contract. Understanding the rent default meaning for insurance is crucial, as it helps tenants and landlords navigate potential disputes and protects both parties' interests.

Where a tenant fails to make rent payments or falls behind on them, they can be said to be in default. Default on payment of rent can lead in turn to a landlord being unable to make their mortgage payments, thereby threatening their property interest.

Liability coverage is a standard offering in most landlord insurance policies. Liability insurance on a landlord's policy will cover liability due to bodily injury or property damage arising out of the ownership, maintenance, and use of the rental premises only.

If you're renting a whole property from a landlord (whether that is your local council, a housing association or a private landlord) you won't need buildings insurance as you don't own the property. However, you probably will need contents insurance to protect your personal possessions.

If you're renting out your property then you need to check with your provider that your home buildings insurance will still be valid. Usually, you need to take out a specific landlord insurance policy, which can include buildings insurance, landlords' contents insurance and property owners' liability insurance.

It's up to you to decide whether you need public liability insurance, but it's included as standard in lots of landlord insurance policies and many landlords decide they need it.