Living Trust

Description

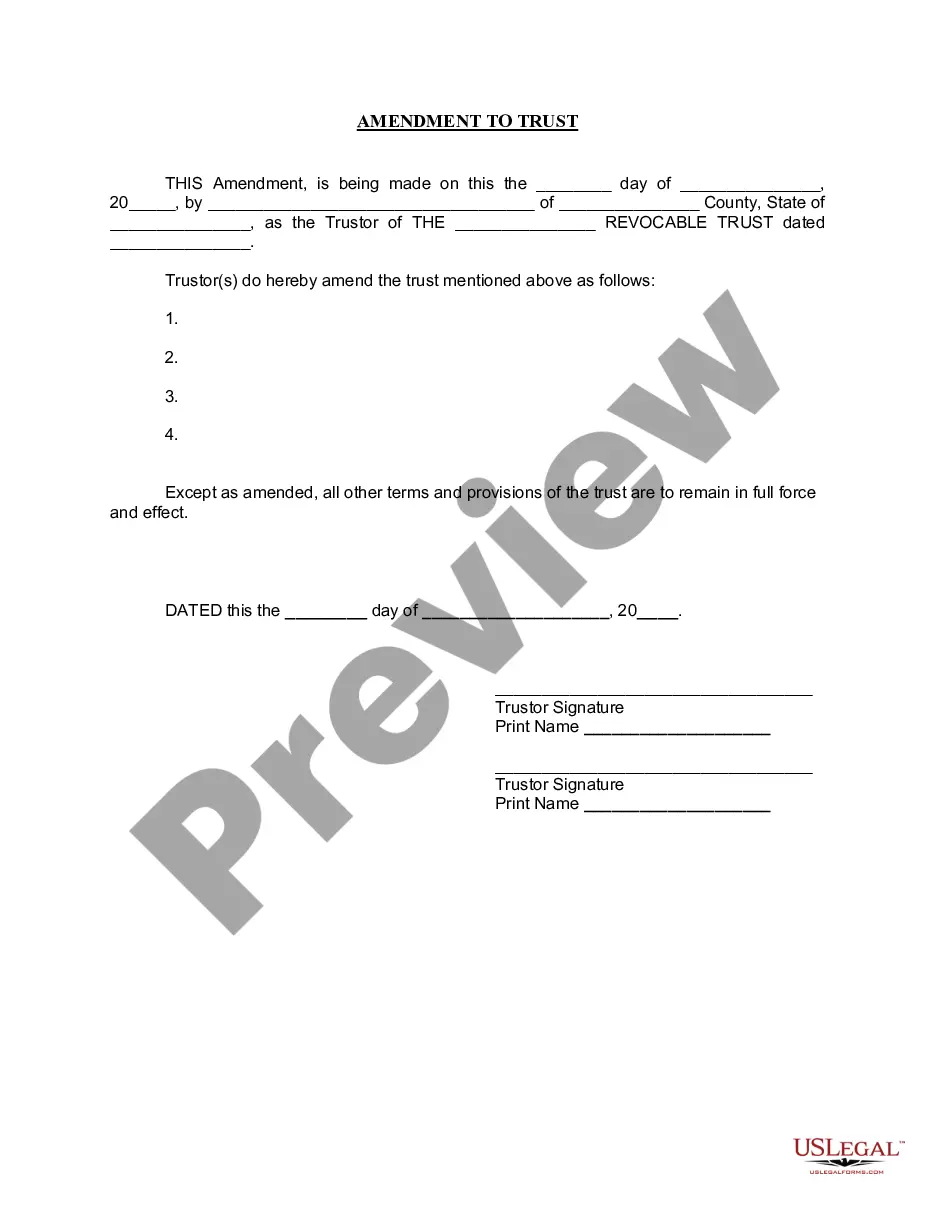

How to fill out Connecticut Amendment To Living Trust?

