Account Amount Contract With The Bank

Description

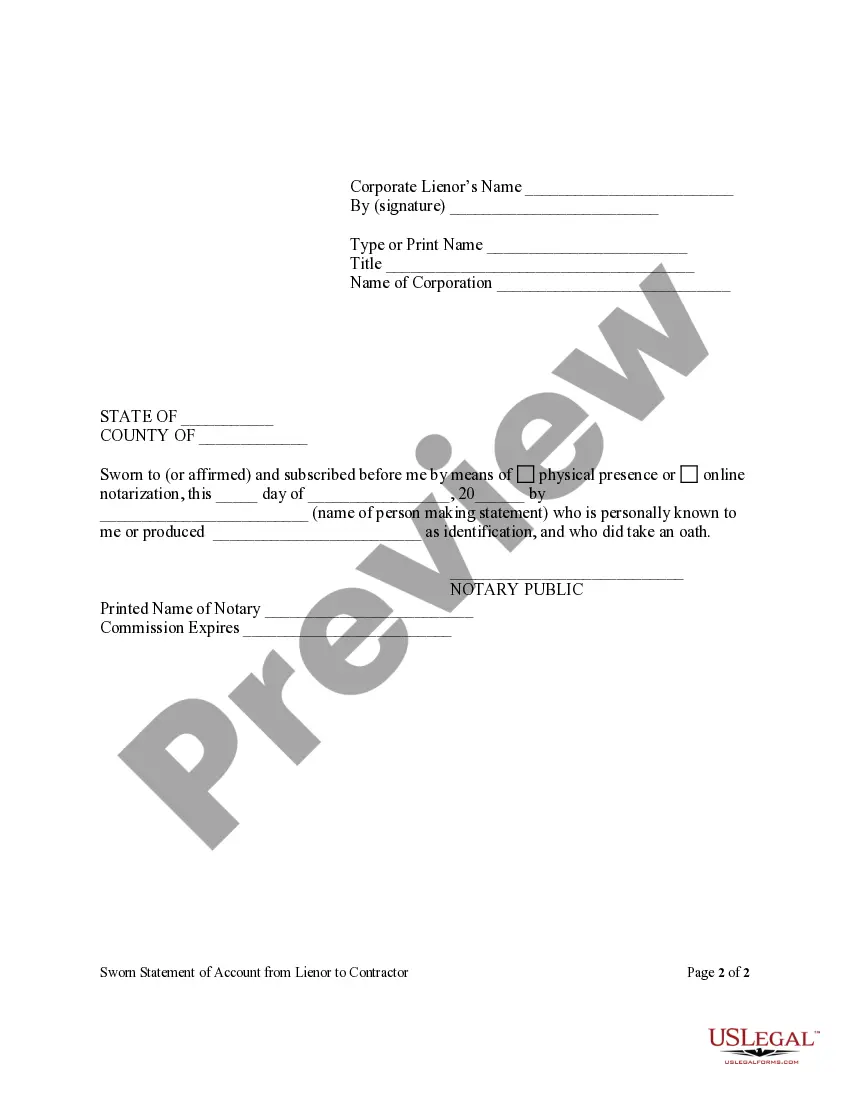

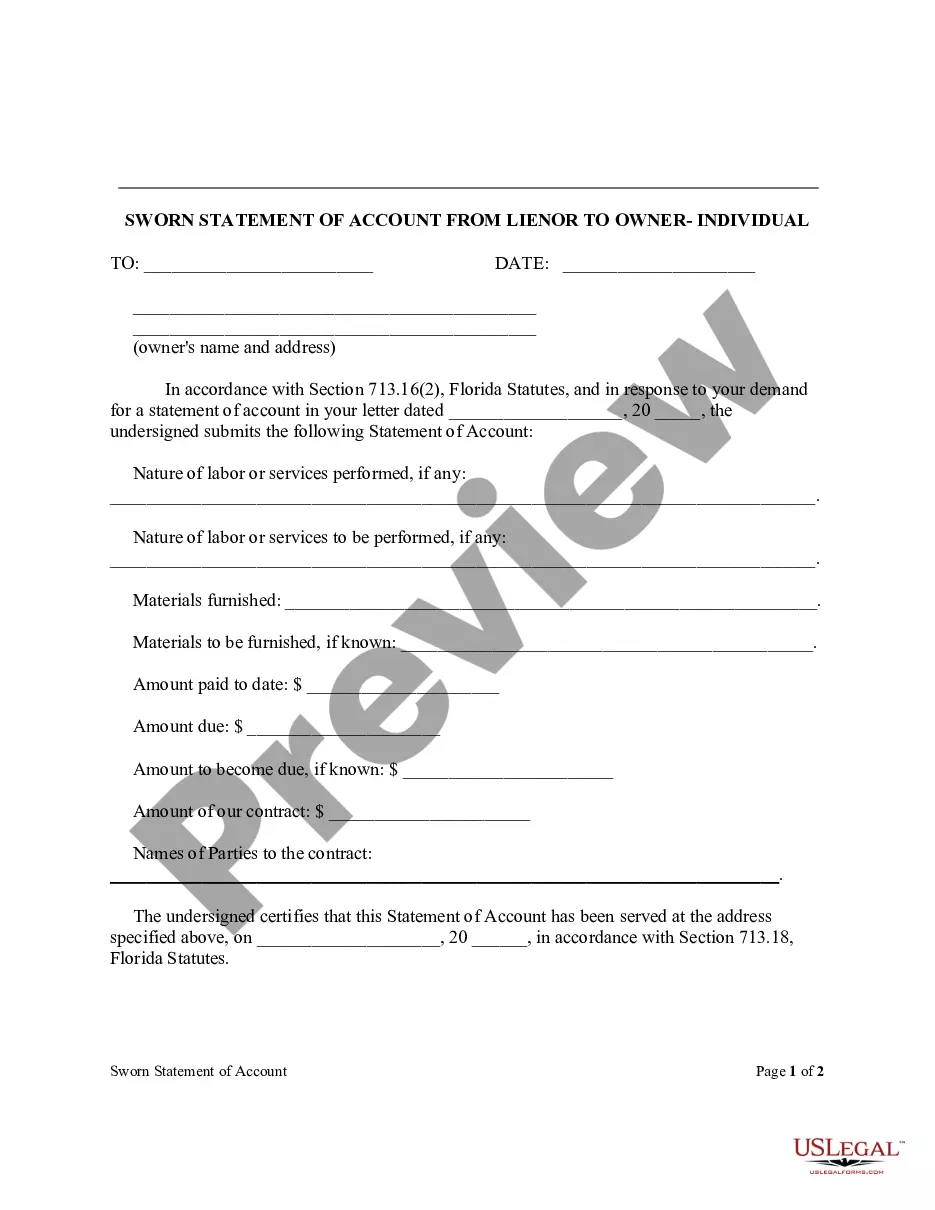

How to fill out Florida Sworn Statement Of Account From Lienor To Contractor - Corporation?

- Access the US Legal Forms website and log into your account if you’re a returning user. Click the Download button to save the desired template to your device, ensuring your subscription is active. If it’s expired, renew it through your payment plan.

- For first-time users, start by reviewing the Preview mode and form description to confirm the selected form meets your requirements and complies with local jurisdiction rules.

- If the initial form isn't suitable, utilize the Search feature to find an appropriate template. Once the right form is located, proceed to the next step.

- Purchase the document by clicking the Buy Now button. You will need to select a subscription plan and register for an account to gain full access.

- Complete your purchase by entering your credit card details or using PayPal for payment.

- Download the form to your device, ensuring you can easily access it in the My Forms section of your profile whenever needed.

By leveraging US Legal Forms, you have the power to streamline your legal document processes effectively. With an extensive library at your fingertips, producing accurate and legally compliant documents is easier than ever.

Take the first step today and explore the premium resources available through US Legal Forms for all your legal documentation needs.

Form popularity

FAQ

To check the balance of a specific bank account, you can utilize your bank’s digital services for quick access. Log into your online banking account or use the mobile app to view all your accounts and their balances. If preferred, you can also call your bank or visit a local branch. Staying updated on your bank account balances is crucial when you have an account amount contract with the bank, ensuring you manage your funds effectively.

You can find out your bank account balance using various easy methods. One of the most popular ways is through online banking, which allows you to check your balance anytime, anywhere. Additionally, you can visit an ATM or branch to get your balance, or call your bank's customer service. Keeping tabs on your account balance is essential, especially if you have an account amount contract with the bank that requires careful financial management.

To get your checking account balance, you can use several convenient methods. Most banks provide online banking services where you can log in to your account and view your balance instantly. Alternatively, you can check your balance through the bank's mobile app or via automated phone services. Regularly monitoring your checking account balance is important, especially when managing an account amount contract with the bank.

