Florida For Business

Description

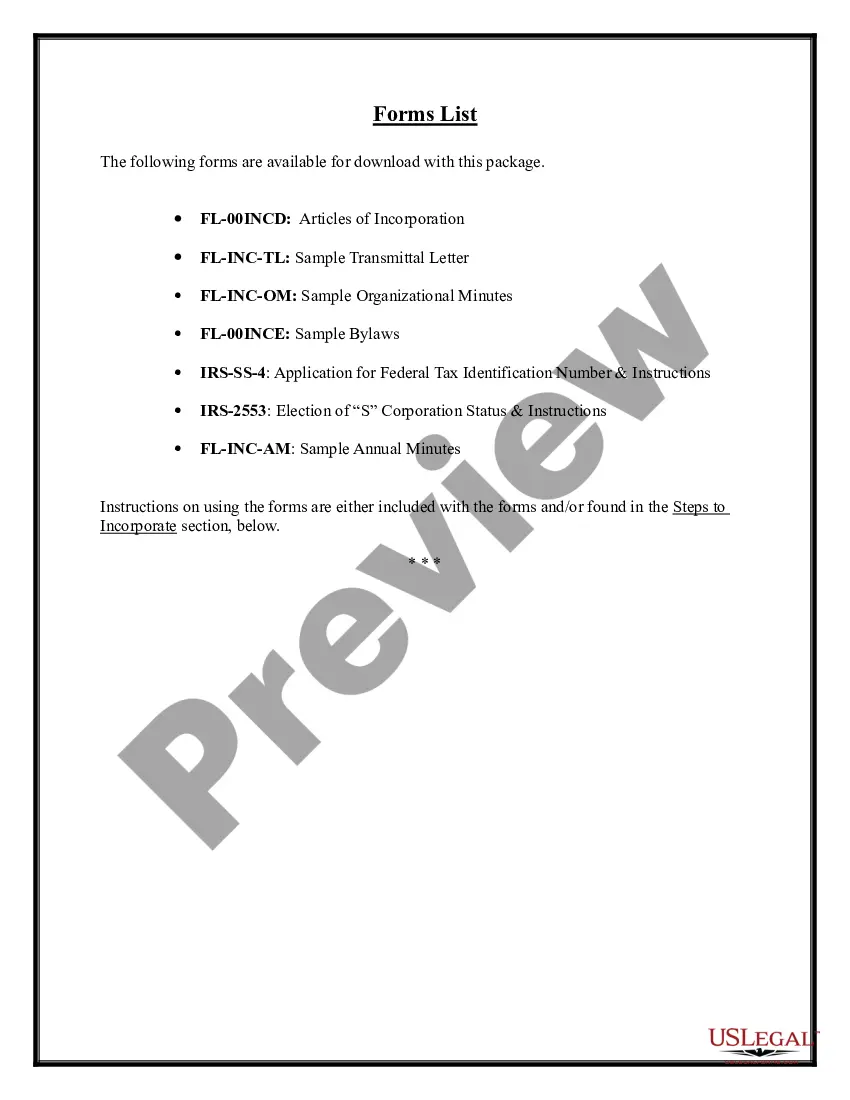

How to fill out Florida Business Incorporation Package To Incorporate Corporation?

Managing legal paperwork can be bewildering, even for the most experienced professionals.

When seeking a Florida For Business and lacking the time to search for the correct and current version, the procedure may become overwhelming.

Explore a database of articles, guides, and manuals pertinent to your situation and requirements.

Conserve time and energy in locating the documents you need, and utilize US Legal Forms’ sophisticated search and Review feature to acquire Florida For Business efficiently.

Take advantage of the US Legal Forms online catalogue, supported by 25 years of expertise and reliability. Transform your daily documents management into a straightforward and user-friendly experience today.

- Confirm it is the correct form by previewing it and reviewing its details.

- Ensure that the template is accepted in your state or county.

- Click on Buy Now when you are prepared.

- Select a monthly subscription plan.

- Choose the format you prefer, and Download, complete, sign, print, and dispatch your documents.

- Access legal and business forms tailored to specific states or counties.

- US Legal Forms caters to all your requirements, from personal to commercial documents, all in one hub.

- Employ cutting-edge tools to create and handle your Florida For Business.

