Enhanced Life Estate For The Elderly

Description

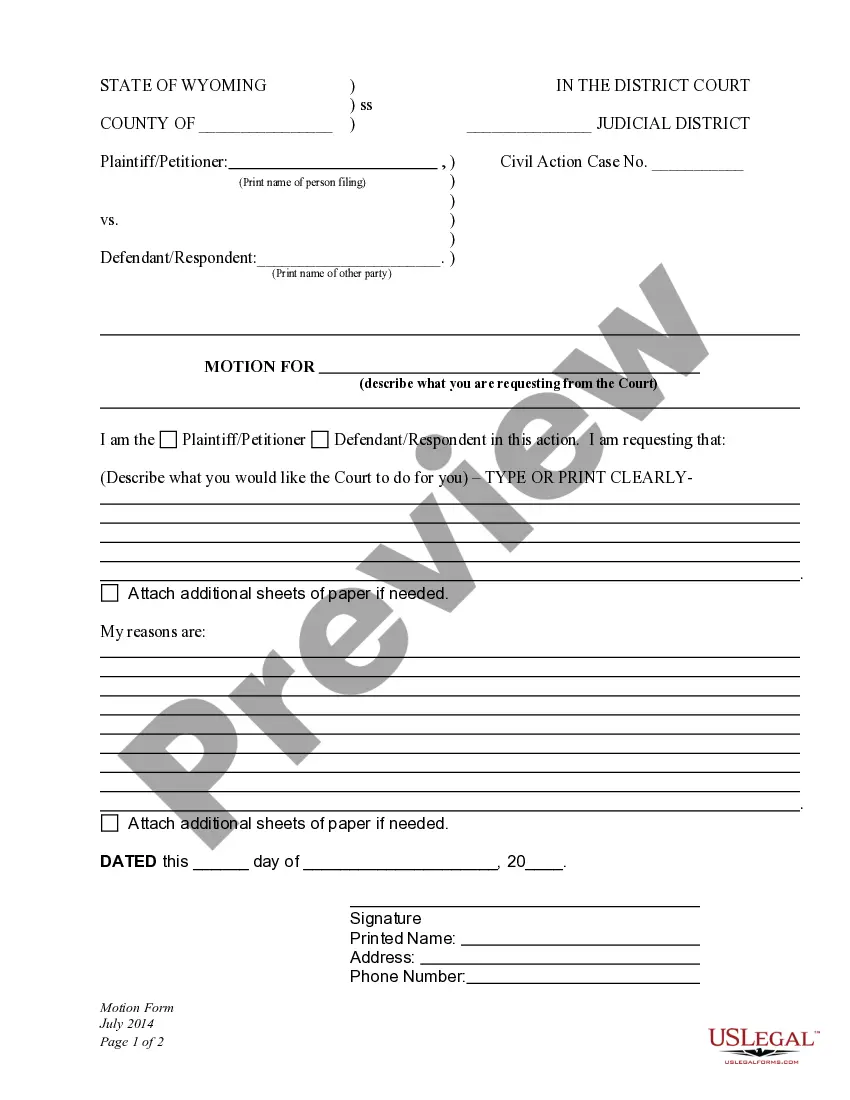

How to fill out Florida Enhanced Life Estate Or Lady Bird Deed - Individual To Two Individuals / Husband And Wife?

- Log in to your US Legal Forms account, or create a new account if you're a first-time user.

- Browse the extensive library to locate the enhanced life estate form applicable to your jurisdiction.

- Review the form preview and description to ensure it meets your specific needs.

- If necessary, utilize the search function to find a different template that better suits your requirements.

- Once the correct document is found, click 'Buy Now' and select your preferred subscription plan.

- Complete the registration process, and enter your payment information via credit card or PayPal.

- After your purchase is confirmed, download your document and save it for easy access within the 'My Forms' section.

With US Legal Forms, you gain access to a robust collection of over 85,000 legal forms, tailored for ease of use. Their platform offers unmatched resources and professional support to ensure your documents are precise and legally sound.

Start planning your estate today. Visit US Legal Forms and take control of your legal needs with confidence!

Form popularity

FAQ

An enhanced life estate for the elderly serves various purposes that make it appealing. It allows individuals to maintain control of their property while planning for the future. This option can help avoid probate, streamline the transfer of assets, and provide peace of mind regarding property management. Carefully considering these benefits can guide your decisions and ensure your wishes are honored.

In Florida, a life estate deed allows an owner to pass their property to beneficiaries upon death, but it may not offer certain benefits. An enhanced life estate for the elderly, on the other hand, provides increased flexibility. With an enhanced life estate, the owner retains the right to sell, transfer, or mortgage the property without needing consent from the beneficiaries. This distinction can significantly impact estate planning.

Creditors may have the ability to pursue a life estate, especially if debts remain unpaid. An enhanced life estate for the elderly does not shield the property from claims against the owner's estate. This means creditors could potentially seize the property if necessary to settle debts. Understanding this risk can help you plan better for your financial future.

While an enhanced life estate for the elderly provides many benefits, it also has drawbacks. One downside is that the property may not be easily sold during the owner's lifetime, as the life tenant has limited control. Additionally, beneficiaries may face complications when trying to transfer the property after the owner's death. It's essential to weigh these negatives against the advantages.

A typical life estate clause might read, 'I grant to name a life estate in the described property, with a remainder to name.' This clause clearly defines who holds the life interest and who will inherit the property afterward. Such clauses should be crafted with precision to avoid misunderstandings. Incorporating an enhanced life estate for the elderly can make this process smoother and ensure their intent is honored.

To create a life estate, the language must be explicit and clear. Key phrases include 'to name, for their lifetime' or 'to name with a remainder to name.' This wording ensures there is no ambiguity regarding the rights conferred. For the elderly, using an enhanced life estate can simplify the transfer process of their property and clarify everyone’s expectations.

The terms of a life estate typically define the rights of the life tenant and the responsibilities that come with those rights. The tenant has the right to use and benefit from the property during their lifetime, but they cannot sell or mortgage it without the consent of the remaindermen. After the life tenant passes away, ownership transfers to the pre-designated heirs without going through probate. These terms can be particularly helpful for the elderly seeking peace of mind in planning.

Life estates are generally created by a legal document known as a deed. This deed outlines the specific rights of the life tenant and the remaindermen who will inherit the property after the tenant's death. The clarity and intent of the deed ensure that all parties involved understand their rights. Utilizing an enhanced life estate for the elderly includes provisions that benefit both the current owner and their heirs.

An enhanced life estate deed is often structured to include the phrase 'with a right of survivorship.' For instance, a property owner may transfer their home to their children while retaining the right to live there for the remainder of their life. This structure protects the property from probate and can offer tax benefits. Such a deed proves beneficial for an elderly person's estate planning needs.

To create a life estate, you typically need specific words in the language of the deed. Phrases like 'for the life of the grantee' are essential to establish the life tenant's rights. It is crucial to use clear language so that everyone understands the intent behind the deed. An enhanced life estate for the elderly allows individuals to retain control over their property while making arrangements for its future transfer.