Trust Deed For House

Description

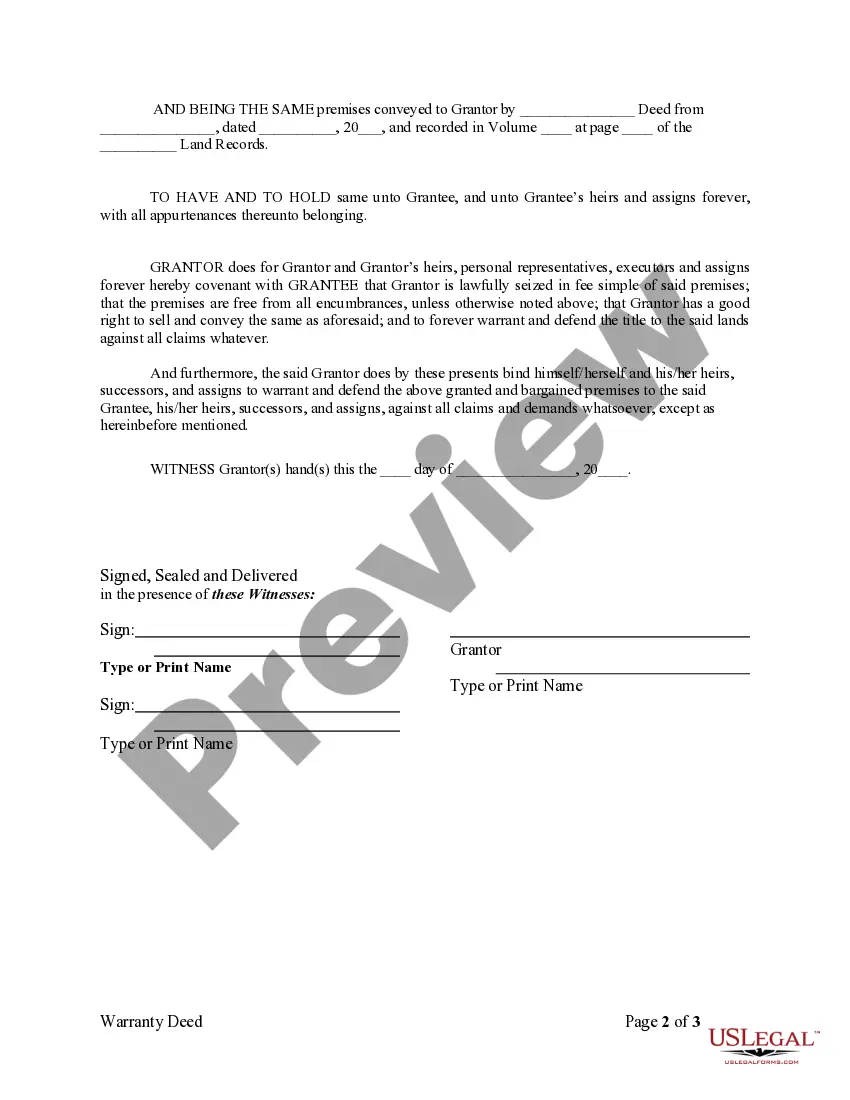

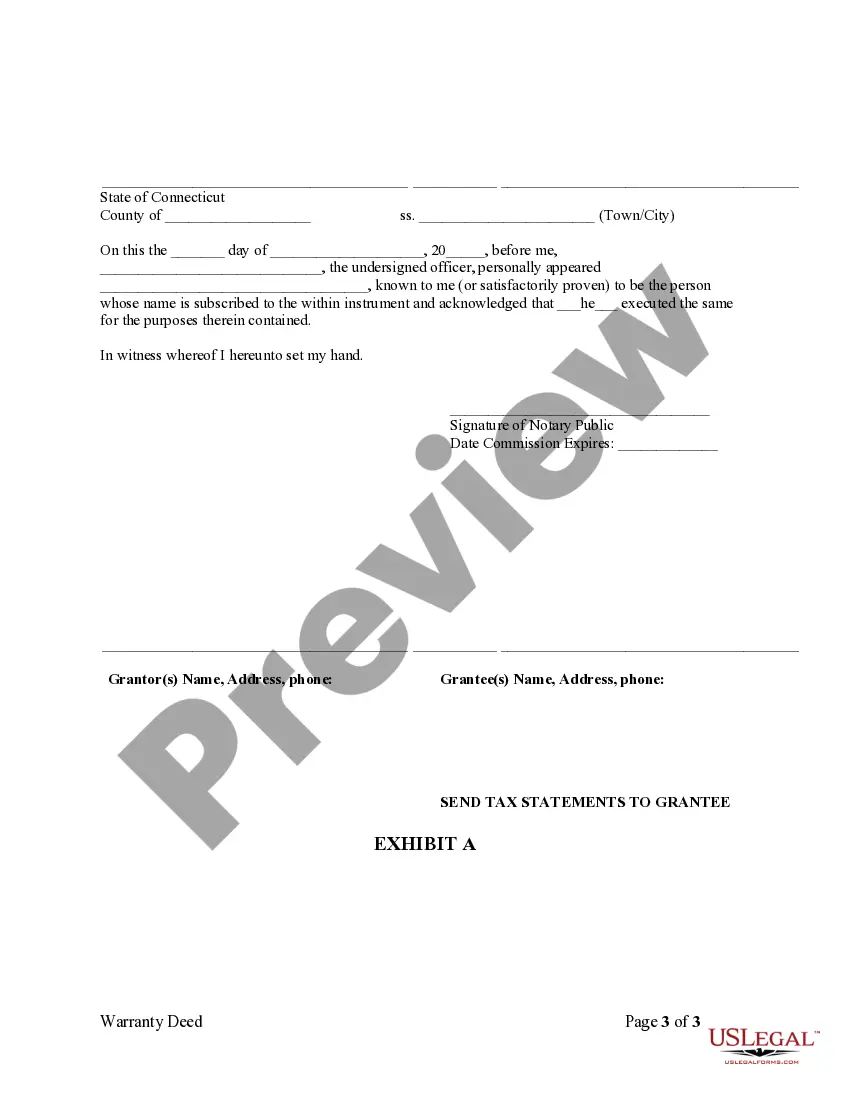

How to fill out Connecticut Warranty Deed From Individual To A Trust?

- Log in to your US Legal Forms account, or create a new account if you are a first-time user.

- In the library, search for the 'trust deed for house' template that matches your specific needs and local laws.

- Review the template in Preview mode to verify that it suits your requirements.

- Choose the 'Buy Now' option and select a subscription plan that works for you.

- Complete your purchase by providing payment details through credit card or PayPal.

- Easily download the trust deed template to your device, and access it later under 'My Forms' in your account.

Following these steps will ensure you have the right trust deed template ready for your house. With over 85,000 forms available, US Legal Forms not only enhances your legal document process but also guarantees quality and accuracy through expert assistance.

Start your journey to secure your property rights today by visiting US Legal Forms and accessing their extensive library!

Form popularity

FAQ

A deed of trust is usually provided by the lender financing your home or mortgage. They prepare this document to protect their interests when extending credit. In some cases, legal professionals can draft the deed, ensuring that it meets all local laws and regulations. Consider using platforms like US Legal Forms for efficient access to professionally crafted trust deed templates.

The trust deed is typically created by a legal professional, such as an attorney or a notary. They draft the document to include essential details about the property, the borrower, and the lender. This process ensures all terms are clear and legally binding. You can also find platforms like US Legal Forms that offer templates to simplify this process.

A trust deed for house can have specific drawbacks, mainly concerning foreclosure speed and borrower rights. Unlike a traditional mortgage, a deed of trust allows lenders to take swift action in case of default without needing to go through court. This can be a disadvantage for borrowers, leading to potential property loss in tough financial situations. Understanding these implications is crucial for anyone considering this option.

