Trust Account With Lawyer

Description

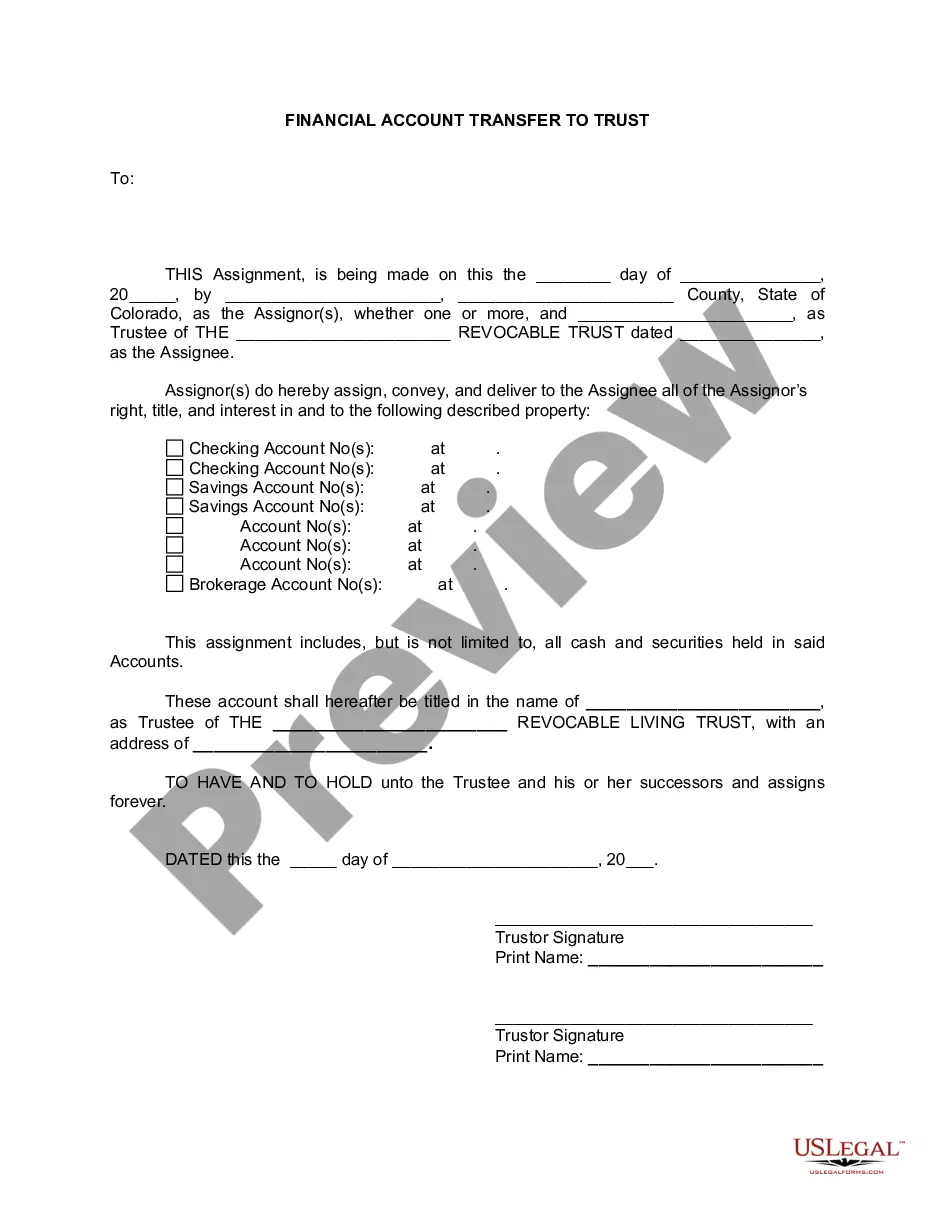

How to fill out Colorado Financial Account Transfer To Living Trust?

- If you're a returning user, log in to your account and navigate to the form templates. Ensure your subscription is active to download your required document easily.

- As a new user, start by reviewing the available templates in the Preview mode. Verify that the form meets your needs and complies with your jurisdiction's regulations.

- Search for additional templates if the chosen one doesn't suit you. Utilize the Search tab to find the appropriate form that fulfills your requirements.

- Proceed to purchase the document by clicking the 'Buy Now' button. Choose a subscription plan that suits your needs and create an account to access the resources.

- Complete your purchase by entering your payment information, using either your credit card or PayPal account.

- After the purchase, download your form and save it on your device. You can access it anytime through the My Forms section of your profile.

US Legal Forms empowers both individuals and attorneys to streamline the process of executing legal documents. With a vast collection of over 85,000 easy-to-edit legal forms, you are assured of finding the right template for your needs.

Don’t wait any longer to secure your trust account with lawyer. Visit US Legal Forms today and take advantage of their robust library to ensure your legal requirements are met!

Form popularity

FAQ

The main purpose of a trust account is to provide a safe and transparent way to manage funds, whether for estate planning or other legal requirements. Such accounts help in distributing assets according to the trust terms, reducing the risk of disputes. For those seeking assistance, a trust account with a lawyer can provide crucial insights and support throughout the process.

People often use a trust to manage their assets while ensuring that their wishes are fulfilled after their death. A trust can protect your assets from creditors and legal disputes, making it a valuable tool for financial planning. With a trust account with a lawyer, individuals can create a structured approach to asset management, leading to peace of mind.

Filling out a trust fund involves documenting client funds accurately within the trust account with a lawyer. This process includes maintaining detailed records of deposits, withdrawals, and the specific purpose of each transaction. It's crucial to keep this information organized to ensure transparency and protect both the lawyer and the client.

A client trust account works by allowing lawyers to collect and hold client funds securely until specific legal services are rendered. When funds are deposited, they are kept apart from the lawyer's personal or business assets. Then, once services are provided, the lawyer can withdraw the agreed-upon fees while keeping accurate records of all transactions.

In most cases, it's advisable to have a separate trust account with a lawyer for each client. This practice not only maintains clarity and organization but also ensures that the funds of each client remain distinct. A dedicated account helps avoid potential conflicts or confusion regarding the handling of client funds.

Certainly, a person can have more than one trust account with a lawyer. Different accounts might serve various clients or purposes, making it easier to manage funds. This flexibility can offer better control over asset distribution in accordance with specific wishes or agreements.

Yes, a trust account with a lawyer typically requires a separate bank account. This separation is crucial for fulfilling legal obligations and maintaining transparency. By using a dedicated account, both the lawyer and client can easily track transactions related to the trust.

To set up a trust account, first choose a bank with favorable terms for trust accounts with lawyers. Collect the necessary documentation, such as your law license and identification. Once established, ensure you understand the accounting requirements and software tools available to manage the account effectively.

The best bank for opening a trust account often depends on the bank’s policies regarding legal trust accounts, fees, and local availability. Many attorneys prefer banks with experience in handling trust accounts with lawyers, offering services like online access and reporting tools. Consider a bank that meets your specific business needs and compliance requirements.

Trust accounting operates by distinguishing client funds from an attorney's operating funds, primarily in trust accounts with lawyers. This involves careful tracking of deposits and withdrawals, ensuring that every transaction is documented clearly. Regular reconciliation of trust accounts is essential for compliance and accurate reporting.