Claim Against Bond With A Shareholder

Description

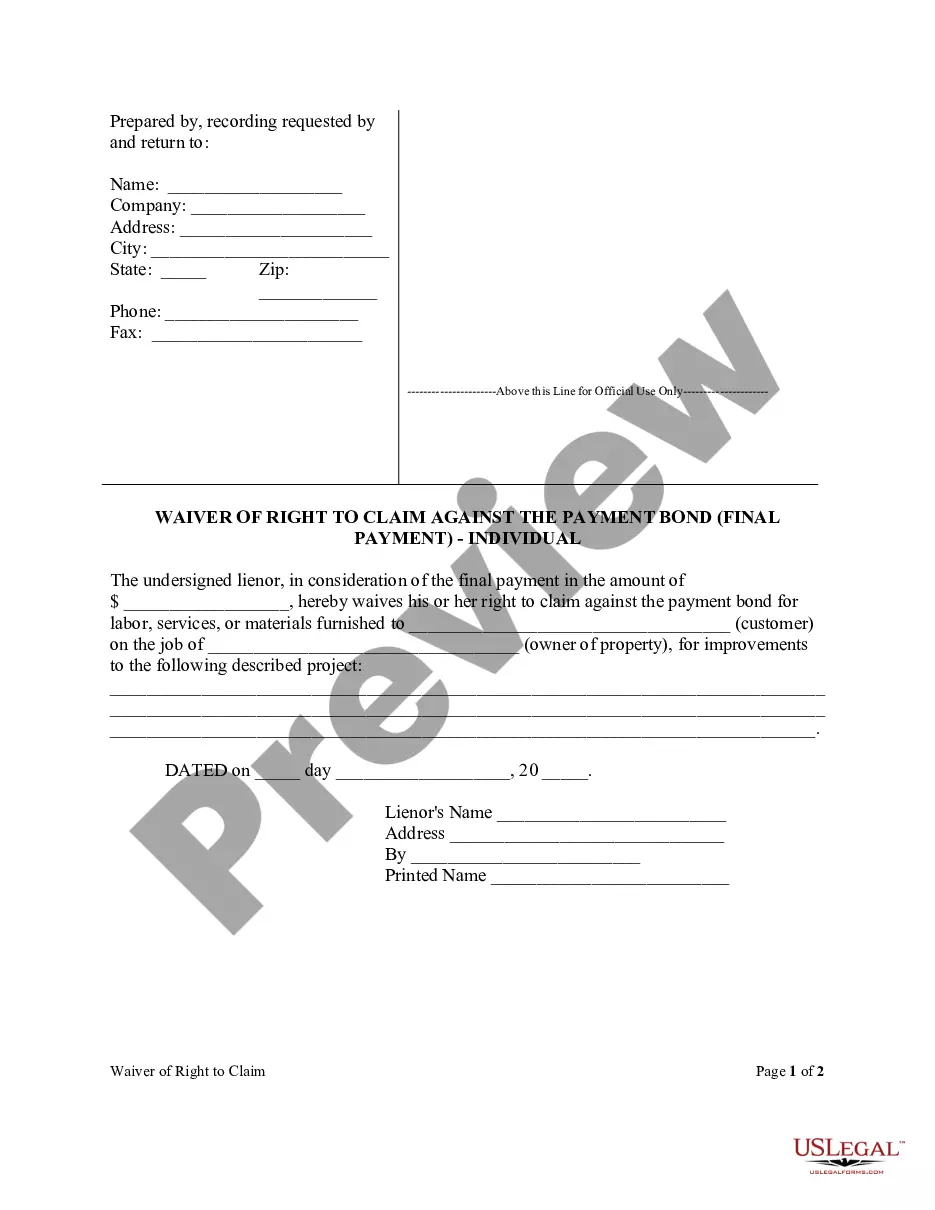

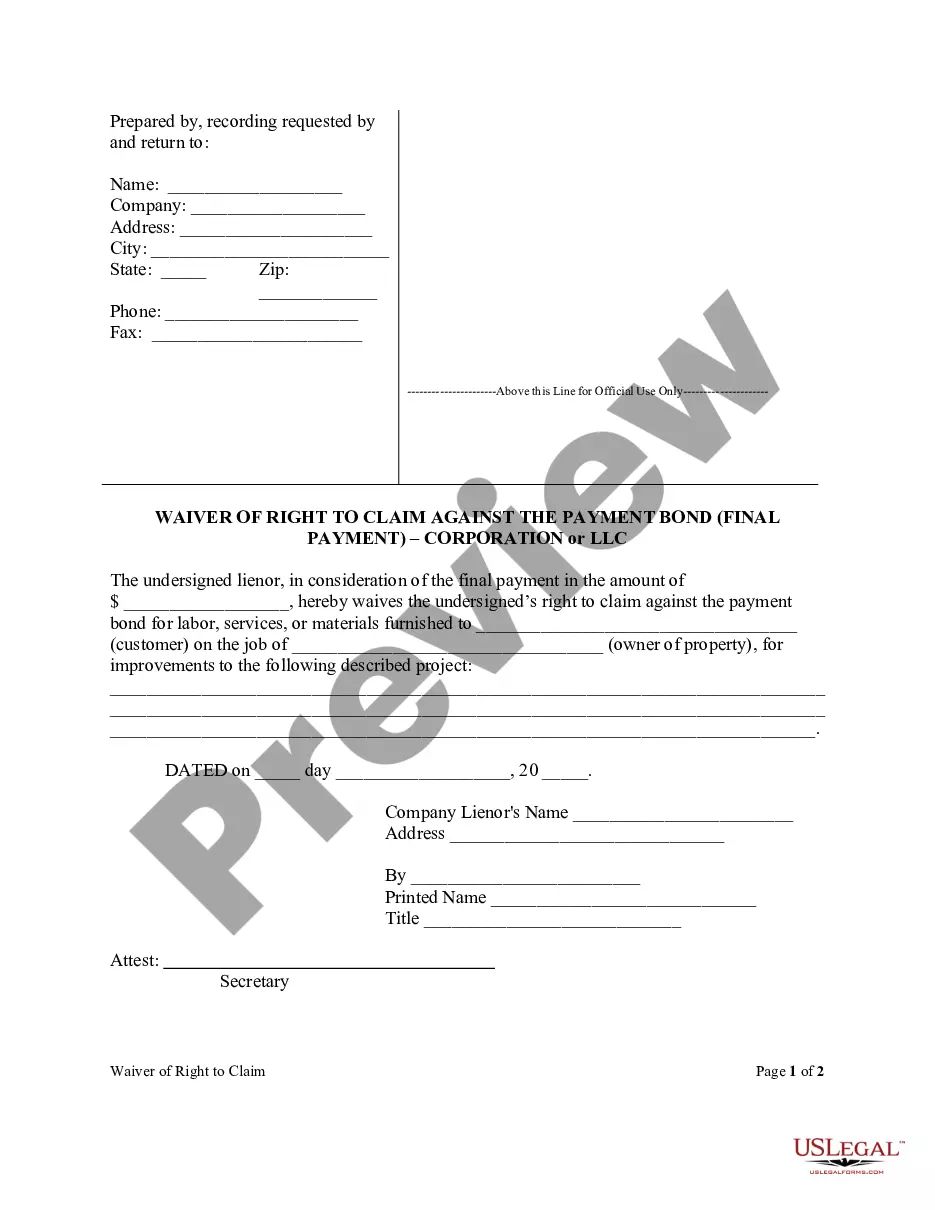

How to fill out Florida Waiver Of Right To Claim Against The Payment Bond (Final Payment) - Individual?

- If you're a returning user, log in to your account to retrieve the necessary document by clicking the Download button. Ensure your subscription is active, or renew it if necessary.

