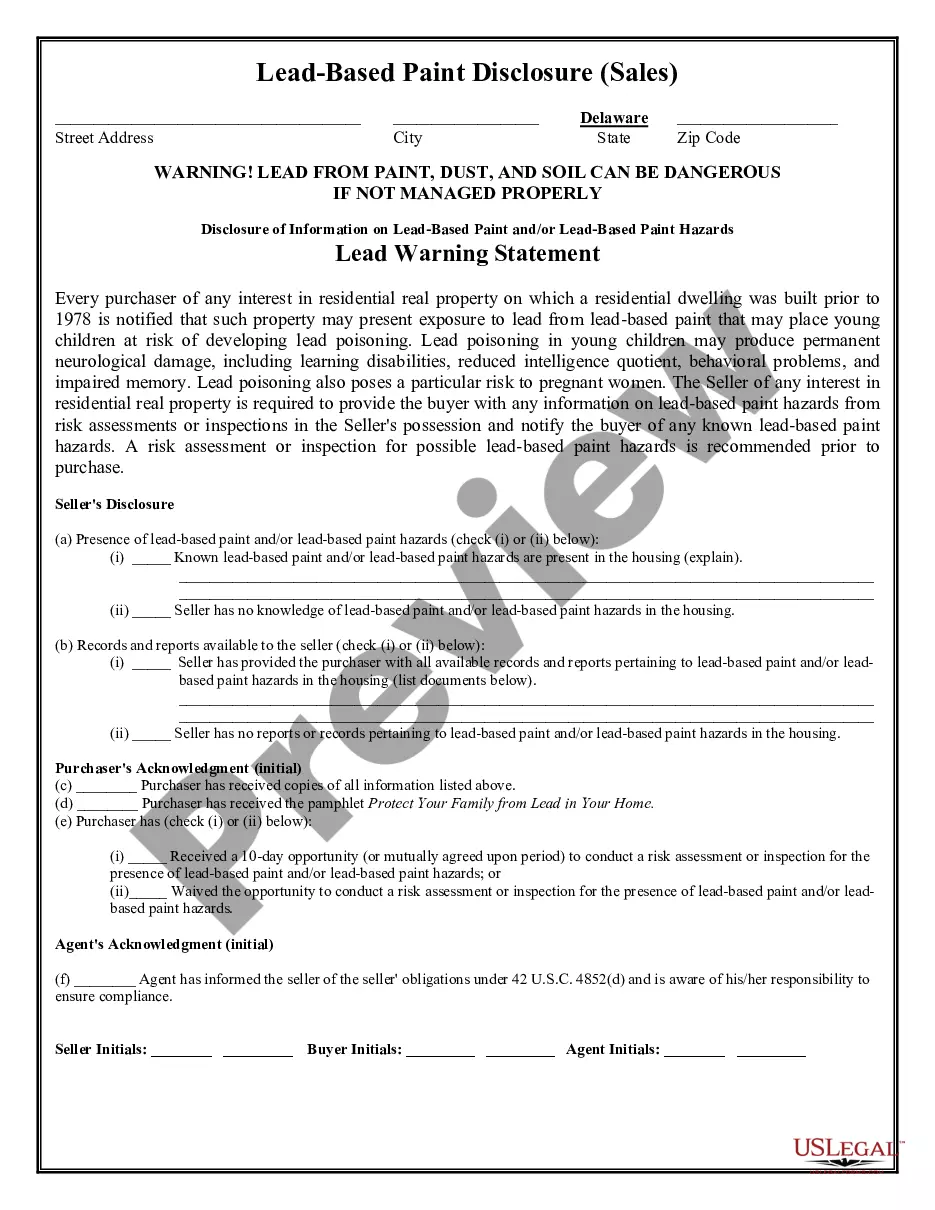

Lead Paint Disclosure Date

Description

How to fill out Delaware Lead Based Paint Disclosure For Sales Transaction?

It’s clear that you cannot instantly become a legal authority, nor can you quickly comprehend how to efficiently prepare the Lead Paint Disclosure Date without possessing a dedicated skill set.

Creating legal documents is an extensive procedure necessitating specific education and expertise. So why not entrust the creation of the Lead Paint Disclosure Date to the professionals.

With US Legal Forms, one of the most extensive legal document repositories, you can discover everything from courtroom forms to templates for workplace communication. We recognize the significance of compliance and adherence to federal and state regulations. That’s why all forms on our platform are localized and current.

You can access your documents again from the My documents tab at any moment. If you’re an existing customer, you can simply Log In, and locate and download the template from the same section.

