Personal Representative For Deceased Taxpayer

Description

How to fill out Colorado Warranty Deed For Personal Representative?

- If you have previously signed up, log in to your account and select the Download button to access the form template. Ensure your subscription is active; if not, renew your plan.

- For first-time users, start by reviewing the Preview mode and description to confirm the selected form accurately meets your specific needs and adheres to your local regulations.

- If discrepancies arise, utilize the Search feature to locate any alternative templates that better match your requirements.

- Take the plunge by clicking the Buy Now button to select your desired subscription plan. You'll need to create an account to unlock access to the extensive legal library.

- Complete your purchase by entering payment details. Use either a credit card or PayPal for quick and secure processing.

- Finally, download the completed form and save it on your device. You can also revisit it later in the My Forms section of your profile.

US Legal Forms stands out with a robust collection of over 85,000 editable legal documents, more than competitors at similar prices. Experienced users and newcomers alike can benefit from direct access to legal experts.

Start your journey toward stress-free estate management today. Visit US Legal Forms and simplify your document needs!

Form popularity

FAQ

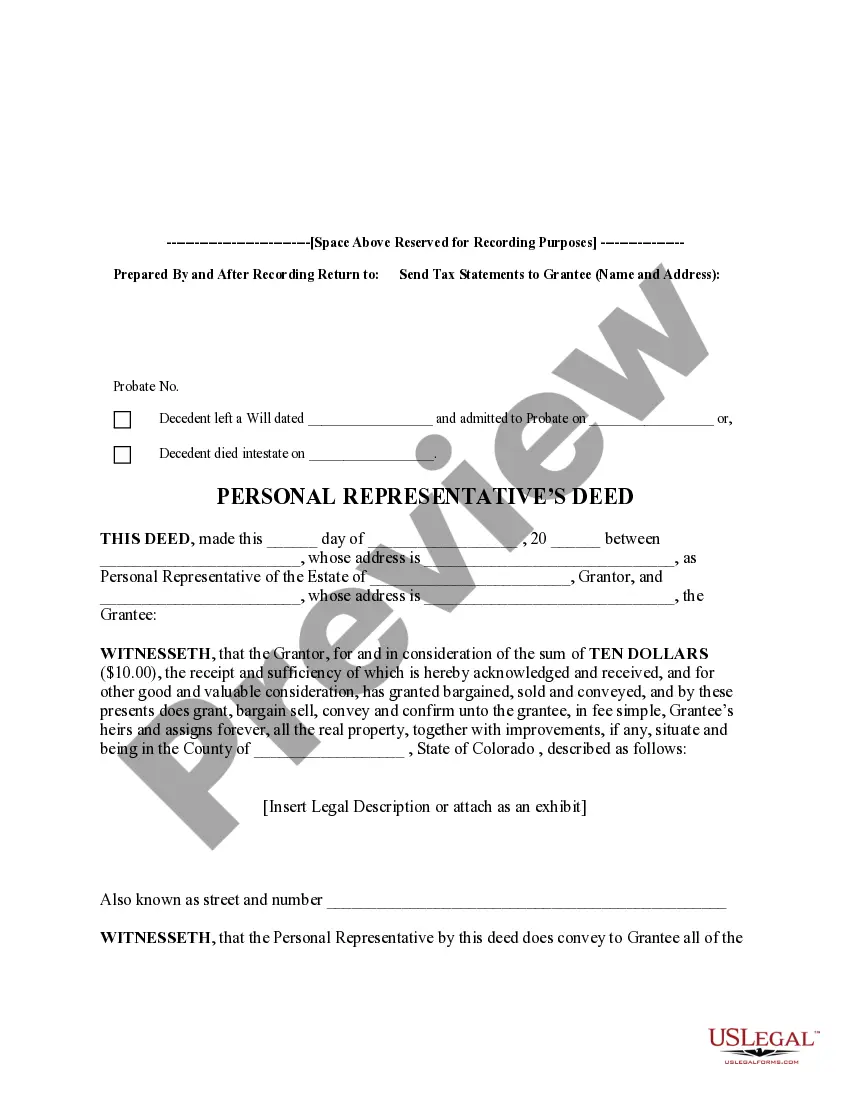

The personal representative for a deceased taxpayer usually needs to file three key tax returns: the final individual income tax return for the deceased, any applicable estate tax return, and short-term returns for any trust income. These returns are vital for settling the estate's financial matters. Using resources like US Legal Forms can simplify this process and ensure all necessary filings are completed correctly.

