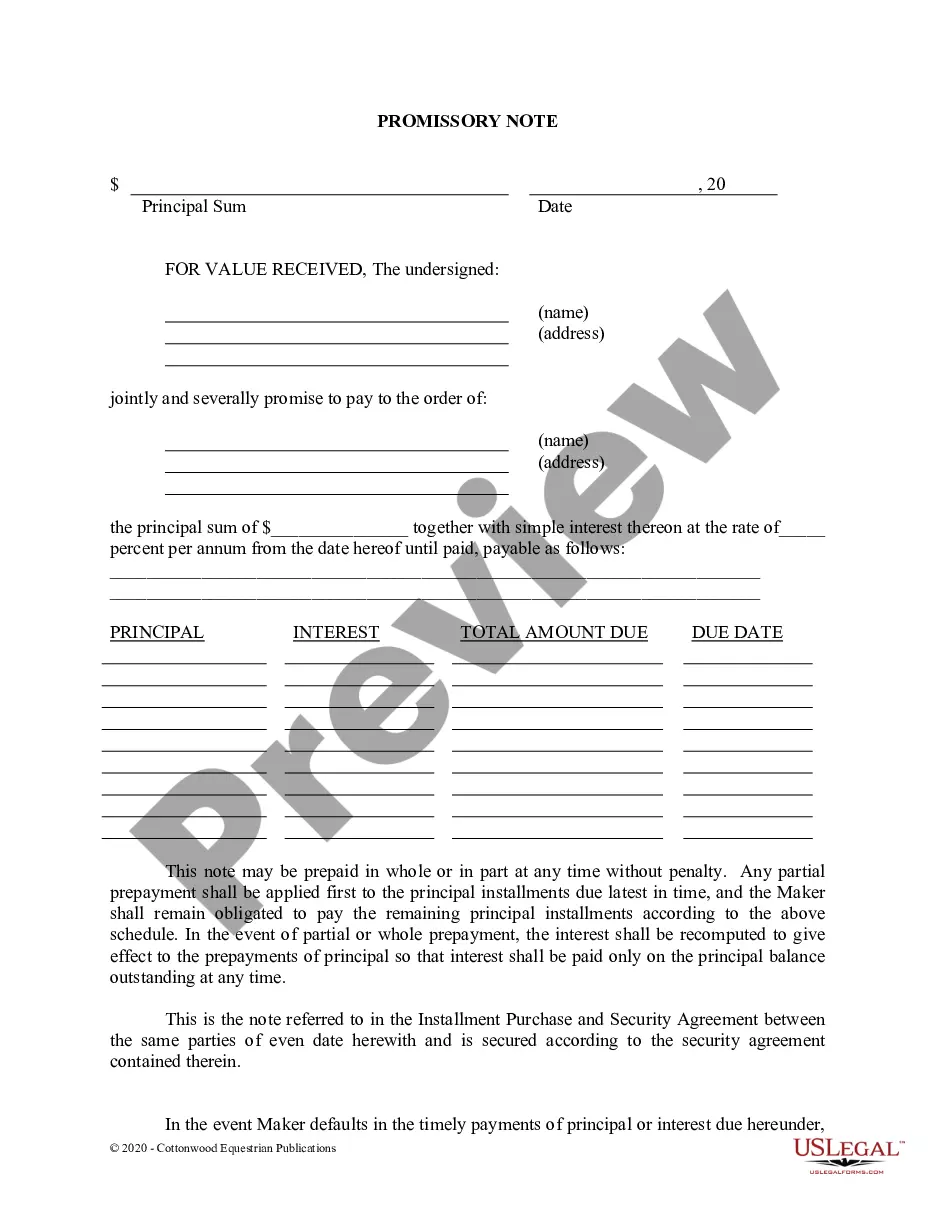

Promissory Note For Florida

Description

How to fill out Florida Promissory Note - Horse Equine Forms?

When you need to file a Promissory Note for Florida that adheres to your local state's statutes and guidelines, there may be several alternatives to select from.

There's no necessity to verify every document to ensure it fulfills all the legal requirements if you are a US Legal Forms subscriber.

It is a reliable service that can assist you in acquiring a reusable and current template on any subject.