Regardless of whether your forms are for financial, legal, or personal reasons, our website has everything you need. Experience US Legal Forms today!

- Locate the document you require using the search bar at the top of the page.

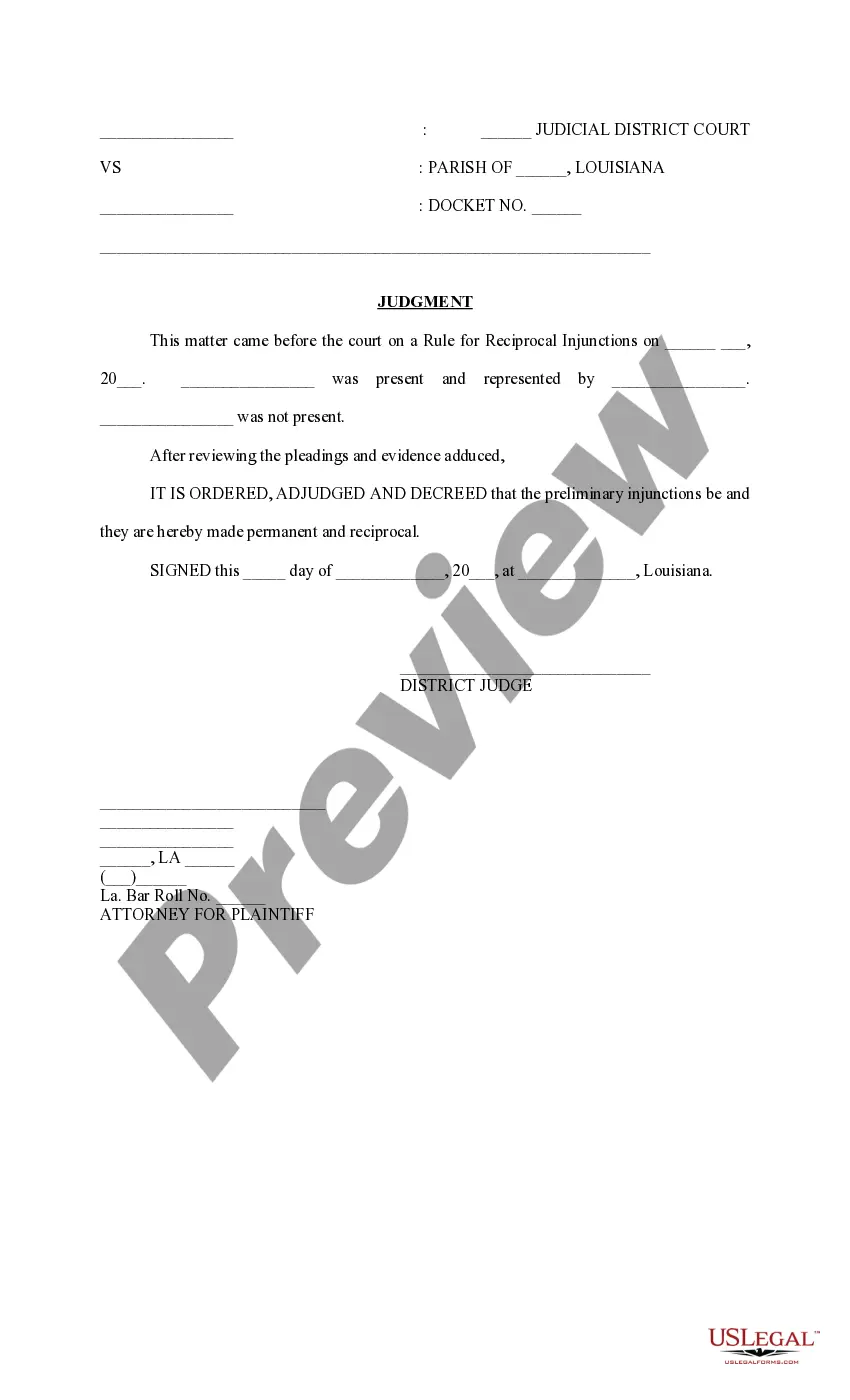

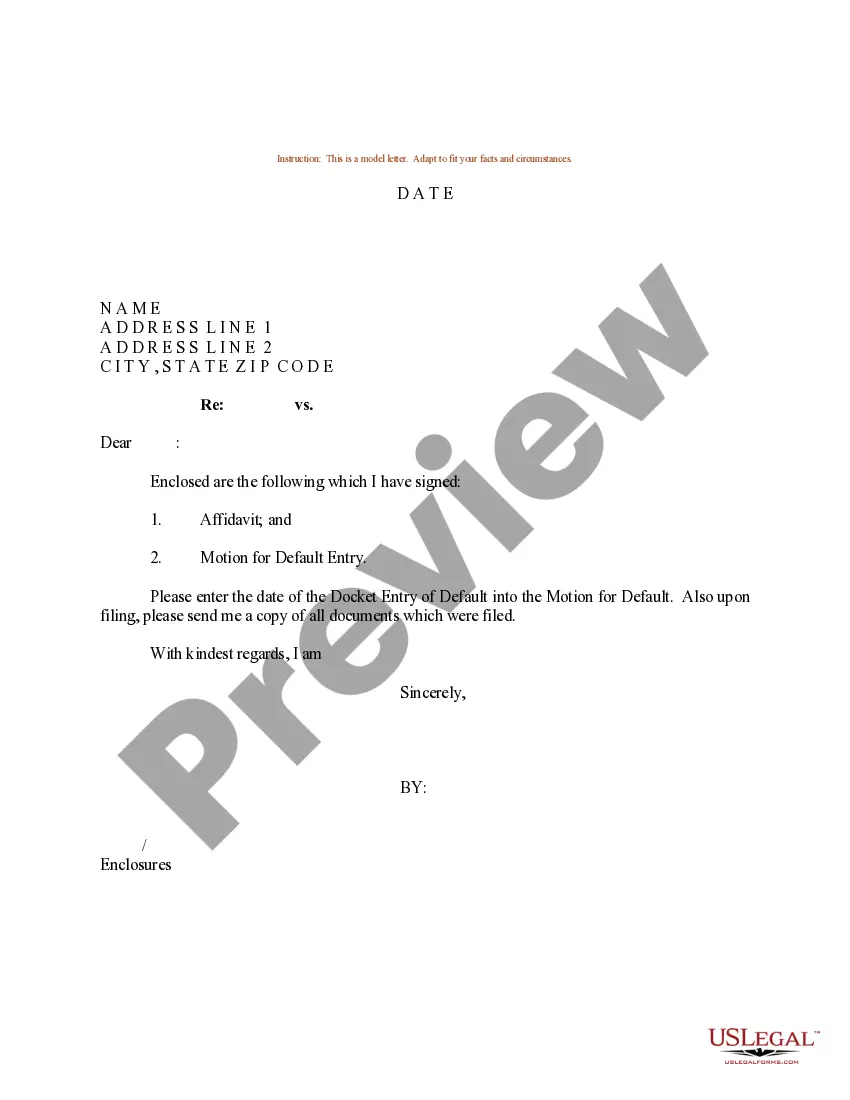

- View a preview (if this option is available) and review the accompanying description to verify if the Lead Paint Disclosure Date meets your needs.

- Restart your search if you need an alternative template.

- Create a free account and select a subscription plan to acquire the template.

- Click Buy now. Once the payment is completed, you can download the Lead Paint Disclosure Date, complete it, print it, and send or mail it to the relevant individuals or entities.

Form popularity

FAQ

Download fillable PDF forms from the web. Free, unlimited downloads! Order forms online. . Order forms by email. tax.formsrequest@vermont.gov.

To file your federal taxes, use Form 1040, U.S. Individual Income Tax Return, and supporting schedules if needed. To file your Vermont taxes, use Form IN-111, Vermont Income Tax Return, and supporting schedules if needed.

Get federal tax forms Download them from IRS.gov. Order online and have them delivered by U.S. mail. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

You can contact the court by phone, in writing, in person, or by sending an email to JUD.VJB@vermont.gov. A motion is a request in writing asking the court to consider doing something specific in your case. All motions must identify the request and give specific reasons for the request.

Vermont Tax Rates, Collections, and Burdens Vermont has a 6.00 percent state sales tax rate, a max local sales tax rate of 1.00 percent, and an average combined state and local sales tax rate of 6.30 percent. Vermont's tax system ranks 44th overall on our 2023 State Business Tax Climate Index.

To order forms by phone: Call 800-338-0505. Select 1 for Personal Income Tax, 2 for Business Entity Information. Select "Forms and Publications"

You do not need to register for an account to file an appeal. If you wish to mail your appeal, you should include the Taxpayer Appeal Form (TAX-610) that came with your NOA and include supporting documentation that outlines why you are appealing.

Local IRS Taxpayer Assistance Center (TAC) ? The most common tax forms and instructions are available at local TACs in IRS offices throughout the country. To find the nearest IRS TAC, use the TAC Office Locator on IRS.gov.