Limited Lliability

Description

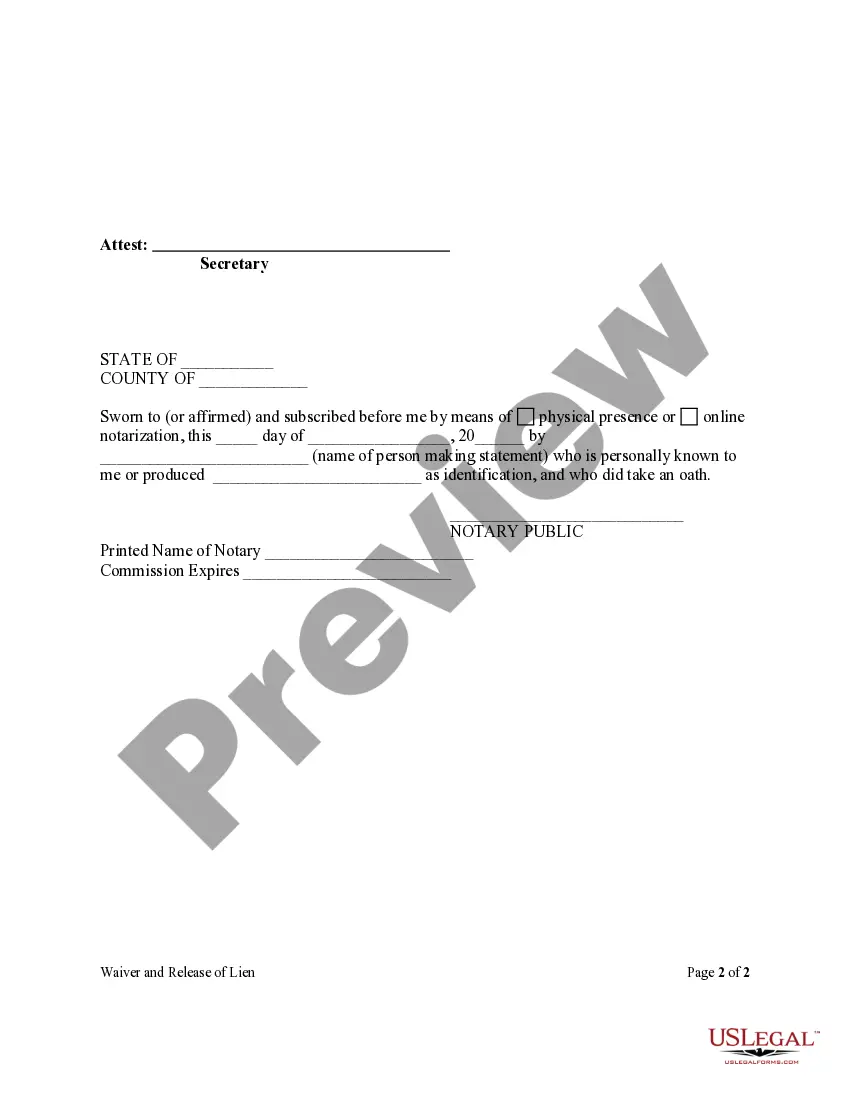

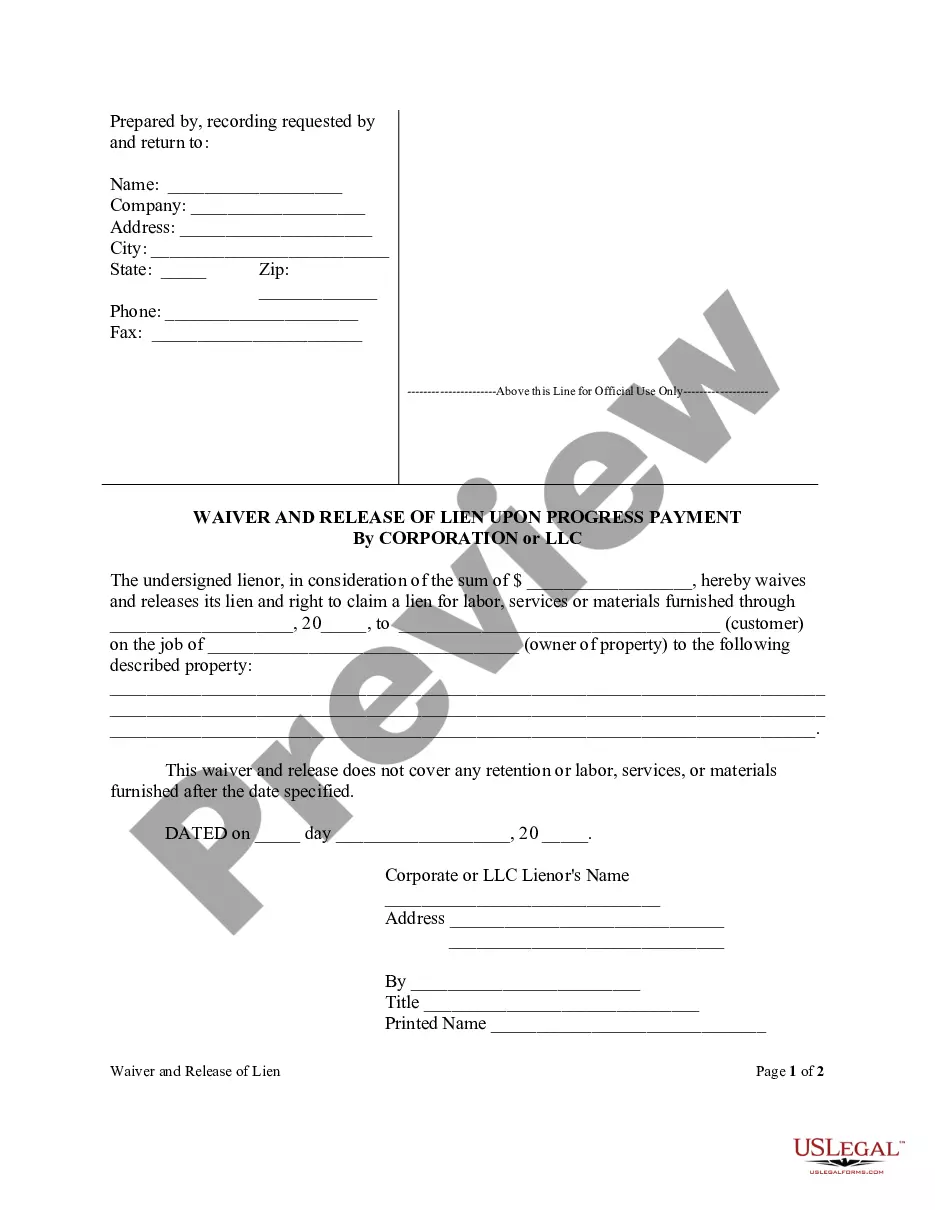

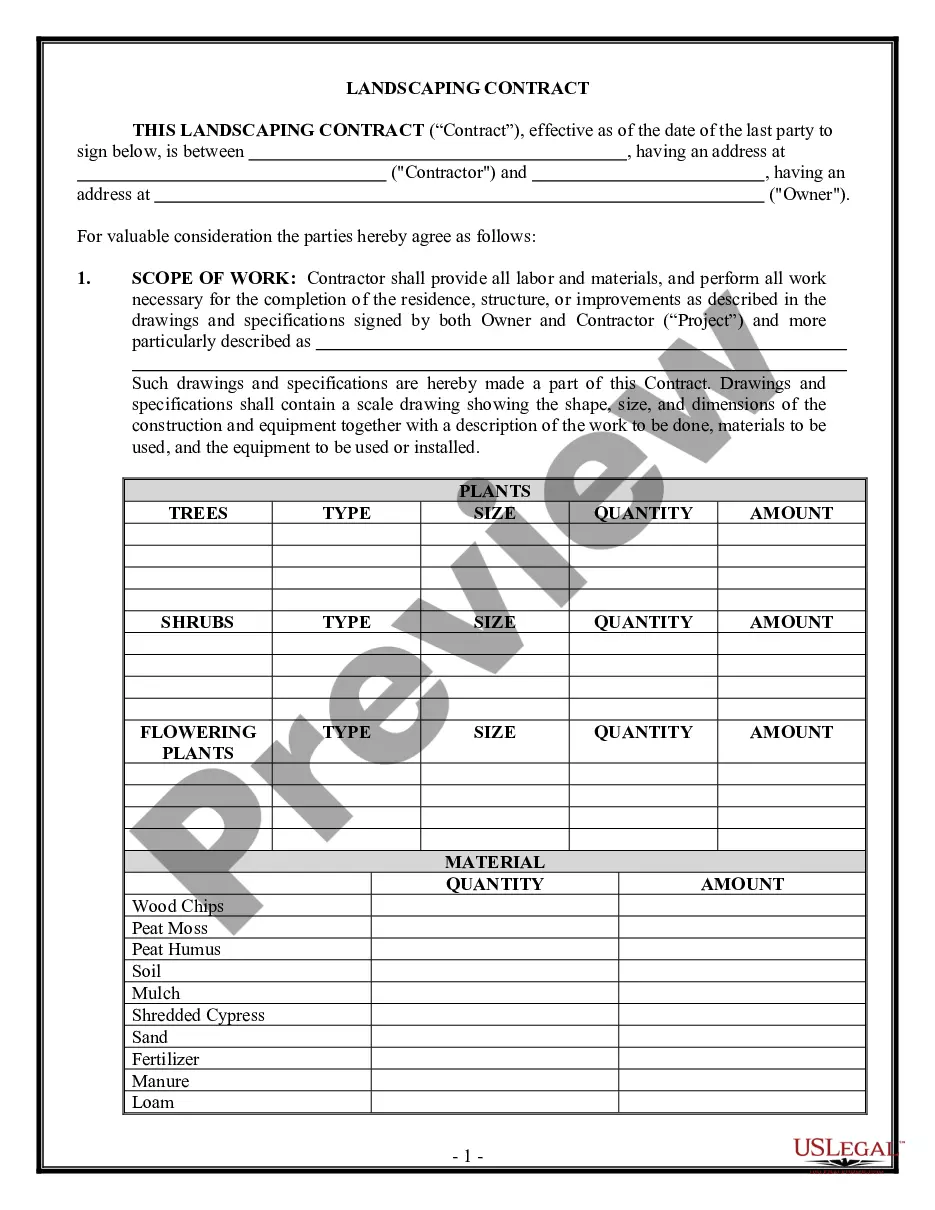

How to fill out Florida Waiver And Release Of Lien Upon Final Payment Form - Construction - Mechanic Liens - Corporation Or LLC?

- Log in to your existing US Legal Forms account. Ensure your subscription is active; if it isn’t, renew it based on your plan.

- Review the form description and Preview mode carefully to choose the correct document that aligns with your needs and complies with local jurisdiction requirements.

- If you need a different template, use the Search tab at the top of the page to locate the right one. Once found, you can proceed to the next step.

- Select the document you wish to purchase by clicking the Buy Now button, then choose your preferred subscription plan. You will need to register for an account to access the library's resources.

- Complete your purchase by entering your payment details or using your PayPal account to finalize the subscription.

- Download the chosen document and save it to your device. You can always access it later in the My Forms section of your profile.

In conclusion, US Legal Forms provides a robust collection of legal documents that are essential for executing limited liability effectively. By following these straightforward steps, you can take control of your legal needs with ease.

Start exploring the extensive library today and empower yourself with the tools to manage your business effectively!

Form popularity

FAQ

