Notice Of Nonpayment Form Florida

Description

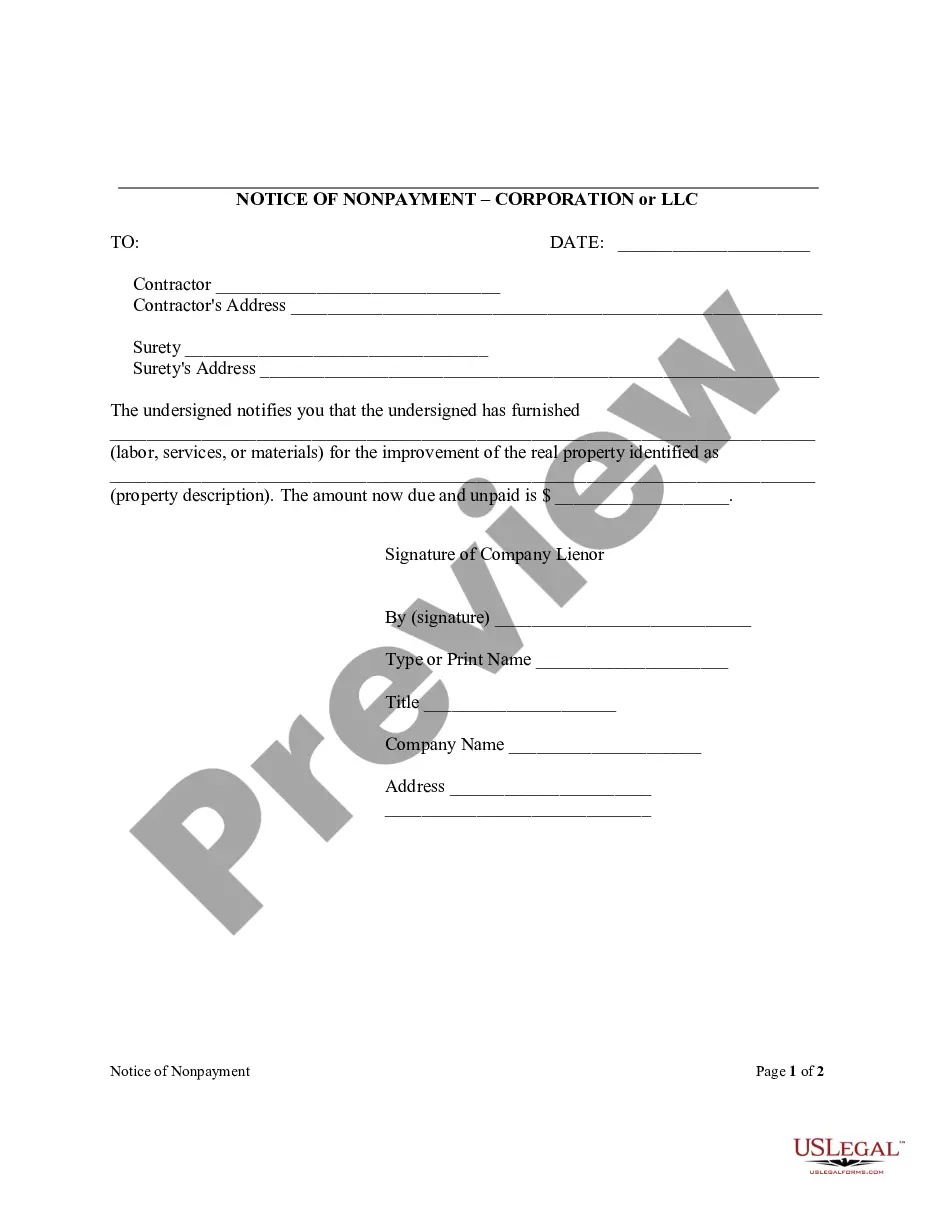

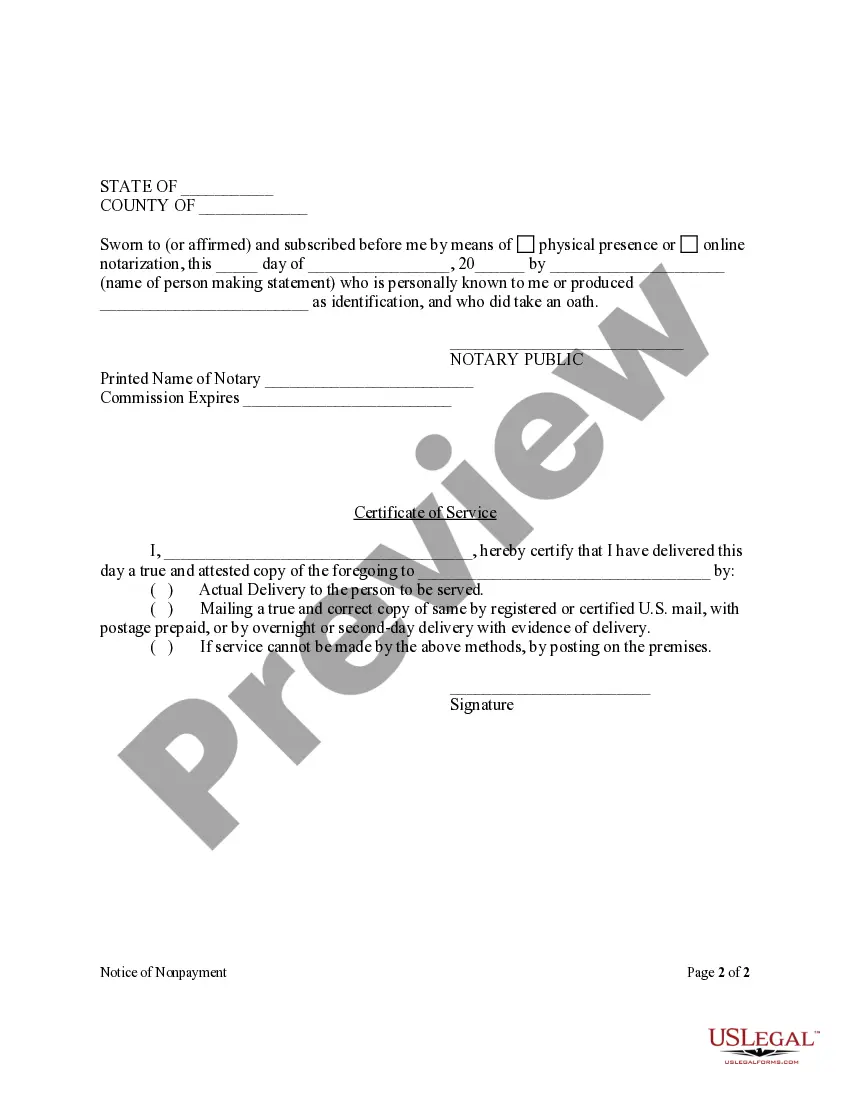

How to fill out Florida Notice Of Nonpayment - Corporation Or LLC?

Whether for business purposes or for personal matters, everyone has to handle legal situations at some point in their life. Filling out legal paperwork demands careful attention, starting with choosing the proper form sample. For instance, when you pick a wrong edition of a Notice Of Nonpayment Form Florida, it will be turned down when you submit it. It is therefore important to get a dependable source of legal files like US Legal Forms.

If you have to get a Notice Of Nonpayment Form Florida sample, stick to these simple steps:

- Find the template you need using the search field or catalog navigation.

- Look through the form’s description to ensure it matches your case, state, and county.

