Us Llc

Description

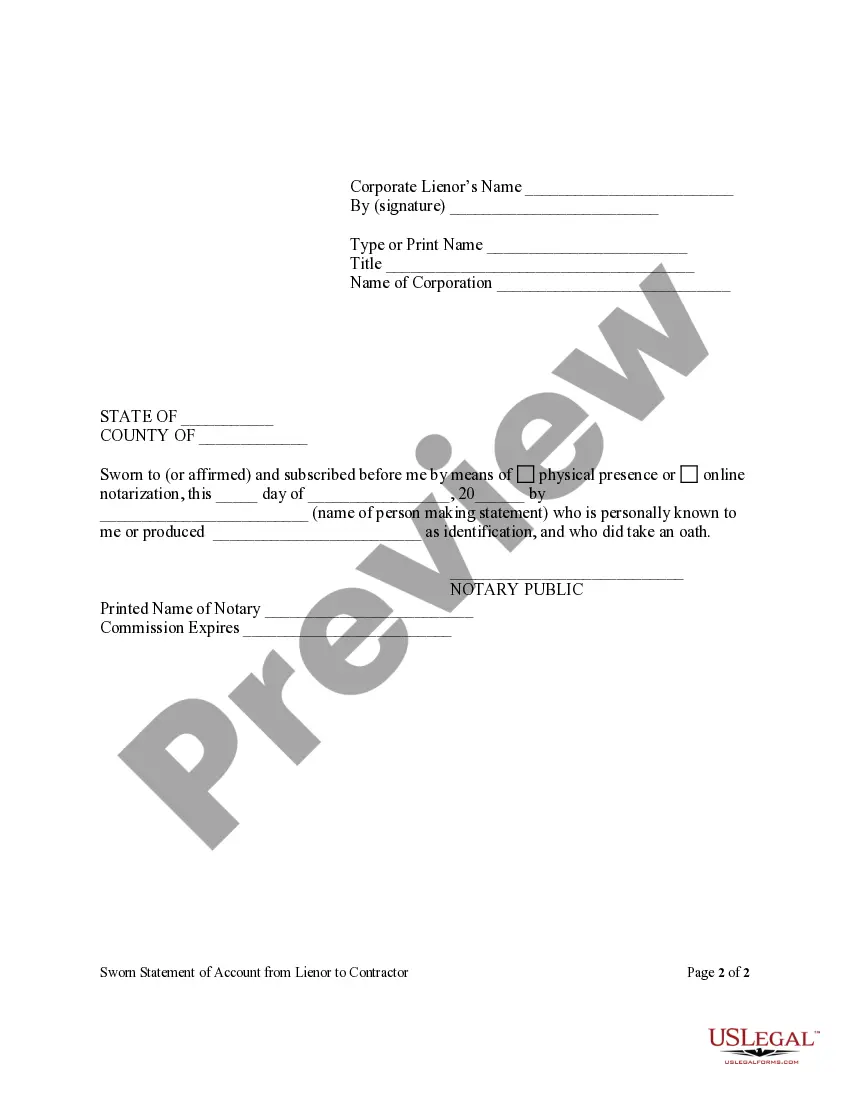

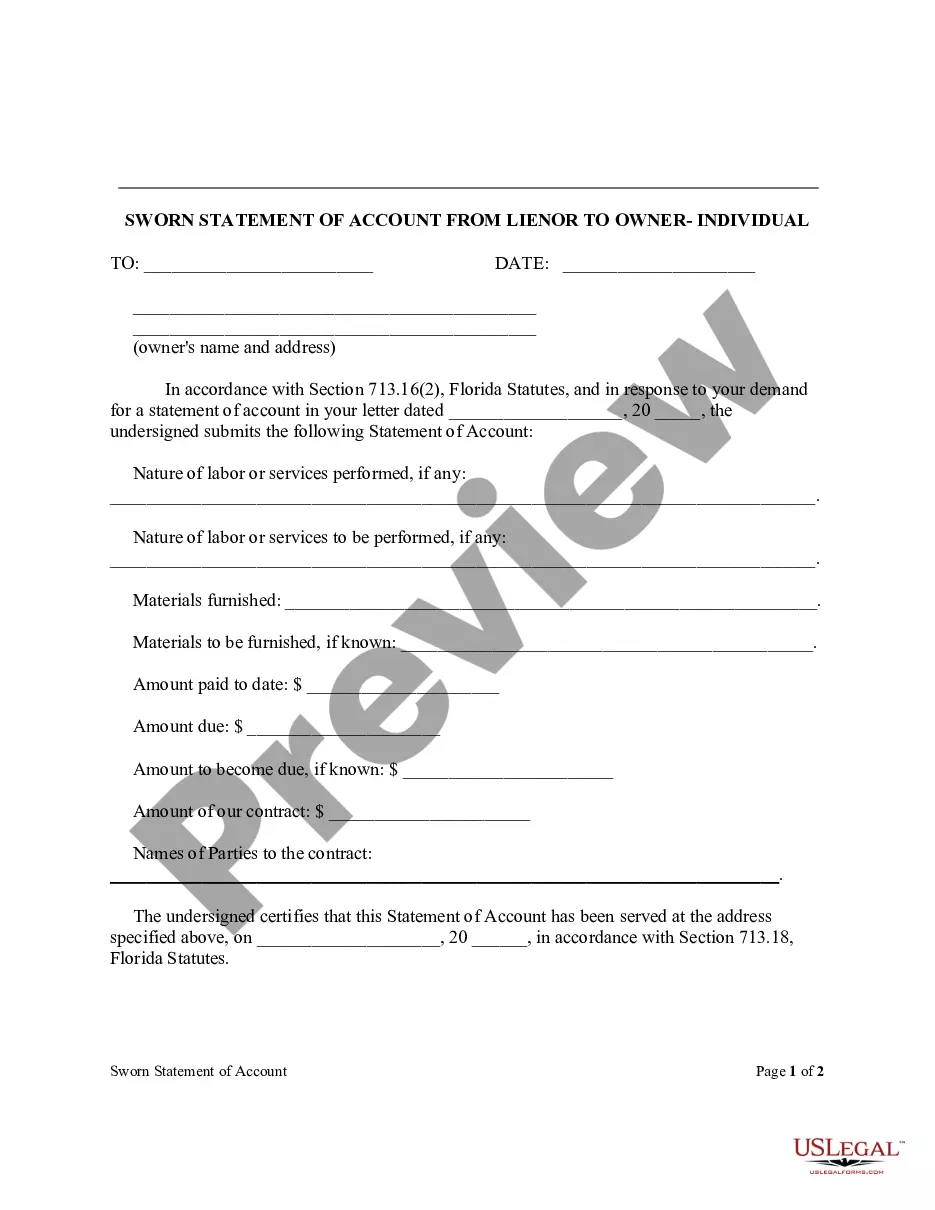

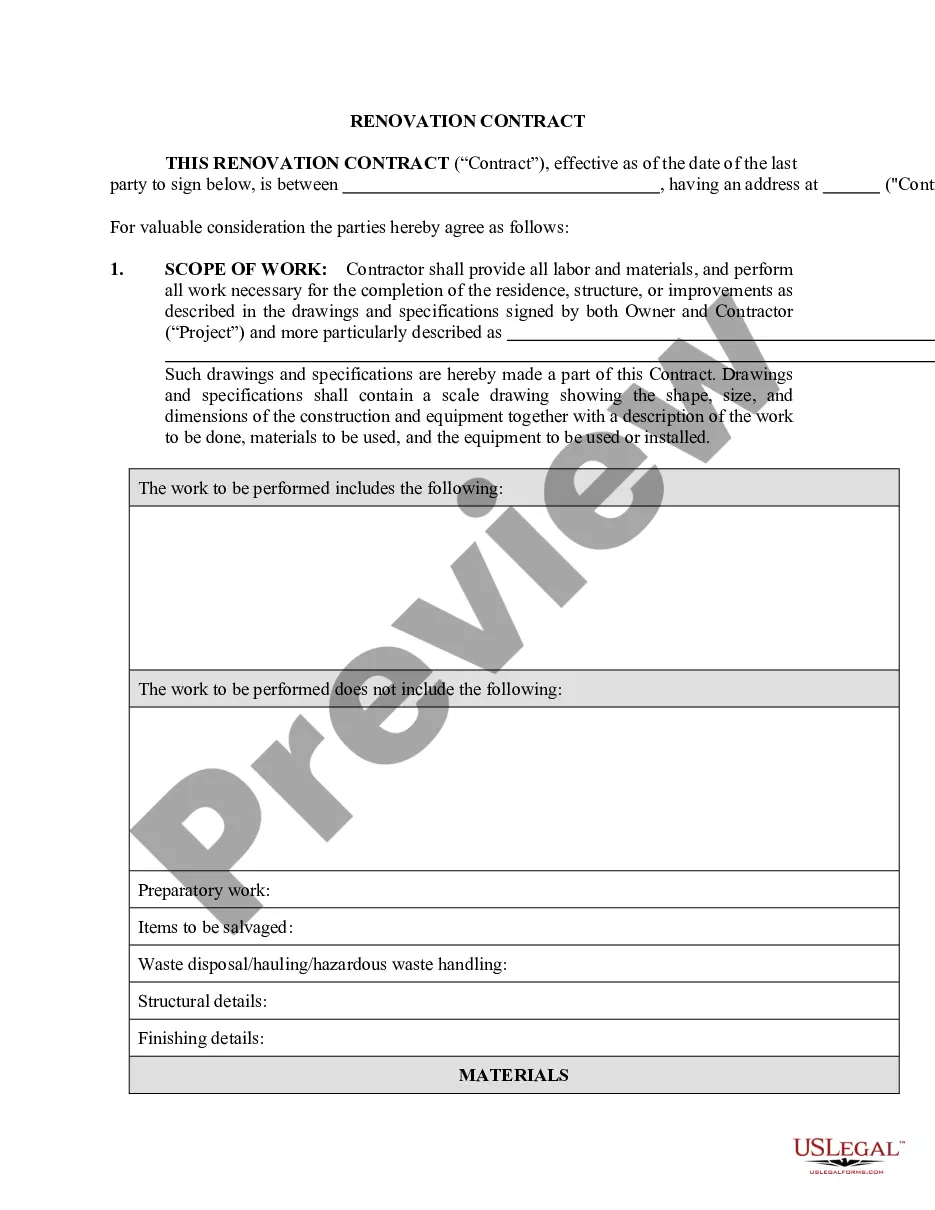

How to fill out Florida Sworn Statement Of Account From Lienor To Contractor - Corporation?

- If you are a returning user, simply log in to your account, confirm your subscription is active, and proceed to download your required form template by clicking the Download button.

- For first-time users, begin by checking the Preview mode of the legal form. Read through the form description carefully to confirm it meets your requirements and complies with your local jurisdiction.

- Should you need a different template, utilize the Search tab to find the right document that suits your situation.

- Once you have located the appropriate document, click on the Buy Now button and select your desired subscription plan to proceed.

- Next, complete your purchase by entering your credit card information or paying via your PayPal account to secure access to the document library.

- Finally, download your purchased form to your device, ensuring you can fill it out as needed. You can also access it later from the My Forms section.

In conclusion, US Legal Forms offers an easy and straightforward way to obtain legal documents tailored for your needs. With a robust library of forms and expert assistance, you can be assured of quality and accuracy in your legal tasks.

Start your journey with US Legal Forms today and simplify your legal paperwork!

Form popularity

FAQ

An LLC can write off various business expenses that contribute directly to its operations, including material costs, travel expenses, and even home office deductions. The exact amount will depend on the business's income and eligible expenses. By keeping meticulous records and using tax preparation tools, your Us LLC can maximize these write-offs. Leveraging services like UsLegalForms can help clarify what qualifies as a deduction, ensuring you make the most of your business expenses.

