Subcontractors For Payroll Tax

Description

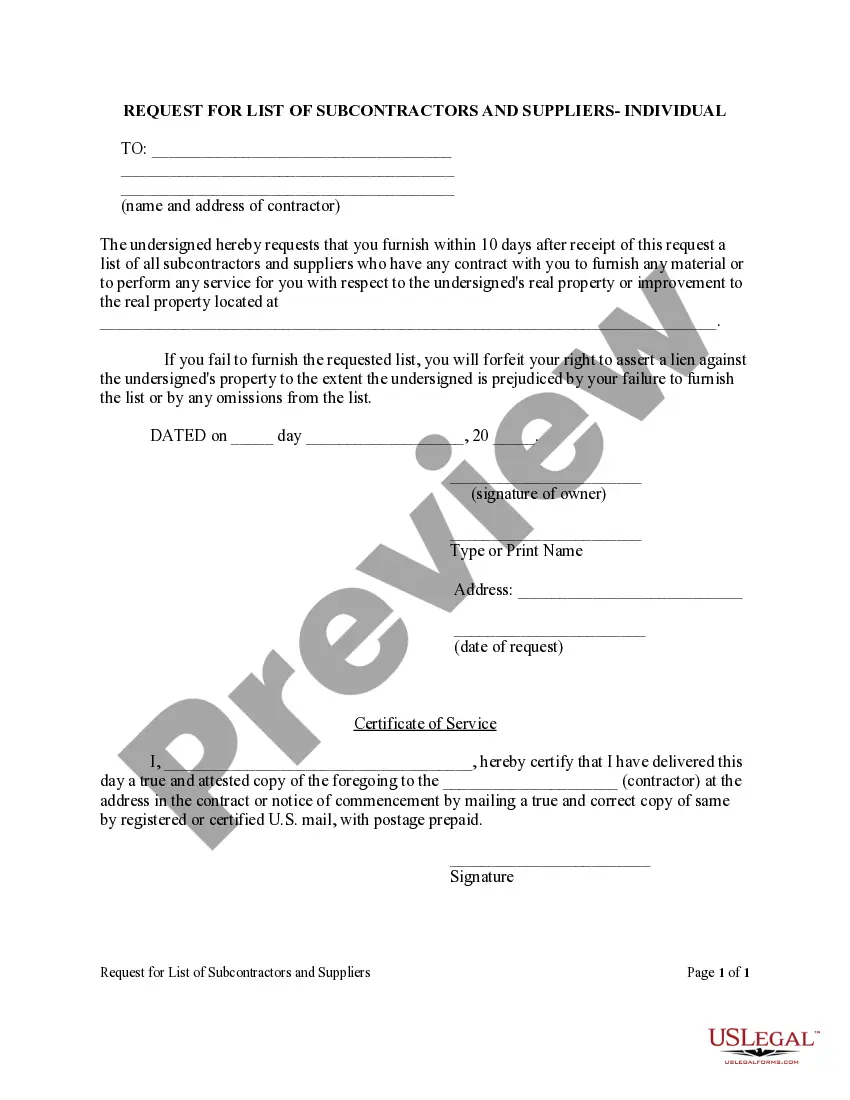

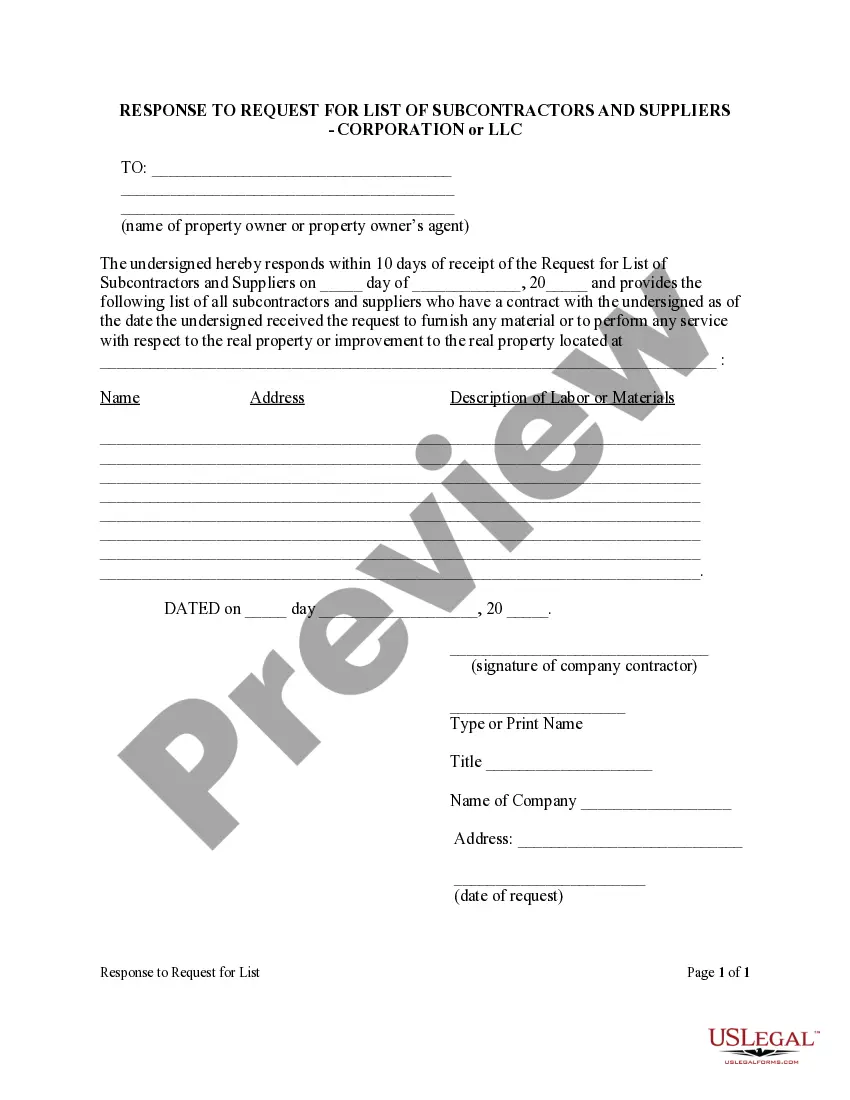

How to fill out Florida Response To Request For List Of Subcontractors And Suppliers - Individual?

Red tape necessitates meticulousness and precision.

If you neglect to manage the completion of documents like Subcontractors For Payroll Tax daily, it may result in several confusions.

Choosing the appropriate template from the outset will guarantee that your document submission proceeds effortlessly and avert any inconveniences associated with resending a document or performing the same task from scratch.

If you are not a subscribed user, finding the necessary template will require a few additional steps: Locate the template using the search box. Confirm that the Subcontractors For Payroll Tax you found is applicable to your state or region. Review the preview or look at the description that contains the details about the usage of the template. When the result aligns with your search, click the Buy Now button. Choose the appropriate option from the suggested pricing plans. Log In to your account or create a new one. Complete the purchase using a credit card or PayPal account. Save the form in the format you prefer. Acquiring the correct and current samples for your documentation can be done in just a few minutes with an account at US Legal Forms. Evade the bureaucratic challenges and simplify your paperwork tasks.

- You can always discover the suitable template for your documentation in US Legal Forms.

- US Legal Forms is the largest online catalog of forms that contains over 85 thousand templates for various topics.

- You can obtain the most recent and relevant version of the Subcontractors For Payroll Tax simply by browsing it on the site.

