Florida Subcontractor's Agreement

What is this form?

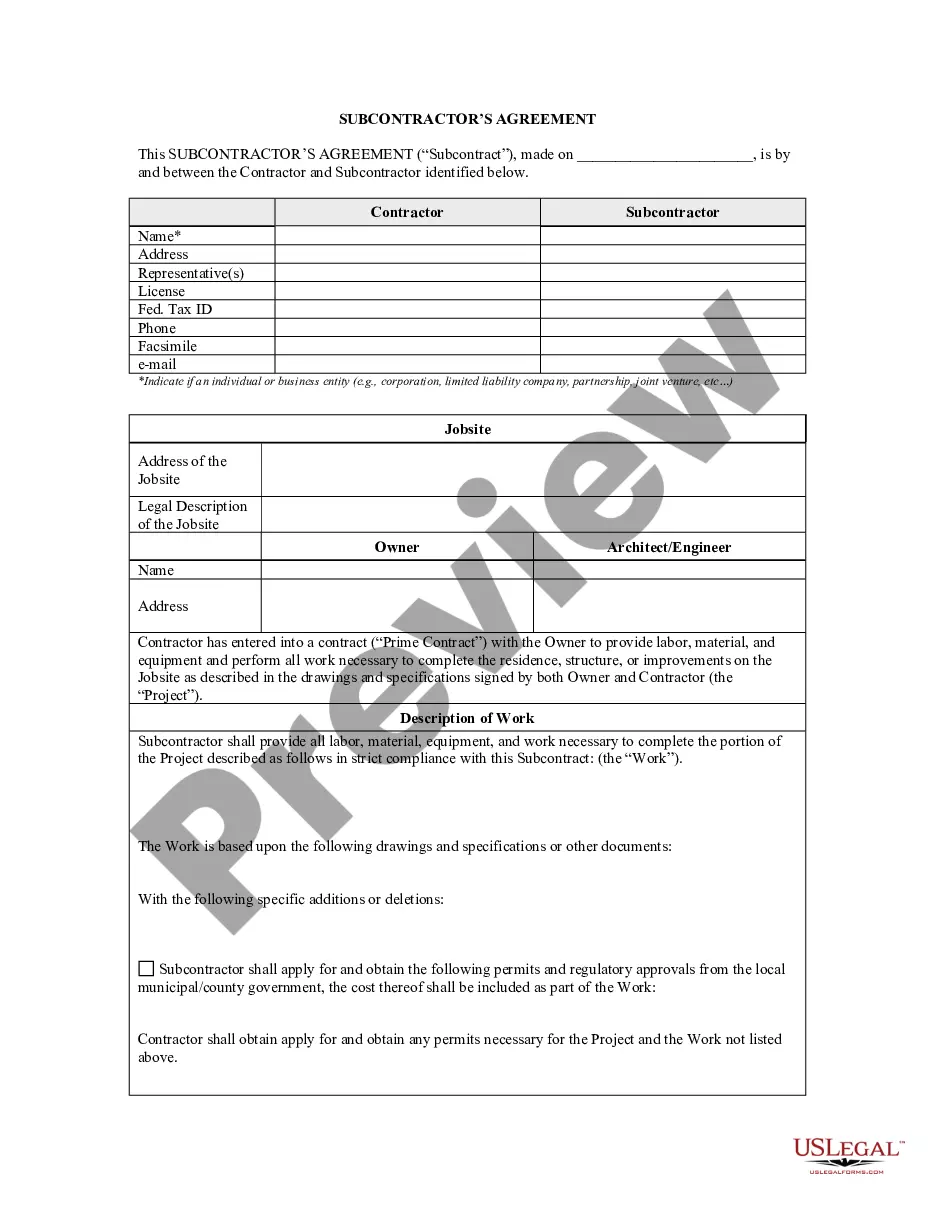

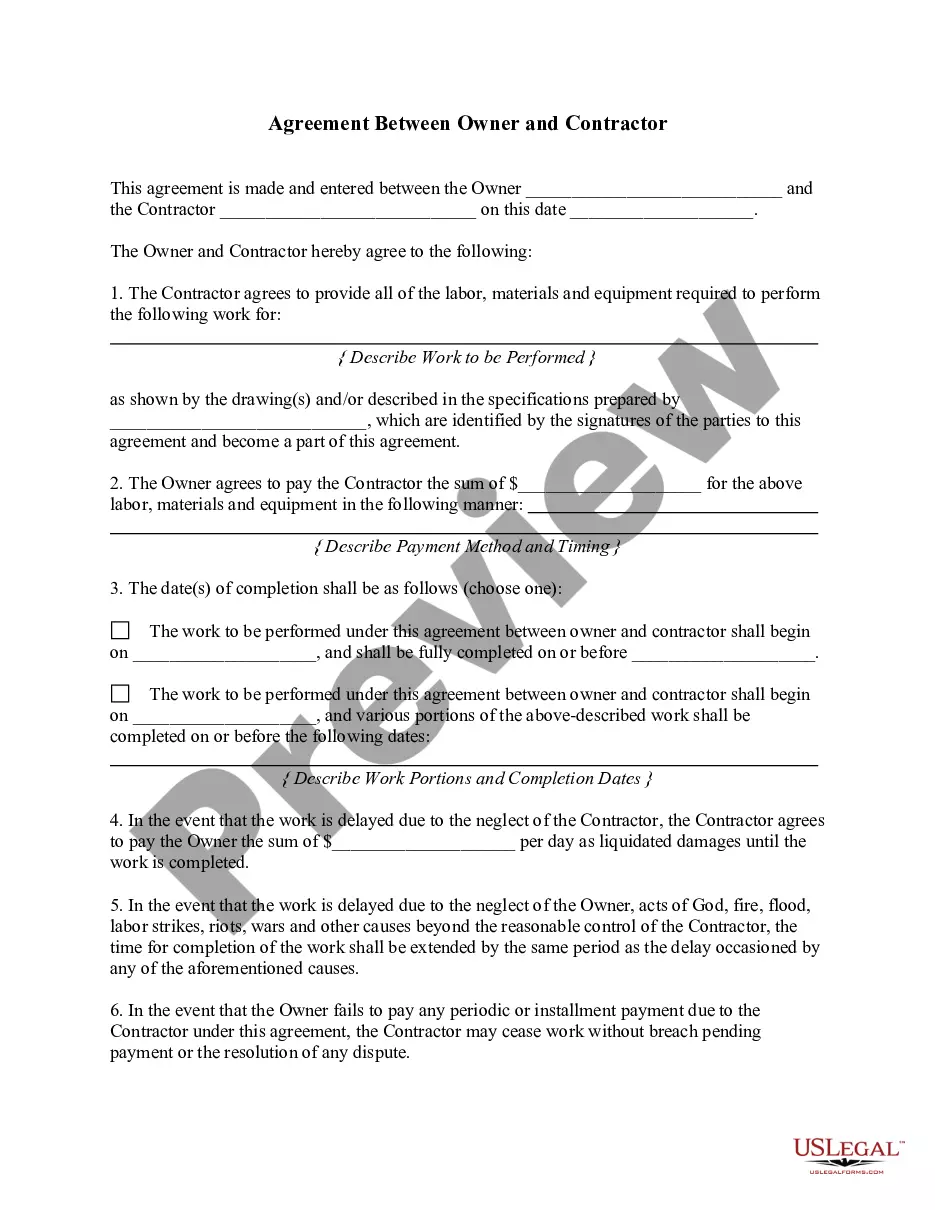

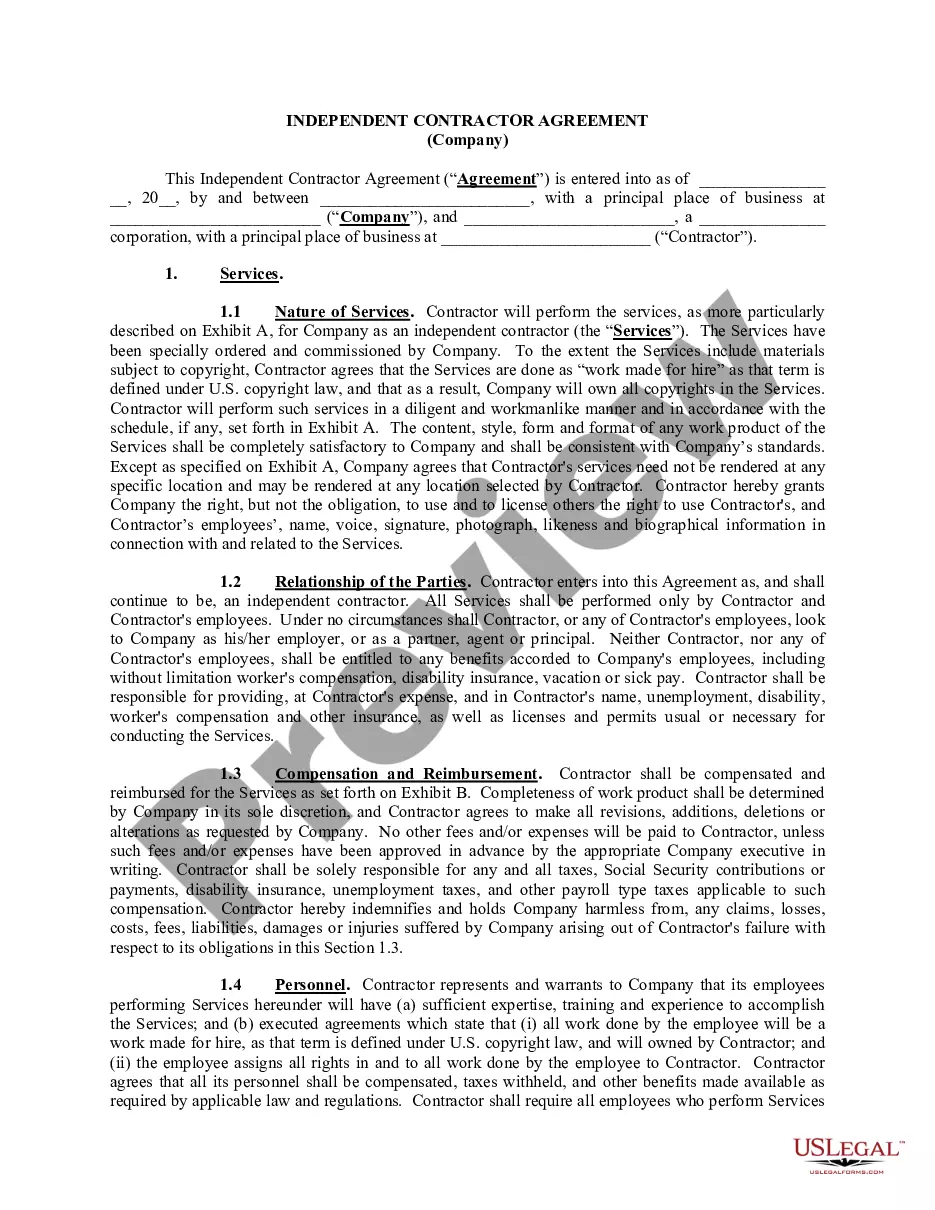

The Subcontractor's Agreement is a legally binding document that outlines the relationship between a contractor and a subcontractor. It specifies the terms of subcontracted work, including project details, payment terms, and responsibilities of both parties. This form is distinct from other construction agreements as it focuses specifically on the arrangement between general contractors and subcontractors, addressing unique considerations for subcontracted tasks.

What’s included in this form

- Identification of the parties involved in the subcontracting arrangement.

- Description of the work to be performed and the job site location.