- If you’re an existing user, log into your account and download the required form template directly by clicking the Download button. Ensure your subscription is active. If it has lapsed, renew it according to your payment plan.

- For first-time users, start by browsing the Preview mode and form description of the living trust to confirm it meets your specific needs and adheres to local requirements.

- If the document doesn’t suit your requirements, utilize the Search tab at the top to find alternate templates that fit your criteria.

- Once you find the right template, proceed to purchase by clicking the Buy Now button and selecting your preferred subscription plan. You will need to create an account to access the library.

- Complete your purchase by entering your credit card details or opting for PayPal to finalize your subscription.

- Download your living trust document. Save it on your device for completion, and access it anytime through the My Forms menu in your profile.

In conclusion, US Legal Forms provides a robust platform with an extensive collection of over 85,000 legal documents. Whether you are revisiting or a first-time user, creating a living trust has never been more accessible.

Start your journey towards effective estate planning today by exploring US Legal Forms!

Form popularity

FAQ

In Texas, some disadvantages of a living trust include the complexity and time involved in establishing it correctly. Additionally, living trusts do not provide protection against debts in life; beneficiaries may still face claims against assets. It's essential to consider your unique situation and possibly consult a professional to tailor your living trust effectively.

Putting your house in a living trust in Texas can be a smart decision. This approach allows you to avoid probate, ensuring a seamless transfer of ownership to your heirs. Additionally, a living trust provides flexibility, allowing you to manage your property during your lifetime while protecting it from potential creditors.

The main purpose of a living trust is to manage your assets during your lifetime and determine how they should be distributed after your death. A living trust helps avoid probate, which can be a lengthy and costly process. By placing your assets in a living trust, you maintain control over them while simplifying the transfer process for your beneficiaries.

Generally, you do not file your living trust with your local court or government unless it needs to be probated after your passing. However, maintaining accurate records of your living trust is crucial for managing assets and distributions. It’s important to keep your trust document, amendments, and all related paperwork organized and accessible. For assistance with trust management and filing obligations, USLegalForms offers valuable tools and documents to simplify the process.

Yes, your living trust may need to file a tax return, depending on the income it generates. If your trust earns income above a certain threshold, you are required to file IRS Form 1041. This requirement ensures that the earnings are taxed appropriately and helps maintain accurate financial records. To navigate the complexities of tax filings for your living trust, you might find useful resources and guidance through USLegalForms.

If you neglect to file taxes on a living trust, you may face penalties and interest from the IRS. Trusts are generally required to file a tax return, and failing to do so can affect the trust's financial standing and tax obligations. This oversight could also lead to difficulties in distributing assets to beneficiaries. It's best to stay informed about tax requirements for your living trust, and consider using platforms like USLegalForms to help manage your responsibilities.