A bank account control agreement typically involves a legal document that outlines the terms between a bank and its client regarding account access and control. This agreement is crucial in securing the rights to account amounts under a specific arrangement, as it helps protect your financial interests. When you initiate an account amount contract with the bank, this agreement establishes who can manage the funds and under what conditions. It’s essential for ensuring clarity and security in financial transactions.

To fill up bank account details, start with your full name as it appears on your account, followed by the account number and routing number. This information is essential when establishing an account amount contract with the bank, ensuring that all transactions align with the correct account. Take your time to enter each detail accurately, as this will save you from possible banking errors.

When providing bank details, the account name should reflect the name associated with the bank account, whether it is an individual or a business entity. This information is crucial when completing an account amount contract with the bank, as it validates the authenticity of the transaction. Ensure that the name is spelled correctly to prevent any complications.

Writing a contract agreement for payment involves outlining the payment terms, specifying the amount, and including the parties' details involved. You can detail what services are provided and when payments are due, ensuring mutual understanding. If you’re looking for guidance, uslegalforms offers templates that can help you create a solid agreement tailored for an account amount contract with the bank.

A bank account number is a unique series of digits assigned by a financial institution to identify an individual’s account. For example, it could look like '123456789', and it often accompanies a routing number for transactions. In transactions related to an account amount contract with the bank, having the correct bank account number is vital for directing funds appropriately.

To fill out your bank account details, first, collect the necessary information including your account number and routing number. You will typically input this information into forms related to the account amount contract with the bank, ensuring you provide accurate data to prevent transaction errors. Double-check your entries for accuracy before submission to maintain financial integrity.

Bank account details include essential information required for transactions, such as the account number, routing number, and the bank’s name. These details are crucial when entering an account amount contract with the bank, ensuring accuracy in payments and deposits. Having precise bank account details helps users avoid issues and delays in their financial dealings.