Florida Double Llc With Irs

Description

How to fill out Florida LLC Notices, Resolutions And Other Operations Forms Package?

Managing legal documents can be challenging, even for experienced individuals.

When you're looking for a Florida Double LLC with the IRS and can't find time to search for the correct and current version, the process can be overwhelming.

US Legal Forms meets all your needs, whether they are personal or business-related documents, all in one convenient location.

Leverage sophisticated tools to complete and manage your Florida Double LLC with the IRS.

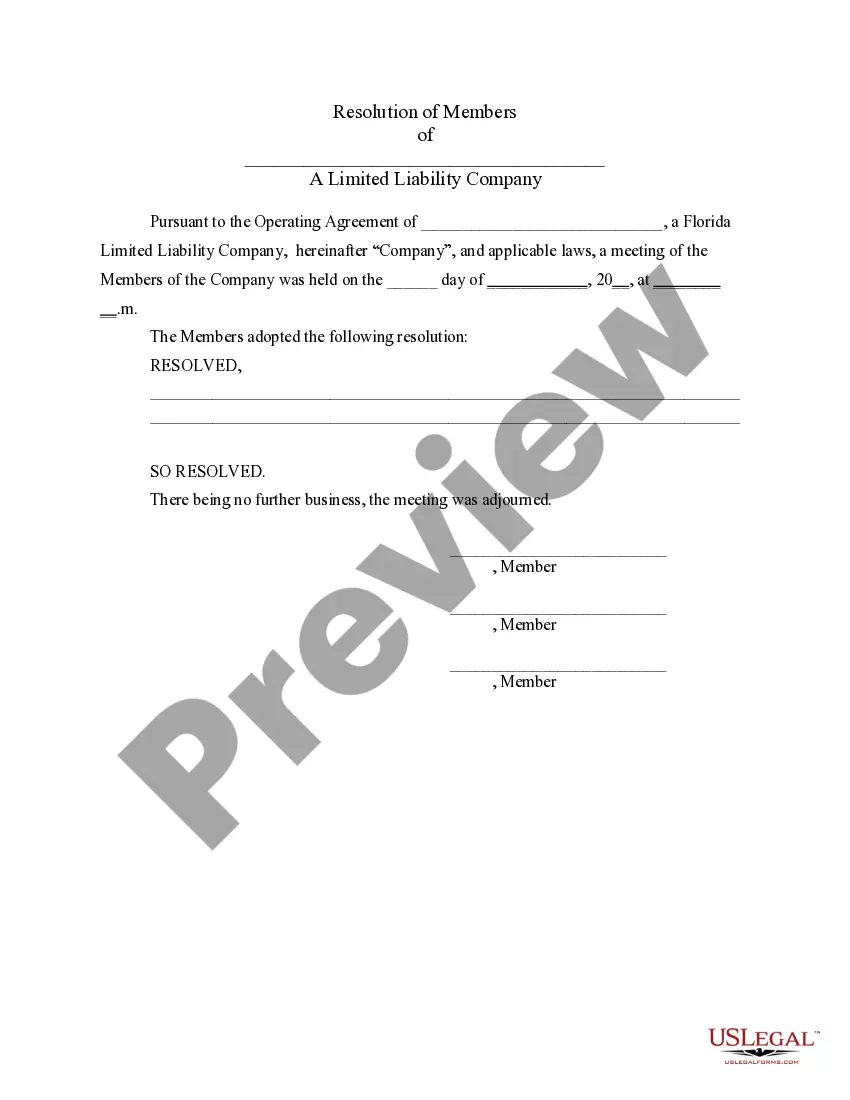

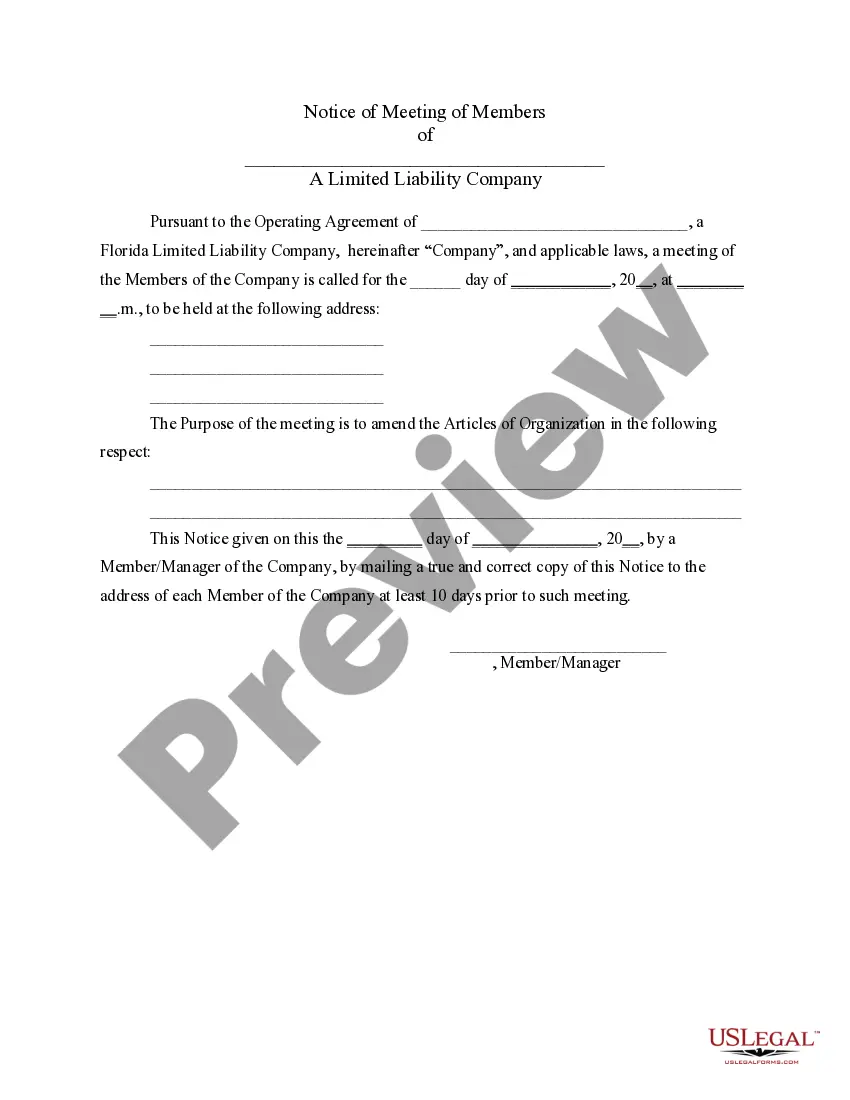

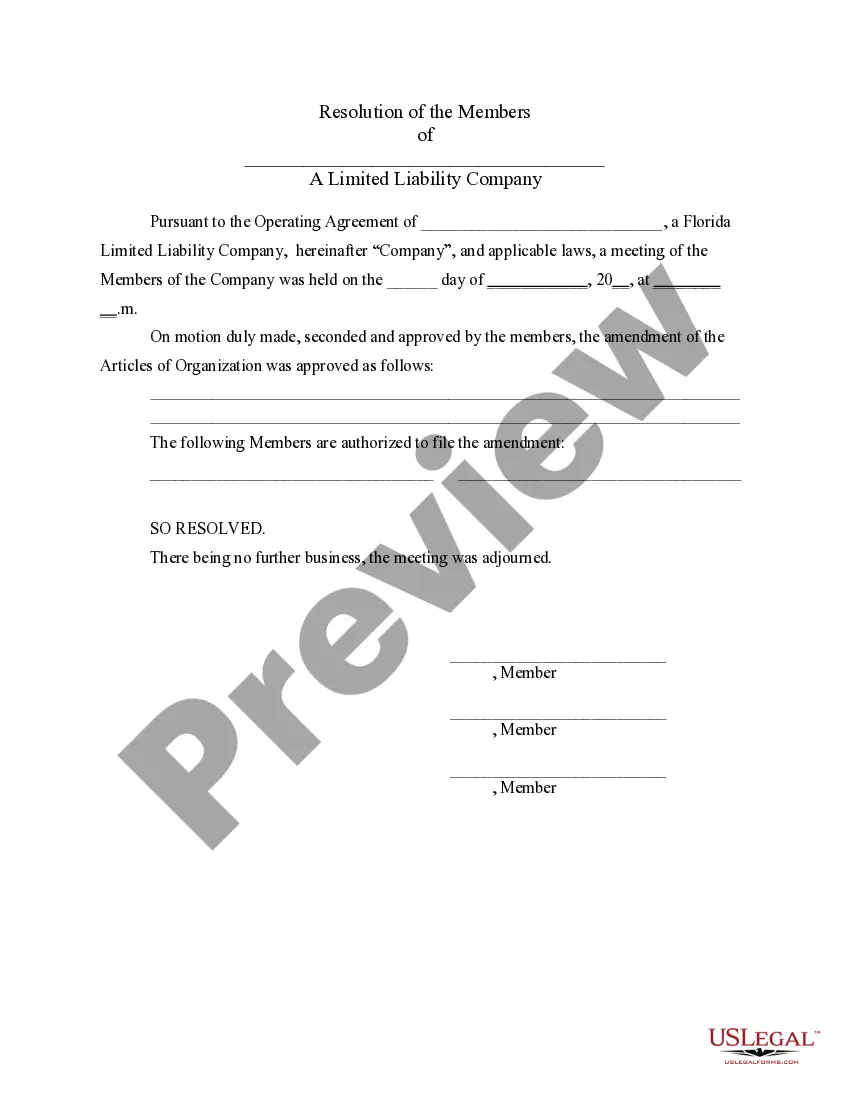

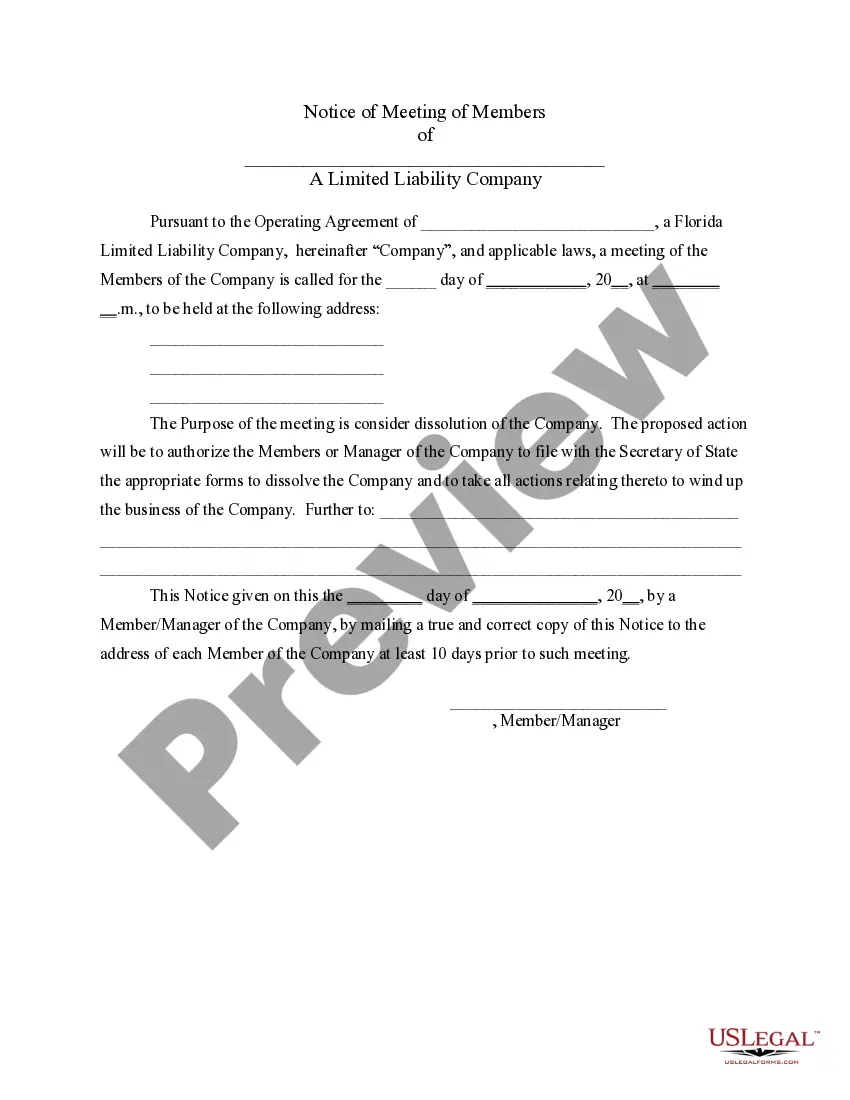

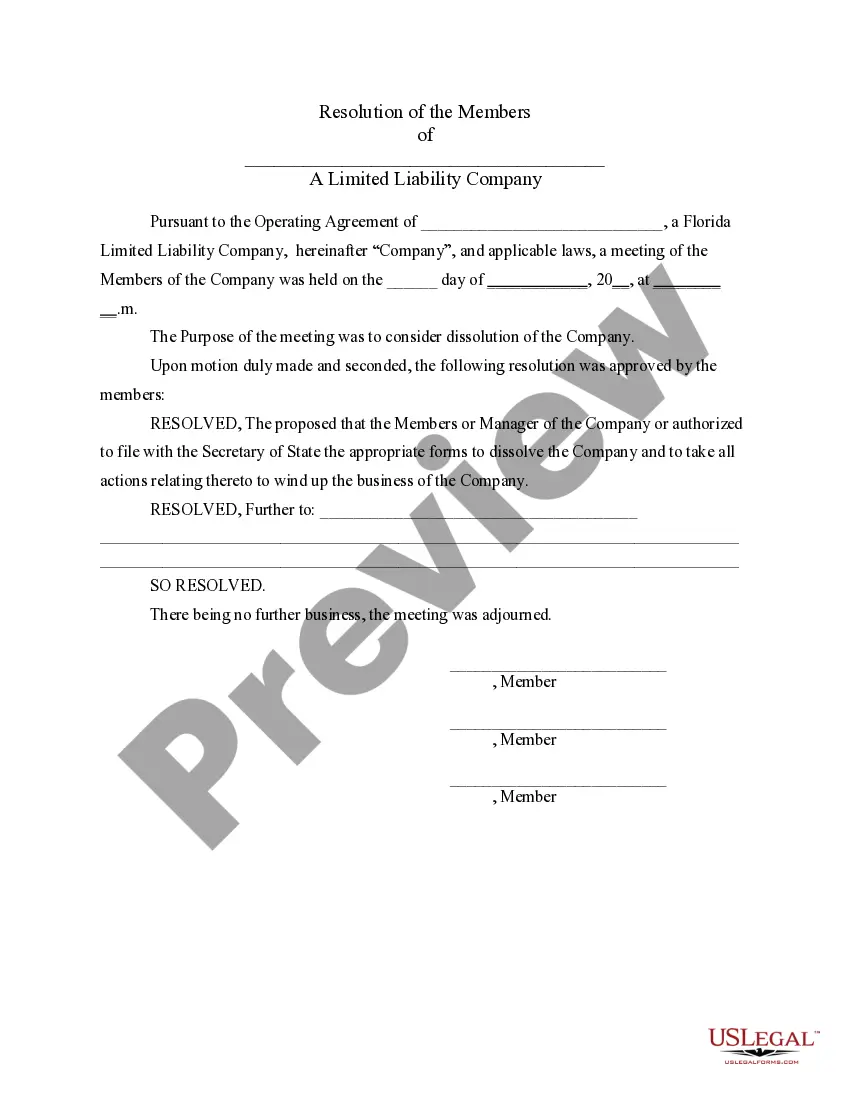

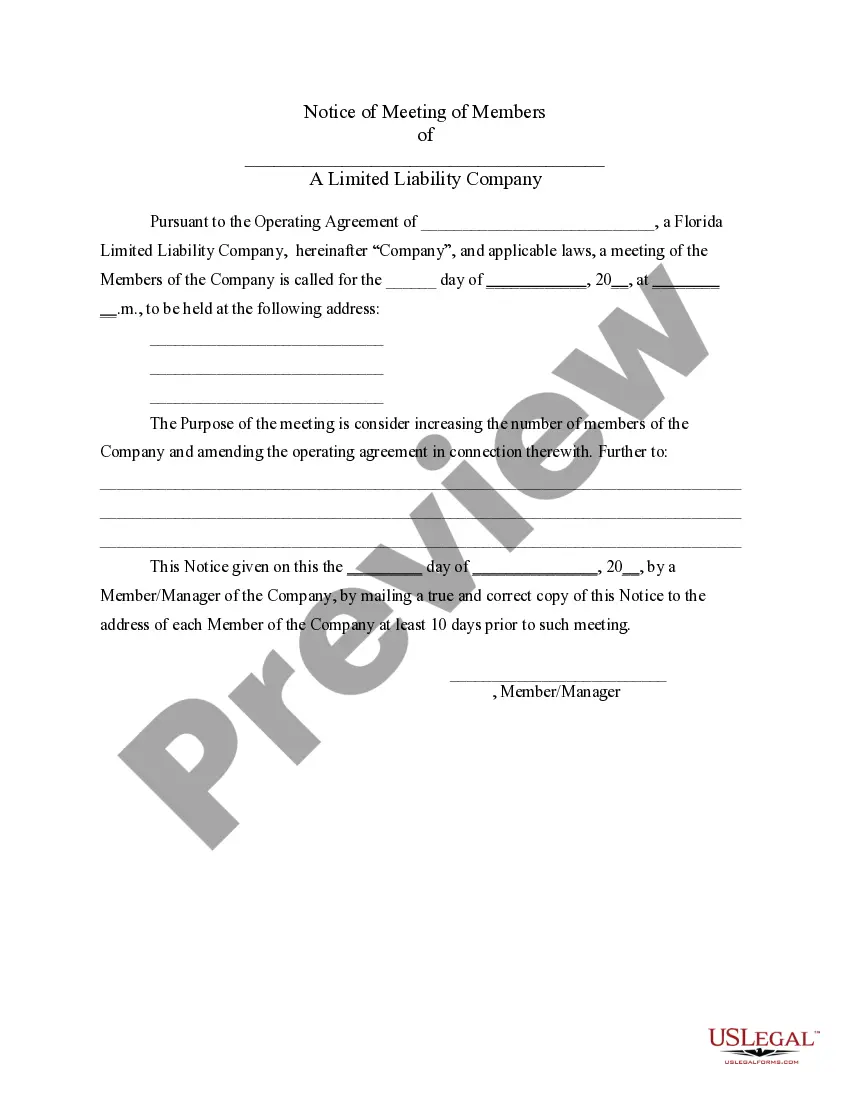

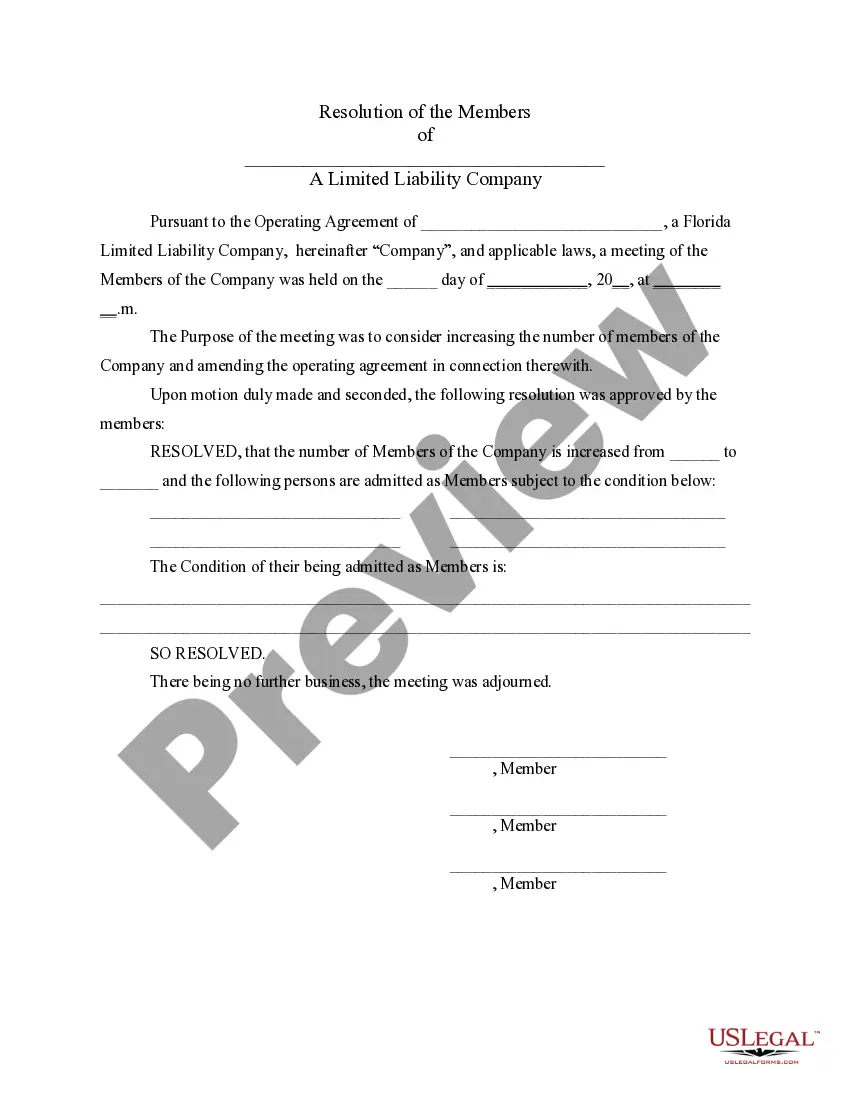

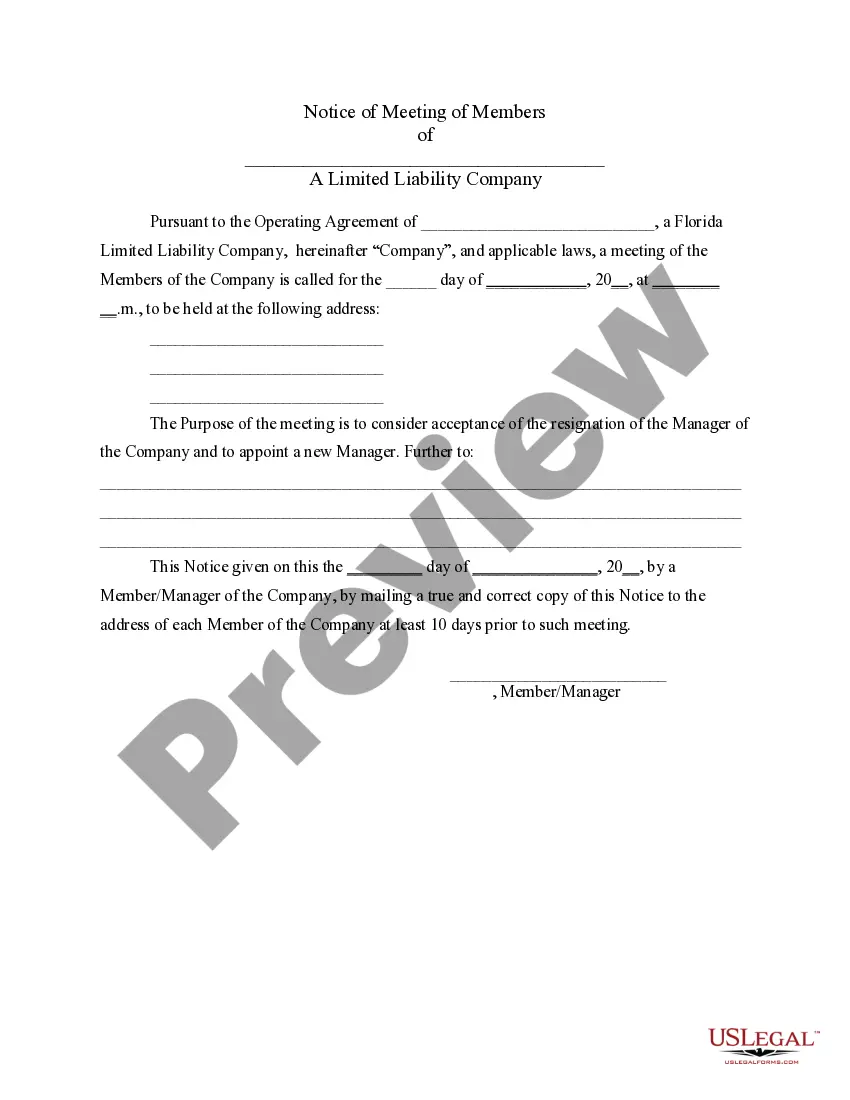