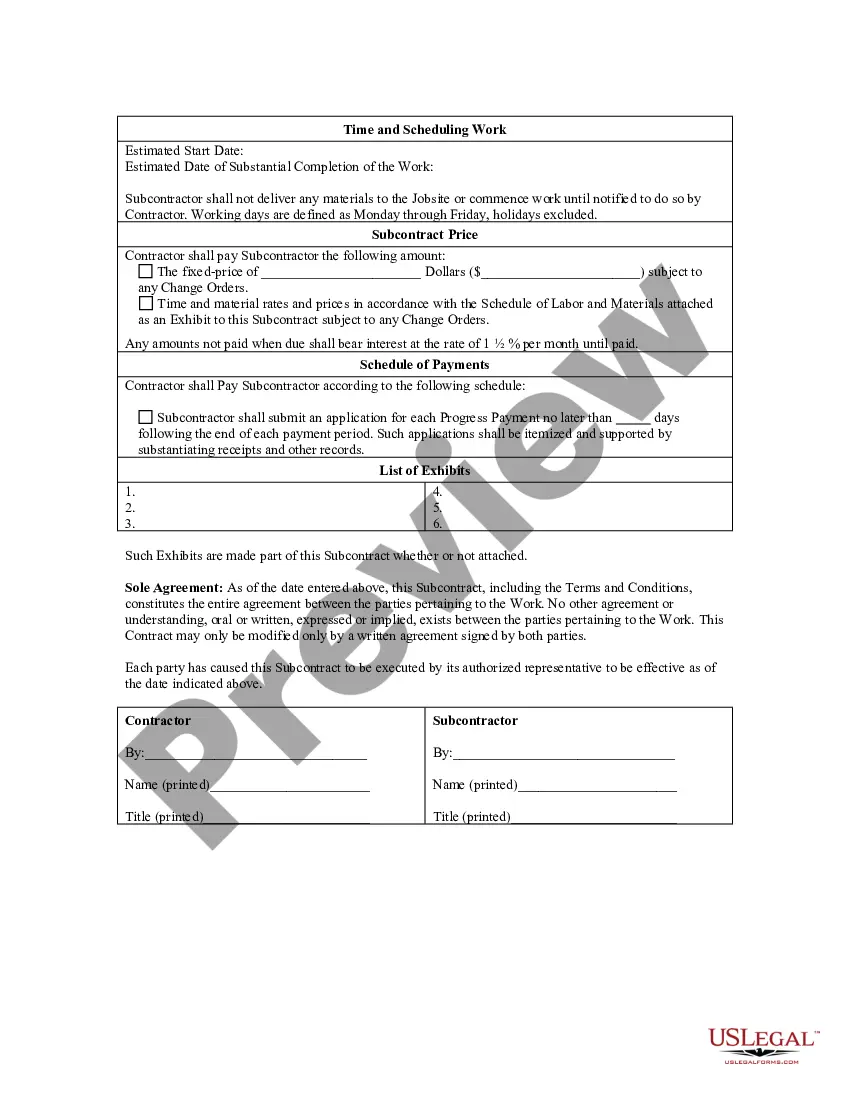

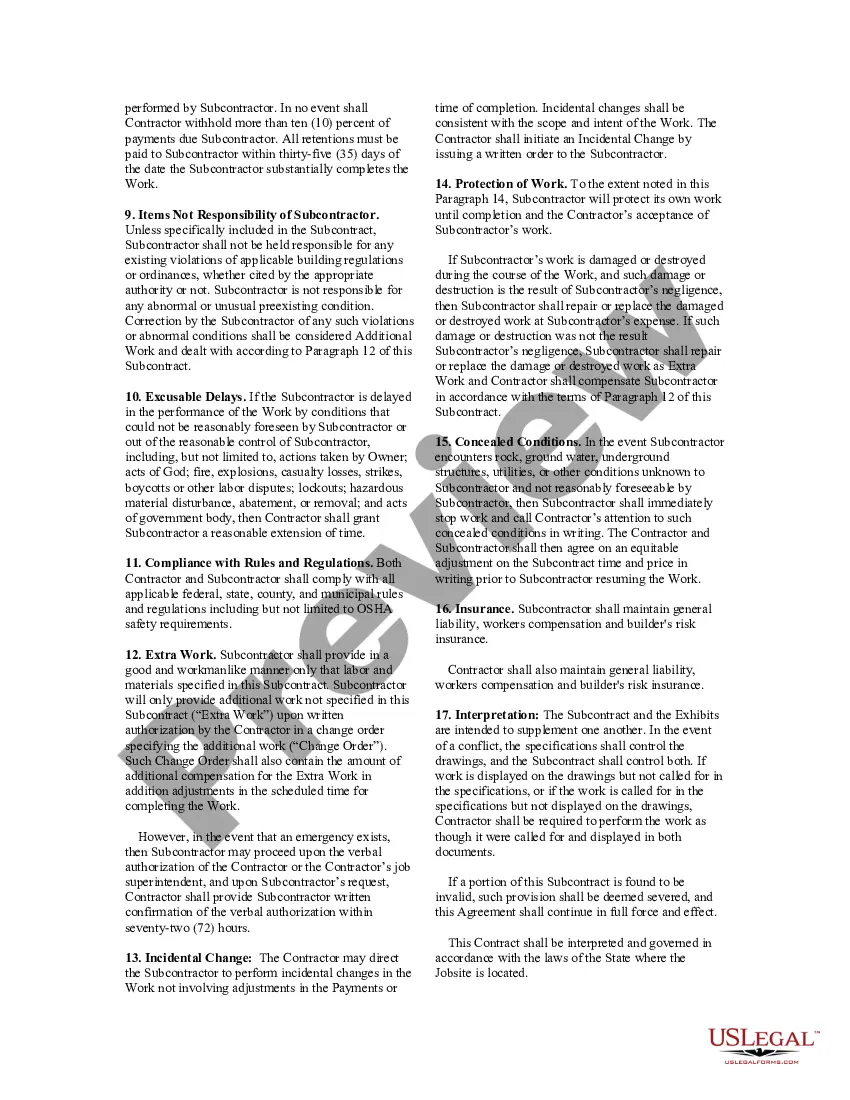

- Details regarding payment amounts, schedules, and procedures for change orders.

- Clauses addressing delays, dispute resolution, and insurance requirements.

- Provisions for compliance with local laws and construction regulations.

When to use this form

This form should be used when a contractor hires a subcontractor to perform specific tasks on a construction project. It is particularly useful in scenarios where the work involves multiple contractors or specialized trades. Common situations include renovations, new constructions, or any project requiring the hiring of skilled labor not provided directly by the contractor.

Who should use this form

- General contractors looking to subcontract portions of their work to other specialized subcontractors.

- Subcontractors who need a formal agreement detailing their rights and responsibilities for the project.

- Construction businesses seeking to establish clear terms before commencing work to avoid disputes.

