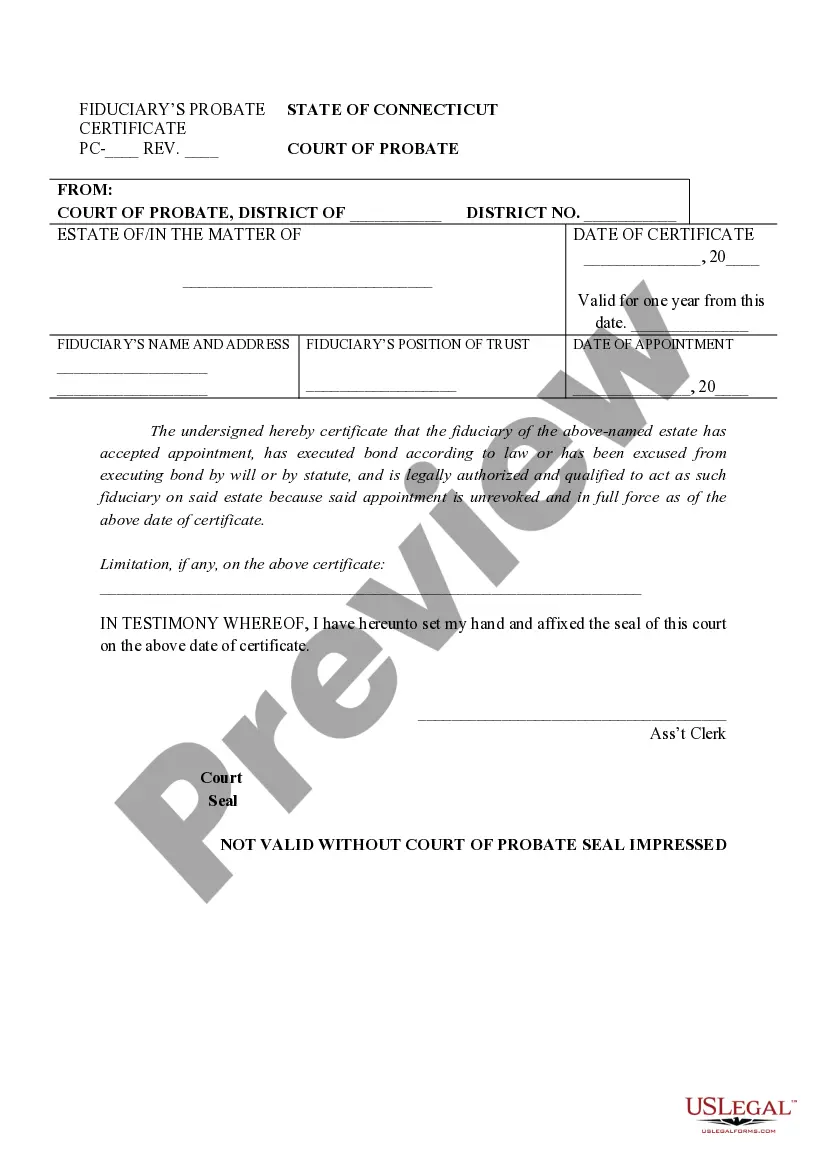

Fiduciary Probate Certificate Withholding

Description

How to fill out Connecticut Fiduciary's Probate Certificate?

The Fiduciary Probate Certificate Withholding displayed on this page is a reusable official template crafted by experienced attorneys in accordance with federal and state statutes.

For over 25 years, US Legal Forms has supplied individuals, companies, and legal experts with over 85,000 validated, state-specific documents for any commercial and personal situation. It’s the quickest, simplest, and most dependable method to acquire the paperwork you need, as the service ensures the utmost level of data security and anti-malware safeguards.

Redownload your documents again whenever needed. Access the My documents section in your profile to re-download any previously acquired forms. Sign up for US Legal Forms to have verified legal templates for all of life's situations readily available.

- Search for the document you require and review it.

- Browse through the file you looked for and preview it or examine the form description to verify it meets your needs. If it doesn't, utilize the search bar to find the appropriate one. Click Buy Now once you locate the template you desire.

- Choose and Log In.

- Select the pricing option that suits your needs and create an account. Use PayPal or a credit card for prompt payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

- Choose the format you prefer for your Fiduciary Probate Certificate Withholding (PDF, Word, RTF) and download the document onto your device.

- Complete and sign the documentation.

- Print out the template to fill it out manually. Alternatively, use an online multifunctional PDF editor to quickly and accurately complete and sign your form with an electronic signature.

Form popularity

FAQ

The personal representative of an estate is an executor, administrator, or anyone else in charge of the decedent's property. The personal representative is responsible for filing any final individual income tax return(s) and the estate tax return of the decedent when due.

The IRS requires the filing of an income tax return for trusts and estates on Form 1041?formerly known as the fiduciary income tax return. This is because trusts and estates must pay income tax on their income just like you report your own income on a personal tax return each year.

Trust beneficiaries must pay taxes on income and other distributions from a trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets. IRS forms K-1 and 1041 are required for filing tax returns that receive trust disbursements.

Generally, you should file Form 56 when you create (or terminate) a fiduciary relationship. File Form 56 with the Internal Revenue Service Center where the person for whom you are acting is required to file tax returns.

If you don't file taxes for a deceased person, the IRS can take legal action by placing a federal lien against the Estate.