Form popularity

FAQ

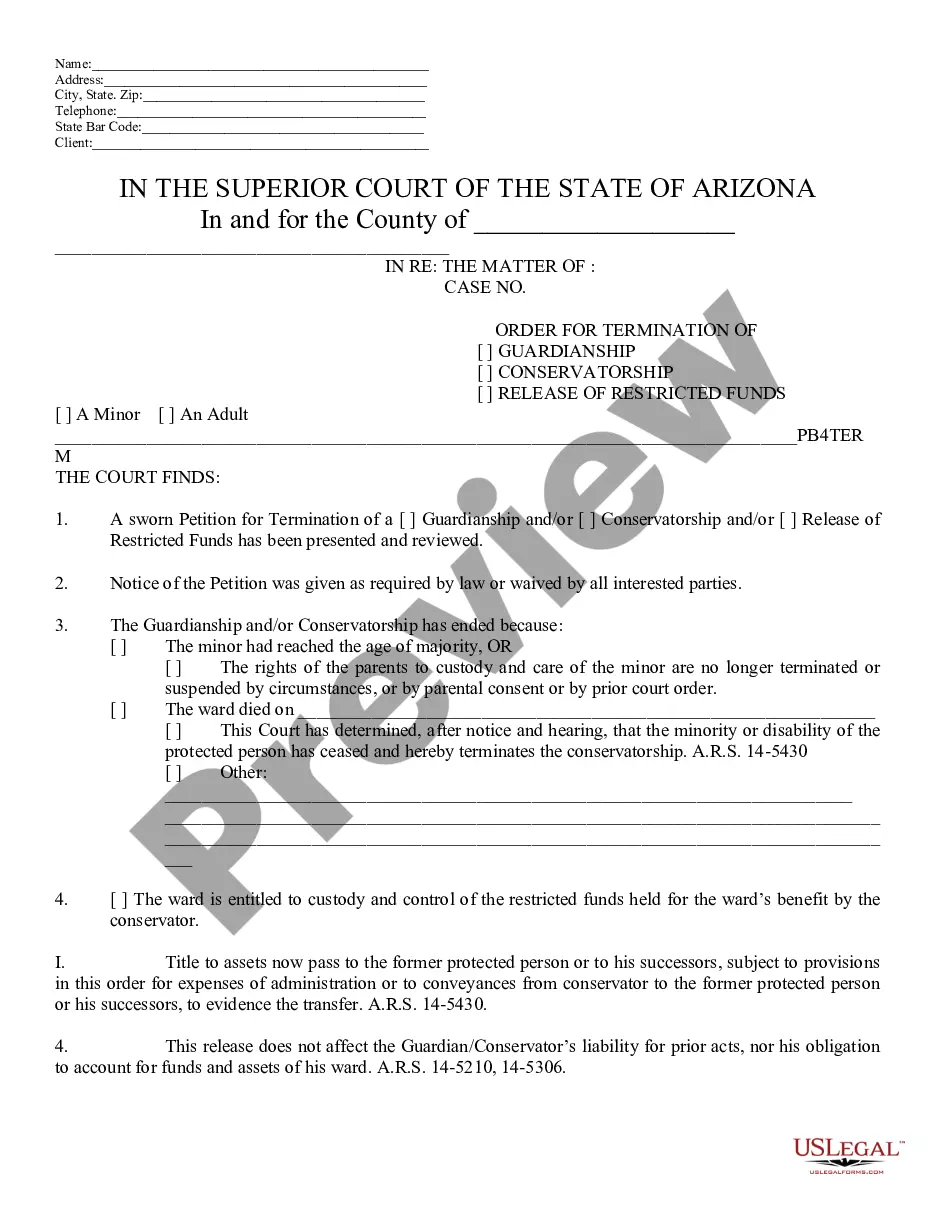

To start a business in Florida you need to: Check with your County Tax Collector to see if you need a license. Register your business with the Department of Revenue. ... Register with the IRS. Corporate entities or fictitious name registrants should register with the Department of State.

Starting an LLC in Florida will include the following steps: #1: Choose a name for your LLC. #2: Appoint a registered agent. #3: Prepare and file your articles of organization. #4: Prepare your operating agreement. #5: Obtain an EIN.

There's a strong chance you'll need to get a local business license. Almost all Florida counties require businesses to obtain a business tax receipt before doing business in the county. This requirement applies to all businesses, including one-person, home-based operations.

Florida LLC Cost. The fee for forming a Florida LLC is $125. You'll also need to pay $138.75 every year to file the state's annual report.

Start a Business Step 1: Research Starting a Business. FYI: Getting Started with a Florida Business. Step 2: Identify Your Type of Business. Decide on a Corporate Structure. Step 3: Form Your Business. Form a Profit or Non-Profit Corporation. ... Step 4: Register Your Business Name (Optional)