- Find, store, and save templates in your account or review the description to confirm that you have the correct one readily available.

- With an account at US Legal Forms, it is simple to gather, store in a single location, and navigate the templates you save for easy access in just a few clicks.

- When on the website, click the Log In button to authenticate.

- Then, proceed to the My documents page, where the record of your documents is maintained.

- Examine the description of the forms and save those you require at any time.

Form popularity

FAQ

Payroll refers to the tasks an employer must execute to ensure employees are paid accurately and on time. An independent contractor is not an employee; therefore, he's not paid through the payroll.

How to Pay 1099 Contractors in PayrollAdd the contractor by going to Payroll > 1099 Contractors > Add Contractor.Enter the 1099 Type and their FEIN or Social Security/Individual Taxpayer ID number.If you have Patriot's Accounting software, be sure the Pay this contractor in payroll box is checked on their record.More items...

An independent contractor is not an employee; therefore, he's not paid through the payroll. As a small-business owner with both employees and independent contractors, it is important that you know the differences between the two.

Form 1099-MISC is an information return, providing both the contractor or subcontractor and the IRS with taxable income information. Complete Form 1099-MISC with the name, address and tax identification number copied from the IRS Form W-9 for accuracy.

Contractors and subcontractors don't affect your payroll, because they're not employees. When you negotiate a job with the contractor, generally, you agree to pay them a flat fee not a salary or hourly rate.