To register your LLC in the USA, you need to choose a unique name and file the necessary paperwork with your state's Secretary of State office. Each state has its own specific requirements and fees, so it's essential to research these beforehand. Moreover, you can streamline the registration process by using platforms like UsLegalForms to ensure you meet all legal requirements efficiently. Remember, it's crucial to also obtain any necessary permits or licenses associated with your business activities.

The primary disadvantage of an LLC is the potential for self-employment taxes on the entire income, unlike corporations that can distribute profits with different taxation. Furthermore, while LLCs provide some liability protection, they do not protect your personal assets in cases of fraud or mismanagement. Understanding these risks is vital before forming your Us LLC. Seeking guidance through UsLegalForms can provide clarity on these matters.

member LLC enjoys passthrough taxation, meaning profits and losses are reported directly on your personal tax return. This structure can simplify tax filing since you avoid double taxation often seen with corporations. Additionally, as a singlemember LLC, you might qualify for various tax deductions, such as home office expenses and businessrelated travel. Using UsLegalForms can help you easily navigate the setup to maximize these tax benefits.

A US LLC refers to a Limited Liability Company established in the United States, specifically offering owners limited liability for company debts. This structure is popular among small business owners due to its simplicity and flexibility. Using platforms like uslegalforms can help you quickly navigate the process of creating a US LLC, ensuring you meet all legal requirements.