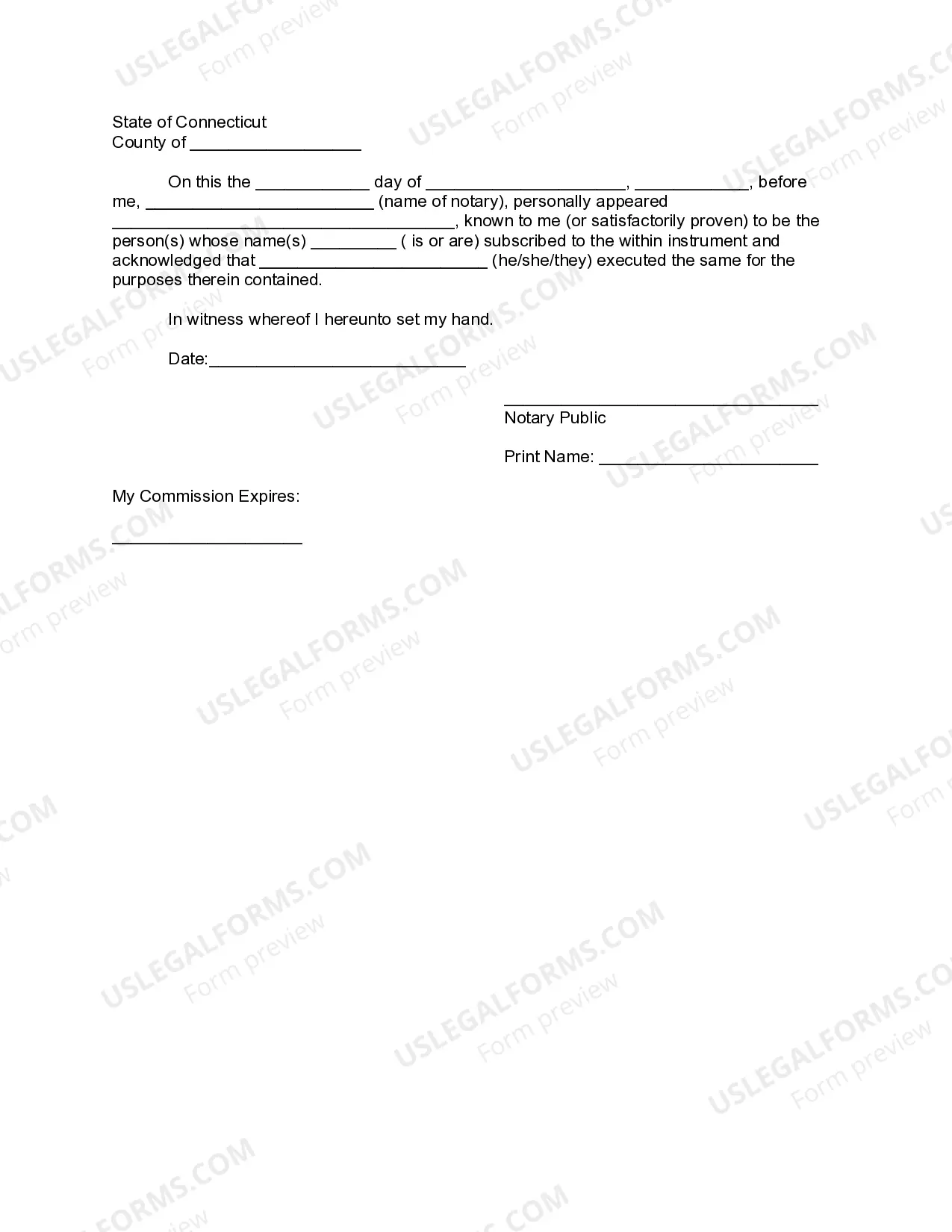

A living trust can be deemed invalid due to several reasons. First, if the trust lacks proper documentation or fails to meet state law requirements, it may not hold up in court. Additionally, discrepancies in signing, such as being undated or not having the appropriate number of witnesses, can invalidate it. To ensure your living trust is valid, you might consider consulting legal professionals or using reliable platforms like USLegalForms.

The best person to set up a living trust is typically an estate planning attorney who specializes in trusts. They understand the intricacies of law and can tailor your trust to align with your personal needs and objectives. Additionally, some may choose to utilize services like US Legal Forms for assistance in creating a trust without intensive legal fees. In any case, it is essential to have someone knowledgeable guiding you to ensure the trust is valid and effective.

To set up a living trust effectively, start by clearly defining your goals for the trust. Choose the right type of trust that suits your needs, whether it is revocable or irrevocable. Using user-friendly platforms like US Legal Forms can guide you through this process, providing the necessary templates and legal information. Once completed, ensure you fund the trust by transferring assets into it to secure your intentions.

Filling out a living trust involves gathering essential documents, such as property titles and financial information, followed by accurately completing the trust forms. It is crucial to identify all trust beneficiaries and outline the management of assets. US Legal Forms simplifies this process by providing clear templates and guidance to help you create a comprehensive living trust that meets your needs. Don’t rush; ensure you understand each section to avoid errors.