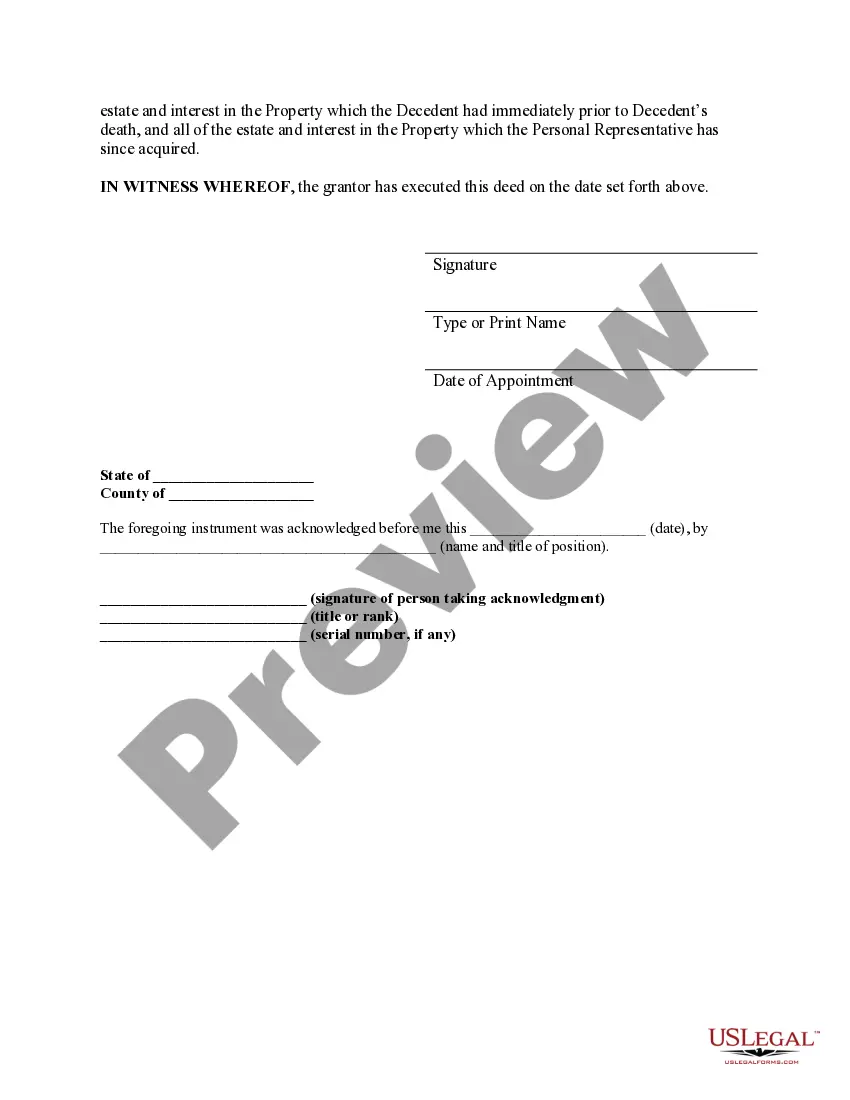

The personal representative for a deceased taxpayer is responsible for providing information such as their own name, contact details, and relationship to the deceased. This information is crucial for verifying authority when handling the estate's tax matters. Ensuring this data is accurate will facilitate smoother communications with the IRS and other entities.

To endorse a tax refund check for a deceased taxpayer, the personal representative must sign their name on the back of the check followed by 'personal representative' or 'PR' to indicate their capacity. It's essential to include the name of the deceased taxpayer also. Keeping thorough records of this process can help prevent any future complications.

The personal representative for a deceased taxpayer needs to file Form 1310 when claiming a refund for the deceased's tax return. This situation arises if the deceased had overpaid their taxes and the personal representative intends to receive the refund. Filing this form helps validate the claim and supports the processing of the refund.

To become a personal representative for a deceased taxpayer, you must first be appointed by the court through the probate process. Typically, this involves filing a petition and providing information about the deceased person's assets and beneficiaries. Once appointed, you hold the legal authority to manage the estate, including tax affairs.

Yes, a personal representative for a deceased taxpayer generally needs to file Form 1310 if they are claiming a refund on behalf of the deceased. This form serves to establish their relationship to the taxpayer and ensure the refund goes to the right person. Additionally, it helps the IRS process the claim more efficiently.

The IRS generally has ten years to collect back taxes from a deceased person, starting from the date of tax assessment. This timeline remains applicable to the deceased taxpayer's estate, overseen by the personal representative for deceased taxpayer. It is vital for the representative to be aware of this timeframe to handle any potential claims effectively. Understanding these deadlines can aid in efficient estate management.

To notify the IRS of a deceased taxpayer, you should send a copy of the death certificate along with the final tax return of the deceased. This process is part of the responsibilities of the personal representative for deceased taxpayer. Be sure to provide the necessary documentation to support the notification. This action helps the IRS update their records and ensures that all tax matters are handled appropriately.

A personal representative for deceased taxpayer is an individual appointed to manage the financial affairs of a deceased person, particularly concerning their tax obligations. This representative can be named in the will or appointed by the court. Their responsibilities include filing the final tax return and addressing any outstanding tax debts. Understanding this role is crucial for ensuring proper management of the deceased individual's IRS affairs.

If a personal representative for a deceased taxpayer dies, the court typically appoints another individual to take over their responsibilities. This new appointee will ensure that the estate is still administered properly and that the wishes of the deceased are respected. It is vital to inform the court promptly to avoid delays in the administration process. Using resources from uslegalforms can assist the new representative in understanding the next steps efficiently.