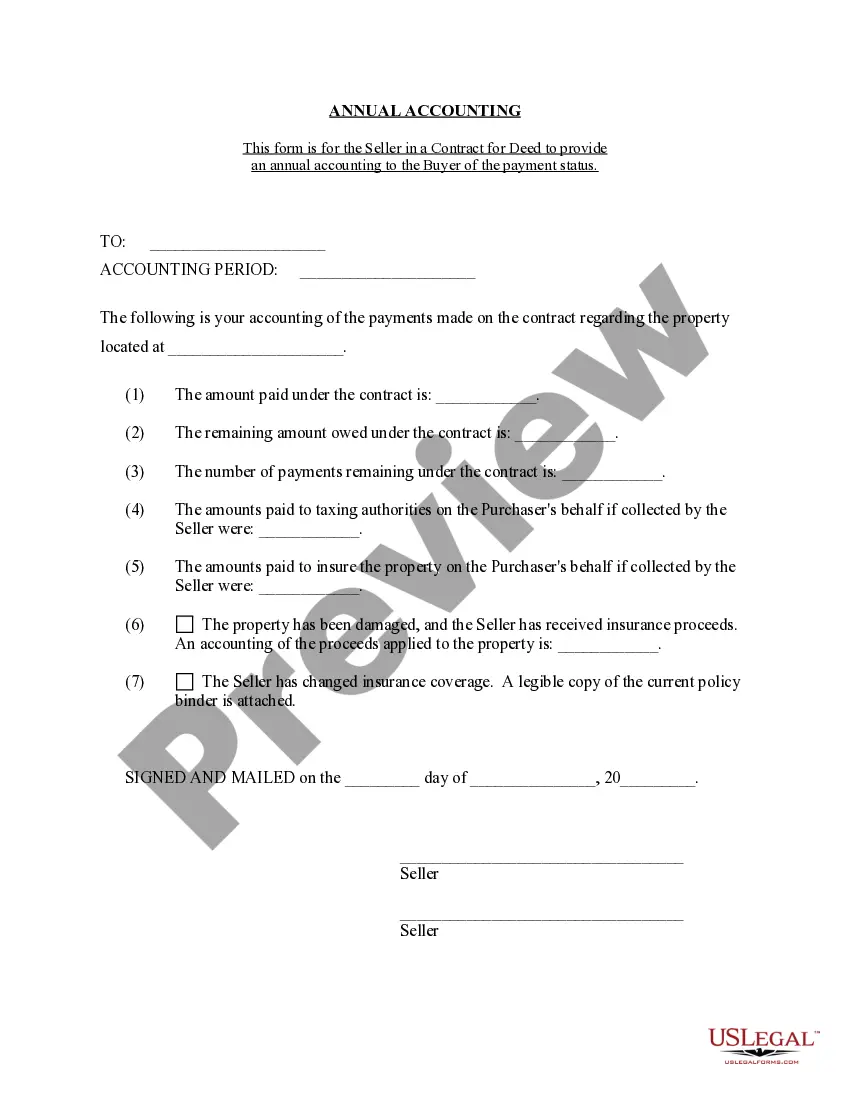

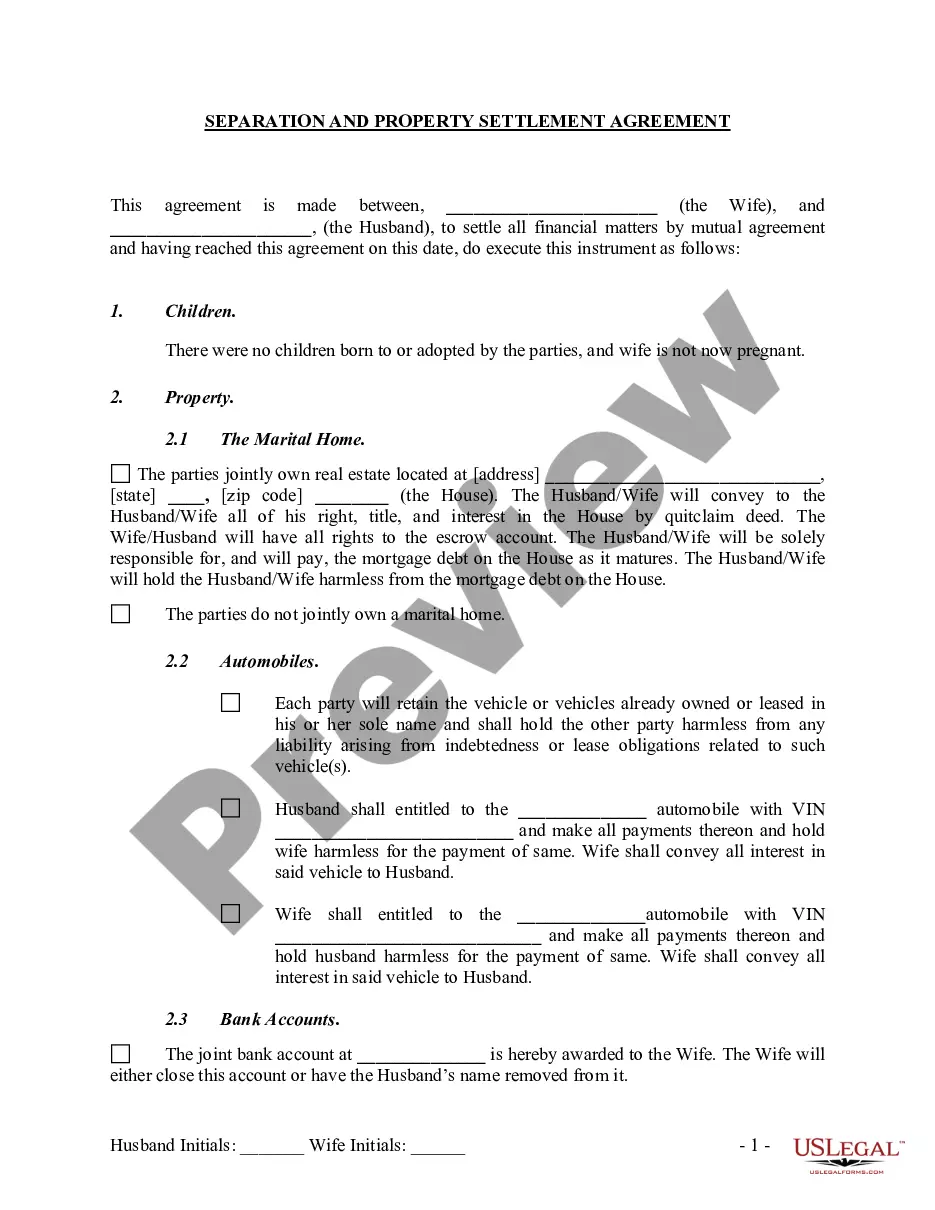

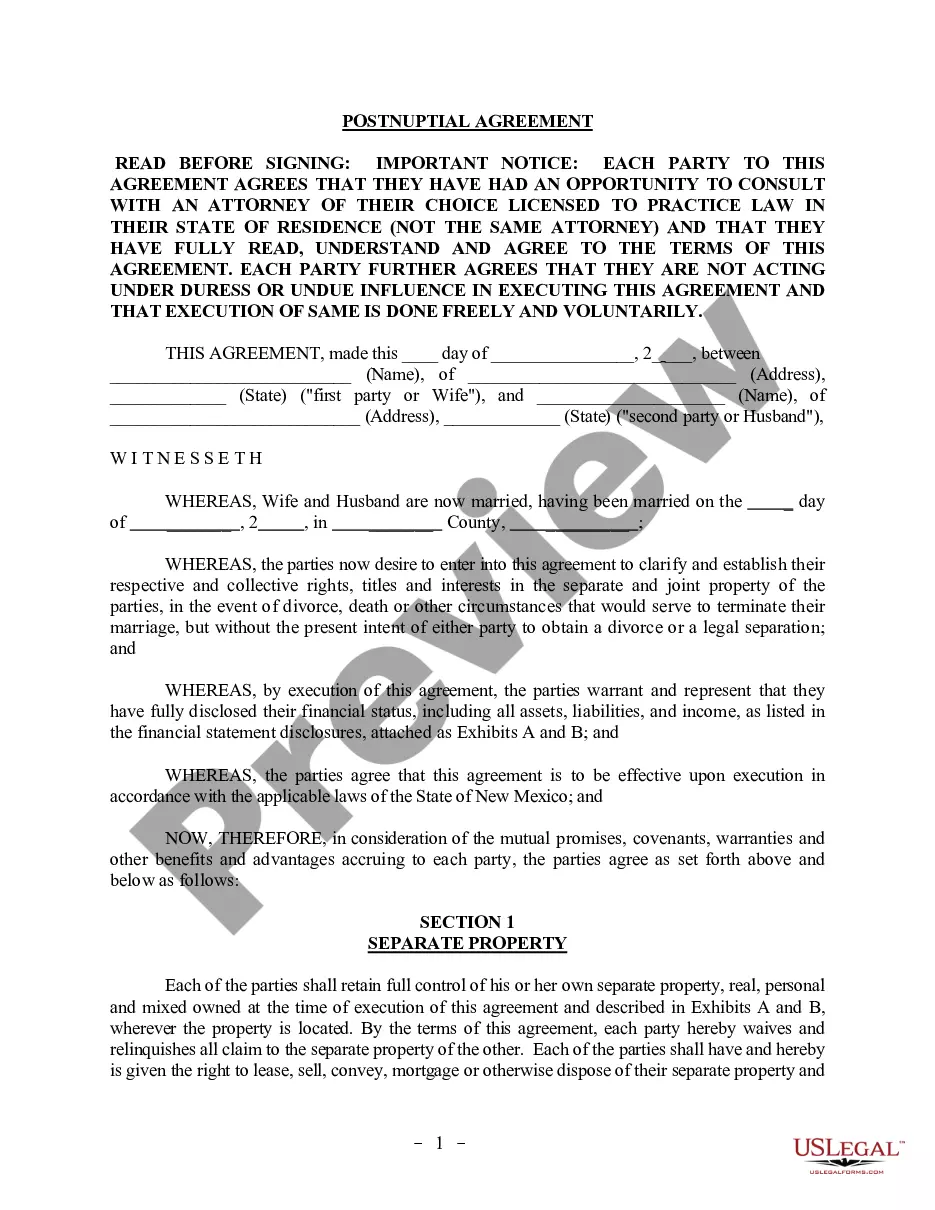

- Click on the form’s preview to view it.

- If it is the wrong document, return to the search function to locate the Notice Of Nonpayment Form Florida sample you require.

- Download the template if it matches your requirements.

- If you have a US Legal Forms profile, just click Log in to access previously saved files in My Forms.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Choose the correct pricing option.

- Complete the profile registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the file format you want and download the Notice Of Nonpayment Form Florida.

- When it is saved, you can complete the form with the help of editing applications or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you don’t need to spend time looking for the appropriate template across the web. Use the library’s easy navigation to get the appropriate form for any situation.

Form popularity

FAQ

1. Exceptions to the 45-day rule. As we wrote above, you should send your Notice to Owner in Florida by certified mail 40 days from the first day that you provide labor or materials to a project.

In Florida, your Notice to Owner needs to be mailed within 45 days of when you completed your service or when you last received a payment. The notice must be served on the owner before filing the lien or within 15 days after you have filed the lien.

Florida Statute (713.06), requires that a Notice to Owner be served on the improvement owner not later than 45 days from the date of first labor, services, or materials delivered to the job site as a prerequisite to secure the sender's right to lien the property in the event the sender is not properly paid for work ...

Yes, in the state of Florida you can file a Mechanics lien for nonpayment if you have a direct agreement (whether verbal or written) with the owner of the property.

Florida's Notice timeline In Florida, your Notice to Owner needs to be mailed within 45 days of when you completed your service or when you last received a payment. The notice must be served on the owner before filing the lien or within 15 days after you have filed the lien.