Enhanced Lady Bird Two For The Road

Description

How to fill out Florida Enhanced Life Estate Or Lady Bird Deed - Individual To Two Individuals / Husband And Wife?

- If you’re a returning user, log into your account and verify your subscription is active. Click the Download button to save the needed form to your device.

- For new users, start by browsing the Preview mode and form description. Confirm that the document fits your requirements and complies with local jurisdiction regulations.

- If adjustments are necessary, utilize the Search tab to locate an alternative template that aligns with your needs.

- Once you've found the correct form, click the Buy Now button and select your preferred subscription plan to proceed.

- Complete your purchase by entering your payment information or using your PayPal account to finalize the transaction.

- Download the form to your device. You can later access it anytime via the My Forms section.

US Legal Forms not only offers a robust collection of over 85,000 legal documents, but it also connects users with premium experts who can assist in completing forms accurately. This ensures that your legal needs are met with precision and reliability.

With US Legal Forms, empowering yourself with the right documents has never been easier. Discover the convenience of a comprehensive legal library and make the most of your legal experience today!

Form popularity

FAQ

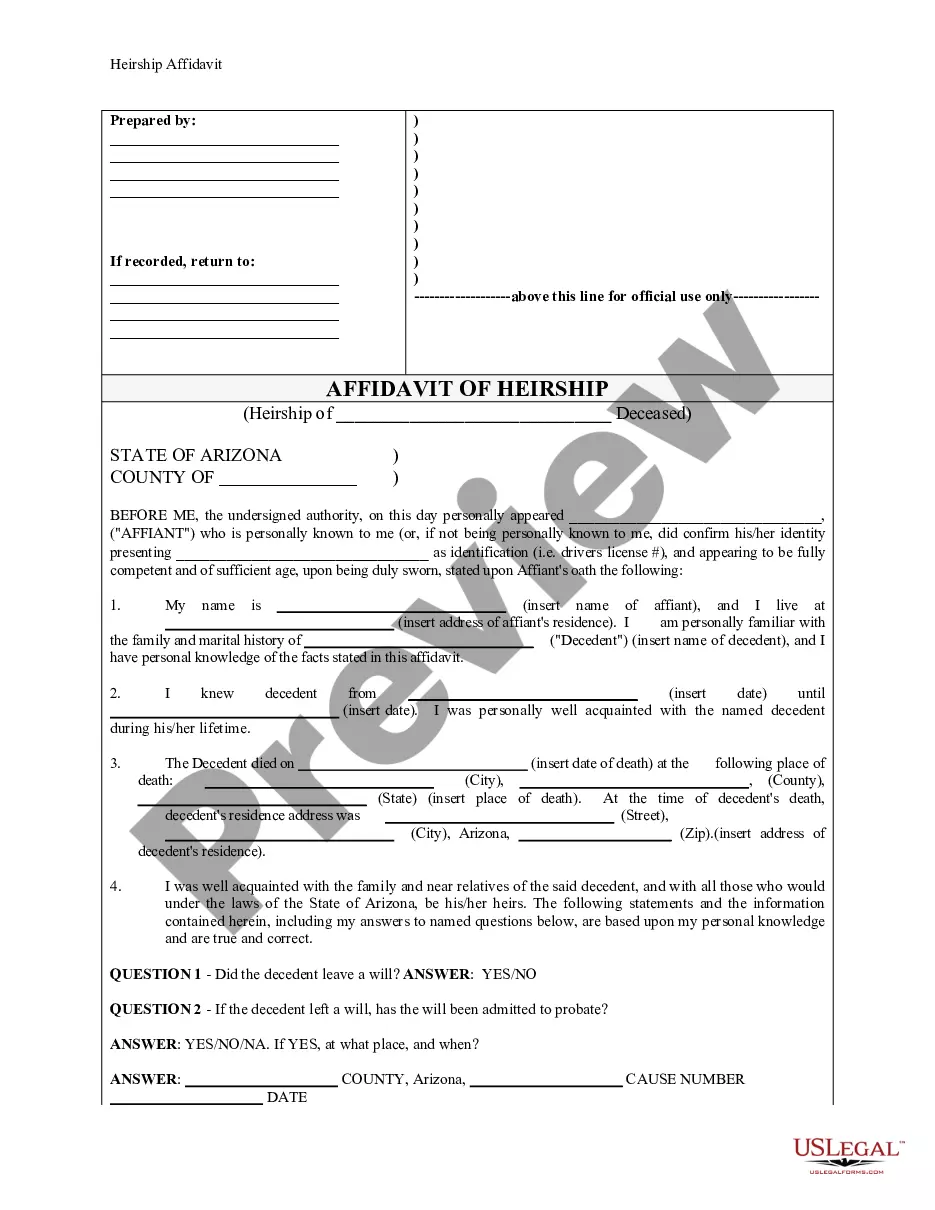

Filling out a lady bird deed involves providing specific information about the property and the individuals involved. Begin by clearly stating the names of the current property owners as well as the intended beneficiaries. It's essential to use accurate legal descriptions of the property to ensure clarity. Consider utilizing the Enhanced lady bird two for the road for a streamlined process, as it simplifies the documentation and ensures compliance with relevant laws.

Medicaid cannot take your house if you have a lady bird deed, as long as certain conditions are met. The Enhanced lady bird two for the road allows you to retain control of your property during your lifetime, which can protect it from Medicaid claims. However, it is essential to consult with a legal expert to ensure compliance with Medicaid rules. Utilizing platforms like US Legal Forms can guide you through this process effectively.

While a lady bird deed offers many benefits, there are some disadvantages to consider. The Enhanced lady bird two for the road may complicate your estate planning if not properly executed, especially regarding Medicaid eligibility. Furthermore, it may not be the best fit for all property types, limiting its effectiveness. Evaluating these factors is crucial for your financial strategies.

The tax implications of a lady bird deed in Florida are generally favorable. When you use an Enhanced lady bird two for the road, you retain property rights while potentially avoiding gift taxes. Additionally, this type of deed allows for a step-up in basis, which can reduce capital gains tax when the property is sold. Understanding these aspects can help in maximizing your estate strategy.

Yes, a lady bird deed is indeed the same as an enhanced life estate deed. Both terms refer to a document that allows property owners to maintain certain rights while designating beneficiaries for the property. Understanding this terminology can help you navigate estate planning more effectively.

The lady bird deed is also known as an enhanced life estate deed. This term highlights its unique features and advantages, particularly in allowing the property owner to retain control over their asset even after the transfer. It's beneficial to choose this deed for its flexibility and potential to simplify estate management.

A lady bird deed does not inherently eliminate inheritance tax. However, it can help in reducing the value of the estate during probate, which might lead to lower taxes in some situations. Consulting with tax professionals can clarify the specifics related to your estate and tax obligations.

The enhanced lady bird two for the road is often regarded as one of the best deeds to avoid probate. This deed allows property owners to retain control while bypassing the probate process upon their death. By using this type of deed, assets can directly pass to designated beneficiaries, streamlining estate management.

The primary difference between a life estate deed and an enhanced life estate deed lies in the rights retained by the property owner. The enhanced life estate deed allows the owner more flexibility to sell or mortgage the property without needing permission from the beneficiary. This feature is particularly beneficial as it offers greater control of the property even after the transfer.

There are several types of life estate deeds, with the lady bird deed being a prominent example. Other types include traditional life estate deeds and enhanced life estate deeds, each having different implications for property rights and estates. Understanding these differences can help you choose the most appropriate method for your estate planning.