Fl Estate Deed Individual Withholding

Description

How to fill out Florida Enhanced Life Estate Or Lady Bird Deed - Individual To Two Individuals / Husband And Wife?

Whether for business reasons or for personal affairs, everyone must confront legal issues sooner or later in their life.

Filling out legal documents requires meticulous care, starting from selecting the appropriate form template.

With a comprehensive US Legal Forms catalog available, you never have to waste time searching for the suitable template across the internet. Utilize the library’s straightforward navigation to find the correct template for any situation.

- For instance, if you select an incorrect version of the Fl Estate Deed Individual Withholding, it will be rejected when you submit it.

- It is therefore crucial to obtain a reliable source of legal documents like US Legal Forms.

- If you need to acquire a Fl Estate Deed Individual Withholding template, follow these simple steps.

- Obtain the template you require by using the search bar or catalog browsing.

- Review the form’s description to ensure it suits your circumstances, state, and county.

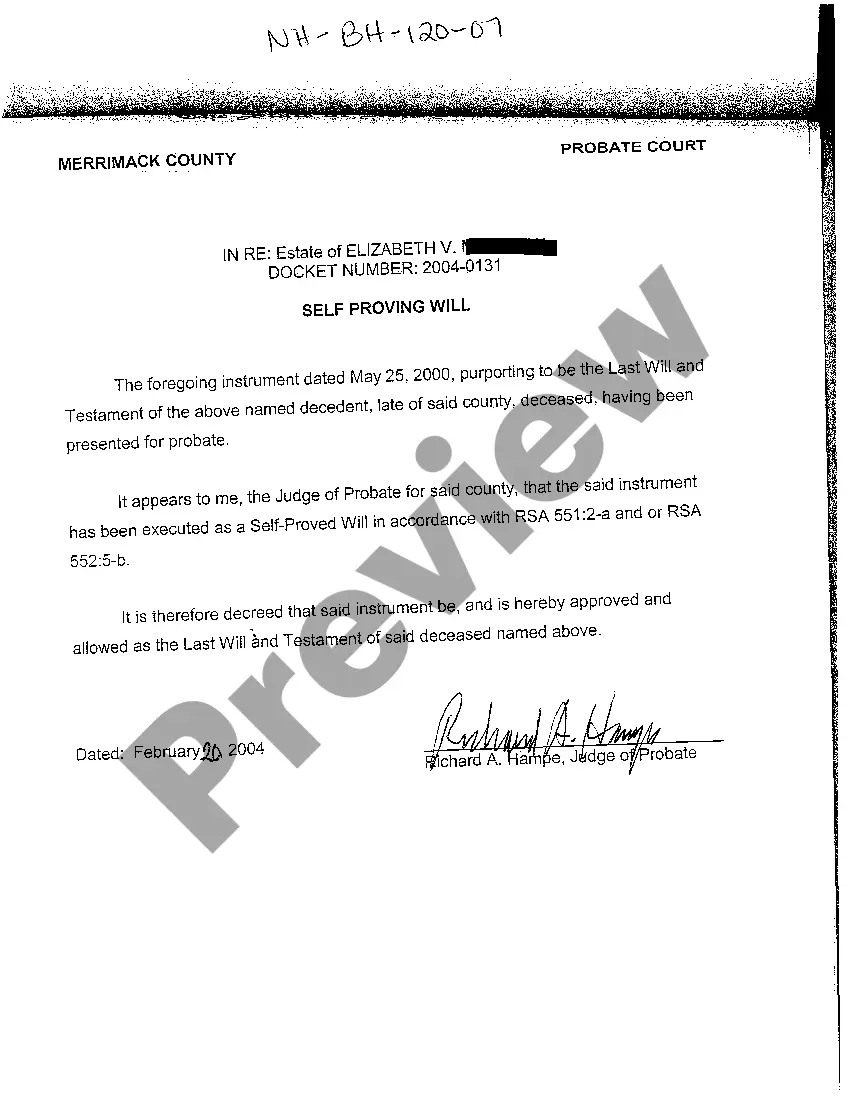

- Click on the form’s preview to examine it.

- If it is the incorrect document, return to the search feature to find the Fl Estate Deed Individual Withholding template you need.

- Obtain the template if it aligns with your needs.

- If you possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you may download the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the file format you want and download the Fl Estate Deed Individual Withholding.

- Once it is downloaded, you can complete the form using editing software or print it and fill it out manually.

Form popularity

FAQ

Ing to Florida Statute 695.26, a quitclaim deed must contain these certain elements: Name and address of person preparing the deed. Grantor's name and address. Grantee's name and address. Signatures of the grantors. Two witnesses for each signature/ Notary acknowledgment with signature.

Leaving Property in a Will in Florida If you have several heirs, you can designate them all as beneficiaries of the home in your will. After your death, they will each inherit an equal interest in the home, unless stated otherwise in the will.

All deeds executed in Florida must be signed in the presence of a notary public and two witnesses. Because there are several different types of deeds used to convey real estate, it is important to work with a Daytona real estate attorney.

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen.

After considering who you can legally disinherit and deciding that disinheritance is the correct decision, you can ensure that someone is removed as a beneficiary by updating or creating your Last Will and Testament. You may wish to include a reason in your Will.