Trust Account For Investment

Description

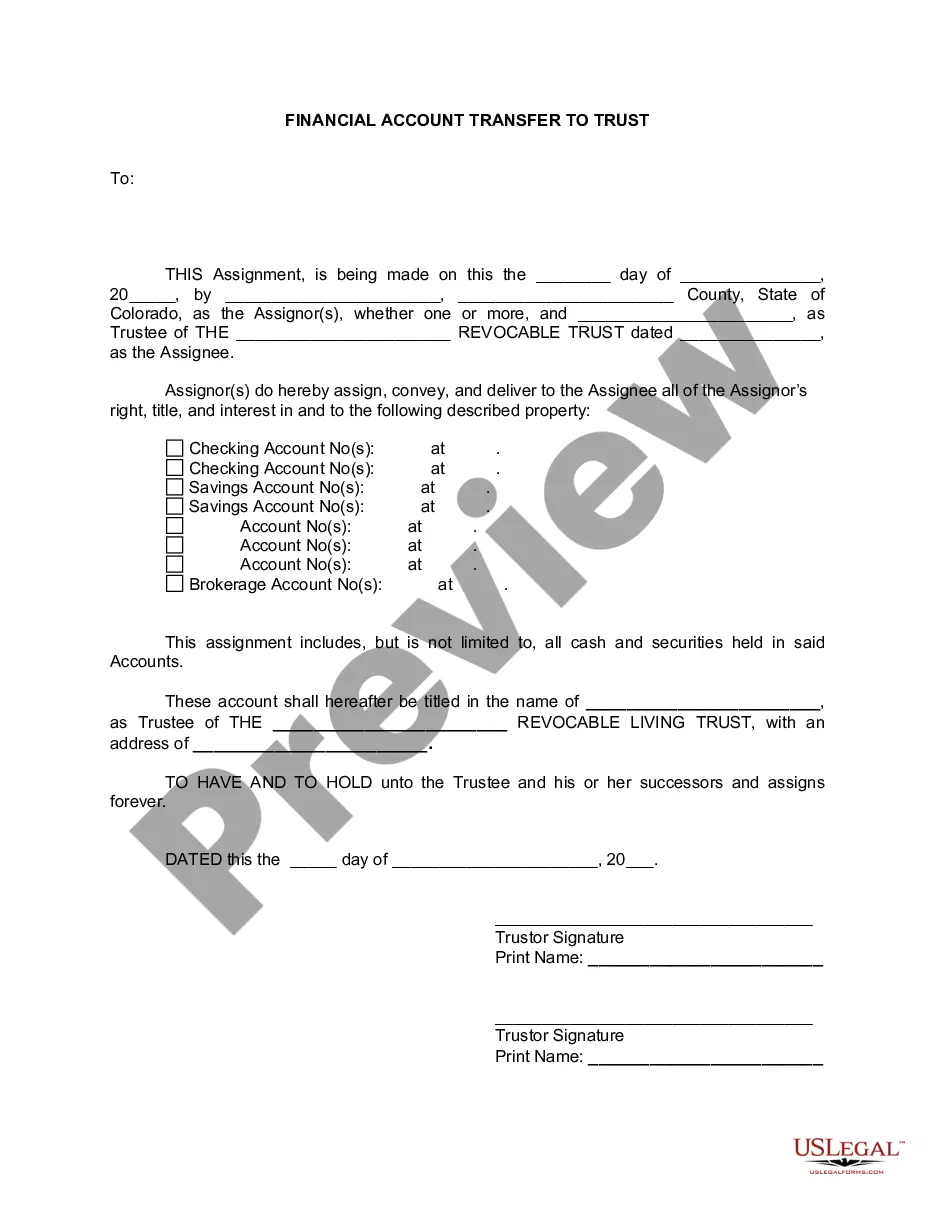

How to fill out Colorado Financial Account Transfer To Living Trust?

- Log in to your US Legal Forms account if you're a returning user. If you haven't subscribed yet, create an account to proceed.

- Browse the extensive form library. Use the search feature to find the specific trust account template that fits your investment needs.

- Review the form's details to ensure it complies with local laws and accurately reflects your investment goals.

- Select the 'Buy Now' option for your desired document. Choose from various subscription plans based on your requirements.

- Complete the payment process using your credit card or PayPal for secure transaction.

- Download your completed trust account form. Access it anytime from the 'My Forms' section of your account.

By following these steps, you can efficiently set up a trust account tailored to your investment strategy. US Legal Forms not only offers an extensive collection of legal documents but also provides access to premium experts who assist in ensuring your documents meet all legal requirements.

Start utilizing US Legal Forms today for a seamless experience in managing trust accounts for your investments!

Form popularity

FAQ

When choosing a bank to open a trust account, consider institutions that specialize in wealth management and offer tailored services. Banks like UBS, Morgan Stanley, and Northern Trust are known for their expertise in handling trust accounts. However, ensure you assess the fees, services, and reviews of each bank. If you want to simplify the process, USLegalForms provides valuable resources for establishing your trust, making it easier to navigate.

The best bank for a trust account often depends on your specific needs and preferences. Factors such as investment options, fees, and customer support can significantly impact your choice. Many people find institutions like Fidelity or Charles Schwab suitable due to their robust investment platforms and comprehensive guidance. Evaluate your options carefully to determine the best fit for your trust account for investment.

Yes, Chase Bank does offer trust accounts for investment purposes. Their services include a range of account types designed for various trust structures. You can benefit from their extensive resources and investment products tailored for trust accounts. If you decide to go with Chase, ensure you fully understand their terms and associated fees.

Many banks offer trust accounts for investment, including large national banks and local credit unions. Common options include Wells Fargo, Bank of America, and TD Bank, which provide comprehensive services for trust accounts. When selecting a bank, consider factors such as customer service, fees, and investment options. Researching these features will help you find the right bank for your trust account.

To open a trust account for investment, you must gather essential documents, such as the trust agreement and the taxpayer identification number. Then, choose a bank or financial institution that offers trust accounts. After selecting the right institution, complete their application process, ensuring you provide all necessary information. If you need guidance, USLegalForms can help you with the required forms and necessary steps.

To fill out a trust fund, you need to complete a document that outlines the trust's purpose, beneficiaries, and terms. Each section should clearly reflect the intentions behind the trust account for investment. After drafting, it is crucial to have the document reviewed by a legal professional. This step ensures compliance with laws and helps avoid future disputes.

The biggest mistake parents often make is not clearly defining the terms of the trust. A trust account for investment needs specific guidelines to ensure that assets are managed and distributed as intended. Additionally, failing to update the trust as circumstances change can lead to unintended consequences. Regular reviews and consultations can keep the trust on track.

A significant downfall of having a trust can be the false sense of security it provides. Some individuals believe that simply setting up a trust account for investment will solve all financial problems. However, without proper management and regular updates, a trust can become outdated or ineffective. Consulting with a knowledgeable advisor can help keep it aligned with current goals.

One disadvantage of a family trust is that it may limit liquid access to assets, making it hard to sell or transfer them without consent from all trustees. A trust account for investment can also involve complexities in tax reporting. Additionally, family dynamics can complicate agreements, leading to potential disputes. Families should communicate clearly to mitigate these issues.

One downside of establishing a trust is the potential upfront costs and ongoing management fees. A trust account for investment might require regular maintenance and oversight, which can also become complex. Moreover, once assets are in the trust, the granters may lose direct control over them. Therefore, understanding these factors is important.