Limited Limited

Description

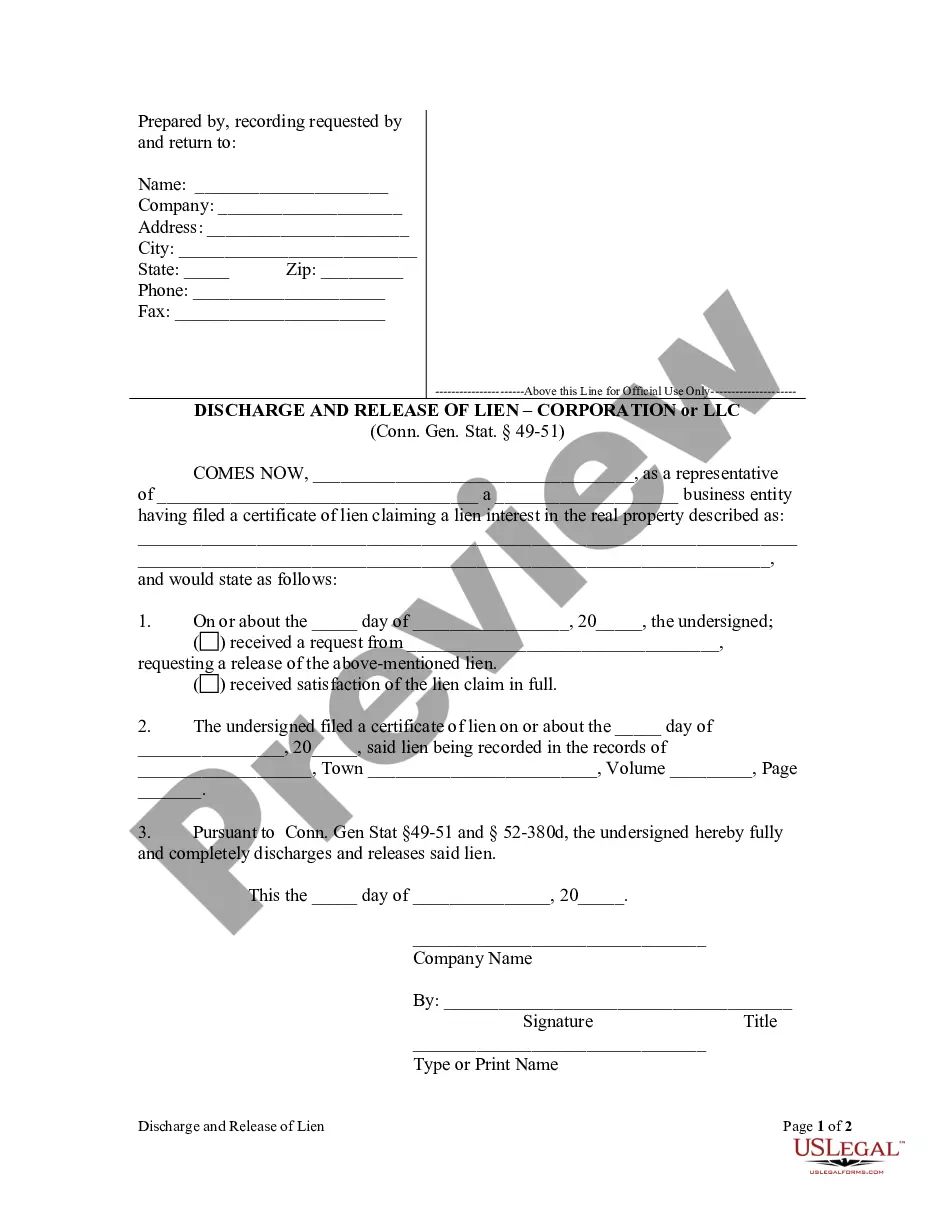

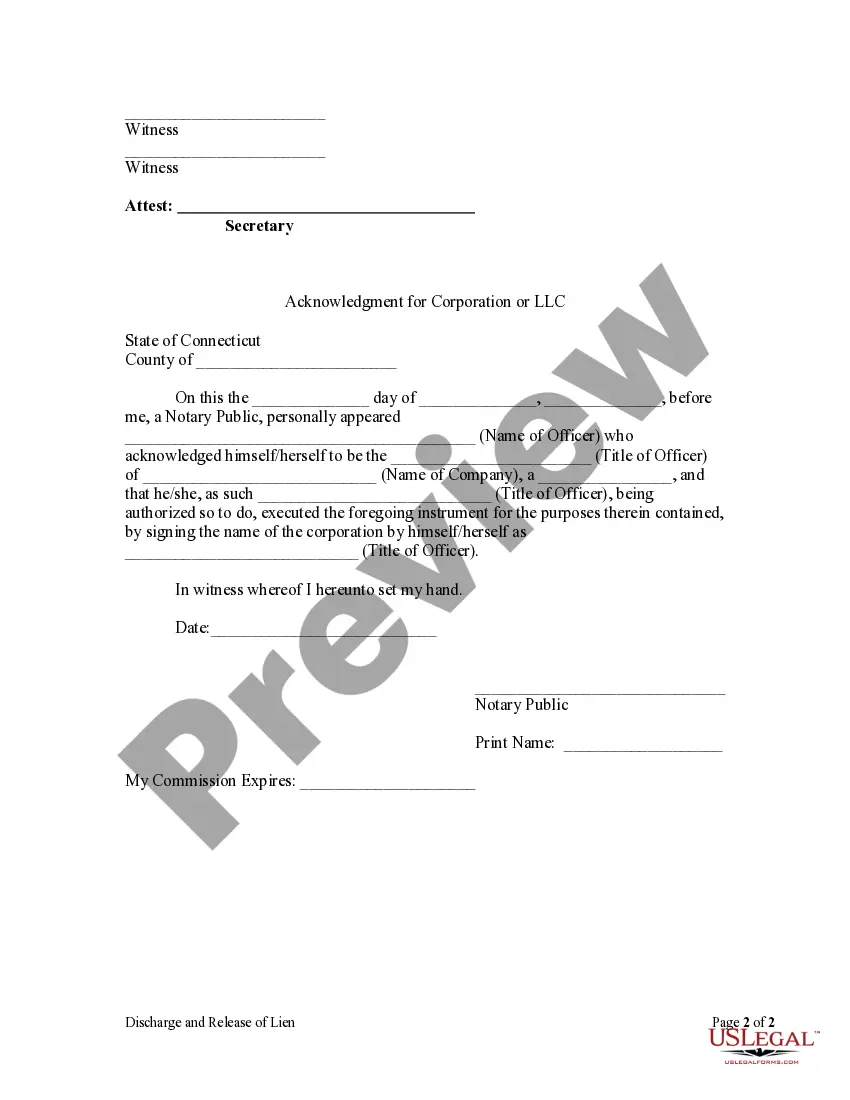

How to fill out Connecticut Discharge And Release Of Lien By Corporation Or LLC?

- If you are a returning user, log into your account with valid subscription details to access and download your needed form directly.

- For new users, start by reviewing the Preview mode and form descriptions to ensure you select a document that fits your requirements and complies with local laws.

- If necessary, utilize the Search tab to find alternative templates that may better suit your needs before proceeding.

- Once you've found the right document, click on the Buy Now button and select a subscription plan that aligns with your needs, ensuring you register for full access.

- Complete your purchase by entering your payment information via credit card or PayPal to finalize your subscription.

- Download your selected form to your device, making it easily accessible in the My Forms section of your account whenever needed.

By following these steps, you can leverage the extensive resources of US Legal Forms to handle your legal documentation effortlessly. With a rich collection of forms and access to expert assistance, achieving legal compliance has never been easier.

Start your journey with US Legal Forms today and gain the confidence of having the right legal documents at your fingertips.

Form popularity

FAQ

You can file your LLC as a separate entity, distinct from your personal finances, by choosing the appropriate tax classifications. This separation provides liability protection and potential tax benefits. To navigate this process effectively, consider using US Legal Forms as a resource for your Limited limited entity, ensuring you meet all necessary requirements.

While both terms indicate a limited liability company structure, 'Limited' generally refers to a United Kingdom designation, whereas 'LLC' is used in the United States. In the U.S., you should use 'LLC' to correctly describe your business entity. For accurate documentation and naming conventions for your Limited limited business, you can find resources on US Legal Forms.

Yes, you can maintain an LLC without engaging in business activities; however, you must still meet annual filing requirements in your state. This includes filing an annual report and paying necessary fees to keep your LLC in good standing. If you have questions about compliance, US Legal Forms provides the clarity and guidance you need to manage your Limited limited effectively.

If you fail to file taxes for your LLC, you may face penalties and interest on any unpaid taxes. Additionally, the IRS may classify your LLC as a disregarded entity, affecting your personal liability protection. Not filing can also hinder your ability to access loans or funding in the future. To avoid these issues, consider using the tools available at US Legal Forms to ensure your Limited limited compliance.

