Personal Services Contract Florida Withholding

Description

How to fill out Florida Summons - Personal Service On An Individual?

When you are required to submit a Personal Services Agreement Florida Withholding that adheres to your local state's laws, there can be various choices available.

There's no requirement to scrutinize every form to verify it satisfies all the legal prerequisites if you are a US Legal Forms member. It is a dependable service that can assist you in obtaining a reusable and current template on any subject.

US Legal Forms is the most comprehensive online collection with an archive of over 85k ready-to-use documents for business and personal legal matters.

Acquiring expertly drafted official documents becomes straightforward with US Legal Forms. Moreover, Premium users can also benefit from the comprehensive integrated tools for online PDF editing and signing. Give it a try today!

- All templates are validated to conform to each state's laws.

- Thus, when downloading the Personal Services Agreement Florida Withholding from our site, you can be assured that you possess a valid and up-to-date document.

- Acquiring the necessary sample from our platform is very simple.

- If you already have an account, just Log In to the system, ensure your subscription is active, and save the chosen file.

- In the future, you can navigate to the My documents section in your profile and access the Personal Services Agreement Florida Withholding at any time.

- If this is your initial experience with our library, please follow the instructions below.

- Review the provided page and verify it meets your needs.

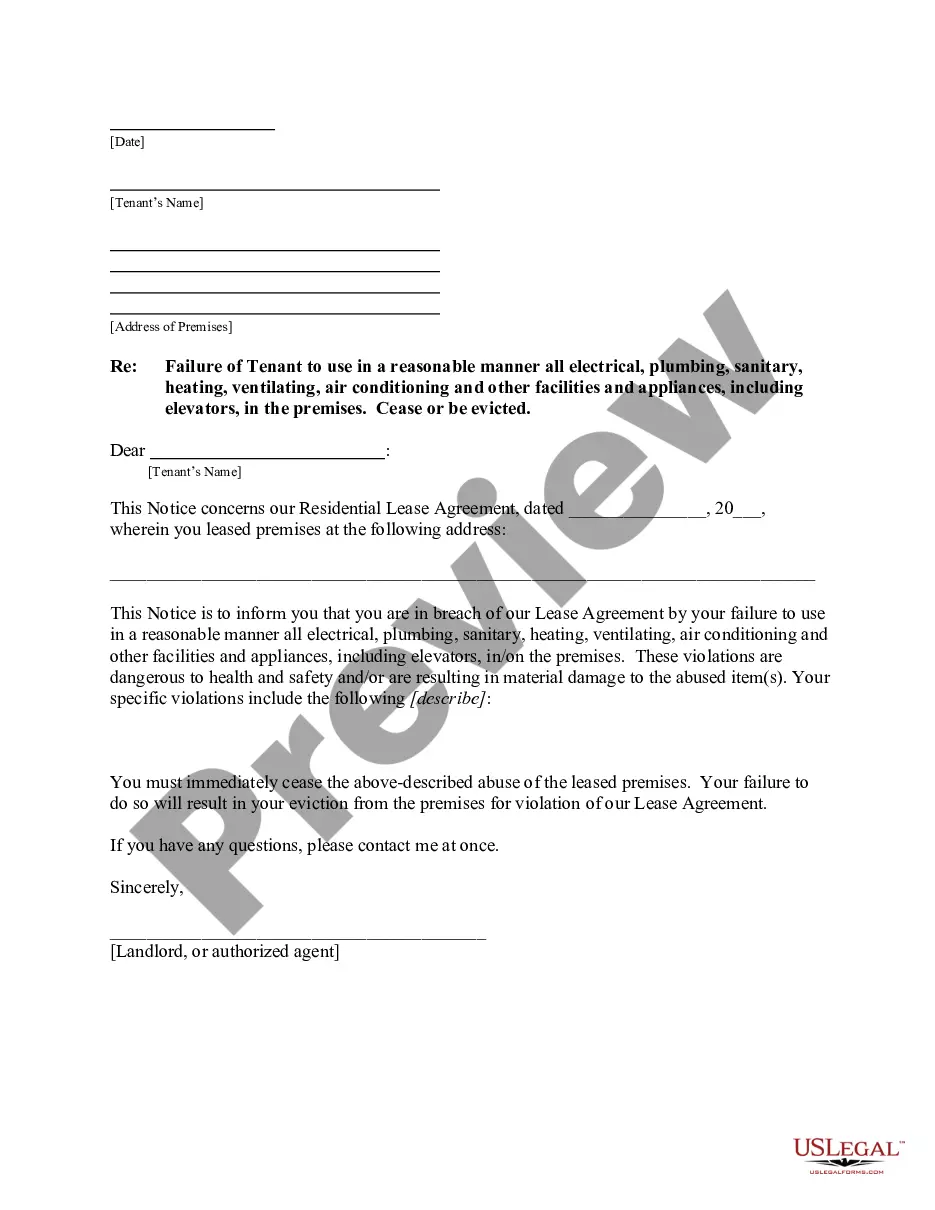

- Use the Preview mode to examine the form description if offered.

Form popularity

FAQ

Personal Services ContractsPersonal service contracts are generally not transferable without the non-transferring party's consent. Many courts similarly restrict assignment of the service recipient's rights in addition to the delegation of duties, if assigning the right would materially impact the non-assigning party.

The Personal Services Contract is a formal, written contract. The two parties to the contract are: (1) The person who plans to apply for Medicaid benefits, usually a parent. (2) A trusted person who will provide that person with caregiving services, usually an adult child.

(a) A personal services contract is characterized by the employer-employee relationship it creates between the Government and the contractor's personnel. The Government is normally required to obtain its employees by direct hire under competitive appointment or other procedures required by the civil service laws.

(a) A personal services contract is characterized by the employer-employee relationship it creates between the Government and the contractor's personnel. The Government is normally required to obtain its employees by direct hire under competitive appointment or other procedures required by the civil service laws.

Personal services include any activity performed in the fields of accounting, actuarial science, architecture, consulting, engineering, health (including veterinary services), law, and the performing arts. 2. They own stock in the corporation at any time during the testing period.