Subcontractors Contract With No

Description

How to fill out Florida Subcontractor's Agreement?

Drafting legal documents from scratch can often be intimidating. Some cases might involve hours of research and hundreds of dollars invested. If you’re looking for a a simpler and more cost-effective way of preparing Subcontractors Contract With No or any other forms without jumping through hoops, US Legal Forms is always at your disposal.

Our online collection of more than 85,000 up-to-date legal documents covers virtually every aspect of your financial, legal, and personal affairs. With just a few clicks, you can quickly get state- and county-compliant templates carefully put together for you by our legal experts.

Use our platform whenever you need a trusted and reliable services through which you can easily locate and download the Subcontractors Contract With No. If you’re not new to our website and have previously created an account with us, simply log in to your account, locate the form and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No worries. It takes little to no time to set it up and navigate the catalog. But before jumping directly to downloading Subcontractors Contract With No, follow these tips:

- Check the form preview and descriptions to ensure that you have found the document you are looking for.

- Check if template you select complies with the regulations and laws of your state and county.

- Pick the best-suited subscription option to buy the Subcontractors Contract With No.

- Download the file. Then fill out, sign, and print it out.

US Legal Forms boasts a good reputation and over 25 years of expertise. Join us today and turn document completion into something easy and streamlined!

Form popularity

FAQ

Each subcontractor should complete Form W-9 before they begin any work. On the form, the subcontractor identifies their business structure type (sole proprietorship, corporation, etc.). Form W-9 also asks for the subcontractor's name and Taxpayer Identification Number (TIN).