Steps to complete this form

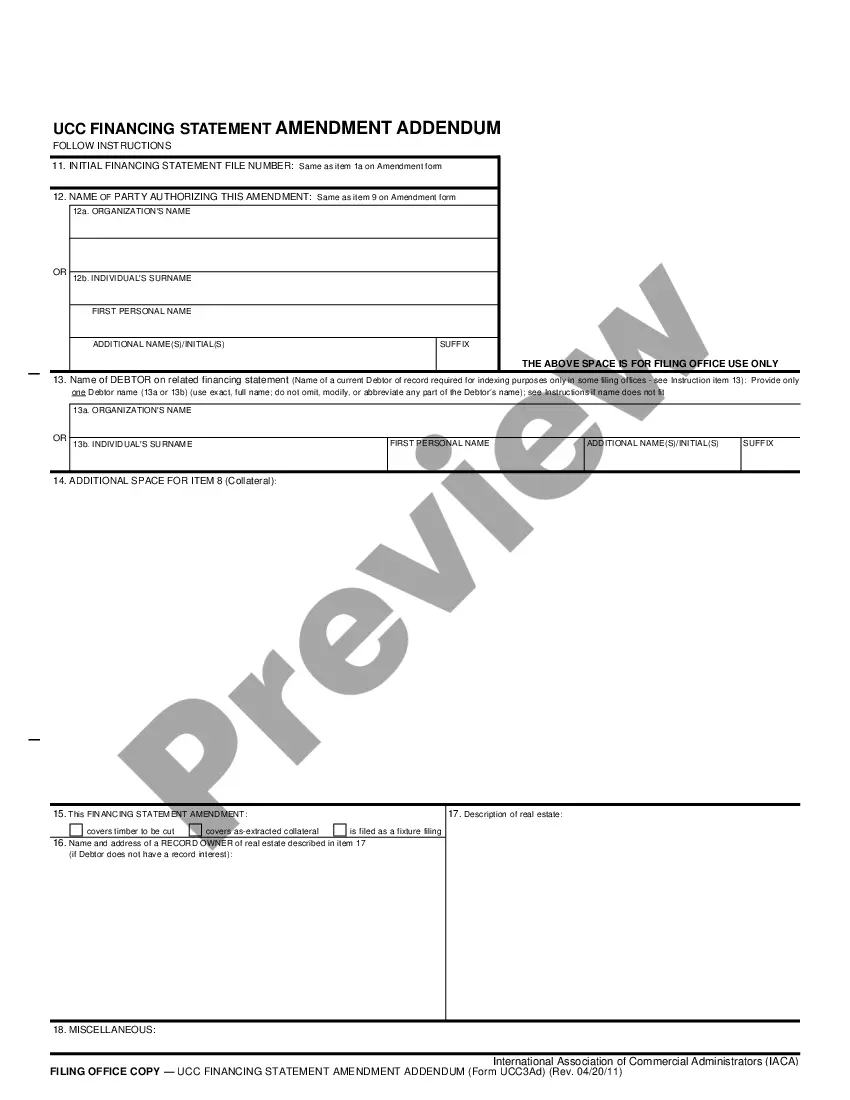

- Identify the parties: Enter the names and addresses of both the contractor and subcontractor.

- Describe the project: Clearly state the scope of work and the job site location.

- Specify the payment terms: Include the fixed price and any conditions for change orders.

- Detail the timelines: Set out start dates, completion dates, and any scheduled payment milestones.

- Include signature blocks: Have both parties sign and date the agreement to make it legally binding.

Does this form need to be notarized?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to clearly define the scope of work, which can lead to disputes over responsibilities.

- Not specifying payment schedules, leading to confusion about when payments are expected.

- Omitting necessary details about delay conditions and dispute resolution processes.

Why complete this form online

- Immediate access: Downloadable forms save time compared to traditional methods.

- Editability: Customize the form to suit individual project needs before finalizing.

- Legally reliable: The forms are drafted by licensed attorneys, ensuring they meet legal standards.