One disadvantage of a trust deed for house is that it may limit your options in case of financial hardship. If a borrower defaults, the lender can initiate foreclosure without a lengthy court process, which can be alarming. Additionally, borrowers may feel a lack of control over their property if they face difficulties. Being aware of these risks can help you make informed decisions.

Using a trust deed for house can provide certain advantages over traditional mortgages. For instance, a deed of trust allows for a faster foreclosure process if the borrower fails to meet their obligations. Additionally, it often involves fewer legal complexities, making the overall process simpler for both lenders and borrowers. This can lead to a more efficient closing experience.

No, a deed of trust is not the same as a title. A trust deed for house acts as a security instrument that gives the lender rights to a property if the borrower defaults. The title is a legal document that proves ownership of the property. While both are essential in real estate transactions, they serve distinct purposes.

One significant mistake parents often make is not clearly defining the terms of the trust fund. This lack of clarity can lead to confusion among beneficiaries and unintended consequences. Additionally, parents may overlook the importance of regular reviews and updates of the trust as family dynamics change. For a more secure setup, considering a trust deed for house can streamline the process and ensure that your intentions are honored.

Putting your house in a trust can have certain drawbacks. One key disadvantage is that it may limit your control over the property, as a trustee will manage it on your behalf. Additionally, transferring your home into a trust can come with fees and paperwork that may seem cumbersome. It’s essential to weigh these factors before deciding if a trust deed for house is the right option for you.