This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Florida Annual Resale Certificate Form Dr-13

Description

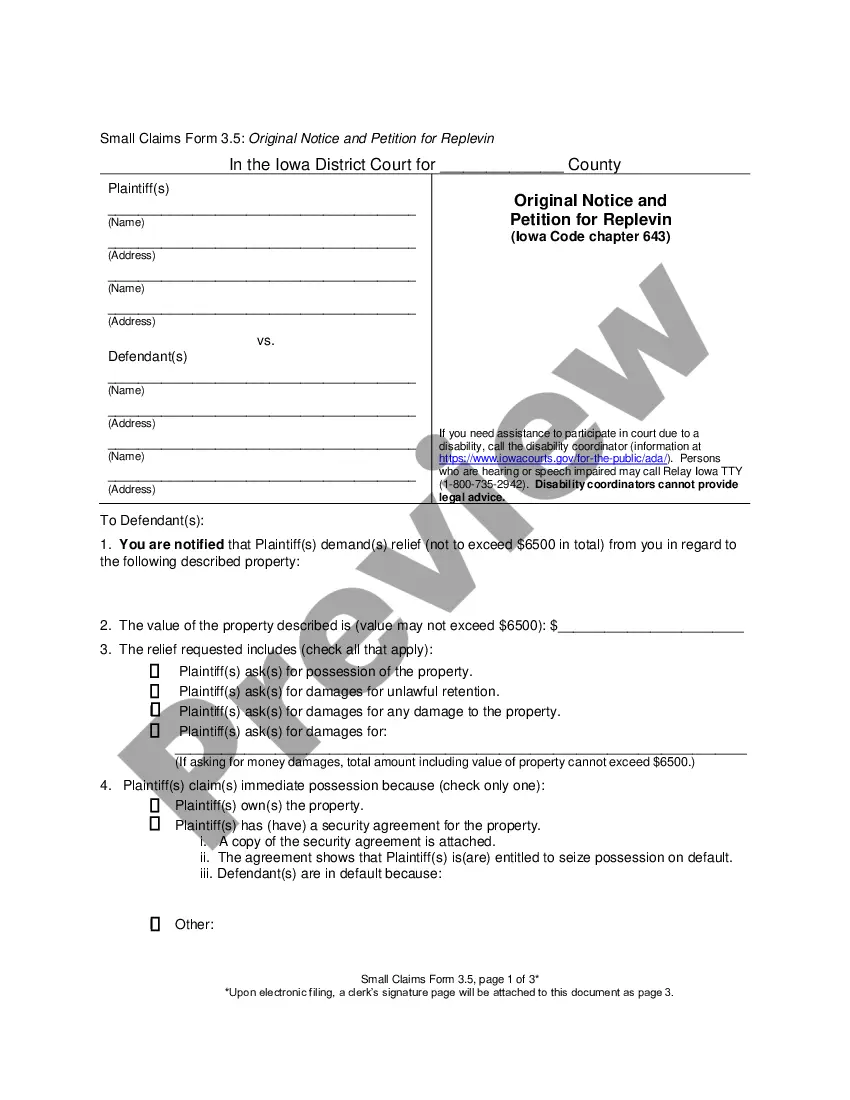

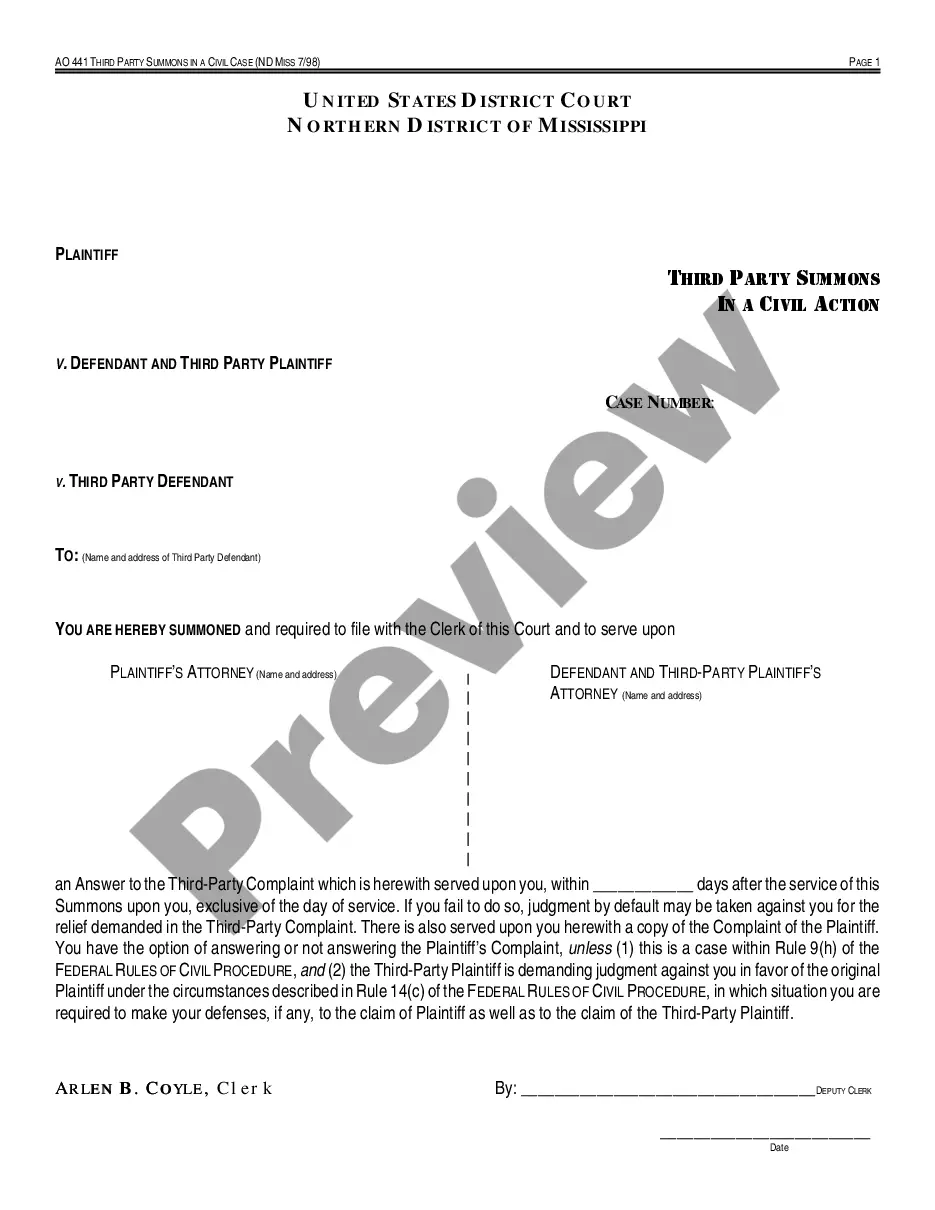

How to fill out Florida Contract For Deed Seller's Annual Accounting Statement?

There's no longer a need to squander hours searching for legal documents to comply with your local state laws.

US Legal Forms has gathered all of them in one place and enhanced their availability.

Our platform offers over 85,000 templates for any business and personal legal situations categorized by state and application area. All forms are properly crafted and verified for legitimacy, ensuring you can trust in obtaining the latest Florida Annual Resale Certificate Form Dr-13.

Complete your payment for your subscription using a credit card or PayPal to continue. Choose the file format for your Florida Annual Resale Certificate Form Dr-13 and download it to your device. Print your form to fill it out manually or upload the sample if you prefer to work with an online editor. Creating official documents in compliance with federal and state regulations is quick and straightforward with our platform. Give US Legal Forms a try today to keep your paperwork organized!

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all acquired documents whenever necessary by accessing the My documents tab in your profile.

- For those who haven't used our platform before, the procedure will require a few additional steps to finish.

- Here's how new users can find the Florida Annual Resale Certificate Form Dr-13 in our collection.

- Examine the page content thoroughly to confirm it contains the sample you seek.

- To accomplish this, utilize the form description and preview options if available.

- Use the Search field above to look for another template if the current one does not meet your needs.

- Click Buy Now next to the template title once you identify the correct one.

- Select the most appropriate pricing plan and either register for an account or sign in.

Form popularity

FAQ

Typically, it takes a few business days to obtain a Florida resale certificate after submitting your application. If you apply online and use the Florida annual resale certificate form DR-13 correctly, the process can be even faster. Always check with your local tax office for specific timelines, as processing times may vary.

Getting your resale certificate in Florida is straightforward. First, complete the Florida annual resale certificate form DR-13, which you can find on the Florida Department of Revenue's website. Submit this form to the local tax office, and they will process your request promptly.

