Social Security Name Change Form Colorado

Description

How to fill out Colorado Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

Creating legal documentation from the ground up can occasionally be quite daunting.

Certain situations may require extensive research and significant financial investment.

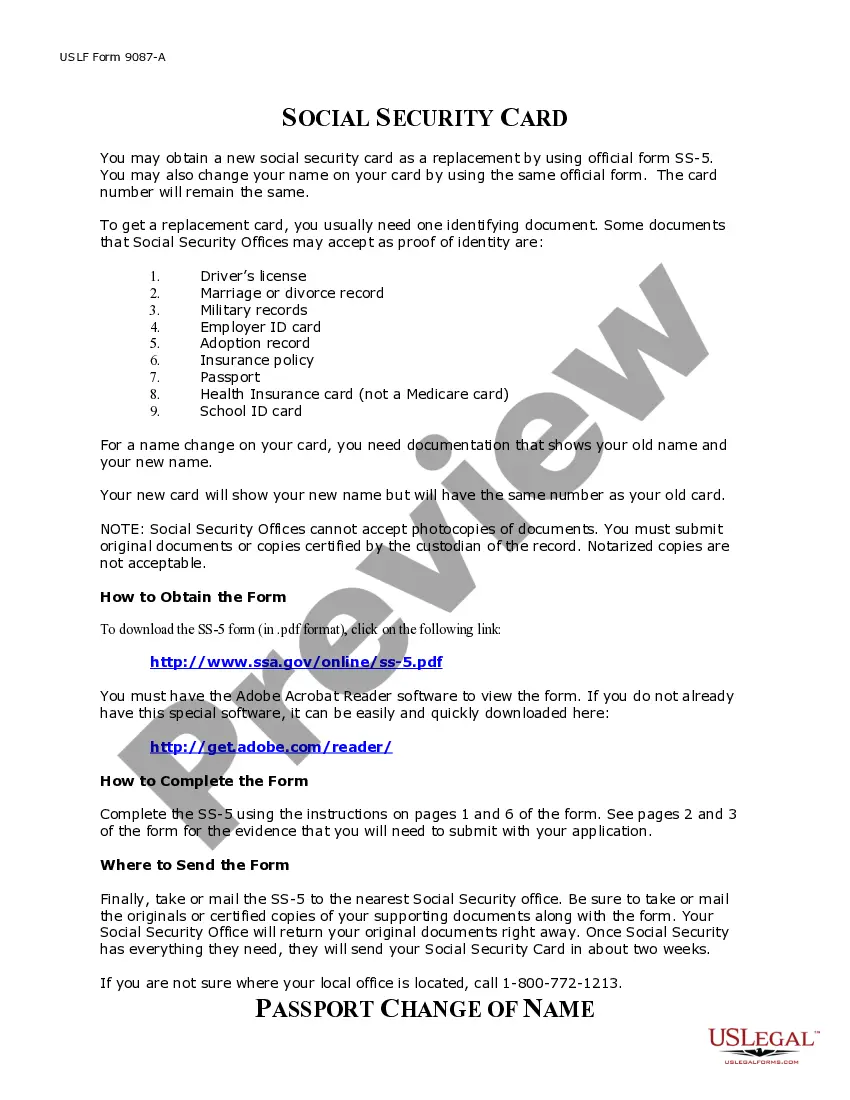

If you’re seeking a simpler and more cost-effective method for generating the Social Security Name Change Form Colorado or any other documentation without unnecessary complications, US Legal Forms is always accessible to you.

Our online repository of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal affairs. With just a few clicks, you can promptly obtain state- and county-compliant forms carefully crafted for you by our legal experts.