Determining a reasonable salary for an LLC depends on various factors, such as the business’s revenue and industry standards. If you’re operating a Limited Liability Company, it’s crucial to compensate yourself fairly based on your work and the business’s profits. This ensures compliance with IRS regulations and contributes to a positive financial outlook. Use tools from US Legal Forms to help you calculate an appropriate salary.

There’s no specific income threshold that dictates when you should form a Limited Liability Company (LLC). However, if your business begins generating revenue or you anticipate growth, it's a good time to consider this structure. Setting up an LLC earlier can help protect your assets and offer tax benefits. Check out US Legal Forms to understand the best timing for your specific situation.

You should consider forming a Limited Liability Company (LLC) when you launch a business or begin taking on liabilities. If you’re involved in a business that has potential risks, an LLC provides crucial protection for your personal assets. It’s also wise to create an LLC if you plan to hire employees or sign contracts. Consulting resources like US Legal Forms can help you make an informed decision.

Yes, you can establish a Limited Liability Company (LLC) even if you don’t have an active business yet. Many entrepreneurs create an LLC to protect their personal assets while they plan their business ventures. This approach also allows you to benefit from limited liability as soon as you start operating. Platforms like US Legal Forms can assist you in this process.

One downside of a Limited Liability Company (LLC) is the complexity involved in setting it up. Unlike a sole proprietorship or partnership, there are more legal and tax responsibilities. Additionally, LLCs may face higher annual fees and compliance requirements, depending on the state. It’s important to weigh these factors when considering limited liability.