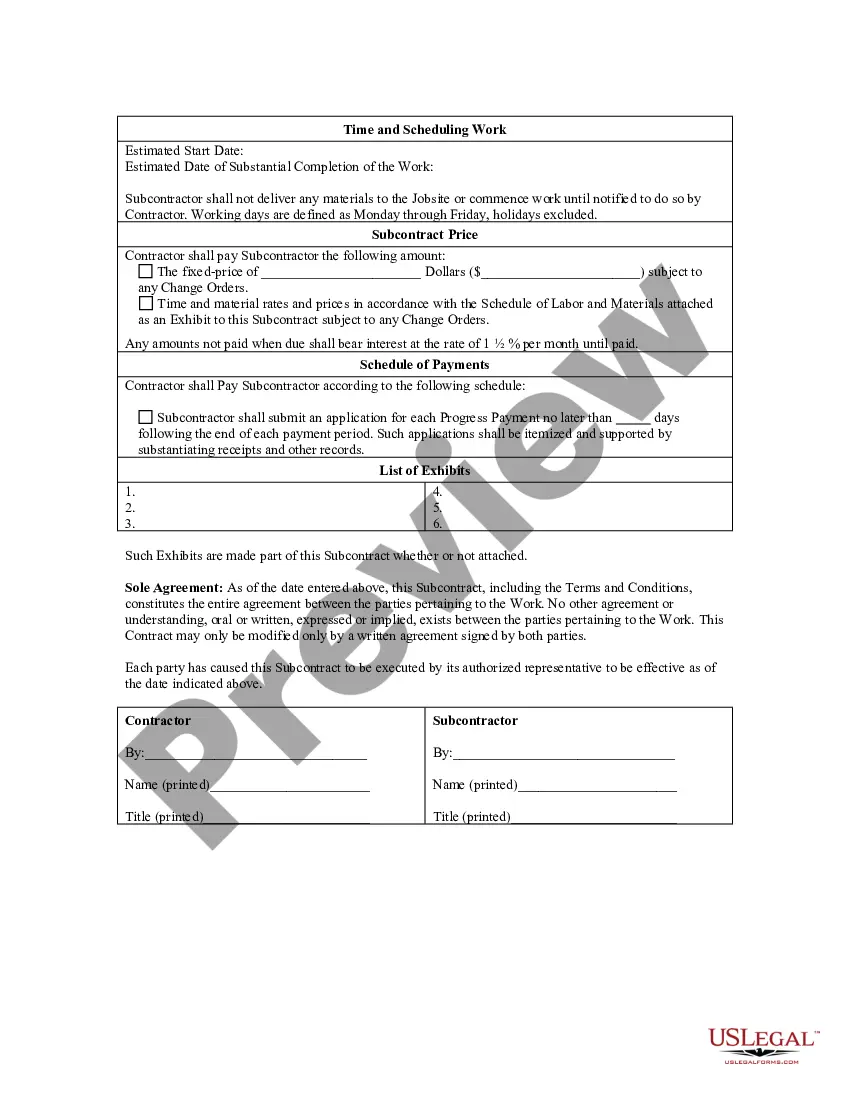

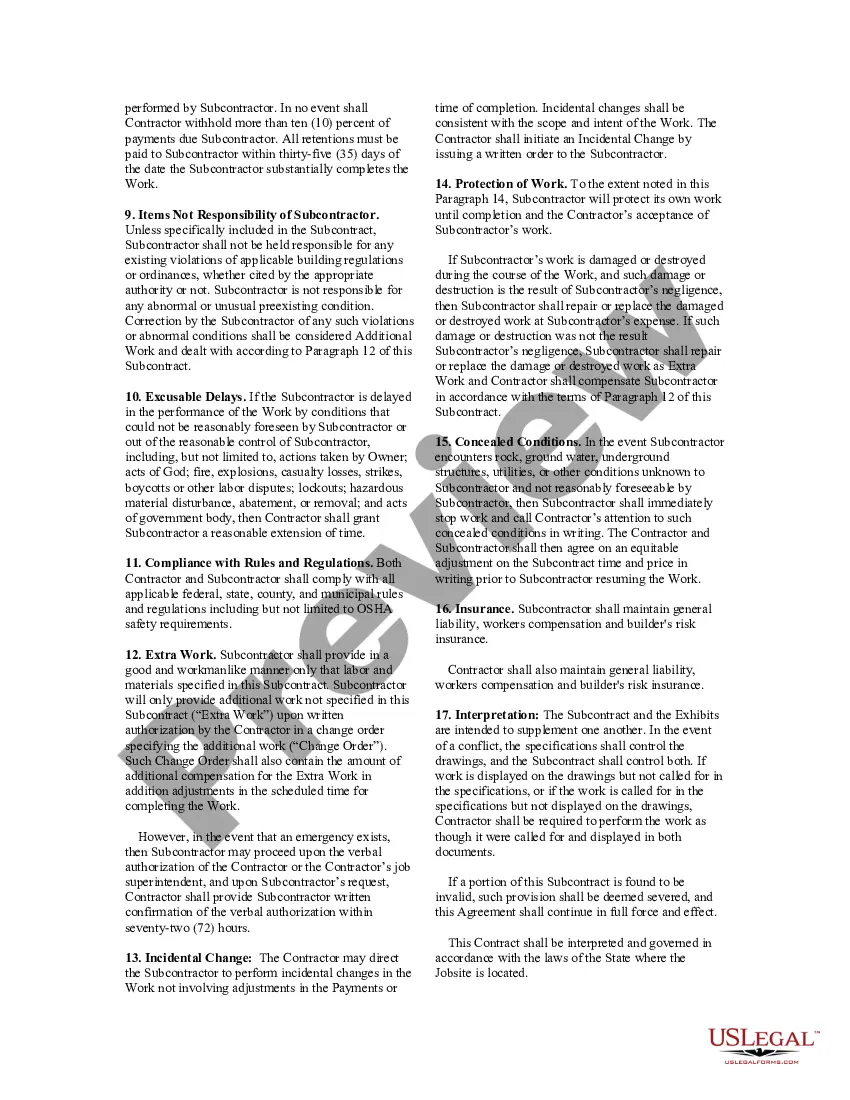

8 things a subcontractor agreement should include Business information. Include names, businesses names, and contact information for both the subcontractor and the hiring contractor. ... Scope of work. ... Payment terms. ... Change orders. ... Licensing and insurance coverage. ... Dispute resolution. ... Termination clause. ... Flow-down provisions.

Most notice provisions require 10-14 days notice, but others require a month or more. If your independent contractor agreement includes notice provision, give the contractual notice of termination to the independent contractor in writing?your contract may even require that you give notice via email.

If you paid someone who is not your employee, such as a subcontractor, attorney or accountant $600 or more for services provided during the year, a Form 1099-NEC needs to be completed, and a copy of Form 1099-NEC must be provided to the independent contractor by January 31 of the year following payment.