To obtain a copy of your resale certificate in Florida, you can request it directly from your local tax collector's office. If you originally applied online, you may be able to download a copy from the Florida Department of Revenue website. Using the Florida annual resale certificate form DR-13 ensures you have all necessary information to make this process smooth.

Some states do not accept out-of-state resale certificates, and this includes Florida. For businesses operating in Florida, it’s essential to utilize the Florida annual resale certificate form DR-13. It is crucial to stay compliant and avoid inconveniences, so always check the requirements for the state you are doing business in.

No, a resale certificate is not the same as an EIN. A resale certificate allows businesses to buy goods without paying sales tax, while an EIN serves as a unique identifier for tax purposes. For businesses in Florida, using the Florida annual resale certificate form DR-13 can help streamline tax compliance when purchasing resale items.

To get the Florida annual resale certificate for sales tax form DR-13, visit the Florida Department of Revenue’s website. There, you can download the form and follow the instructions for completion. Once filled out, submit the form to your local tax collector to obtain your official certificate.

No, a seller's permit and an Employer Identification Number (EIN) are not the same. A seller's permit allows businesses to collect sales tax on taxable sales, while an EIN is used for tax reporting and identifying a business entity. If you operate in Florida, you'll likely need both, as the Florida annual resale certificate form DR-13 may require your EIN.

To obtain a sales tax exemption certificate, start by gathering the required documents, such as proof of your business's tax-exempt status. Then, navigate to your state's revenue department website, where you can find the online application or download the form. For Florida, you may also need to provide the Florida annual resale certificate form DR-13 to complete the process.

In Florida, any retailer who sells tangible personal property or taxable services is required to collect sales tax. This includes businesses operating online or in physical stores. It's crucial to understand your obligations to maintain compliance with state laws. By utilizing the Florida annual resale certificate form dr-13, retailers can efficiently manage sales tax collections and fulfill their responsibilities.

To fill out a sales tax exemption certificate, begin by providing your business information, including your name, address, and tax identification number. Clearly state the reason for the exemption and ensure that you sign and date the document. Make sure each copy is distributed appropriately to vendors when making tax-exempt purchases. The Florida annual resale certificate form dr-13 can be a valuable tool for ensuring seamless transactions in this process.