Absolutely, an LLC can have more than 100 members if it is not classified as an S Corporation for tax purposes. This flexibility allows businesses to expand their networks and invite more investors or partners as they grow. Recognizing the distinct types of member structures in LLCs can significantly influence your business trajectory. If you're exploring options, platforms like uslegalforms can aid you in navigating member regulations.

Yes, you can have a 50-50 ownership structure in an LLC, which means that two members share equal control and profits. This equality fosters a collaborative environment where both owners have a say in the direction of the business. However, it’s essential to establish clear terms in your operating agreement to prevent disputes down the line. This documentation serves as a limited guide for member responsibilities and decision-making.

Filling out a limited power of attorney form involves stating your name, the agent's name, and defining the scope of authority granted. Be clear about the specific tasks or decisions you allow your agent to make on your behalf, as this document is intended for limited purposes only. After completing the details, sign and date the form in accordance with your state's requirements, which may include a witness or notary. Resources available on uslegalforms can help ensure you understand all necessary steps.

An LLC is not strictly limited to 100 members unless it chooses to elect S Corporation status for tax purposes. This limited classification often creates confusion, but it is essential to note that a standard LLC can have an unlimited number of members. By understanding these distinctions, business owners can select the most appropriate structure for their goals. Utilizing platforms like uslegalforms can further clarify the nuances of LLC membership for you.

An LLC cannot technically have unlimited partners; however, there is no upper limit on the number of members that can join. Yet, if your business structure seeks to offer shares to the public or exceed certain thresholds, it may be necessary to transition to a corporation. The term 'limited' in Limited Liability Company often refers to the legal protections afforded to the owners rather than the number of partners. So, while flexibility exists, understanding the limitations is key.

The Limited Liability Company (LLC) emerges as a popular business structure that can have a maximum of 100 members. This limitation is particularly crucial when considering the advantages of both limited liability and management flexibility. LLCs provide a balance of structure, allowing a manageable number of owners while delivering protection for personal assets. Therefore, it’s an ideal choice for small to medium enterprises aiming for growth.