Default On A Lease With Bad Credit

Description

How to fill out Florida Notice Of Default On Residential Lease?

Locating a reliable source for the most current and suitable legal templates is half the challenge of navigating bureaucracy.

Selecting the appropriate legal documents requires accuracy and meticulousness, which is why it's essential to obtain samples of Default On A Lease With Bad Credit solely from trustworthy providers, such as US Legal Forms.

After you have the form on your device, you can edit it with the editor or print it out and complete it manually. Remove the hassle associated with your legal documentation. Explore the extensive US Legal Forms catalog where you can discover legal samples, verify their relevance to your situation, and download them instantly.

- Utilize the catalog navigation or search function to find your template.

- Examine the form’s description to ensure it meets the criteria of your state and county.

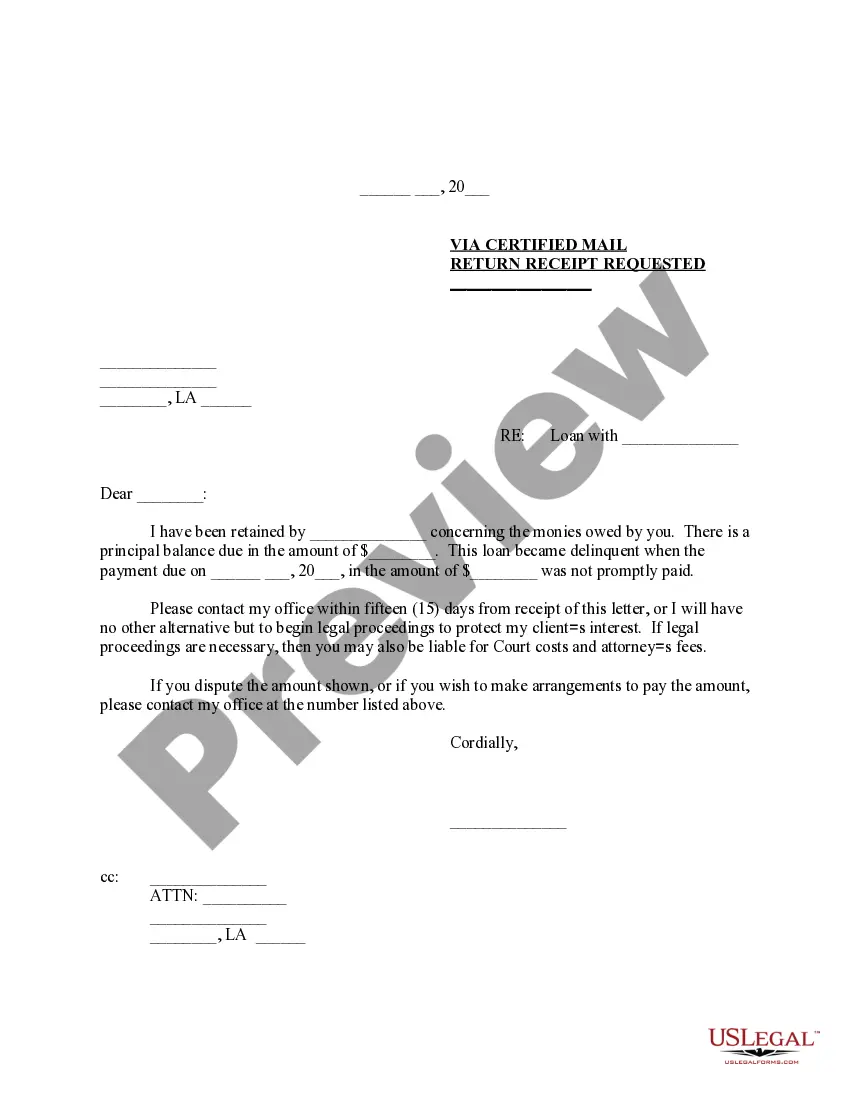

- Check the form preview, if available, to confirm the template is the one you need.

- Return to the search and look for the correct document if the Default On A Lease With Bad Credit does not suit your requirements.

- Once you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify your identity and access your selected forms in My documents.

- If you do not yet have an account, click Buy now to acquire the template.

- Choose the pricing plan that aligns with your needs.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Default On A Lease With Bad Credit.

Form popularity

FAQ

The good news is there's no minimum credit score needed to lease a vehicle in Canada. Yes, it's true, you can lease a car with bad credit. That being said, the lower your credit rating, the more difficult it can be to find a car dealer that will approve a bad credit car lease.

Provide proof of financial Stability Letter from your employer. Reference letter from previous landlords. Proof of income or pay stubs. Rent receipts from your last rental. A Co-Signer.

Explain Your Situation- Be extremely honest with your landlord or property manager about your credit history. Explain why your credit score may be low, whether you're dealing with medical bills, divorce, or other financial situations, and your landlord may be more lenient.

Landlords can find key pieces of financial information by performing a credit check on a Tenant during the Tenant Screening process, including, creditworthiness, typically based on credit score, payment history, outstanding loans, credit cards, or other debts, any accounts in collections as well as any public records, ...

Make sure to explain the details surrounding your damaged credit, and what you're currently doing to repair it. Share information on your current employment status to show you have money coming in regularly.