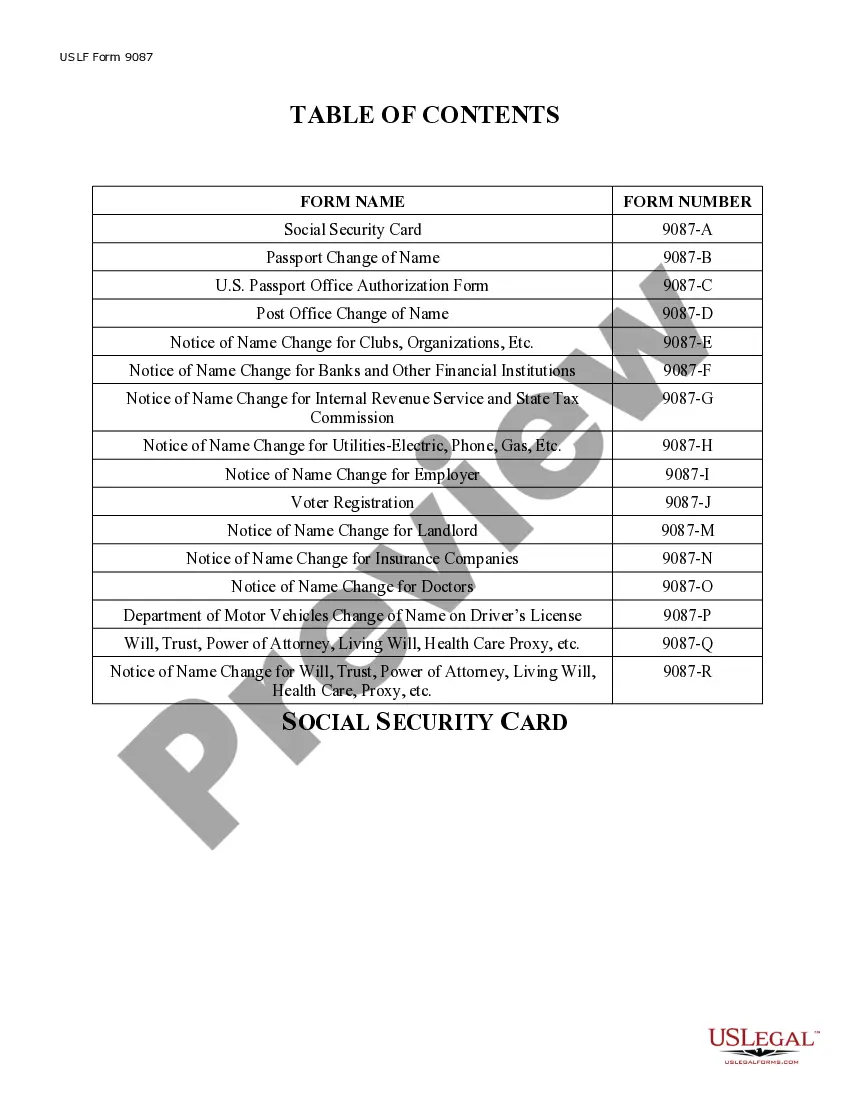

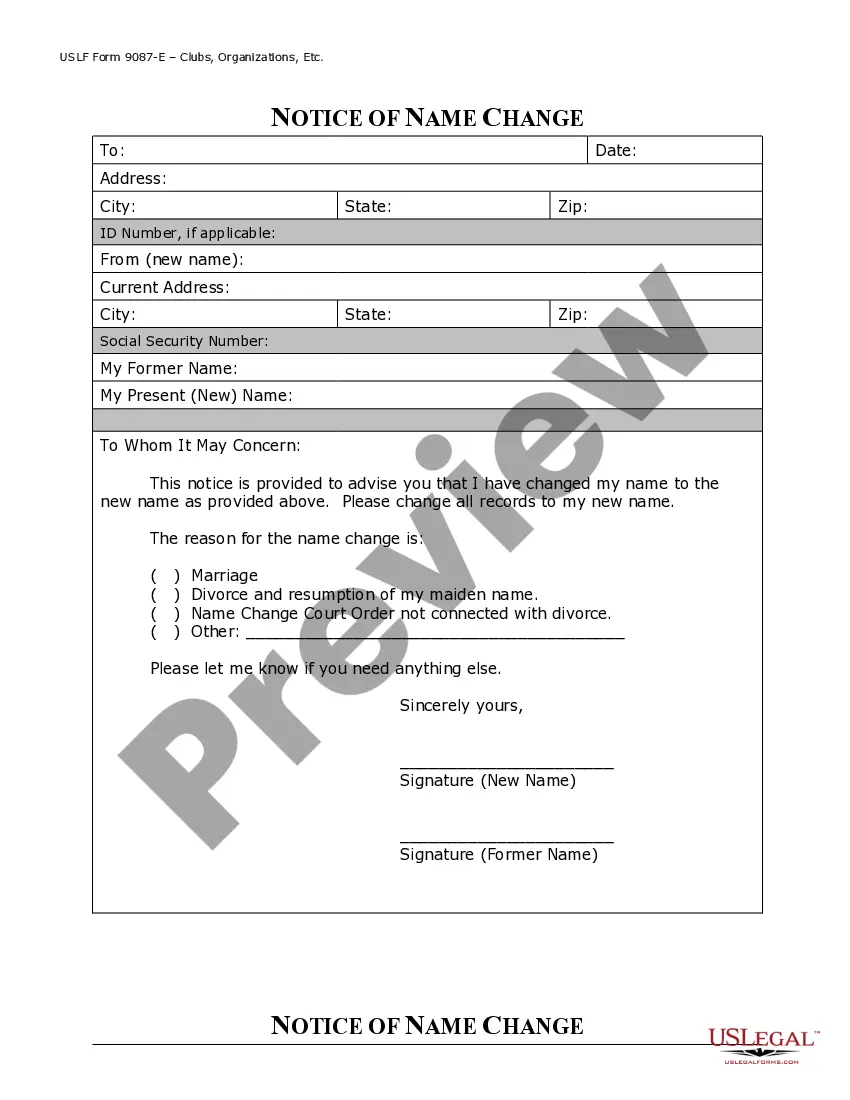

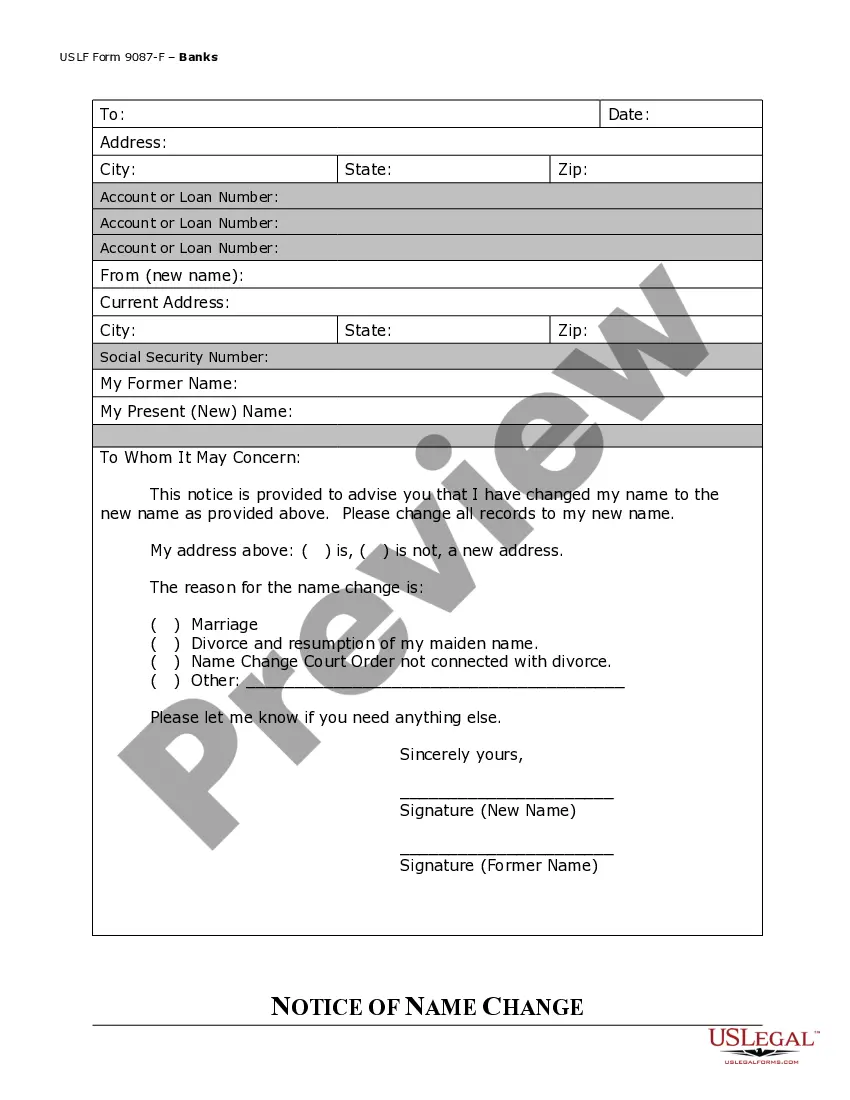

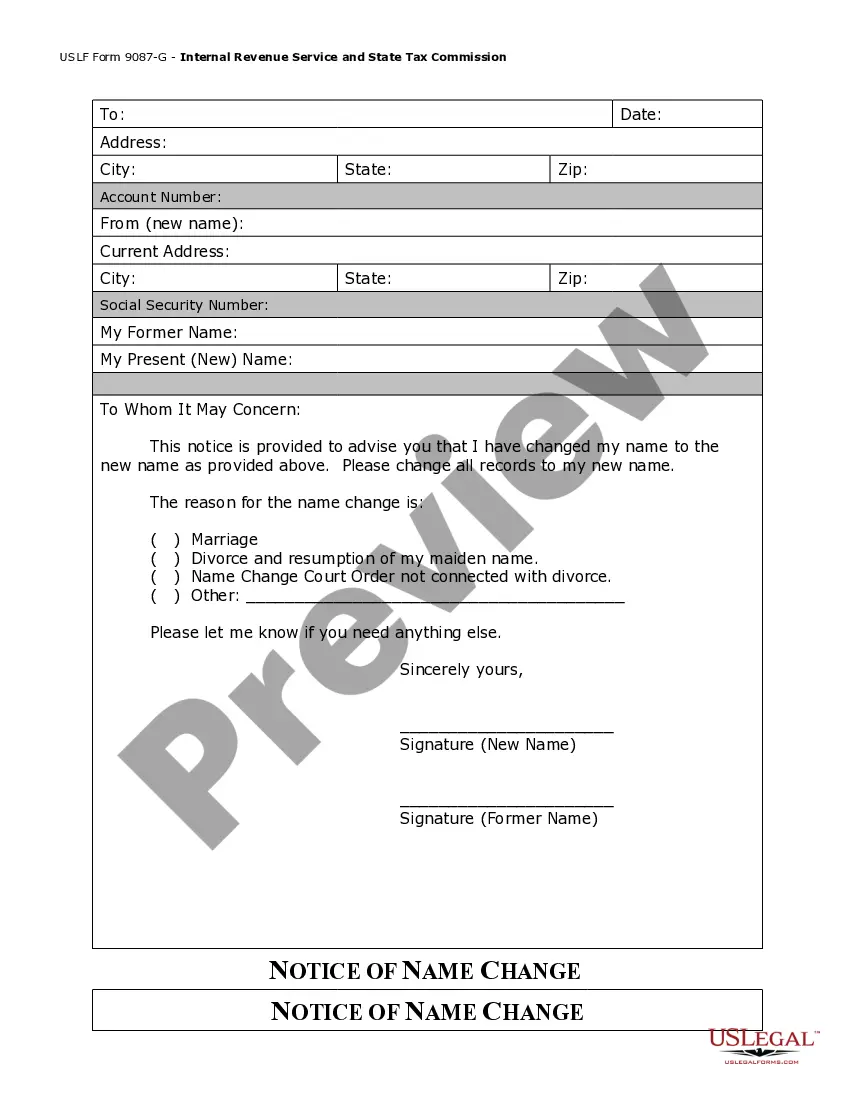

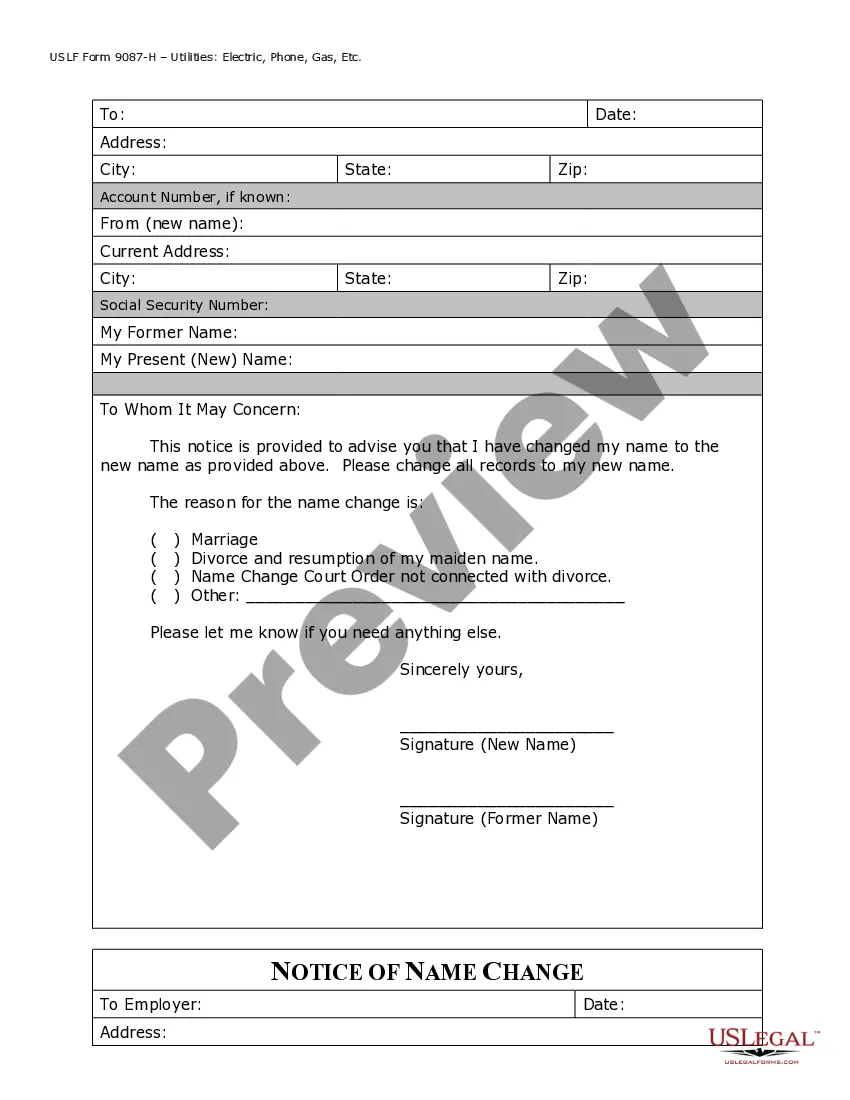

Examine the document preview and descriptions to confirm that you are viewing the document you need. Ensure that the selected form complies with your state and county regulations. Choose the most suitable subscription plan to purchase the Social Security Name Change Form Colorado. Download the form, then complete, sign, and print it. US Legal Forms has a solid reputation and over 25 years of experience. Join us today and make form completion straightforward and efficient!

- Utilize our platform whenever you need reliable and trustworthy services to swiftly find and download the Social Security Name Change Form Colorado.

