Claim Against Bond With The Bank

Description

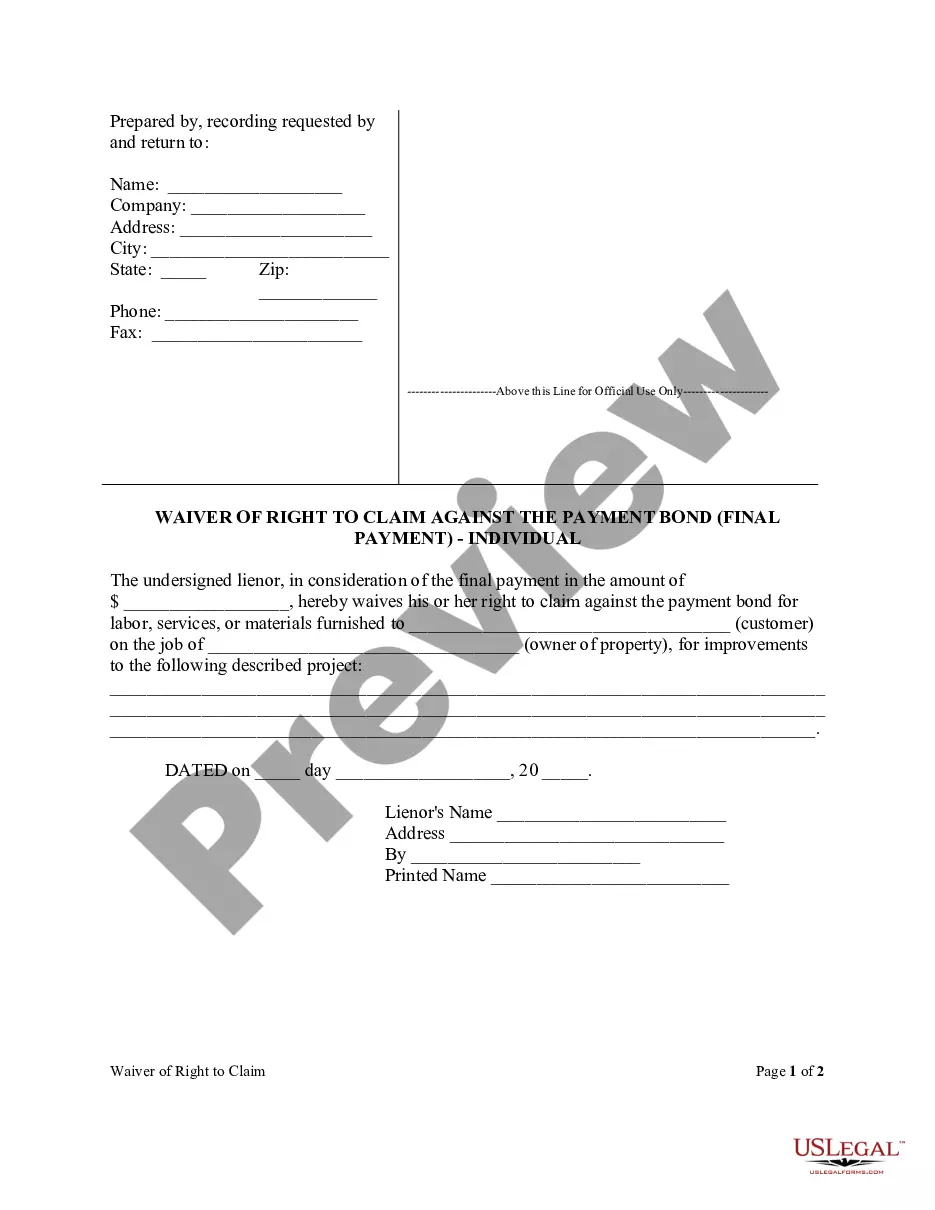

How to fill out Florida Waiver Of Right To Claim Against The Payment Bond (Final Payment) - Individual?

- Start by logging into your US Legal Forms account. If you haven't used the service before, create a new account to access the form library.

- Search for the specific form related to your claim. Use the Preview mode to review the document description and confirm it aligns with your needs.

- If the form does not meet your requirements, utilize the search feature to find an alternative template that works for you.

- Select your desired form and click on the Buy Now button. Choose the appropriate subscription plan that fits your needs.

- Complete your purchase by entering your payment information, whether via credit card or PayPal.

- Download the completed form to your device. You can always revisit it later through the My Forms section of your account.

Following these steps will help you efficiently claim against the bond with the bank while ensuring your documents are compliant and accurate.

Start using US Legal Forms today for a hassle-free document preparation experience!

Form popularity

FAQ

Two critical time frames for asserting a claim against a payment bond include the notice period, which typically requires you to notify the surety within a specific time after the subcontractor's default, and the overall statute of limitations, which sets a deadline for filing your claim in court. It is essential to be aware of these timelines to avoid losing your right to collect damages. Consulting with professionals at uslegalforms can help ensure that you understand and adhere to these important deadlines.

To claim a bond means to request compensation from a surety bond due to a failure by the bonded party to fulfill their obligations. This process often involves providing evidence of the default and following the proper procedures to claim against the bond with the bank. Essentially, claiming a bond allows you to seek a remedy for losses incurred as a result of someone's failure to meet their contractual duties. Using resources like uslegalforms can simplify this process and provide guidance each step of the way.

You should file a bond claim whenever there is a breach of contract or violation of the bond terms. It is important to act promptly, as there are often time limits associated with filing a claim against a bond with the bank. Generally, you should file the claim as soon as you notice the issue to avoid missing deadlines. Platforms like uslegalforms can help you understand these timeframes and assist you in submitting your claim effectively.

An example of a surety bond claim might involve a contractor who fails to complete a construction project as promised. In this situation, the owner of the project can file a claim against the bond with the bank to recover damages caused by the contractor's failure. This claim typically involves demonstrating how the contractor's actions have negatively impacted the project. Using services like uslegalforms can streamline this process and ensure that you have all the necessary documents to support your claim.

To collect on a surety bond, you first need to understand the terms of the bond. Typically, you should notify the surety company of the claim against the bond with the bank and provide evidence supporting your claim. It is crucial to follow the specific procedures outlined in the bond agreement which may include sending a formal notice of claim and submitting relevant documentation. Utilizing a trusted platform like uslegalforms can guide you through the process and help ensure you meet all necessary requirements.

The notice of intent to make bond claim form is a crucial document that signals your intention to claim against bond with the bank. This form informs the relevant parties that you are taking steps to seek reimbursement from the surety bond. It outlines the reasons for your claim and provides necessary details for processing. By using this form through a trusted platform like US Legal Forms, you can ensure that your claim is clear and well-documented, increasing your chances for a favorable outcome.

To claim your bonds, first gather the necessary documentation, including the bond certificate and identification. Follow the specific procedures outlined by the bond issuer or bank. If you face challenges, consider utilizing resources like USLegalForms, which can help guide you through the claiming process effectively.

To fill out an indemnity form, begin by providing all required personal information. Clearly state the circumstances that necessitate the indemnity. After completing the form, review all entries for accuracy and ensure that you include any supporting documents needed to strengthen your claim against a bond with the bank.

An example of a bond claim is when a contractor fails to complete a project as agreed and the client seeks compensation. In such cases, the client can claim against the bond provided by the contractor. This process helps ensure financial protection and accountability when engaging in contractual obligations.

Filling an indemnity form for a bank requires you to input your personal information and specifics about the bond. Make sure to read instructions carefully to avoid mistakes. Once you complete the form, double-check it for accuracy and provide any additional documentation as requested by the bank.