An LLC, or Limited Liability Company, is a business structure designed to protect personal assets from business liabilities. This means that your personal finances remain separate and secure from debts or lawsuits related to the business. Forming an LLC through uslegalforms not only provides these protections but also offers tax advantages and is relatively easy to manage.

The United States LLC is a business structure that combines elements of both a corporation and a partnership. This formation offers limited liability protection to its owners while providing flexibility in management and taxation. By using uslegalforms, you can easily form a US LLC and gain access to legal resources that help streamline your business processes.

A US LLC, or Limited Liability Company, is not automatically considered a US person under tax law, but it can be treated as such depending on the ownership structure. If the LLC has only US individuals as members, it may qualify as a US person for tax purposes. Understanding your LLC's classification is key for compliance, especially when engaging with services like uslegalforms that provide guidance on legal classifications.

Writing an LLC example starts with creating a fictitious name, followed by defining the purpose of the LLC. For instance, 'XYZ Consulting LLC' can serve as a good example. Ensure that the name reflects the nature of your business and adheres to your state’s naming rules, making your US LLC appear professional and responsible.

To fill out an LLC, begin by obtaining the Articles of Organization from your state’s business website. Fill in the required information, such as your LLC’s name, address, and the names of the members. It is important to ensure you meet all state-specific requirements to have a valid US LLC formation.