Limited Liability Company File Without Operating Agreement

Description

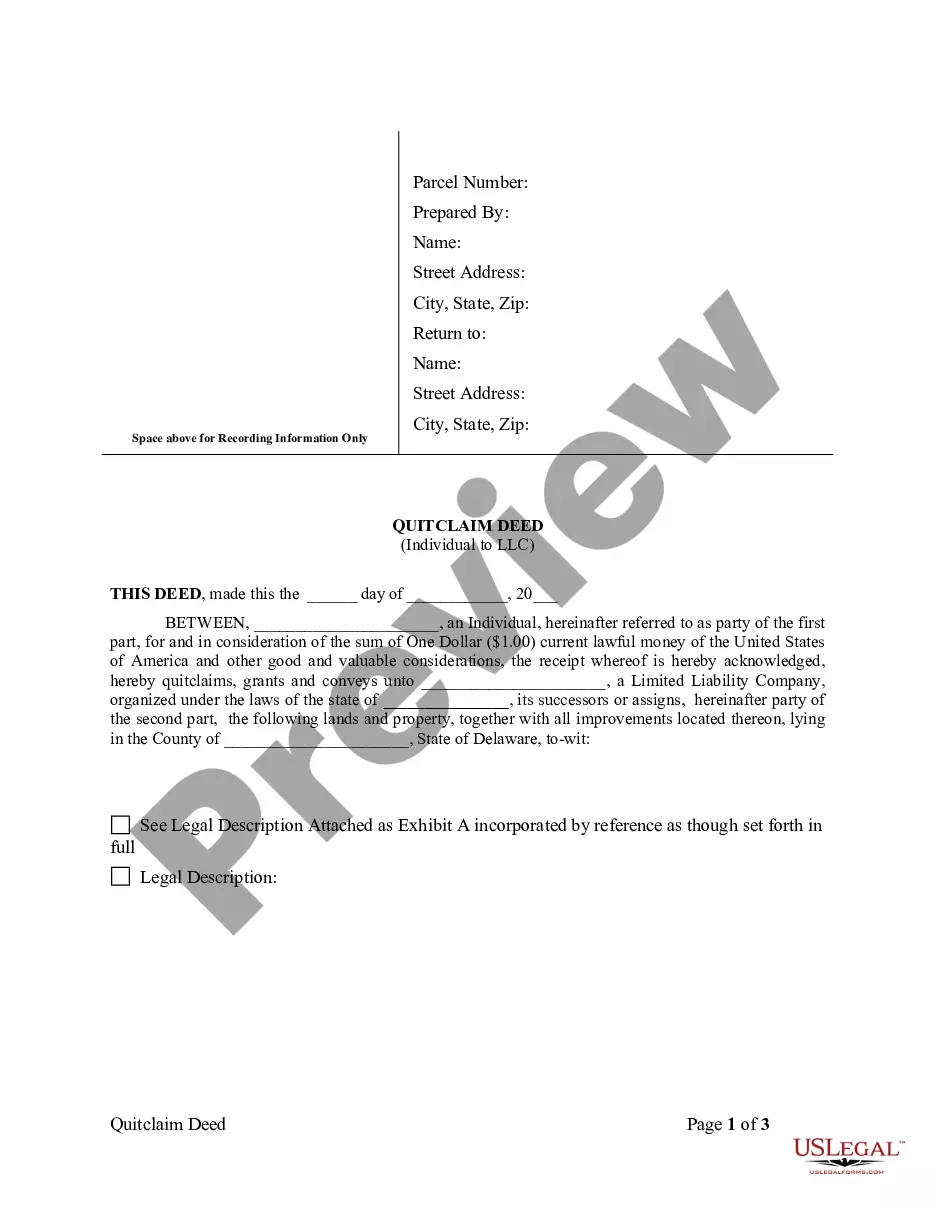

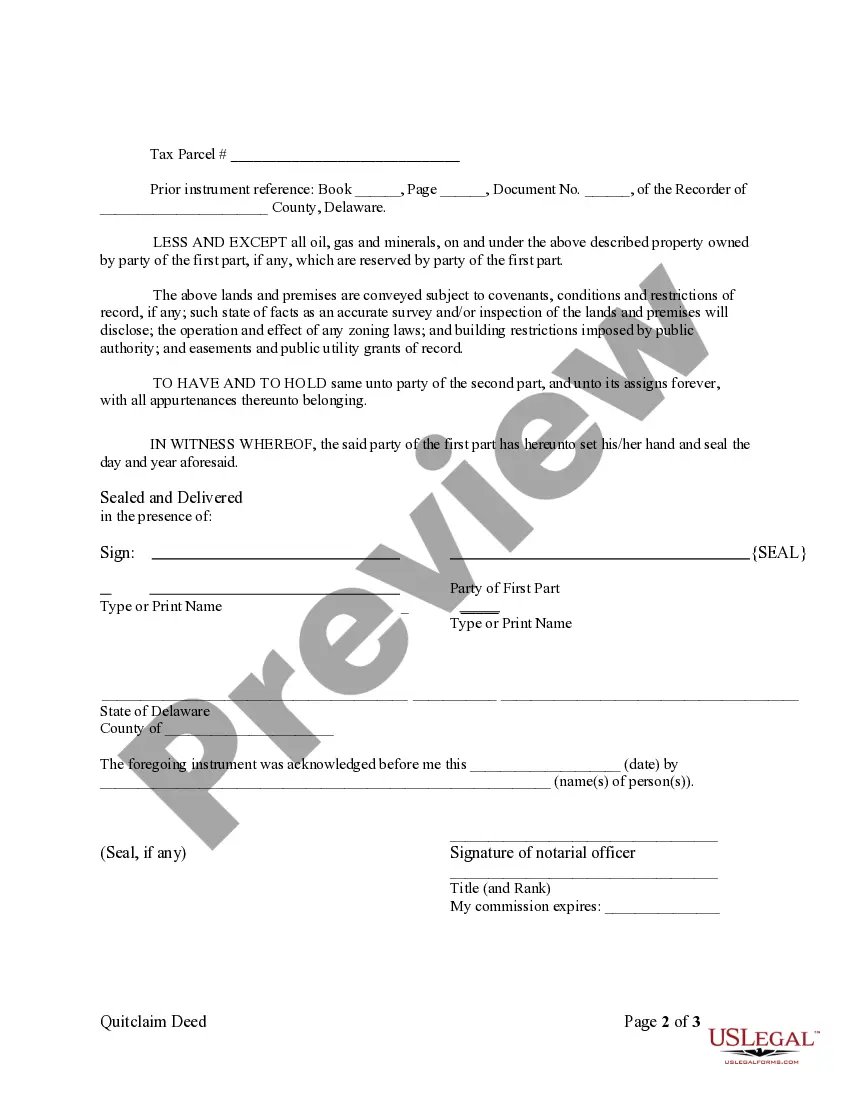

How to fill out Delaware Quitclaim Deed From Individual To LLC?

Properly composed official documents are one of the critical assurances for preventing complications and legal disputes, yet acquiring them without the assistance of an attorney might require time.

Whether you're looking to swiftly obtain a current Limited Liability Company File Without Operating Agreement or any other forms for employment, family, or business circumstances, US Legal Forms is consistently available to assist.

The process is even more straightforward for current users of the US Legal Forms library. If your subscription is active, all you need to do is Log In to your account and click the Download button adjacent to the chosen document. Additionally, you can retrieve the Limited Liability Company File Without Operating Agreement at any time later, as all documents previously acquired on the platform are accessible in the My documents tab of your profile. Save time and resources on preparing official documents. Experience US Legal Forms today!

- Verify that the form aligns with your situation and locality by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar located in the header of the page.

- When you identify the suitable template, click Buy Now.

- Choose the payment plan, Log In to your account, or create a new one.

- Select your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Choose either PDF or DOCX file format for your Limited Liability Company File Without Operating Agreement.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

If you do not get an operating agreement, your LLC will be governed by the Texas Limited Liability Act. However, these statutes are skeletal in substance and clumsy in their application.

Why do you need an operating agreement? To protect the business' limited liability status: Operating agreements give members protection from personal liability to the LLC. Without this specific formality, your LLC can closely resemble a sole proprietorship or partnership, jeopardizing your personal liability.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

Too often, founders rush to form the LLC without having a suitable written operating agreement in place. The operating agreement can state that the members will form an LLC within a certain period or when certain milestones are achieved, and that if those events don't transpire, then the agreement is terminated.

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.