Eviction Process For Florida

Description

How to fill out Florida Letter From Tenant To Landlord Containing Notice To Landlord To Cease Retaliatory Threats To Evict Or Retaliatory Eviction?

It’s widely recognized that you cannot instantly become a legal authority, nor can you swiftly learn how to draft the Eviction Process For Florida without possessing specific expertise.

Assembling legal documents is a lengthy endeavor that necessitates particular training and expertise. So why not entrust the formulation of the Eviction Process For Florida to the professionals.

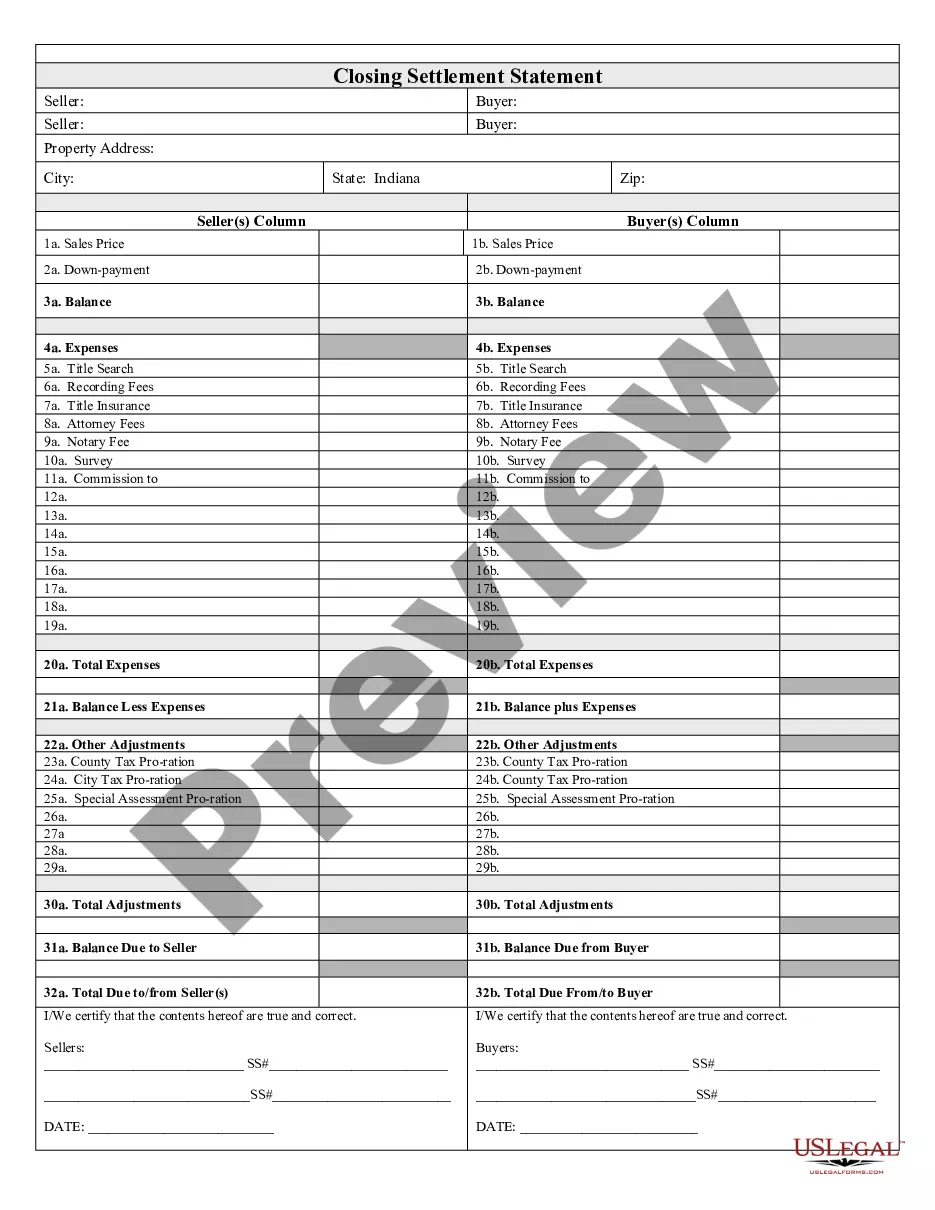

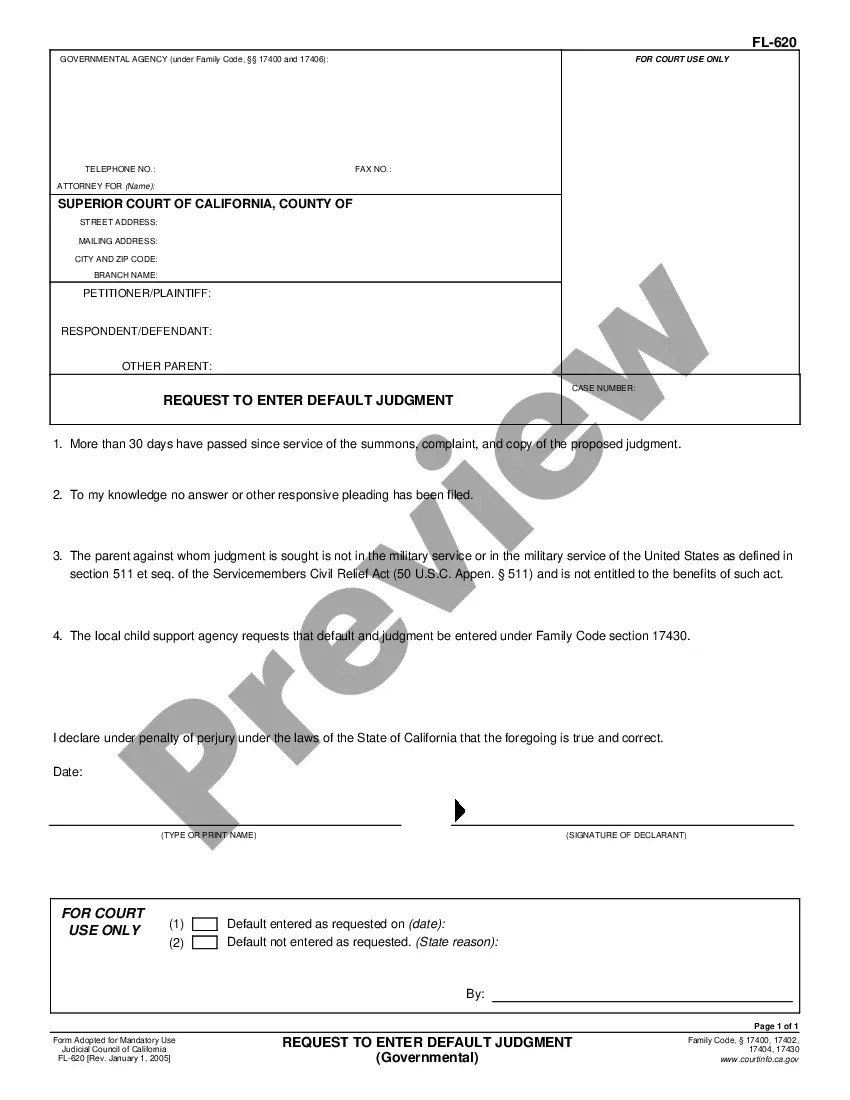

With US Legal Forms, a vast legal document repository, you can discover everything from court documents to templates for internal business correspondence. We understand the significance of compliance and adherence to federal and state regulations.

You can access your documents again from the My documents tab at any moment. If you are an existing client, you can simply Log In, and find and download the template from the same tab.

Regardless of the objective of your documents—be it financial, legal, or personal—our platform has you sorted. Experience US Legal Forms today!

- Identify the document you require by utilizing the search bar located at the top of the page.

- View it (if this option is available) and review the accompanying description to ascertain whether Eviction Process For Florida is what you are looking for.

- Restart your search if you require a different document.

- Create a free account and choose a subscription plan to purchase the template.

- Click Buy now. Once the payment is completed, you can obtain the Eviction Process For Florida, complete it, print it, and send it or mail it to the designated individuals or organizations.

Form popularity

FAQ