- For first-time users, begin by checking the Preview mode and descriptions of the forms to ensure they meet your specific requirements.

- If the required form is not found, utilize the Search tab to locate the correct document that aligns with your needs.

- Once you've identified the right template, click on the Buy Now button to select your desired subscription plan and create an account to access a broader library.

- Complete the purchase by providing your payment information via credit card or PayPal for your subscription.

- After purchasing, download your legal form and save it on your device. Access it later through the My documents section of your profile.

With over 85,000 forms available, US Legal Forms empowers you and your attorney to effortlessly navigate legal documentation. Their extensive library and user-friendly features ensure you have the right tools for your claim.

Start your legal journey with ease by visiting US Legal Forms today and take the first step towards effectively managing your legal needs!

Form popularity

FAQ

To make a claim on a contractor's bond in California, start by collecting all documentation related to your project's issues. Then, contact the bonding company to obtain their claim form and include all necessary information such as contract details and evidence of the breach. Utilizing platforms like uslegalforms can streamline this process, guiding you effectively to claim against the bond with a shareholder and aiding in the resolution of your concerns.

In California, the statute of limitations for filing a claim against a contractor's bond is generally two years from the date of the completed contract or the date the damage was discovered. This time frame is crucial, as it defines your window for action. Understanding this limitation helps ensure you can promptly claim against the bond with a shareholder if necessary, safeguarding your rights.

Filing a claim against a contractor's bond in California involves a few important steps. First, you need to identify the bonding company and obtain their claim form, which typically outlines the required details of your claim. By following this method, you can effectively claim against the bond with a shareholder and enhance your chances of receiving compensation for any grievances related to the contractor’s work.

To file a claim against a contractor in California, you first need to gather all relevant documents, including your agreement with the contractor and any evidence of the issue you encountered. Next, fill out the appropriate complaint form and submit it to the local contractor's licensing board. This process allows you to officially claim against the bond with a shareholder, ensuring your concerns are addressed and potentially recovering your losses.

A bond claim arises when an individual or entity seeks compensation from a bond issued to secure a financial obligation. For instance, if a company fails to fulfill its contractual duties, a stakeholder may file a claim against bond with a shareholder to recover losses. This process ensures that affected parties receive due compensation. Understanding bond claims is essential for anyone involved in corporate finance.

A surety bond claim can occur when a contractor fails to complete a project as agreed, resulting in financial loss for the property owner. For instance, if a contractor abandons a public works project, the property owner can file a claim against the contractor's performance bond. This claim allows the owner to seek compensation for incurred costs to hire another contractor. Accessing tools and forms from US Legal Forms can assist in filing a claim against bond with a shareholder effectively.

Collecting on a surety bond involves several key steps. First, you must file a claim with the surety company, providing evidence of the loss incurred due to the bonded party's failure to meet obligations. After the claim is reviewed and approved, the surety will compensate you for the damages. Remember, leveraging the resources on US Legal Forms can streamline your efforts to collect when making a claim against bond with a shareholder.

To file a claim against a public official bond, gather necessary documentation that supports your claim. This may include proof of loss or damages caused by the official's actions. Next, contact the surety company that issued the bond and submit your claim. Using our platform, US Legal Forms, can simplify this process with forms and guidance tailored specifically for a claim against bond with a shareholder.

To put a claim on a surety bond, you must gather necessary documentation, such as contracts, invoices, and evidence of work completed. Next, you need to submit a claim to the surety company that issued the bond. Following their specific procedures ensures a smoother claims process. If you encounter challenges, platforms like US Legal Forms can provide valuable templates and guidance for filing a claim against bond with a shareholder.

Claiming a bond involves formally requesting payment from the surety when a contractor fails to meet their obligations. This claim acts as a protective measure for those who provided services or goods. Understanding the process empowers subcontractors and suppliers to safeguard their interests. When you submit a claim against bond with a shareholder, it is essential to be aware of all associated rights and responsibilities.