- If you’re familiar with our services and have already created an account with us, simply Log In to your account, find the form, and download it or re-download it anytime in the My documents section.

- Don’t possess an account? No problem. Registering is quick and effortless, allowing you to browse the library.

- However, before proceeding to download the Social Security Name Change Form Colorado, consider these guidelines.

Form popularity

FAQ

Step 1: ? Verify that the estate is eligible. This will include identifying and valuing all of the decedent's property to make sure it falls below the state maximum. ... Step 2 ? Contact all the Heirs. ... Step 3 ? Settle any remaining obligations. ... Step 4 ? Fill out, sign, and file the affidavit form.

Instead of a small estate affidavit, Alabama allows for distribution of small estates through an abbreviated estate process known as summary distribution. To qualify for summary distribution, the estate must meet the criteria of a ?small estate? as defined by the statute.

Following the Alabama Probate Code, an estate's probate has to be filed within five years after the estate owner's death. Probate can be filed by the named executor, any beneficiaries named in the will, or anyone with a financial interest in the estate.

In Alabama, the executor has four months from the date of their appointment to notify creditors, who then have six months to make claims against the estate for any debts owed. Paying Debts and Taxes: After notifying the creditors, the executor must then pay off any valid claims from the estate's assets.

Often, executors take 8-12 months to settle an estate; however, the process can take two or more years. Executors are given an executor year, referring to a granted period where they are expected to fulfill their fiduciary duties.

The Alabama Small Estates Act was passed in 1979 and amended in 2009. This Act provides a method, through a court proceeding, to distribute personal property of a deceased person in a summary distribution manner to a surviving spouse, or appropriate distributes of the decedent, without full probate administration.

As a rule, gifts of a set amount of money in a will should be paid out within a year of death. If the executor isn't able to pay the legacy within that time, the beneficiaries will be entitled to claim interest.

Generally, Wills must be filed for probate in the county where the deceased lived. WHEN MUST A WILL BE FILED FOR PROBATE? To be effective, a Will must be filed for probate within five years of the date of the testator's death.