Limited Liability Company With One Member

Description

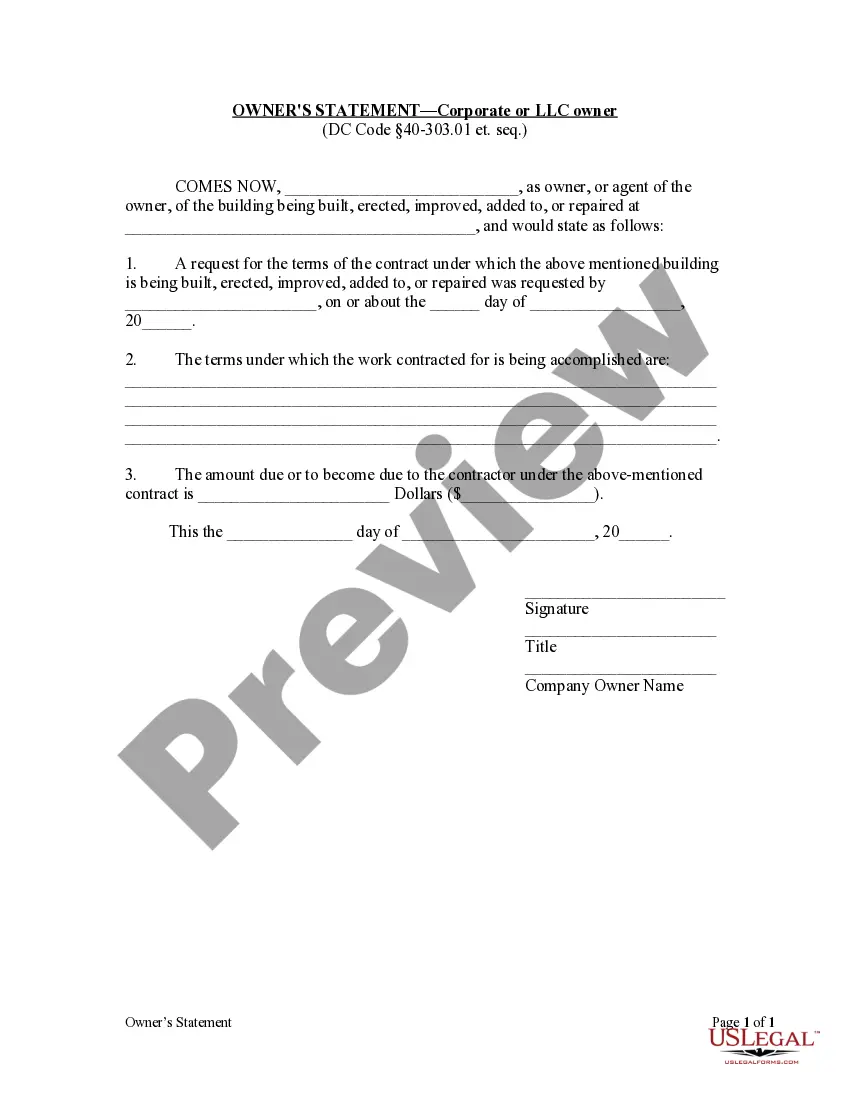

How to fill out District Of Columbia Owner's Statement By Corporation?

- If you're a returning user, log in to your account and access the needed form template by clicking the Download button. Ensure your subscription is current; if not, renew it per your payment plan.

- If you're new to our service, start by checking the preview mode and form description to confirm you’ve selected the appropriate form that complies with your local regulations.

- Use the Search tab above if you need to look for additional templates. If you discover inconsistencies, find the correct form to proceed efficiently.

- Purchase the document by clicking the Buy Now button and selecting your desired subscription plan. You will need to register an account for full access.

- Complete your purchase by providing your payment information, either via credit card or your PayPal account.

- Download your form to your device. You can always access it later in the My documents section of your profile.

US Legal Forms simplifies the process of setting up a limited liability company by providing a robust library of over 85,000 legal forms. With access to premium experts, users can ensure that their documents are both completed accurately and are legally compliant.

Don't hesitate—visit US Legal Forms today to start your journey towards establishing a limited liability company with one member!

Form popularity

FAQ

Filling out a W9 as a single-member LLC requires several straightforward steps. First, write your name and business name, if different, in the designated fields. Next, check the box for ‘Limited Liability Company’ and specify it's a single member by adding 'D.' Lastly, input your EIN or SSN and ensure all details are accurate to facilitate smooth reporting for your limited liability company with one member.

To fill out a W-9 for a single member LLC, start with your name and enter the business name in the appropriate section. Indicate your tax classification by checking the box for 'Limited Liability Company' and add 'D' for single member. Finally, provide your EIN or SSN, along with your address, to complete the form accurately. This ensures your limited liability company with one member maintains proper tax documentation.

When filling out a W9 as a single person, you need to include your name and the name of your business, if applicable. Additionally, include your Social Security Number or EIN, as required. Ensure that you mark the appropriate box to indicate that you are a sole proprietor or single member LLC. This clarity helps streamline your tax reporting and keeps your limited liability company with one member compliant.

A single member LLC should use an Employer Identification Number (EIN) when filling out a W9 form. However, if you have not obtained an EIN, you are allowed to use your Social Security Number (SSN) instead. Using an EIN can enhance your business professionalism and help separate personal and business finances. If you need assistance obtaining an EIN for your limited liability company with one member, consider checking out resources from USLegalForms.

An LLC with one person is commonly referred to as a single member LLC. This structure provides all the benefits of limited liability while allowing for full control over business decisions. It simplifies management and taxation, making it an attractive option for individuals. Thus, many entrepreneurs choose to form a limited liability company with one member to suit their business needs.

Yes, a single member LLC owner generally has limited liability protection. This structure means that your personal assets are usually protected from business debts and lawsuits. However, it's essential to maintain proper separation between personal and business finances to uphold this protection. Following best practices ensures that your limited liability company with one member remains compliant and safeguards your assets.

Filling out a W-9 for a limited liability company with one member is straightforward. You should start by entering your LLC name on the first line and your name on the second line. For the tax classification, select 'Individual/sole proprietor or single-member LLC' to ensure the IRS correctly identifies your company. Lastly, provide your Taxpayer Identification Number, which can be your Social Security Number or Employer Identification Number, depending on your choice of identification.

A significant tax benefit of a limited liability company with one member is the ability to file taxes as a sole proprietorship. This simplifies the tax process and can help reduce your overall tax burden. Additionally, you can deduct business expenses directly from your personal tax return. Understanding these benefits can guide your operational decisions, and uslegalforms can assist with your tax-related questions.

While a single-member LLC has many advantages, some disadvantages do exist. For instance, obtaining financing can be more challenging compared to multi-member LLCs. Additionally, your personal finances may still be at risk if the courts find that the LLC does not operate as a separate entity. It's beneficial to understand these factors fully, which you can explore further through uslegalforms.

Being a single-member LLC offers both flexibility and simplicity for business owners. You maintain full control over operations while benefiting from liability protection. Additionally, the tax treatment as a disregarded entity can simplify your tax filings. Many entrepreneurs appreciate these advantages when choosing a limited liability company with one member as their business structure.