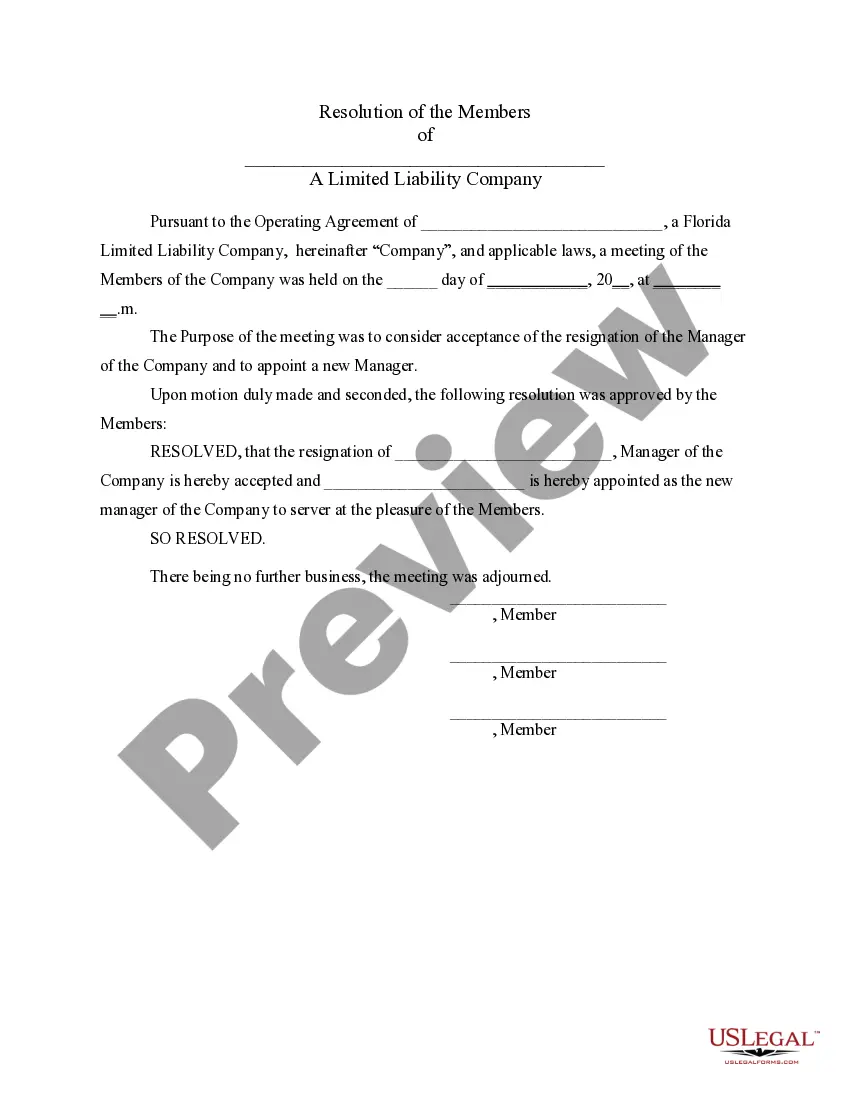

Here's what to do after downloading the desired form: Verify that it's the correct one by previewing it and reviewing its description.

- Access a rich resource library filled with articles, guides, and documents relevant to your needs and circumstances.

- Save time and effort when searching for necessary paperwork, utilizing US Legal Forms' advanced search and Preview tool to find the Florida Double LLC with the IRS and download it.