Yes, you can choose to file your LLC separately from your personal tax return, depending on how you set it up. If you elect to have your LLC taxed as a corporation, it will file its own tax return. However, the default for a single owner is to report on your personal return. Understanding these options can help you maximize the benefits of limited liability.

Filling out an LLC requires several steps, starting with the Articles of Organization. You will need specific information like your LLC's name, address, and the names of its members. Additionally, some states require an operating agreement outlining management and operational procedures. Using resources from U.S. Legal Forms can simplify this process significantly.

To write a limited liability company, start by choosing a unique name that complies with state rules. Include 'Limited Liability Company' or an abbreviation in the name. Next, draft and file your Articles of Organization with the state, detailing the LLC’s purpose and structure. U.S. Legal Forms offers templates to make this process easier.

A single owner LLC typically files taxes as a sole proprietorship. This means you report business income and expenses on your personal tax return, benefiting from the limited liability framework. Be mindful of the self-employment taxes that may apply. To ensure accurate filings, you may want to consider resources from U.S. Legal Forms.

Yes, you can establish an LLC and choose not to engage in active business. However, even a dormant LLC may still have filing requirements and annual fees. To fully benefit from limited liability protection, ensure you keep up with these obligations, as neglect could lead to administrative dissolution. Always consult U.S. Legal Forms for clarity on maintaining your LLC.