Delaware Corporation De Force

Description

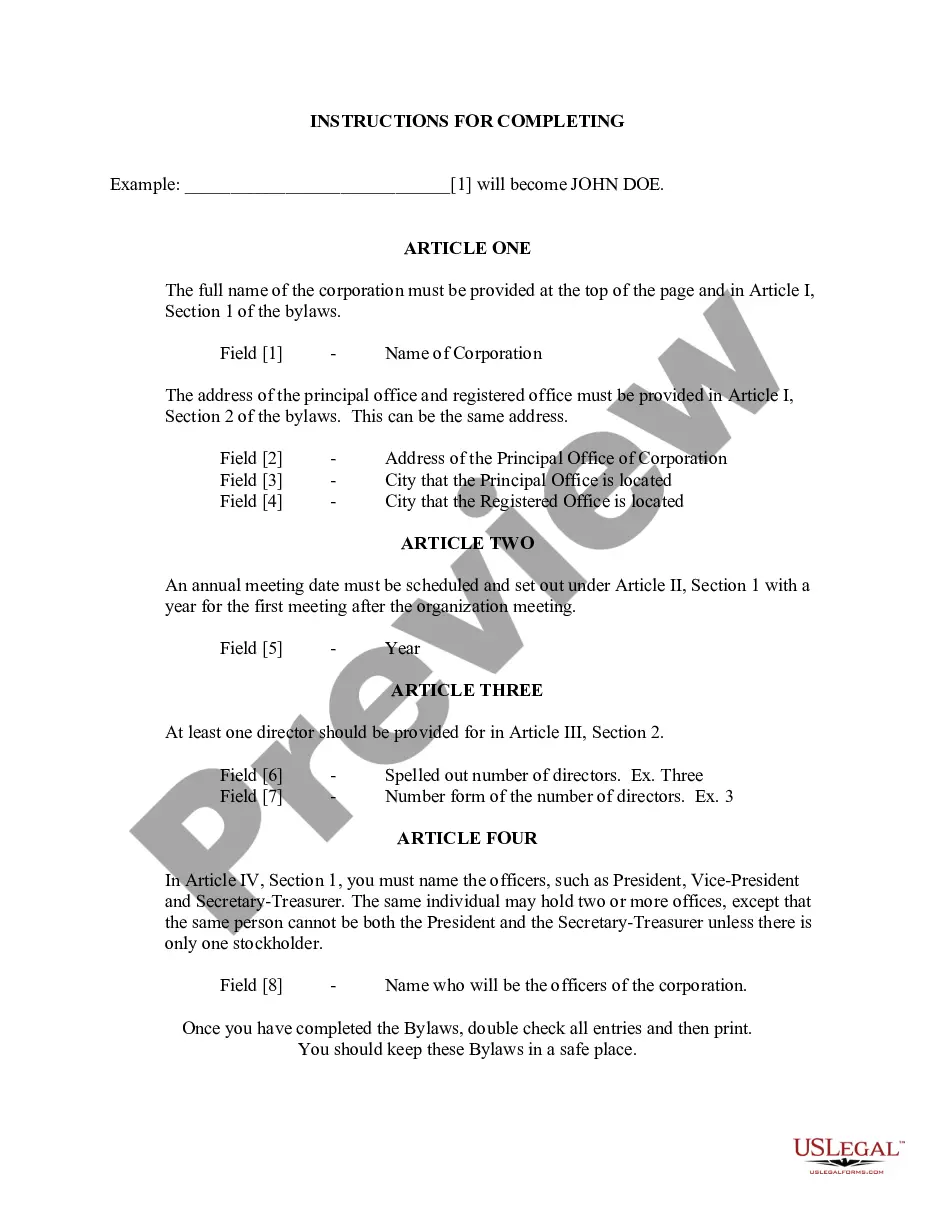

How to fill out Delaware Bylaws For Corporation?

Handling legal documentation and processes can be a lengthy addition to your daily tasks.

Delaware Corporation De Force and similar forms often necessitate searching for them and figuring out how to fill them out properly.

Therefore, whether you are managing financial, legal, or personal issues, having an extensive and user-friendly online directory of forms readily available will be incredibly beneficial.