Delaware has a graduated state individual income tax, with rates ranging from 2.20 percent to 6.60 percent. There is also a jurisdiction that collects local income taxes. Delaware has a 8.70 percent corporate income tax rate and also levies a gross receipts tax. Delaware does not have any state or local sales taxes.

A: Resident individuals and resident businesses must file an annual return, even if no tax is due. Non-resident individuals who have income earned in Delaware that is not subject to employer withholding must file an annual return.

Every domestic or foreign corporation doing business in Delaware, not specifically exempt under Section 1902(b), Title 30, Delaware Code, is required to file a corporate income tax return (Form 1100 or Form 1100EZ) regardless of the amount, if any, of its gross income or its taxable income.

Form 1120 is the US corporation tax return. It's one of the most detailed and complex tax returns you can file as a Delaware corporation, but filing it correctly is essential. Failure to file or complete Form 1120 correctly can result in hefty penalties and other unwanted consequences.

PUBLIC ACCESS TO COURT ELECTRONIC RECORDS (PACER) The Clerk's office provides two public terminals where customers have direct access to (PACER) dockets and PDF documents, and copies may be self-printed for $. 10 per page.

The Division of Revenue links for online filing options are available at . Electronic filing is fast, convenient, accurate and easy. When completing a form electronically, please download the form prior to completing it to obtain the best results.

A Delaware tax power of attorney (Form 2848) is a paper submission that can be used to designate an agent to represent the principal in front of the Delaware Division of Revenue.

Delaware Form 1100S and its schedules is an information return used to reconcile Federal ordinary income to Delaware distributive income and to pay any additional tax due on behalf of non-resident shareholders for the calendar year 2022 or fiscal year beginning in 2022 and ending in 2023.