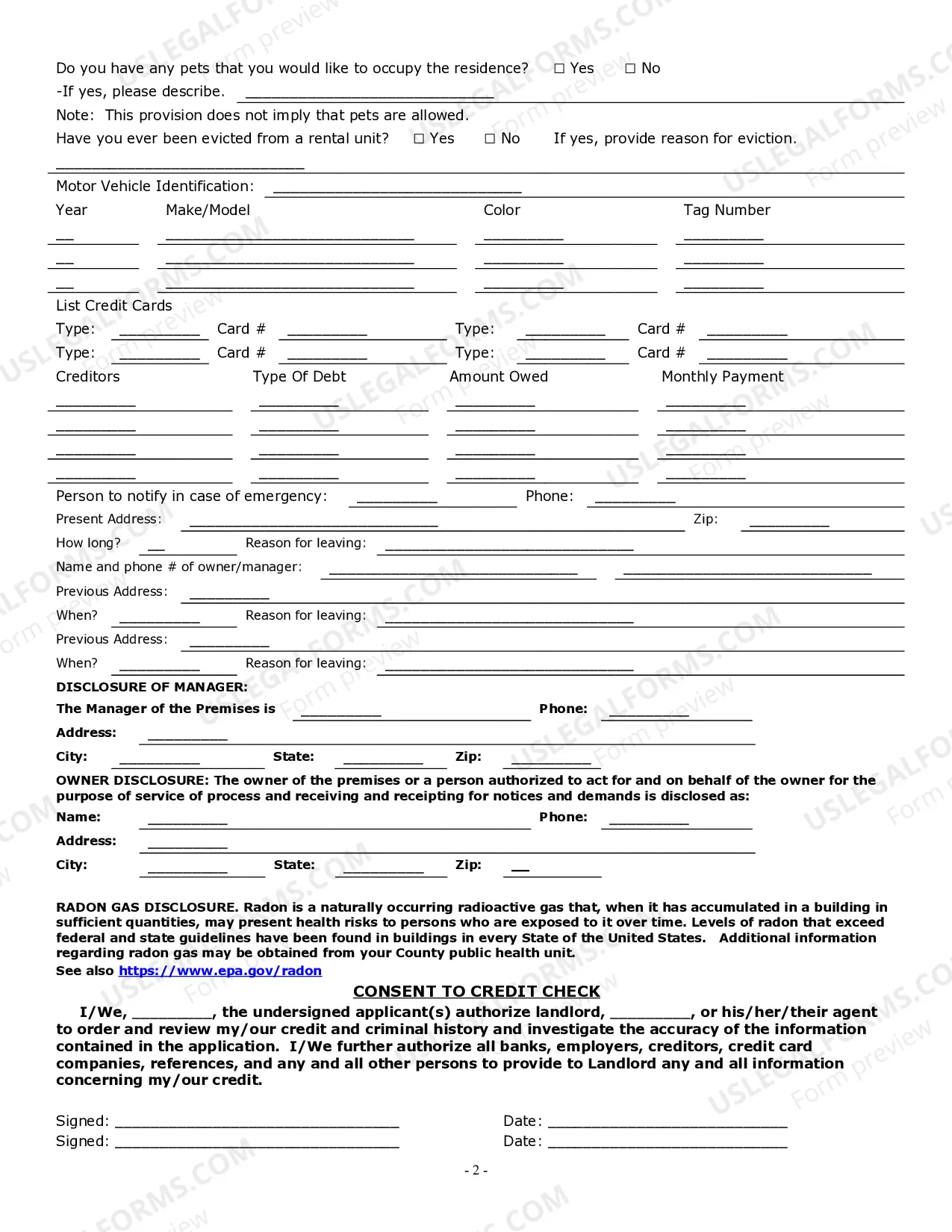

Florida Rental Application With Credit Check

Description

How to fill out Florida Residential Rental Lease Application?

Utilizing legal document examples that adhere to federal and local regulations is essential, and the internet provides numerous choices to select from.

However, what is the purpose of spending time searching for the suitable Florida Rental Application With Credit Check template online when the US Legal Forms digital library already compiles such documents in one location.

US Legal Forms is the most extensive online legal repository featuring over 85,000 editable templates created by lawyers for various business and personal situations.

Review the template using the Preview option or the text outline to confirm it satisfies your requirements.

- They are easy to navigate with all documents categorized by state and intended use.

- Our experts stay updated with legal changes, ensuring your documents are current and compliant when you acquire a Florida Rental Application With Credit Check from our site.

- Obtaining a Florida Rental Application With Credit Check is fast and straightforward for both existing and new users.

- If you possess an account with an active subscription, Log In and download the required document template in your desired format.

- If you are new to our website, follow the outlined steps below.

Form popularity

FAQ

To pass a rental credit check online, start by reviewing your credit report for any inaccuracies. Ensure that your credit history reflects timely payments and responsible credit use. When completing a Florida rental application with credit check, be prepared to provide accurate personal information, including your income and rental history. Using a reliable platform like US Legal Forms can streamline this process, helping you access the necessary forms and guidance.

While a 500 credit score makes it challenging to secure an apartment, it is not impossible. Some landlords may consider other factors like income, rental history, or even a larger security deposit. Utilizing a Florida rental application with credit check can clarify your financial standing and help you find landlords open to working with you. Additionally, platforms like USLegalForms can assist you in navigating the application process more smoothly.

The 3x rent rule in Florida suggests that your monthly income should be at least three times your rent. For example, if your rent is $1,000, you should earn at least $3,000 monthly. This guideline helps landlords ensure you can afford the expenses associated with a Florida rental application with credit check. It’s a good idea to have documentation of your income ready to support your application.

To rent in Florida, landlords often look for a credit score of at least 620. However, some may accept lower scores if you have a strong rental history or can provide a co-signer. A Florida rental application with credit check can help you understand where you stand. It’s always best to be upfront about your financial situation to find the right rental option.

Yes, bad credit can lead to denial when applying for an apartment. Landlords often view poor credit as a sign of financial instability. However, a Florida rental application with credit check does not solely rely on credit scores; factors like income and rental history also play a role. If you face challenges, consider working with US Legal Forms to strengthen your application.

A rental credit check typically examines your credit history, including payment history, outstanding debts, and credit utilization. Landlords use this information to assess your financial responsibility. When submitting a Florida rental application with credit check, maintaining a good credit score can significantly improve your chances of approval. Being proactive about your financial health will benefit you in the long run.

Getting around rental verification is not advisable, as honesty is essential in the rental process. However, you can enhance your Florida rental application with credit check by providing additional documentation. For instance, offer references from previous landlords or proof of steady income. Using platforms like US Legal Forms can help you present a strong application tailored to your needs.