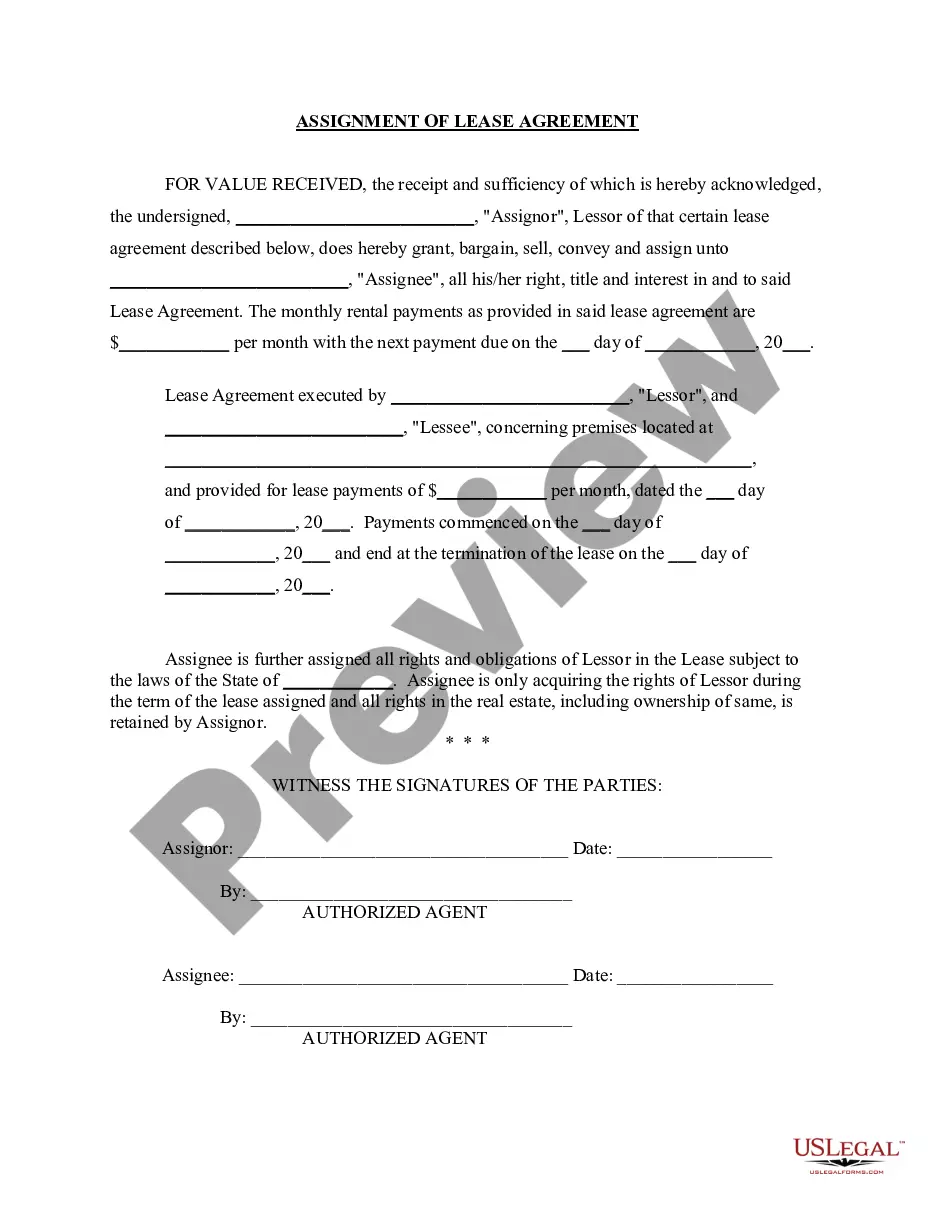

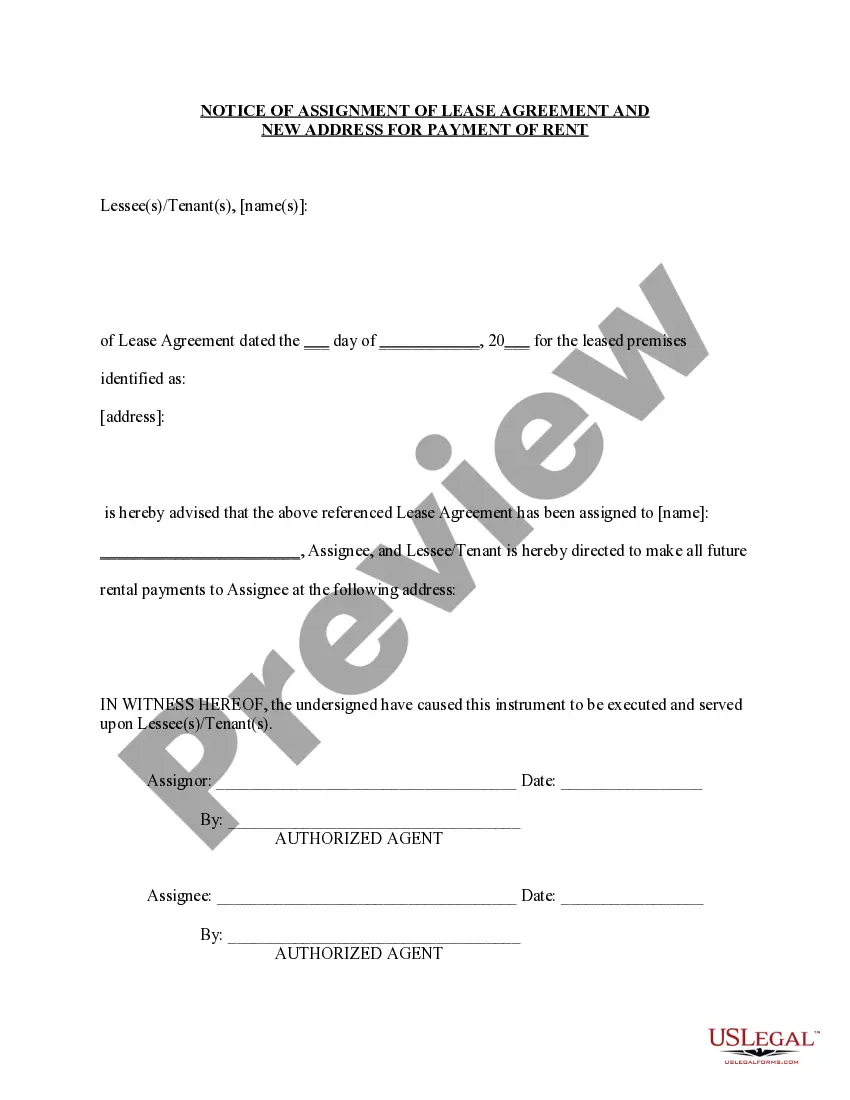

An assignment is the transfer of a property right or title to some particular person under an agreement, usually in writing. Unless an assignment is qualified in some way, it is generally considered to be a transfer of the transferor's entire interest in the estate, chattel, or other thing assigned. An assignment is distinguished from a grant in that an assignment is usually limited to the transfer of intangible rights, including contractual rights, choses in action, and rights in or connected with property, rather than, as in the case of a grant, the property itself. Some contracts restrict the right of assignment, so the terms of the contract must be read to determine if assignment is prohibited. For example, a landlord may permit a lease to be assigned, usually along with an assumption agreement, whereby the new tenant becomes responsible for payments and other duties of the original lessee.

Title: Understanding Assignment of Lease Florida Withholding: Types and Key Considerations Introduction: In the state of Florida, assignment of lease withholding refers to a specific procedure where a tenant withholds a portion of the rent due to the landlord in order to fulfill certain obligations or address particular issues. This detailed description aims to provide a comprehensive overview of assignment of lease Florida withholding, highlighting its types and important considerations. Types of Assignment of Lease Florida Withholding: 1. Rent Abatement: Rent abatement is a common type of lease withholding in Florida. This occurs when tenants temporarily withhold a portion of the rent due to mitigate damages caused by uninhabitable conditions, construction or repairs, or other issues that affect the property's habitability. The withheld sum is often negotiated based on the extent of the inconvenience caused. 2. Security Deposit Deduction: In certain instances, tenants may utilize their security deposit to satisfy lease obligations when the landlord fails to fulfill their responsibilities, such as necessary repairs or pest control. By deducting the required amount from the security deposit, tenants can cover the expenses incurred. 