Quitclaim Deed For Trust

Description

How to fill out Florida Quitclaim Deed - One Individual To Two Individuals / Husband And Wife - With Life Estate In An Individual?

- Log in to your US Legal Forms account if you're a returning user. Make sure your subscription is active to download the required template.

- For first-time users, start by reviewing the preview mode and form description to ensure you select the correct quitclaim deed for your trust needs.

- If the form doesn’t match your requirements, utilize the Search function to find a more suitable template. Only proceed when you've found the right one.

- Proceed to purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. Remember to create an account to unlock full access.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Finally, download the quitclaim deed form to your device and access it anytime through the My Forms section of your profile.

Utilizing US Legal Forms empowers you to efficiently create legally sound documents for your property management needs. With a vast library at your fingertips, you’re sure to find what you need.

Ready to simplify your legal form process? Visit US Legal Forms today and take advantage of our extensive resources.

Form popularity

FAQ

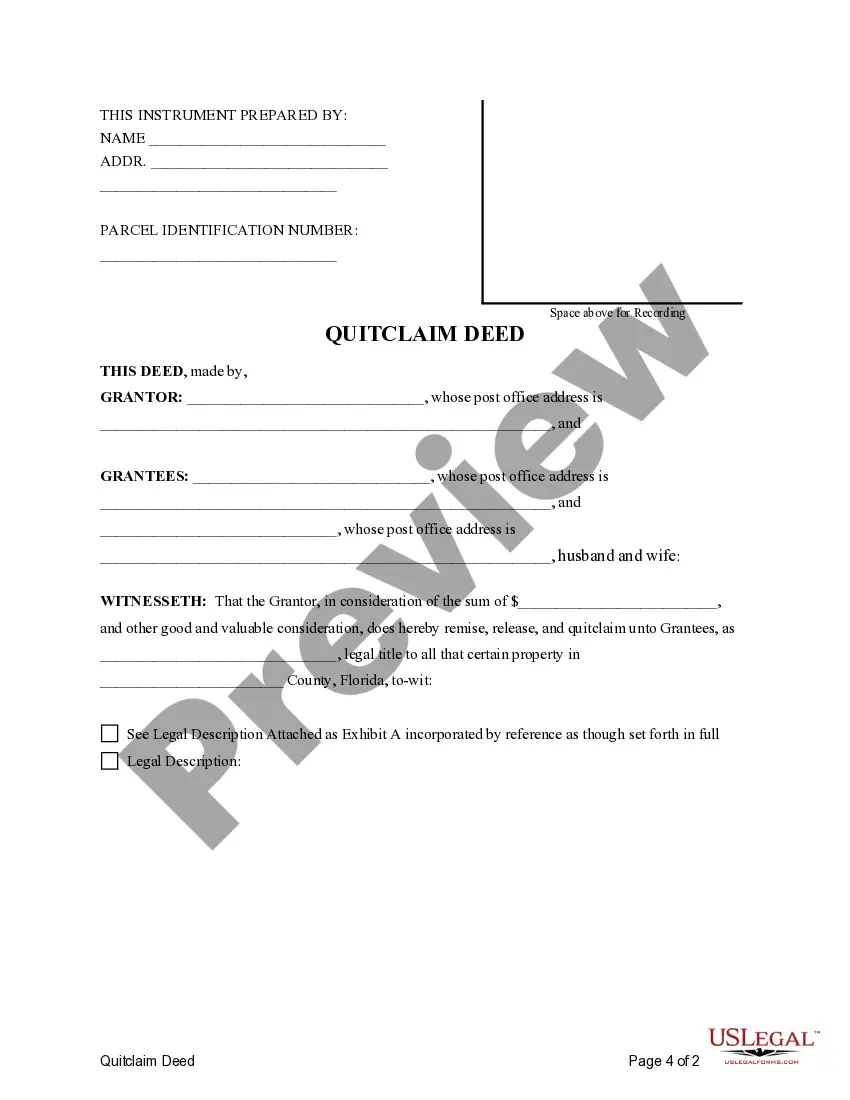

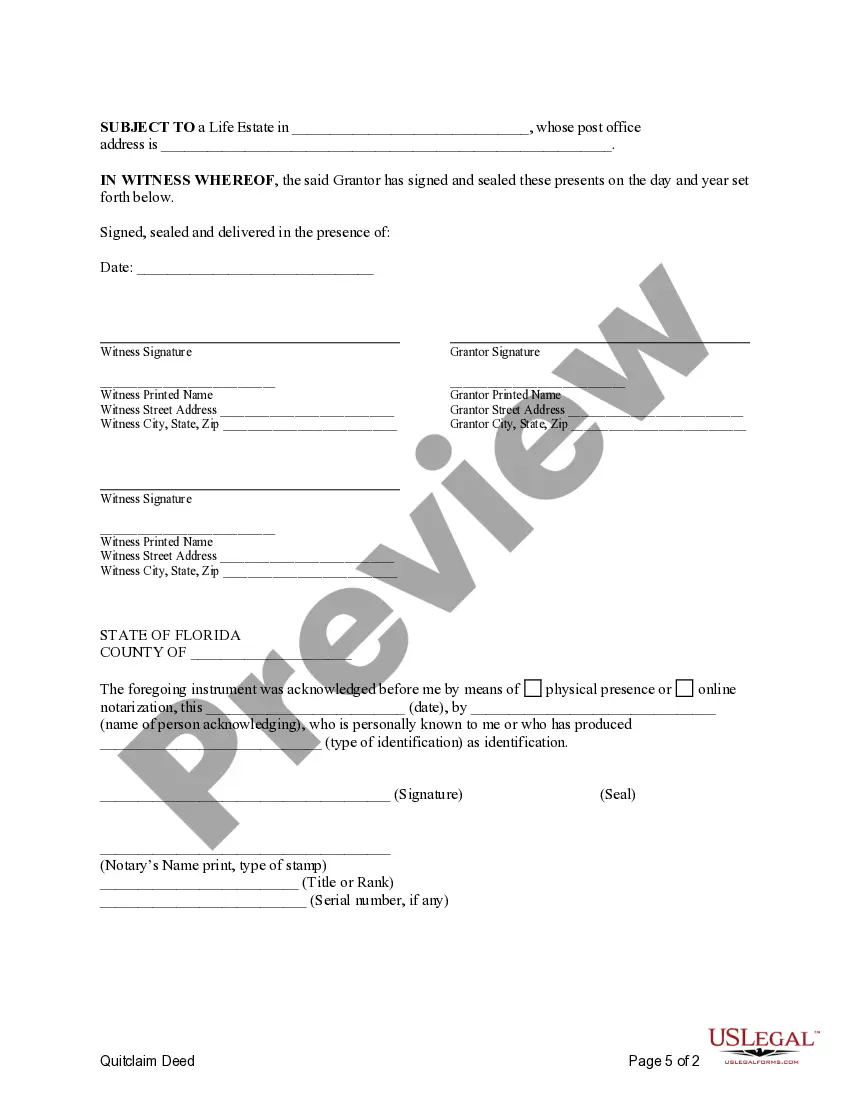

Filling out a quitclaim deed form requires specific information, including the full names of the parties involved and the precise legal description of the property. In addition, include the property's address and any pertinent identification numbers. Once completed, sign the document before a notary, ensuring that all parties are present. If you need assistance, US Legal Forms offers resources and templates to simplify the process of creating a quitclaim deed for trust.

Quitclaim deeds are often regarded with caution because they convey no warranty, meaning the grantor does not guarantee clear title to the property. This lack of protection can lead to potential disputes or undisclosed claims against the property. It is essential to conduct thorough due diligence before accepting a quitclaim deed for trust. Understanding these risks helps you make informed decisions about your property.

Properly filling out a quitclaim deed involves entering the grantor's name, the grantee's name, and a precise legal description of the property. Be sure to state your intent to convey the property to the trust clearly. After filling it out, sign the document in front of a notary public. This meticulous approach ensures the quitclaim deed for trust is valid and legally binding.

