Fiduciary Probate Certificate For Connecticut

Description

How to fill out Connecticut Fiduciary's Probate Certificate?

Creating legal documents from the beginning can frequently be overwhelming.

Some situations may require extensive research and considerable funds.

If you’re looking for a simpler and more economical method of drafting the Fiduciary Probate Certificate For Connecticut or any other paperwork without the hassle, US Legal Forms is always available to assist you.

Our online library of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal affairs.

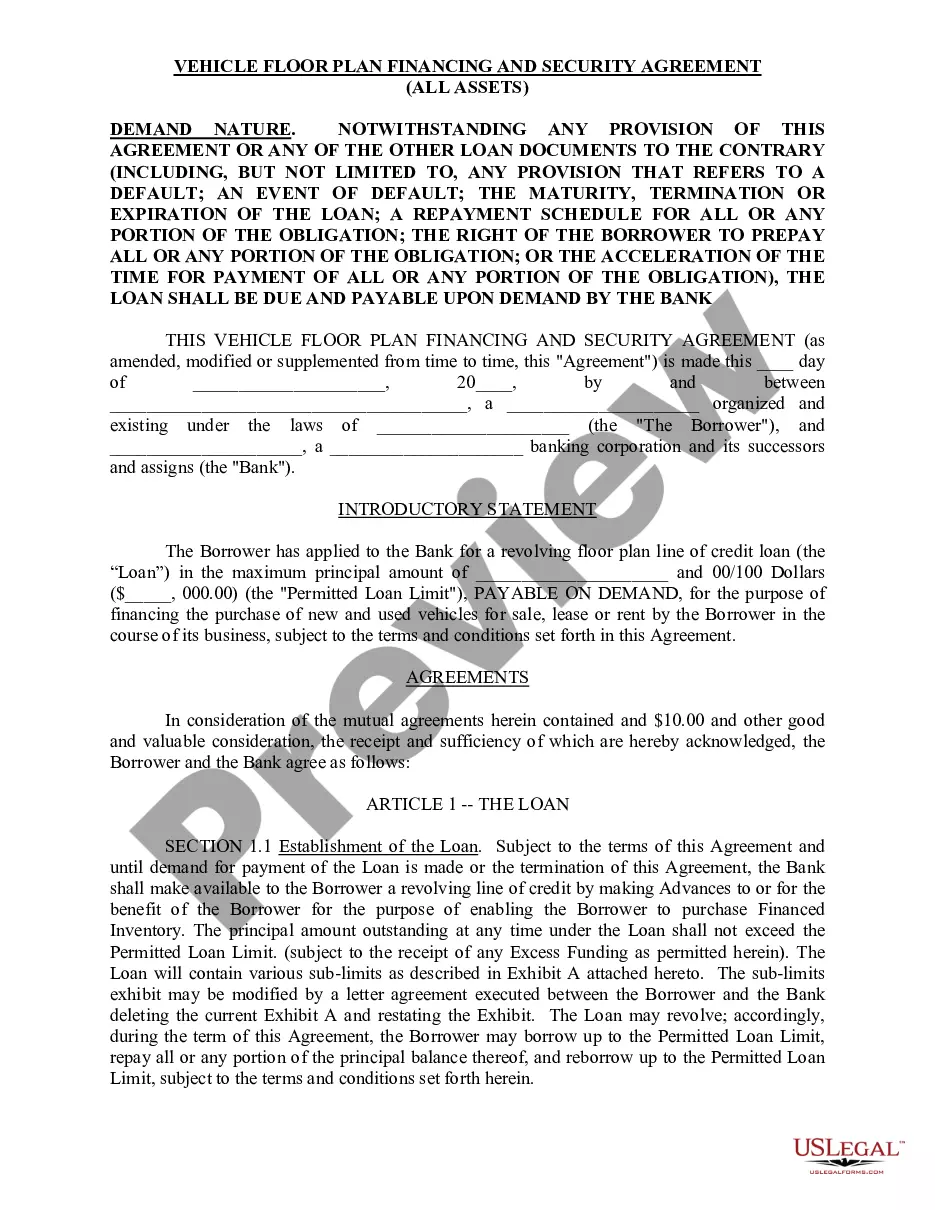

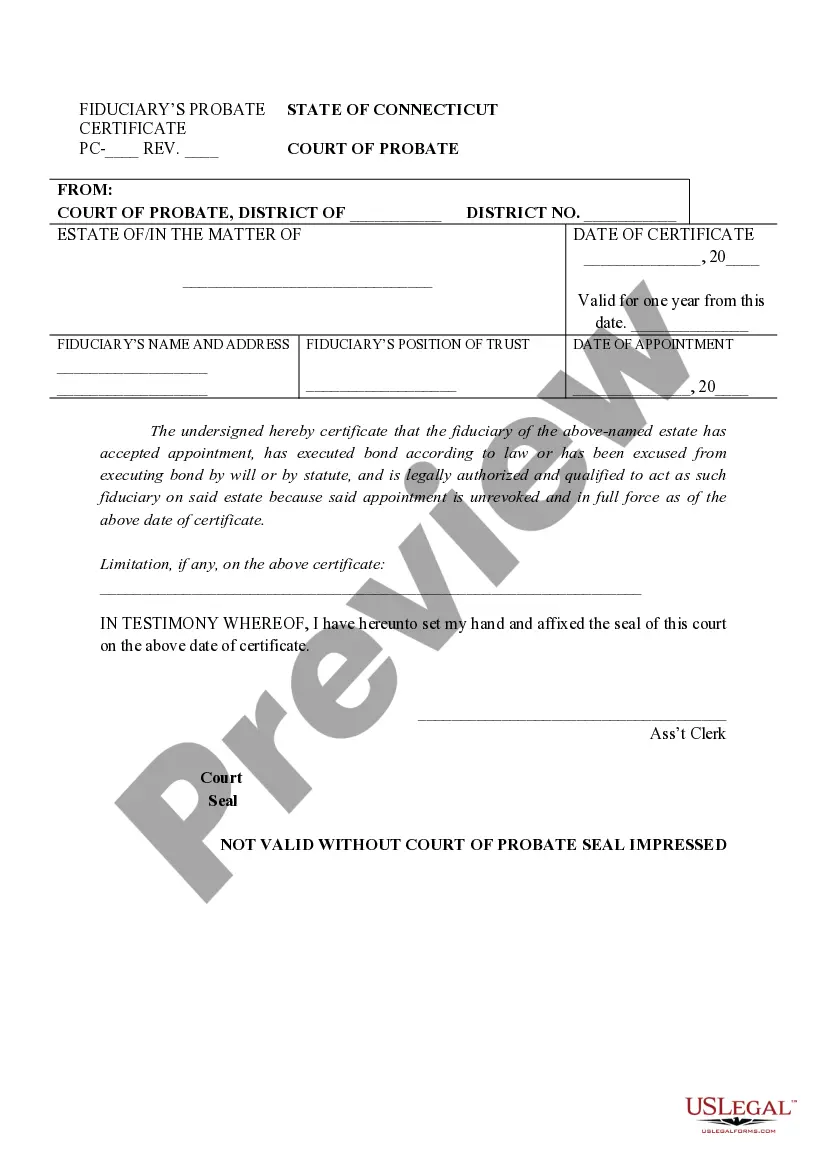

Examine the document preview and descriptions to confirm that you are on the document you need. Validate if the form you select meets your state and county's requirements. Select the appropriate subscription option to purchase the Fiduciary Probate Certificate For Connecticut. Download the file. Then complete, sign, and print it out. US Legal Forms has an impeccable reputation and over 25 years of experience. Join us now and simplify document execution!

- With just a few clicks, you can quickly obtain state- and county-specific forms carefully prepared for you by our legal experts.

- Utilize our platform whenever you require trustworthy and dependable services to easily find and download the Fiduciary Probate Certificate For Connecticut.

- If you’re familiar with our services and have set up an account with us before, simply Log In to your account, pick the template, and download it immediately or access it again at any time in the My documents section.

- Not registered yet? No worries. It only takes a few minutes to sign up and browse the library.