Simplifying the acquisition of properly drafted official documents is easy with US Legal Forms. Additionally, Premium users can take advantage of the robust integrated tools for online document editing and signing. Try it today!

- US Legal Forms is the largest online repository with a collection of more than 85k ready-to-use documents for business and personal legal matters.

- All templates are verified to comply with each state's regulations.

- Consequently, when you download a Promissory Note for Florida from our site, you can be assured that you possess a legitimate and current document.

- Accessing the necessary sample from our platform is quite simple.

- If you already have an account, just Log In to the system, ensure your subscription is active, and save the chosen file.

- Later, you can access the My documents section in your profile and maintain access to the Promissory Note for Florida anytime.

- If this is your first time using our site, please follow the instructions below.

- Browse the suggested page and verify it against your requirements.

Form popularity

FAQ

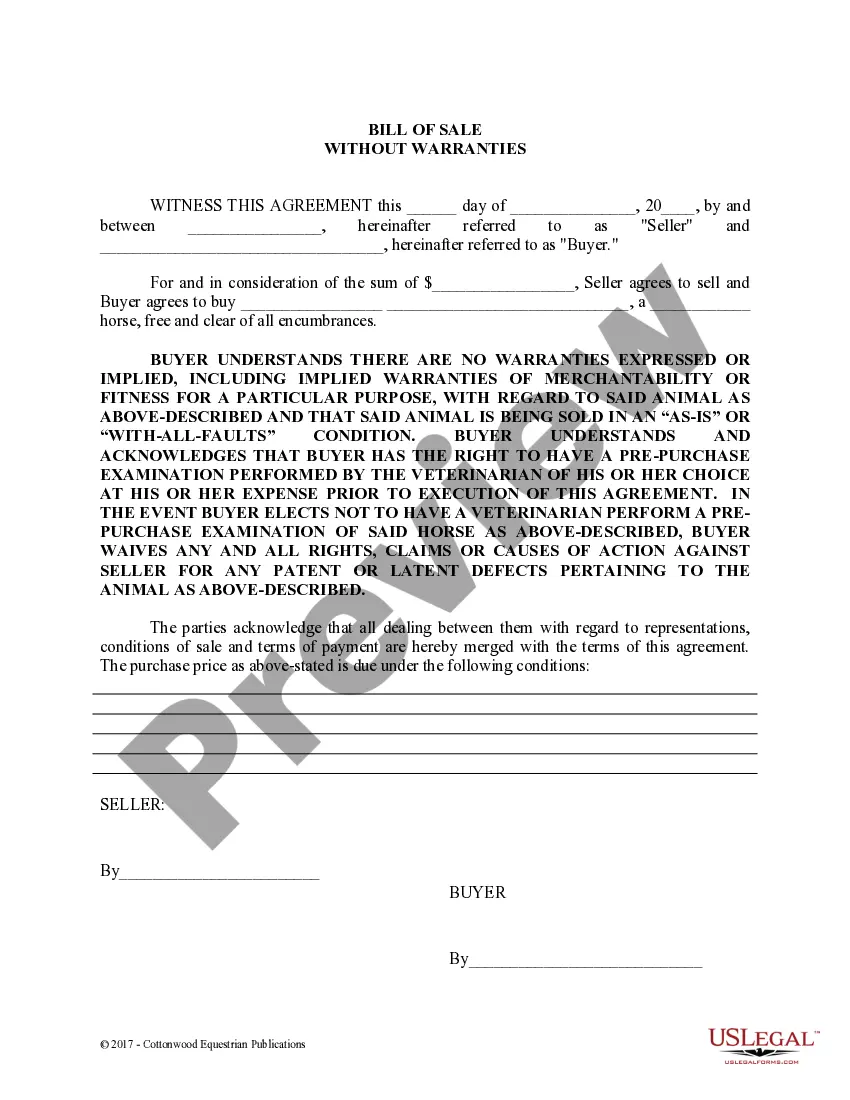

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

Dated Signature: In Florida, both unsecured and secured promissory notes must be signed and dated by the borrower, any co-signer, and two witnesses; the lender need not sign. There is no legal requirement for a promissory note to be notarized in Florida.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.