Legal use & context

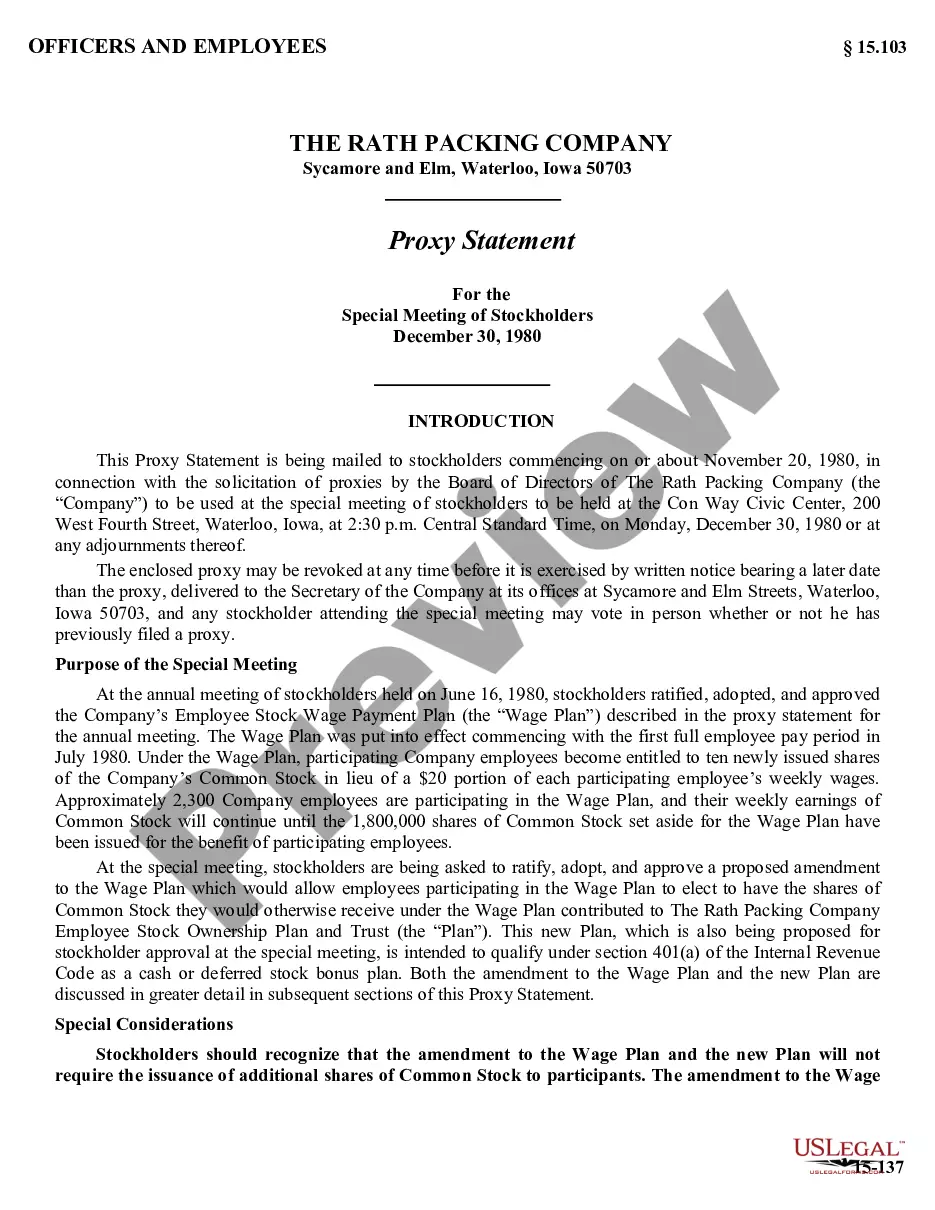

- This form provides a clear framework for subcontracting agreements, reducing the potential for legal disputes.

- It outlines obligations and protections for both contractors and subcontractors within the construction industry.

Looking for another form?

Form popularity

FAQ

Start with procurement standards. Execute all subcontracts prior to starting your projects. Help those who help you. Award the job to the lowest fully qualified bidder. Use contract scope checklists. Make sure you have tight clauses. Meet to review the proposed subcontract.

A subcontractor agreement is a contract between contractors or project managers and subcontractors. This solidifies any agreement between the two parties and assures work. Subcontractors should read the subcontractor agreement and assure specifics to protect themselves from unfair risk.

Subcontractor agreements outline the responsibilities of each party, to ensure that if a claim were to arise, the responsible party is accountable. A subcontractor agreement provides protection to the company that hired the vendor or subcontractor by transferring the risk back to the party performing the work.

Each subcontractor should complete Form W-9 before they begin any work. On the form, the subcontractor identifies their business structure type (sole proprietorship, corporation, etc.). Form W-9 also asks for the subcontractor's name and Taxpayer Identification Number (TIN).

The disadvantages contractors doing this work lie in costs: The hourly expenses are high, and the professionals are independent in that they don't report to supervisors inside the company. These factors make it challenging to control the costs of these subcontracts.

Scope of the Project. Timing for Completion: Duration of Work Clause. Payment and Billing Clause. Independent Contractor Notice. Non-Disclosure Agreement. Non-Complete Clause. Work for Hire Inclusion. Responsibilities for Insurance for Accidental Damages.

A Notice to Owner (NTO) is a written notice prescribed by Florida Statute (713.06) that officially advises the owner of an improvement that the sender, usually a subcontractor or supplier not dealing directly with the owner, is looking to the owner to be sure the sender is paid before payment is made to the contractor

A subcontractor has a contract with the contractor for the services provided - an employee of the contractor cannot also be a subcontractor.