- However, before proceeding to download the Fiduciary Probate Certificate For Connecticut, keep these suggestions in mind.

Form popularity

FAQ

To initiate the estate probate process in Connecticut, you first need to file a petition with the local probate court. This legal step ensures you can obtain a fiduciary probate certificate for Connecticut, which is necessary for managing the deceased's assets. Next, you will notify all interested parties, including heirs and creditors, about the probate proceedings. US Legal Forms can help you find the right forms and instructions to simplify your journey through this process.

PC-213: Affidavit Of Closing Of Decedent's Estate (Rev. 7/20) - Connecticut | Atticus® Forms.

Here's a walk-through of the Connecticut probate process: Application for administration or probate of Will. ... Certificate for Land Records. ... Inventory of solely-owned assets. ... Pay expenses and claims. ... File estate tax returns. Final accounting and proposed distribution.

The Executor (or Administrator) of an estate will be supplied with a Fiduciary Probate Certificate (called PC-450), a document from the Probate Court that will evidence that the Executor/Administrator is appointed as such for the estate.

Full "probate" is ONLY required by law if the person who dies, with or without a will, (1) owned real estate (not just a life use) that does not pass by the deed to the "surviving" joint owner, OR (2) owned $40,000 or more of other assets that also don't pass by beneficiary or joint ownership to another person.

In Connecticut, the following assets are subject to probate: Solely-owned property: Any asset that was solely owned by the deceased person with no designated beneficiary is subject to probate. This could include bank accounts, cars, houses, personal belongings, and business interests.