- If you're a member, Log In to your US Legal Forms account, locate the required form, and download it.

- Visit the My documents tab to view documents you've previously saved and manage your folders as desired.

- If this is your first time using US Legal Forms, create an account for unlimited access to the library's advantages.

- A comprehensive online form repository could be transformative for anyone looking to handle these matters effectively.

- US Legal Forms is a leader in online legal documentation, offering over 85,000 state-specific forms available to you at any moment.

- With US Legal Forms, users can access essential legal and business documents tailored to specific states or counties.

Form popularity

FAQ

The entry of appearance shall include the name and signature of counsel or the unrepresented party, the name of the party represented by counsel, the mailing address, telephone and fax numbers, Oklahoma Bar Association number, and name of the law firm, if any.

An Entry of Appearance is the first document an attorney must file in any case. An EOA should be filed in every case in which an attorney intends to file, including cases removed from State Court.

The jurisdiction of the Western District of Oklahoma consists of all the counties in the western part of the state of Oklahoma.

An Entry of Appearance is a legal document that says that an attorney represents one party in a case. It is a representation to the court that an attorney represents one party or the other.

Entry of Appearance for Represented Parties Within 14 days after a new case is docketed, counsel must file an Entry of Appearance. For counsel retained after the case is docketed, counsel must file an Entry of Appearance within 14 days after being retained or admitted to the Federal Circuit's bar. See Fed. Cir.