3. Repairs and Maintenance: In situations where the landlord fails to adequately maintain the property or fulfill their obligations for repairs, tenants may choose to withhold a portion of the rent to cover the costs incurred for necessary upkeep. This type of withholding requires proper documentation and contractual agreement between the tenant and landlord. Important Considerations: 1. Legal Compliance: Tenants must ensure that their decision to withhold rent adheres to the applicable laws of Florida. It is recommended to consult an attorney or legal professional to ensure compliance and avoid potential legal consequences. 2. Written Notice: To initiate an assignment of lease Florida withholding, tenants must serve written notice to the landlord, specifying the reason for withholding, the amount to be withheld, and the time frame for the issue to be resolved. Maintaining a clear communication trail is crucial to avoid misunderstandings and facilitate resolution. 3. Documentation: Prior to withholding rent, tenants should compile evidence and documentation supporting their claims or justifying the withholding, such as photographs, inspection reports, or documented correspondence with the landlord. This evidence can be essential in protecting the tenant's rights and justifying their actions. 4. Mediation or Legal Action: If a dispute arises due to the withholding or if the issue remains unresolved, tenants can explore mediation services or consider legal action. Professional guidance from a lawyer specializing in real estate law can be invaluable in navigating complex legal procedures and ensuring fair resolution. Conclusion: Assignment of lease Florida withholding provides tenants with a means to address specific issues related to their rental property and hold landlords accountable. By understanding the types of withholding and adhering to legal requirements and key considerations, tenants can navigate this process effectively and safeguard their rights as tenants in the state of Florida.