US Legal Forms is the premier web platform for legal templates, featuring over 85,000 state-specific forms and various resources to help you complete your documents effortlessly.

Is this your first experience with US Legal Forms? Enroll and establish your account in just minutes to gain access to the form catalogue and Delaware Corporation De Force. Then, follow the guidelines below to complete your form: Ensure you have located the right form by utilizing the Review feature and examining the form details.

- Explore the collection of relevant documents accessible with just one click.

- US Legal Forms offers state- and county-specific forms available for download at any time.

- Protect your document management processes by using a high-quality service that enables you to assemble any form within minutes without extra or hidden fees.

- Simply Log In to your account, locate Delaware Corporation De Force, and download it instantly within the My documents section.

- You can also retrieve previously saved forms.

Form popularity

FAQ

Incorporating as a Delaware corporation de force can present some disadvantages. Notably, companies may encounter higher annual fees and complex legal requirements that can strain resources. Additionally, businesses may face challenges related to maintaining compliance with Delaware laws, which can be burdensome. Understanding these potential drawbacks is crucial for entrepreneurs when deciding the best structure for their ventures.

Elon Musk's decision to leave Delaware stems from a desire for more favorable conditions for his businesses. By relocating to states with more appealing tax structures and less stringent regulations, he aims to streamline operations and maximize innovation potential. This move reflects a broader trend among high-profile entrepreneurs seeking environments that support growth and flexibility. Ultimately, the decision underscores the importance of choosing the right state for corporate incorporation.

Companies like Meta are re-evaluating their presence in Delaware because of its evolving legal landscape and associated costs. As these corporations face heightened scrutiny and shareholder expectations, they seek jurisdictions that offer greater flexibility and less regulatory burden. Furthermore, the push for a more favorable environment for innovation and growth drives these companies to consider other states. This trend signifies a broader movement towards finding the best fit for business operations.

Companies are exploring alternatives to Delaware due to increasing costs and regulatory changes. While Delaware has long been a favored state for incorporation, some businesses now seek states with more favorable tax structures and fewer legal complexities. Additionally, the rise of remote work has allowed companies to consider locations that better align with their operational needs. Ultimately, the move reflects a shift in corporate strategy toward optimizing costs and efficiency.

To form a Delaware corporation, start by selecting a suitable name and ensuring it is available for use. Then, prepare and file the Certificate of Incorporation with the Delaware Division of Corporations, including details like the number of shares and registered agent information. After approval, you must obtain an Employer Identification Number (EIN) from the IRS. US Legal Forms provides comprehensive guidance and templates to assist you in successfully forming your Delaware corporation de force.

Forming a Delaware corporation begins with choosing a unique name that complies with state regulations. Next, you will need to file a Certificate of Incorporation with the Delaware Division of Corporations. This document outlines important details about your corporation, such as its purpose and registered agent. To streamline this process, consider using US Legal Forms, which offers resources and forms to help you establish your Delaware corporation de force.

While you don't necessarily need a lawyer to dissolve a corporation, having legal guidance can help ensure compliance with Delaware laws. A lawyer can assist with the paperwork and provide advice on settling debts and obligations. However, if you prefer a straightforward process, the uslegalforms platform offers resources that simplify the dissolution without needing extensive legal knowledge.

To shut down a Delaware corporation, you must first file a Certificate of Dissolution with the Delaware Division of Corporations. Make sure that you settle any outstanding debts and obligations before submission. This process formally ends the corporation's existence in Delaware and protects you from future liabilities. For assistance, consider using the uslegalforms platform to ensure compliance with all legal requirements.

To become a Delaware corporation, you need to file a Certificate of Incorporation with the Delaware Division of Corporations. This includes providing specific information such as your corporation's name, registered agent, and purpose. Using the US Legal Forms platform can simplify your filing process, offering templates and guidance tailored to your needs. Establishing your Delaware corporation de force opens up numerous benefits, including favorable tax treatment and enhanced credibility.

You can get your certificate of good standing by visiting the Delaware Division of Corporations online. If you prefer a more user-friendly approach, consider using the US Legal Forms platform to streamline the process. You will need to provide your corporation's details, and you can receive your certificate quickly. This document is essential for your Delaware corporation de force to operate effectively and maintain credibility.