To quit claim a deed to a trust, begin by preparing a quitclaim deed form that includes the names of both the grantor and the trust. You must provide a detailed legal description of the property, followed by the trustee's name. Additionally, ensure you sign and notarize the deed, then record it with your local county office. This process allows you to transfer property into the trust efficiently.

When deciding whether to gift a house or place it in a trust, consider your goals and circumstances. A quitclaim deed for trust can secure your property within a legal structure, ensuring it transfers to your beneficiaries without going through probate. This option often provides more control over asset distribution and can help in managing taxes. Ultimately, choosing between gifting and using a trust involves understanding your long-term intentions and consulting with legal professionals.

While placing your house in trust can provide benefits, there are some disadvantages to consider. For instance, transferring property to a trust can incur upfront costs and may have tax implications. Additionally, you will need to manage the trust according to its terms, which might be cumbersome. Weighing these factors against the benefits is crucial for making an informed decision.

Yes, you can prepare a quitclaim deed for trust yourself, but it requires accuracy and adherence to state laws. Many online platforms, like US Legal Forms, offer templates and guidance to help you through the process. However, it’s wise to consult a professional if you have any doubts, as improper completion can lead to complications down the line. Ensuring that your deed is correctly prepared protects your interests effectively.

Choosing between a quitclaim deed for trust and a trust largely depends on your specific needs. A quitclaim deed efficiently transfers property rights, making it a quicker option for some situations. However, a trust can offer additional benefits, such as privacy and protection from probate. It’s essential to assess your goals to determine which option best serves your circumstances.

A quitclaim deed in a trust is a legal document that transfers ownership of property into the trust without warranties. This type of deed is particularly useful when a property owner wishes to simplify the transfer process while maintaining control over the asset within the trust. Utilizing a quitclaim deed for trust can streamline estate planning and manage assets efficiently. For more information and access to necessary forms, US Legal Forms is a reliable resource.

The main disadvantage of a quitclaim deed for trust is that it does not provide protection for the buyer against potential title issues. This means the buyer could become responsible for any claims or liens against the property. Additionally, since a quitclaim deed transfers ownership without warranties, it may not suit all situations. For personalized guidance, consider exploring the resources available at US Legal Forms.